Wow the stock market has been strong! There hasn’t been a bear market in a long time. Yes, there was the very brief “technical” bear market at the onset of COVID-19 in the spring of 2020 but that lasted a nanosecond and was vanquished by massive government assistance, particularly liquidity and debt. Even the scary bear market of the Great Financial Crisis (GFC) of late 2008/2009 didn’t last very long from a historical perspective. So, are we due? The S&P 500 plus dividends has returned greater than 300% since it crossed its 2007 high after the GFC! That is in an economy that has shrunk - but for the increase in government debt. It seems a lot of people are afraid that we are long overdue for at least a slowdown and a bear market. Investors are scared of getting eaten by a bear!

There is an interesting story though about that subject. Two hikers are walking in the woods and encounter an angry looking grizzly bear. One looks at the other and says, “I’m getting out here, going to run as fast as I can!” The other looks at him puzzled and questions, “You think you can outrun that bear?” As his (former) friend turns to get going he responds, “I don’t need to outrun the bear, I only need to outrun YOU!”

Why bring up that story? Well, if there may be a bear growling out there, could it be menacing the United States? Last week was a very bad week for the country. In fact, the past decade since the GFC has not been a great one for United States. As mentioned, debt has exploded. In addition middle class living standards have stagnated, inequality has skyrocketed and social problems boiled over into full scale riots in many cities last year. On the international scene, the country has for the first time been forced to come to terms with that it may not be the world’s unchallenged super power. Russia has thus far thwarted our efforts in Syria and the Ukraine, Germany ignored us and went ahead with the Nordstream II pipeline and of course there is China. Consensus opinion seems to believe that the next country to ascend the throne of the world’s great power, and possibly soon, will be China. The absolute and humiliating debacle around the withdrawal from Afghanistan was the event that made for last week’s really bad week. Many think this event is marking the formal beginning of the transition to China of the crown of world leadership.

Well, history is written by events and not by the prognostications of so-called “experts.” Predicting the future is hard. For those of us old enough to remember, there were many such forecasts that similarly thought the depressing fall of Siagon in 1975 was the end of Pax Americana. That was followed up a few years later by the humiliating Iran hostage situation which came after Jimmy Carter’s famous “Malaise Speech”, which is arguably one of the most disheartening speeches ever given by an American president. Well soon after that Ronald Reagan ascended to the Presidency, Charlie Daniels “In America” hit near the top of the music charts and less than a decade later the world’s other competing superpower was vanquished and the United States was on top as the world’s leading power.

Right before the unexpected collapse of the Russian empire in the late 1980s, “experts” began to predict the demise of the United States to a new ascending economic power, Japan. We remember those days well and the argument that accompanied them. It was a persuasive argument! The Japanese economic miracle rose from the devastation of defeat in World War II and the country grew into an economic juggernaut that expanded much faster than the rest of the world during the 1970s and 1980s. This led many to predict that country would displace the United States as the next great power. A well-known academic, Paul Kennedy, wrote a well-received book at the time entitled “The Rise and Fall of Great Powers,” which, by its cover pictured below, indicated his prediction for the future ascending power.

Just two years later, the Japanese miracle began to unravel when its central bank sought to and succeeded in popping its monstrous property bubble. To put it mildly, the subsequent thirty years has been far from what Professor Kennedy predicted for Japan.

China “Inevitably(?)” Displaces the United States?

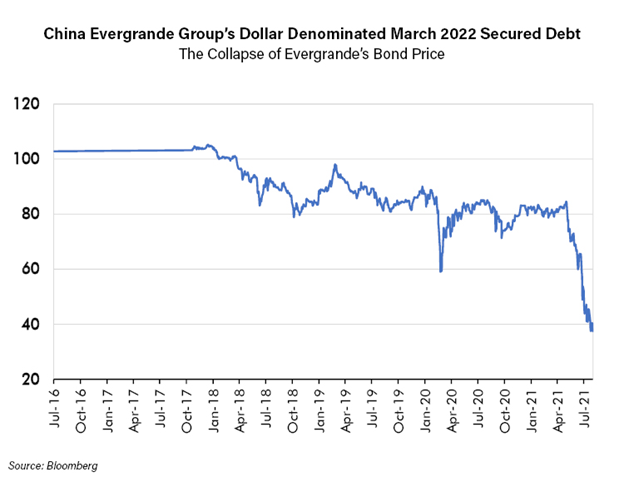

It is with this history in mind that we watched with interest recent events. Two interesting and potentially important things happened. First, the Taliban overran Kabul, which the international press used to highlight the weakening status of the United States relative to China. As mentioned above, China, according to most experts, appears poised to overtake the United States as the next great power. Interestingly, the same week, China Evergrande Group, the country’s second largest property developer, seems to have fallen into severe financial in distress. Too much debt appears to be the obvious culprit. Could this be the catalyst, perhaps, for a peak in the Chinese real estate market? Few are asking this question but we are.

