“Five percent of the people think;

ten percent of the people think they think;

and the other eighty-five percent would rather die than think.”

― Thomas A. Edison, someone who knew a little bit about energy

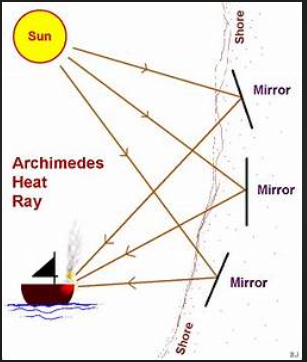

Archimedes of Syracuse was really smart. In fact, he is considered by many to be the smartest mathematician of ancient times and one of the greatest in human history. He was also a scientist and inventor credited with a variety of novel machines and weapons. For our purposes, we are interested in the fact that he appears to have been the first human to attempt to harness the sun’s energy for power in what is called the Archimedes heat ray. This invention used mirrors to allegedly concentrate the sun’s heat energy towards enemy wooden ships attacking his home city of Syracuse and causing them to catch on fire. We say “appears” and “allegedly” because many scholars and scientists contend there was not and could not have been such an invention at that time. Even with today’s best mirror technology, such a feat would be exceedingly complex to engineer. The legend (or fact) has been debated throughout history.

Many scientists followed in Archimedes footsteps in attempting to use mirrors to harness the energy of the sun. One such person was William Calver who, around the turn of the nineteenth century, claimed to have invented a system that would have made decarbonization a reality more than a hundred years ago, before carbonization had really gotten started. He patented a contraption called the Helio Motor that presumably used mirrors to concentrate the sun’s energy and then store it using bricks and water for enough power to create electricity. The invention generated a lot of excitement at the time and was backed by Leland Stanford, one of the wealthiest and possibly one of the most thoughtful men in California who is famous today for having started the university in Palo Alto that bears his name. Stanford and others believed the Helio Motor would displace the steam engine and the newly invented internal combustion engine. In retrospect, it was not thought through; it did not work and its investors, including Leland Stanford, lost a lot of money.

Many scientists followed in Archimedes footsteps in attempting to use mirrors to harness the energy of the sun. One such person was William Calver who, around the turn of the nineteenth century, claimed to have invented a system that would have made decarbonization a reality more than a hundred years ago, before carbonization had really gotten started. He patented a contraption called the Helio Motor that presumably used mirrors to concentrate the sun’s energy and then store it using bricks and water for enough power to create electricity. The invention generated a lot of excitement at the time and was backed by Leland Stanford, one of the wealthiest and possibly one of the most thoughtful men in California who is famous today for having started the university in Palo Alto that bears his name. Stanford and others believed the Helio Motor would displace the steam engine and the newly invented internal combustion engine. In retrospect, it was not thought through; it did not work and its investors, including Leland Stanford, lost a lot of money.

Is the Energy Transition in Its Current Form the Right Approach?

Fast forward more than one hundred years and scientists are having pretty good success with Archimedes’ idea in the form of today’s solar energy. In places with cheap land and abundant sun, humans can make electricity as cheaply from the sun as from natural gas. This appears to be good because natural gas and other hydrocarbons emit carbon dioxide into the atmosphere in large quantities. Most people believe this is causing climate change. Many think this climate change is going to cause catastrophe in the not-too-distant future and that the threat must be eradicated as quickly as possible. Those holding this view have convinced politicians in much of the developed world to embark on a massive enterprise to rid the world of the noxious emission and save the planet.

We have devoted a lot of time to studying this which is generally categorized as the energy transition. Recently we became familiar with the work of Vaclav Smil, a Czech who emigrated to Canada and is now one of the world’s most respected environmental scientists.

We have devoted a lot of time to studying this which is generally categorized as the energy transition. Recently we became familiar with the work of Vaclav Smil, a Czech who emigrated to Canada and is now one of the world’s most respected environmental scientists.

We are particularly intrigued by his 2017 book Energy and Civilization: A History. Although not referencing Archimedes’ attempt to use solar energy in war, the book contends that the history of civilization is intimately intertwined with technological innovations in energy usage. Dr. Vaclav is of the opinion that the energy transition the world is embarking upon is going to be much more difficult than expected.

