“I made my money by selling too soon.”

-Bernard Baruch

Could Fed Mistakes Turn An Inventory Destocking Cycle Into Something Worse?

The S&P 500 has fallen more than 7% in the last three weeks, erasing almost all the market’s advance for the year. The Russell 2000 Index of US small capitalization stocks is down nearly 10% year to date with almost all of that decline taking place in the last six weeks. Is this volatility just noise to ignore, or is there an important message in the market’s growing concern? We agree with legendary investor Bernard Baruch, that it’s better to be safe than sorry. In this week’s Trends and Tail Risks, we explain why we think an inventory led slowdown is now underway and outline our nagging fear that a bad situation could be made worse by a Fed policy error.

Frequent readers of this publication will be familiar with our long running concern about an inventory led downturn in growth this year (Making Volatility our Friend: Trading the Kitchin Cycle, Unsustainable Steel Premiums, Revisiting the Inventory Cycle). As we suspected, scrap steel prices in Turkey have swung down dramatically, taking with them the equity prices of US steel producers such as AK Steel (AKS) down 50% in the last few weeks and US Steel (X) down 32%. The huge $1 trillion global steel market shows the forces of supply and demand as they, in real time, drive the economy. The message of steel right now is one of weakness, which is a message that we have been anticipating for months.

This is the chief reason that we have been the voice of caution - especially for the last several months. We observed an overly optimistic credit market (What does the Bond Market Know?, Is Credit Quality Peaking?,Credit: Caught Leaning?) priced for perfection in front of what we believed would be a meaningful inventory slow down. These fears are now playing out as the market falls. We cannot grow clients’ investments without taking risks. But not every risk is worth taking. Our goal is to expose investor capital only to those risks that offer the best possible return with the least risk. This is why we have been raising cash, extending bond duration (Our Bond Strategy: The Power of Duration) and generally de-risking portfolios. The risks of a slowdown that we foresaw are now more priced in than they were just a few short weeks ago. This is real progress. But is it enough?

Our persistent fear has been that an overly restrictive Fed would cause greater disruption to the markets than many had feared as the Fed wound down its controversial “quantitative easing” (QE) program. In effect, our worry has been that the Fed would repeat the policy error of 1937.

The Policy Error of 1937

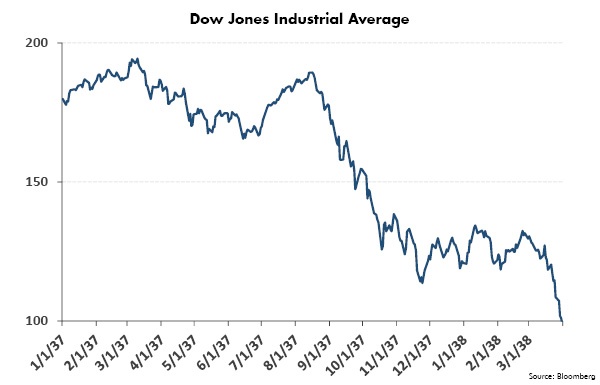

The US equity markets by early 1937 had enjoyed five long years of solid improvement after their initial lows in 1932. The Fed, President Roosevelt, and other policy makers had become complacent with the recovery and confidently took steps to wind down what had been to date the greatest set of “stimulative efforts” in US history. The US government’s bias turned from fostering growth to cutting back stimulus in bank reserves and especially in the public’s perception of the direction of future inflation. This proved to be an enormous mistake. The market - and belatedly the Fed - would learn that the over-indebted world of 1937 had not sufficiently deleveraged to be taken off of “life support.” The Dow Jones Industrial Average would fall almost 50% in the next year.

Will the market suffer such a debilitating decline during this transition from extended QE stimulus? Surely this is the most important question in the investing world today.

In next week’s publication, we will dive more deeply into what the Fed got wrong back in 1937 to understand the factors we are now watching to guard against this risk. This is why we study market history – to learn from the past so that we may profit in the future. Thankfully, our experience in volatile markets has already provided a pathway forward by which we can take safe and profitable steps even in the face of uncertainty. In our portfolio construction all year long and in these pages to our clients we have already taken the most important steps to diversify and stabilize our investments - while explaining in real time why we were doing so. The next signals for which we will be watching will be a bottom in the all-important scrap steel market. A move from falling to rising scrap steel prices will suggest that the pressures of the destocking cycle are behind us. Our investment allocations will then turn more aggressive. We will then gladly expose new capital to risks for which we are being sufficiently compensated and for which we have a compelling margin of safety. As always, we remain committed to following these trends in real time to keep your money growing safely.•