Most everyone reading this article has probably heard of the SPAC boom. The bull market in SPACs has been hard to miss if you follow financial news. But what is a SPAC? A SPAC is a “Special Purpose Acquisition Company” that has no business to speak of. It is created to go out and find a real business to invest in. So, the boom in SPACs is really a boom in investing in nothing in the hopes it turns into something. This phenomenon seems to be appropriate given the state of the investing world, real economy and even the sociopolitical environment at present. These days, there appears to be a whole lot of nothing meaningful or at least worthwhile being done. At the same time, we would argue, there is substantial underinvestment in what's real. Excitement about investing in nothing is certainly not limited to SPACs. Bitcoin and perhaps Ethereum may turn out to be something, but the vast majority of crypto-currencies that have been created and are sporting substantial valuations will turn out to be nothing. A shockingly high percentage of initial public offerings this past year have no profits or even cash flow. They are, at present, seemingly investments in nothing. The list goes on. What is happening here and how should we respond as investment and risk managers?

Investing in What's real

The flip side of investing in nothing is investing in something. Something real. What is real? People are real. Robust supply chains are real. Energy is real. Has there been enough investment in those things? We would argue, it does not seem so. There used to be a time when investment dollars were allocated with more single mindedness than they are today. Money was invested solely on the basis that the investor thought he or she would make a financial gain from the decision. It seems times have changed. Today markets appear to be distorted by central bank money printers, incredibly powerful regulatory bureaucracies, ESG (environmental & social governance) mandates and the like. Perhaps these differences with the past make the world better … but it’s hard to believe that to be the case.

Take for example labor. It appears there is a shortage of labor. The unemployment rate is 4.6% which is well below the average of the past 40 years but not near its sub 4% low of the last several troughs. However, labor force participation is very low and by many measures it is apparent that there is a worker shortage. So apparent that workers appear to be emboldened to start going on strike again for the first time in a generation. Strikes have recently become so prevalent that last month was described repeatedly in the media as “striketober”.

3.jpg?width=825&name=Picture1_revised%20(002)3.jpg)

What could be causing this shortage? Perhaps 40 years of the Federal Reserve distorting price signals by lowering rates has caused under investment in labor? Could that be possible? Well there are only three factors of production: land, labor and capital. Artificially low interest rates are a subsidy to capital which would mean we’ve substituted that for labor. Could it be that low wages, which have disincentivized work (especially when government transfer payments keep growing) is due to over-investment in capital? We think that is part of the reason. For example, there has been a chronic truck driver shortage in this country for years. Why invest in the training to become a truck driver when incessant media chatter is that truck drivers are going to be replaced by automated driving systems? Despite the current shortage of drivers, that is a rational position for a potential truck driver to take given that behemoth companies like Amazon and Tesla (beneficiaries of nearly free capital from the Federal Reserve Board) are making those claims? It does not appear that Amazon or Tesla has created anything real that can get goods from point A to point B without a driver, but they have disincentivized real workers from training and joining the labor force to do just that.

Shortages of workers are not the only thing afflicting our economy and causing problems at present. Stretched supply chains are something we are hearing a lot about. For the past forty years there has been magical thinking about an ever-increasing integration of the world economy and the ability to source production from a few lowest cost factories in the lowest cost regions far from consumption locations. This effort created wonderful financial results for a time for the owners of this production as costs, including the cost of holding inventory, declined. However, as current supply chain issues are now making clear, perhaps some of those returns were the result of under investment in a robust system. Retailers and final stage manufacturers became so dependent on a few factories in a few distant places that needed to ship goods and parts into a few ports and for delivery by a few trucking companies and railroads that small kinks quickly spread and exposed the fragility of the system. Perhaps there was over investment in impossible to achieve efficiency? It doesn’t appear to be so efficient in the long run now that the weakness is apparent. We think there was under investment in robust systems that can deal with the reality of a world where problems like trade wars, pandemics and energy crises inevitably show up from time to time.

