“For every action, there is an equal and opposite reaction.”

- Sir Isaac Newton’s Third Law of Motion

China has been a powerhouse economy for the last several decades, astounding the world with its economic growth. China has pulled off the largest, most rapid industrialization in the history of the world. In 2003, I began to travel quarterly to China to research the foundations of the unfolding commodity boom. What I saw in China was amazing. Those who understood China in those early days of the unfolding boom profited immensely in what would be the dominant investment theme of the decade. But along with any sustained success comes the inevitable over-exuberance and its close corollary –overinvesting. Overinvestment carries within it the seeds of its own demise. Upcycles and their booms are followed by downcycles and their busts.

China is now so big and has been such a force for so long in so many markets, that we have to watch it carefully – and dispassionately. There is much to be worried about in China, especially its rising debt levels which have nearly doubled relative to GDP since 2008, according to the magazine ‘The Economist.’ The number one leading indicator of future financial distress is credit growth, which is a lesson the US housing crisis made clear. I spent a week in China in March of 2012 investigating the Chinese shadow banking system, whose growth fueled the tremendous credit expansion in China since 2008. In this week’s Trends and Tail Risks, I take a fresh look at the Chinese credit market to ponder the potentially dark side of China for the global economy.

My 2012 trip to China focused on one issue only: the Chinese shadow banking system. The shadow banking system is an informal network that funnels capital to investment opportunities outside of the narrowly defined banking system. This involves, for instance, unregulated shorter term investment trusts that pay interest rates in excess of those offered on bank deposits. This shadow banking system was really blossoming then and has continued to do so. Frankly what I saw in China in 2012 concerned me. I witnessed many of the same errors that I was able to identify profitably as precursors to the US financial crisis, such as investors placing money in hard-to-understand vehicles to chase higher yields, and capital allocators borrowing short term to lend long term. Any break in confidence could undo these assumptions that underlay the appearance of abundant liquidity.

During this trip I had the pleasure of meeting one of the most astute observers of China I have ever met, a highly placed official with the influential Chinese policy making body, the NDRC. He confided to me in March of 2012 that the biggest risk for China was that it would not be able to complete its ambitious reforms and liberalization policies before the next tightening cycle in the US when the Federal Reserve would start to raise interest rates. He told me, “No country has ever attempted a leap of this magnitude in so little time.”

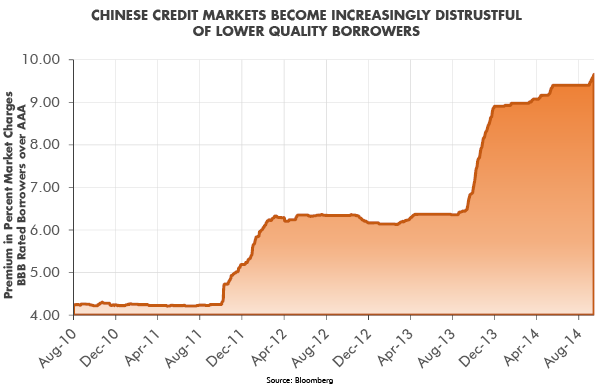

Now, two and a half years later, the Fed has initiated its tightening cycle. Has China made the leap successfully? The data so far is not encouraging. As the chart above illustrates, credit stress within China has continued to rise. A rising line means that the market continues to charge lower quality borrowers a rising premium to the interest rate it charges higher quality borrowers. This is the clearest sign possible of rising credit stress and a potential credit crisis unfolding in China. An alternate hypothesis to explain this data is that China is still in the process of making its great leap of reform and this rising cost of capital, and rising credit spreads, are a sign of China’s commitment to let the market more freely allocate capital within China. Even if this more charitable interpretation is the case, it still suggests that China has been caught midway in its leap of reform. China’s shadow banking system has also shown other signs of stress. In recent months there have been a number of increasingly visible signs of disappointed investors who are losing faith in China's shadow banking system. Just today in China, a group of investors, shown below, protested in Beijing outside the China Credit Trust office demanding the return of their money.

Long time readers of this publication will understand my framework that credit quality leads equity prices. My reasoning (Simplicity, June 18, 2014) is that equity is the junior tranche in a company’s capital structure, and thus is subordinate in security to that of bonds. So by definition rising credit spreads suggest weakness in debt values, and logically weakness in equity prices. Once credit stress in China peaks, investors should be presented with a strong buying opportunity in Chinese equities. But when will we see that peak in Chinese credit stress? One thing we may have to watch is the value of the US dollar, as I explain below.

Long time readers of this publication will understand my framework that credit quality leads equity prices. My reasoning (Simplicity, June 18, 2014) is that equity is the junior tranche in a company’s capital structure, and thus is subordinate in security to that of bonds. So by definition rising credit spreads suggest weakness in debt values, and logically weakness in equity prices. Once credit stress in China peaks, investors should be presented with a strong buying opportunity in Chinese equities. But when will we see that peak in Chinese credit stress? One thing we may have to watch is the value of the US dollar, as I explain below.

The US Dollar Wild Card

The US dollar matters to China a great deal because China’s currency is still largely pegged to the value of the US dollar. A weaker US dollar helps lower the price of Chinese exports into markets with stronger currency values, such as Europe, which is China’s largest export market. So a falling US dollar is a form of ‘stimulus’ for Chinese exports. The converse, however, is also true. A stronger dollar is a form of tightening for China, since as the USD rises, Chinese exports become increasingly less competitive, which slows down the Chinese economy. A stimulative devaluation of China's currency would be a rational policy response to counteract its ongoing slowdown and rising credit stress. Currency appreciation is literally the last thing that China needs right now. But that is exactly what it is getting - as long as the Renminbi remains linked to the value of a rallying US dollar.

Since May of 2014 the dollar’s value has increased 10% versus the Euro as European financial leaders adopt ever more desperate attempts to restart Europe’s slowing economy. Europe has now joined the ‘beggar thy neighbor’ policies of Japan, which has cut the value of its currency vs. the US dollar by more than 30% in the last few years to ‘stimulate’ the Japanese economy. These competitive devaluations by our trading partners harm not only the US but also threaten China – as long as the Renminbi remains relatively fixed in value to the US dollar. In time it would be very rational for China to respond to these competitive devaluations by guiding a policy of Renminbi devaluation versus the US dollar. I can see both the compelling logic and enormous political and economic consequences of Renminbi devaluation. China may be ready for a Renminbi currency devaluation - but is the world ready? A devaluation of the Chinese currency could set off a cycle of economic distress around the world as other countries would be likely to respond with devaluations of their own.

Individual countries are devaluing their currencies to deal with the ongoing global problems of disappointing growth and overindebtedness, but collectively we may all suffer. That was one of the chief lessons of the competitive currency devaluations of the 1930s. In future Trends and Tail Risks, we will explore the unintended consequences of the competitive devaluations now sweeping the globe.•