From Dr. Smil’s work as well as other research and analysis it is apparent that the world has launched a massive endeavor with no equal before in human history. The developed world is attempting to transition from one predominant form of energy to another in roughly twenty years, much faster than ever before, and without having a new, more efficient (or even close to equally efficient) source of energy available. Due to this, the undertaking has the serious potential of being a colossal case of malinvestment the implications of which are much more serious than a few of today’s Leland Stanford types losing money on the Helios Motor.

Given the already precarious state of the world’s economy because of enormous over-indebtedness, malinvestment of this magnitude could have grave consequences for the economic, social and political landscape. Granted, if the more strident climate alarmists are correct, doing nothing about global warming could have similarly dire implications. In our opinion, however, choosing drastic decarbonization is a much worse choice because it has an equally high likelihood of bad outcomes, and it suffers from the further possibility of not even solving the problem! We think those backing a rapid energy transition through decapitalizing the hydrocarbon industry may get us off one system that works before a new system is ready to replace it. Specifically, our fear is that the efficient renewable or other technologies to replace hydrocarbons do not exist now and appear to us to be unlikely to exist in the time frame that is being put on the transition. Are they thinking things through sufficiently?

De-Capitalizing the Traditional Energy Business

The last two weeks of May might have been a watershed time of clarity about the new energy transition. Three notable events took place. First, Engine No. 1, an ESG (Environmental and Social Governance) activist institutional investor won three of the twelve seats on the Board of Directors of Exxon Mobil Corporation, the largest private oil company in the world. They did so with the support of many of the top institutional shareholders in the world, including Blackrock, which owns nearly 7% of the shares outstanding of the company as well as New York and California’s large pension funds, among others. Second, just days earlier a Dutch court ordered Royal Dutch Shell to reduce its carbon emissions 45% by 2030, just 9 years from now. Third and perhaps most surprising, on May 18 the International Energy Agency released a special report entitled “Net Zero by 2050: A Roadmap for the Global Energy Sector.” In it, the influential international group said that in order to achieve zero carbon emissions by 2050, oil companies needed to “halt all investment in new fossil fuel supply projects” starting between now and 2035.

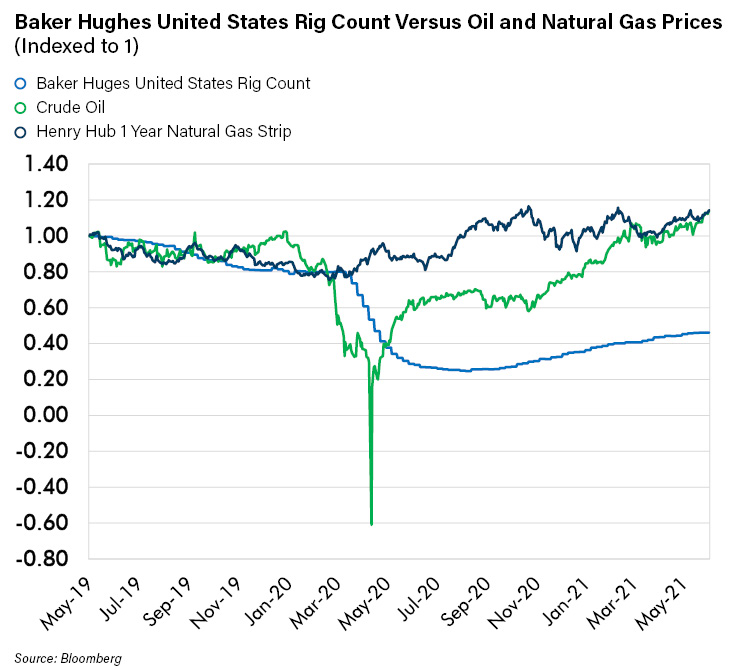

What these three events make clear is that efforts to rapidly decapitalize the fossil fuel industry are gaining traction. What does that mean? We think at the very least it means there will be more and more reluctance to invest in oil and gas exploration and production. This could have a substantial impact on supply in the not very distant future … we think well before commercially viable alternatives are available to take the place of these commodities in energy production. Supply could fall short of demand well before cleaner substitutes arrive. One can already see this decapitalization taking place in the number of oil and gas wells being drilled in the United States. As the following chart shows, despite oil and gas prices rebounding to nearly 15% above pre-covid levels, the exploration and production industry is deploying 54% fewer drilling rigs than two years ago.