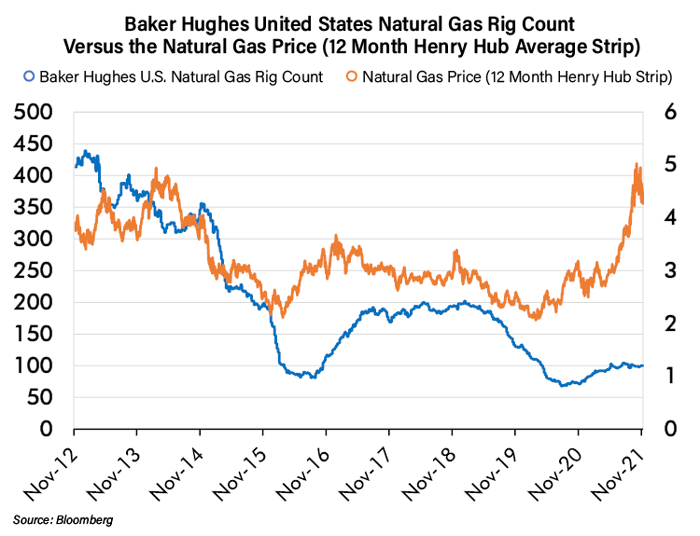

Similarly, as we have written about before, it seems that the headlong rush to decarbonize the world in the future is provoking a rapid underinvestment in the energy that is needed today. This investment in decarbonization may be an investment in nothing! That is because it is possible, as several studies have shown, that the carbon footprint of the new renewable energy system will not be much less carbon intensive than the existing system when all inputs, maintenance and energy sources are counted. In addition, emerging economies and China are likely to grow carbon emissions for far longer than environmentalists are projecting. So, this may be an investment in nothing. We go into the details on this point in our Risk On Risk Off report entitled “Think Things Through.” In the meantime, traditional hydrocarbon energy producers are being starved of capital or shamed into under investing in the energy that is needed today and in the near future. This fact is illustrated by the lack of new drilling for natural gas in the United States despite the significant increase in the natural gas price as shown in the chart below.

doubling down on Unreality

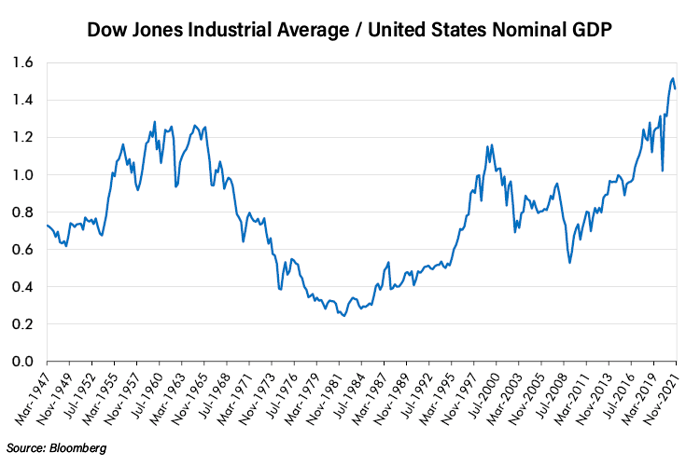

There does not appear to be an end in sight to the current trajectory. From our vantage point, investors and policy makers are doubling down. GDP forecasts are declining and yet the stock market is hitting all-time highs. In fact, the stock market to GDP ratio is now the highest in history by far.

The disconnect from reality was illustrated a few weeks ago by the price movement of a rental car company when it announced a very good quarter and that it was going to buy electric vehicles for its fleet. At its peak on that day the company’s market value jumped from $10 billion to over $28 billion! The investment would most likely do nothing to the company's profits. The crazy in the market seems to not be letting up, to say the least. Similarly, as evidence of a disconnect from reality in our opinion, last week at the COP26 climate conference there appeared to be no acknowledgment of the energy crisis gripping the world. Leaders are forging ahead with mandates that will discourage the production of the hydrocarbons that are needed now without seemingly batting an eye. Likewise, the Biden administration is forging ahead with OSHA regulations that will impose vaccine mandates on much of America’s work force with what appears to be no consideration of the impact that may have on companies that are struggling with labor shortages. We are not arguing that decarbonization or Covid-19 vaccination are unworthy goals, quite the contrary. However, pursuing those goals while dramatically weakening the economy may accomplish nothing.

The way forward: Invest in real cash flows

What are we to do as investors? Our view is to always look to invest in those things that are being underinvested in. So, we think real investments will outperform going forward. By this we mean companies that make real commodities and goods and that produce real current cash flows. We are particularly bullish on companies with those characteristics that pay high dividends. In this environment, we like the forced discipline of paying a large portion of cash flow back to the owners. Even for good managers, the temptation to invest in fashionable things that may turn out to be nothing is strong, so we prefer the cash flow be distributed to us.

The exciting thing about this approach is that such companies appear to be extremely cheap and are carrying some of the historically highest dividends we have seen, especially relative to current interest rates. There are companies in sectors that are being dramatically impacted by some of the factors we discussed above that have yields of 5% or more. Some even 8% or more. At present high yield bonds, in general, yield well less than 4% and appear to us to have little principal upside. Given that, a cheap, stable cash flowing equity yielding 6% is extremely attractive. We are finding such companies in sectors such as pipelines, consumer staples, defense, energy production, tobacco and others. All in businesses that make real things for which there is real demand today.

Conclusion

Many sectors and asset classes have been on a tear recently. Prices for some of those keep going up and up. Can this go on forever? Certainly not. Assets can always get more expensive but it is difficult to have confidence in your investment portfolio when that is how you invest. When the tide turns on frothy investments, counting on your ability to get out before others is not a strategy. This is especially true for investments that have a plausible likelihood of being fads or not having staying power for other reasons. We think there are a lot of those out there. On the other hand, real goods and services that have stood the test of time and consumer demand do not carry as much risk. That can be true even if the market thinks demand will perpetually shrink, such as it does now for energy, tobacco, certain food categories or others. If companies that produce those things are valued right and provide steady dividends, they can be profitable contributors to our investment portfolios. They also might provide a bit more certainty in a world where things appear to be more uncertain than usual.