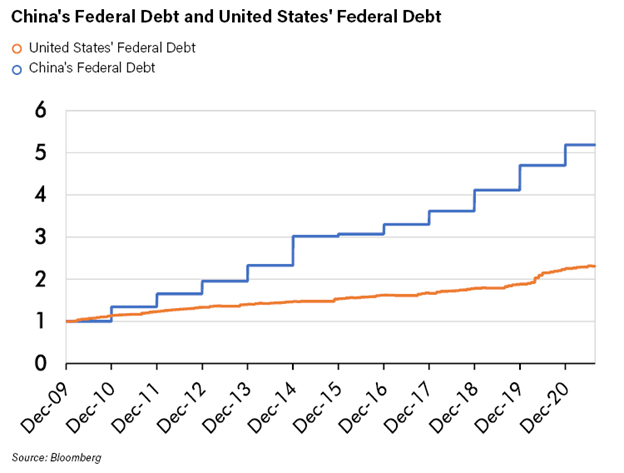

Not unlike Japan of four decades ago, the debt fueled property market in China may be a co-conspirator of China’s several decade growth miracle. Data from China is hard to come by and notoriously unreliable, but it seems clear to us that much of China’s wealth is represented by real estate ownership. The value of this real estate is driven at the margin by heavily indebted companies like Evergrande and funded by a shadow banking system whose depth and breadth are challenging to define, though widely believed to be the largest in the world by far. It is difficult to know the level of private debt in China but we do know about government debt. Although government debt as a percentage of GDP is lower in China than the United States, the growth of that debt has dwarfed that of the United States since the GFC. The following chart tells the tale.

China’s aggressive debt growth likely helped the country out of the GFC and played a role in this decade’s strong growth. How much of that nation’s debt wound up facilitating the country’s sharply appreciating real estate markets? With the recent severe and very public debt problems at Evergrande, we think the answer is important. One concern is that slowing debt growth could suddenly detract from the long-entrenched upward price trend in Chinese real estate. A sudden increase in debt costs is the recipe for exactly what the Chinese real estate market does not need. But, as the chart below illustrates, the recent collapse of Evergrande’s bond price (meaning rising bond yields) is doing just that.

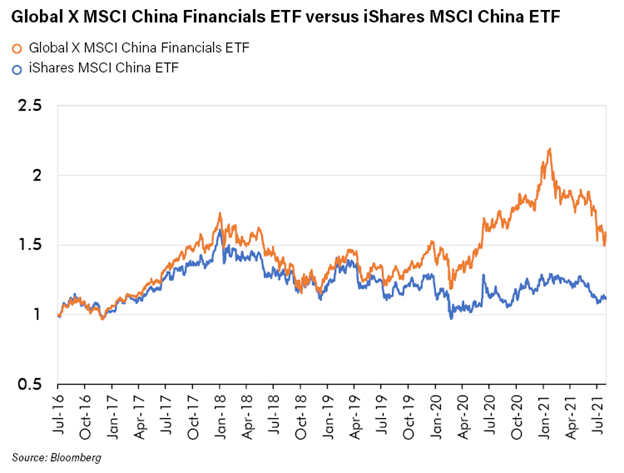

We also refer to the chart below, showing the dramatic underperformance of Chinese financial stocks relative to the broader China indices. Our experience has been that, when banks and other financial stocks trade weakly in line with real estate securities, that is noteworthy and could be a leading indicator of wider weakness. It is also interesting that since peaking early in the year, the broader index has been falling rapidly. This combination – plus the now near universal belief that China is poised to overtake the United States, leads us to examine the contrarian case.

The United States May Only Need to Outrun China, Not the Bear

As noted above, there are plenty of reasons to be bearish the United States. However, these negatives, despite how real they may be, might not be enough to cause a bear market in financial assets here. If there were to be a debt driven financial crisis in China it would immediately have to rebound to our shores. One potential consequence could be the collapse in confidence in many markets and currencies and that could lead to capital flows into the United States. If so, this would likely create a favorable environment for domestic assets, particularly bonds and long duration stocks. This might be buoyed by a reversal of taper talk by the FED and perhaps instead an increase in monetary accommodation “just in case.” For those of us old enough to be the markets in late 1990s, we recall that a similar environment after the Asia crisis and then the Russia crisis led to the last stages of the long-running Tech Boom in the U.S., and set the stage for the future commodity bull market of the 2000’s. Its an interesting example to ponder.

California Often Leads

Of similar long-term consequence is the question of whether the United States might somehow rally off the depths of the current poor political/social environment in which it now suffers. Have the outcomes flowing from the capture of government by corporate and financial special interests in combination with the new “woke” social movement become too extreme and created bad enough economic outcomes that voters will take action? The poorly designed “energy transition” is one example that we have written on previously. There are others. Given that, we are intrigued by the upcoming governor recall referendum in California. Gavin Newsome appears to be an archetype politician that is acceptable to the elite establishment and the woke movement. The history of the past half century or more has seen California lead the nation in most political change. From the election of Ronald Reagan as governor in 1966 to the leading and most stringent environmental policies of today, California has been a bellwether. The recall of Governor Newsome would be interesting indeed especially if he were to be replaced with a libertarian minded candidate. If that were to happen, perhaps that would be a harbinger of coming change on the national level. Wouldn’t that be a surprise? We are following the situation with great interest as such an outcome might give further weight to the argument that the United States will revive rather than succumb to China as the world’s great economic power.

Conclusion

The past decade has been a tough one for the United States and has ostensibly been a great one for China on a relative basis. It’s not surprising, especially after the realization last week that our country wasted trillions of dollars and thousands of lives in a lost cause in Afghanistan, that many are convinced that the future belongs to China and not the United States. This belief may be causing investors to position themselves accordingly. What if that conventional wisdom is wrong? It wouldn’t be the first time. China may have a debt problem that is as bad or worse than ours. The growth of that debt may be one of the driving forces that made their economy look so strong over the past decade similar to what happened in Japan in the 1980’s. If China should stumble, America will likely be the safe haven, as it has been for investors during every crisis since World War II. We are open to this view and watching carefully as events unfold.