Energy Is About Efficiency

According to all the studies we have examined, the plain fact is that at present renewable energy generation is far less efficient than hydrocarbon generation. According to commodity specialists Goehring and Rozencwajg Associates, as much as 25-60% of the energy generated by solar or wind power is consumed internally as opposed to only 3% for a combined cycle gas turbine. This is because, despite the very high efficiency of the current generation of these types of renewable assets, the sun and the wind are intermittent, and therefore their generation units only dispatch 20%-25% of the day. This means that either redundant hydrocarbon (or nuclear) capacity or battery storage capacity needs to be available. At present, battery storage capacity is very far from being economic and solving the problem. Additionally, battery production is extremely energy-intensive.

According to Dr. Smil, the current transition would be the first time in history that humanity would (at least voluntarily), be moving from a more efficient to a less efficient form of energy. In fact, he argues in the book cited above that much of human progress has been brought about by innovation that is able to convert energy to productive use more effectively. This started with the use of domesticated animals to plow fields and carry out other tasks, then to heat energy from wood (fire) to forge metals for better plows and other agricultural implements, then to the harnessing of hydro and wind power for milling and powering ships. Finally, the burning of fossil fuels - first coal which provided fuel for the steam engine. This was such a giant efficiency gain that it ushered in the industrial revolution. Next came oil and natural gas in the internal combustion engine, which was even more efficient. Dr. Smil argues that going to solar and wind at this time moves backwards in efficiency substantially and therefore will require far less energy usage per capita in developed countries than currently given the available technology. This is bad because, historically, higher economic growth has only been possible with higher energy use.

The Facts about Current Energy Use and Our View on Prices

We think drastically lower energy use and thus slower growth in the developed world will be unacceptable or at least strongly resisted. At the same time, there is and will continue to be pressure on energy resources from the developing world. The numbers tell the story. The average person in the United States uses 300 gigajoules of energy per year. In the EU that number is 150. China is only at 100 while India is at 50. Most of Africa, with a population of 1.3 billion people is under 10 gigajoules per person per year. Environmentalists have had very little success convincing the developing world to use far more expensive renewable energy as they seek to lift the prosperity (e.g., energy usage) of their populations. Even China, which signed the Paris Climate Accord and speaks often about becoming greener, has made it very clear that economic growth is its paramount concern and that it will keep growing carbon emissions until 2030. According to Global Energy Monitor, China was still rapidly building 88,000 megawatts of coal-fired electric plant capacity as of early 2020 with another 53,000 megawatts fully permitted. In fact, a total of 269,000 megawatts of coal-fired generation is being built (or is fully permitted) around the world including 8,300 in developed Japan. That amounts to 14% growth in the dirtiest but cheapest form of energy.

So, what might be the net result? We believe that the developed world may well spend trillions of dollars on renewable energy, but its hydrocarbon consumption will not change much, particularly if nuclear plants continue to be shut down as they are scheduled to be. In the developing world, hydrocarbon demand will continue to grow at a rapid pace. Therefore, total world demand could grow as fast as it has in the past. What then is likely to happen if there is underinvestment in the oil and gas industry? In our opinion, the most probable result will be low-supply growth and higher prices. Perhaps much higher prices.

Higher oil and gas prices coupled with trillions of dollars essentially wasted (at least temporarily) on the renewables transition could be very detrimental to the economies of the developed world. We have written on many occasions about how economic stress has led to social and political stress. Things are difficult in that regard already and might get a lot worse if markedly higher energy prices negatively impact growth. And remember, that higher energy prices translate into higher prices for almost all commodities, given the energy intensity of commodity production. For instance, crop fertilizers are very energy-intensive, so high energy prices mean high food prices.

At the same time, the position of countries, such as China and Russia, who continue to use and benefit from cheap energy or are energy producers benefitting from higher prices, would improve relative to the West. The already dangerous great power competition might become more intense and could begin to favor those countries. Is it really a good idea to unilaterally disengage from the efficient use of energy when your mercantile and potential military competitors are not? That seems to not be a well-thought-out strategy.

The Energy Transition Might Not Even Work!

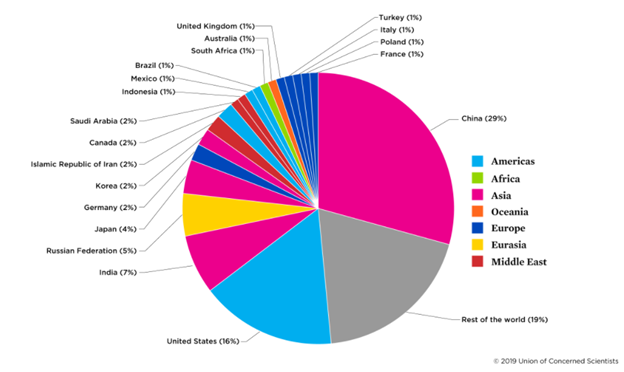

When considering these consequences, it is necessary to consider that all this very well might happen without helping the world’s carbon dioxide problem much. As noted above, hydrocarbon usage is likely to continue to grow for a long time given that much of the world is not embracing decarbonization. Nearly 50% of emissions currently come from China, India, Russia and other hydrocarbon-producing countries that are not intending to limit usage. Other developed countries that cannot afford the transition add up to another 20-25%.

Source: Union of Concerned Scientists

These countries are likely to grow emissions and negate the impact of cuts elsewhere. Further, there is a lot of research and analysis that concludes that the carbon emissions reduction from renewables and electric vehicles will be much lower than expected. For one, renewable energy is not renewable. Every windmill, solar panel and lithium battery has a finite life and will need to be replaced. The energy needed to make and maintain these assets is substantial. Both Goehring & Rozencwagj as well as investment bank Jefferies have published studies which claim that over the normal life of an electric vehicle, when the energy to produce it is counted, there is no carbon emission benefit. So, is it worth it? By it, we mean the policy-induced risk of potentially pushing oil and gas prices to dangerously high levels. We remain unconvinced and believe skepticism is warranted given the risks involved. We do not think the technology exists to deliver the results for which policymakers hope, and we believe basing the strategy on the hope for very difficult to achieve technology improvements is not thinking things through. Hope is not a strategy.

Investment Implications

As with all problems, our goal is to understand them and find a way to invest so that we may benefit. We call it “being long the solution.” In this case, the investment implications are somewhat obvious albeit with a subtle twist. If decapitalizing the oil and gas industry is going to lead to higher prices for oil and gas, then returns to existing assets should rise and one strategy would be to buy the companies that own those assets. The twist is that due to the very reasons we cited above; the pressure to avoid investing in traditional energy could make multiples compress even though earnings are rising from high prices. We think it may be a good idea to avoid certain bigger name, “lightning rod” companies. Those companies will be targets for bad press and overly zealous investor aversion. The other way to benefit may be to consider investing in those countries less determined to risk it all in an expensive gamble on the energy transition or who are commodity producers themselves. We think it is possible that the economic winners in such an environment might include Russia, China, and certain other hydrocarbon-producing regions. The companies, particularly energy companies in those places, may prove to be attractive. We are studying many of them and have already invested in several.

Conclusion

Energy is an important thing. Civilization depends on its efficient use. Those who have figured out how to harness it best have been the winners throughout history. We fear that the headlong rush to decarbonization has not been thought through properly. We do not disagree with the sought-after result. However, we think the needed technology does not yet exist, and support for the change is not shared across the entire planet. The countries that are engaging in the attempt could end up creating massive malinvestment, energy price spikes and therefore enhance the economic and geopolitical position of their rivals such as Russia and China. All of this without perhaps any reduction in greenhouse gas emissions! Has the United States and the rest of the developed world really thought this through? We do not think so.

The job of setting policy thankfully is not ours. Our only job is to shepherd capital through an often dangerous investment environment. With all great change there is danger but there is also great opportunity, even if that opportunity takes a form that is surprising. We will be watching the energy transition carefully for opportunities and suggest you do the same!