Many of us grew up enjoying the cartoon Peanuts and its Charlie Brown Specials on TV. Charlie was the brainchild of Charles Schulz, who is now widely considered to be one of the most influential cartoonists of all time.

Many of us grew up enjoying the cartoon Peanuts and its Charlie Brown Specials on TV. Charlie was the brainchild of Charles Schulz, who is now widely considered to be one of the most influential cartoonists of all time.

His cartoon strips provided countless hours of joyful relaxation to many generations across the globe. At its peak his work was carried by 2,600 papers in 75 countries and produce more than $1 billion in revenue per year. Schulz earned his star on the Hollywood Walk of Fame in 1996. In 2000 he was awarded the Congressional Gold Meal, the highest honor our Congress can award to a civilian.

There are just so many iconic moments that are indebted to Shulz’s pen: Snoopy as the Red Baron, Linus hammering away at his piano, and Pig Pen surrounded by a cloud of dust. To me the most enduring – and most frustrating - of all the scenes Schulz would illustrate featured Lucy and Charlie Brown. You know the one I mean! Lucy is kneeling and holding a football in her hands, poised for Charlie to kick it. Long-time fans of Charlie Brown have likely watched this scene many times – each time with the same result.

Inwardly we all warn Charlie: don’t trust Lucy!! Somehow Charlie never listens. Lucy fails Charlie time after time. Charlie ends up, yet again, on his back, wondering what just happened to him. In today’s “Trends and Tail Risks,” I see the U.S. Federal Reserve’s “promise” to hike rates as playing the role of Lucy, and the market’s seemingly boundless trust in the Fed as the long-suffering Charlie Brown.

Whatever Happened to Those “Imminent” Fed Interest Rate Hikes?

When will the market, our long-suffering Charlie Brown in this analogy, stop believing the Fed? When will the market start to embrace the growing evidence, building up now for years, that growth and inflation both downshifted dramatically in the aftermath of the 2008 Global Financial Crisis? My doubts about the universally held belief in “imminent rate hikes” have been a common refrain in these pages for more than the last year. Most recently I noted the two items below, in The Art of Contrary Thinking, 5/6/15, as among my favorite candidates for what would disappoint investors the most.

Under the heading “What Everyone Knows is Often Not Worth Knowing!” I listed as items three and four the following:

- The U.S. recovery is (finally!) self-sustaining. The Fed will definitely hike interest rates this year – and certainty won’t have to resort to quantitative easing again in the near future, if ever. U.S. bonds are a terrible long term investment.

- The U.S. dollar will continue to strengthen relentlessly as the Fed tightens monetary policy while the rest of the world struggles with lackluster growth.

My own biggest source of (seemingly un-ending) personal frustration has been, rather, why everyone else seemed to be believe the Fed in the first place. The Fed’s estimates for both growth and inflation have been much too high and have completely missed the mark – not just for a few months but for years. Strangely over the past two years the market just didn’t seem to care. It was all just a “temporary” delay – until just a few weeks ago, that is.

The Eurodollar market: Expectations for Interest Rates 12 Months into the Future Peaked a Year Ago

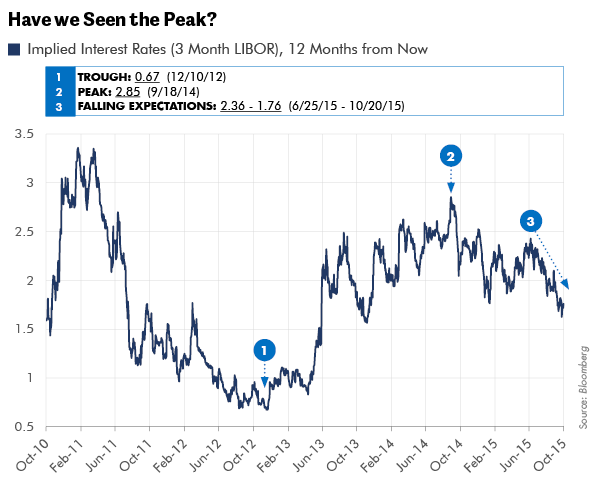

The Eurodollar market is one of the world’s largest, deepest and most active financial markets. Companies, banks, and investors use this market to arrange financing terms and hedge risk. I show below one key facet of this market: how we may use it to understand the market’s expectations for short term interest rates (3 month LIBOR rates) one year from now.

On September 18, 2014 the market’s estimate for interest rates in the coming year peaked at 2.855%, as the chart above illustrates. The market’s expectations for rates one year from now have been declining ever since. The prevailing rate this morning is 1.745%. The pace of the decline has accelerated in recent weeks. From September into October of 2014, the S&P 500 fell 10% as did the MSCI Index of global equities. Both markets recovered from that depressed level to hit new highs in 2015. However, both indices are now roughly unchanged since the market’s estimate of forward interest rates peaked back in September of 2014. Since then, credit distress has spread beyond the much-beleaguered commodity sector and emerging markets. In recent weeks this weakness finally infected the broader U.S. stock market indices.

Was this – September 2014 - the peak of growth? Certainly I can say with complete certainty that September 2014 represented the peak – so far – of the market’s expectations for interest rates a year from now. This time period also coincided with the peak in the inventory cycle that I had long expected (Making Volatility our Friend: Trading the Kitchin Cycle, 5/28/14, Revisiting the Inventory Cycle, 10/1/14).

The market’s expectations for the level of interest rates in the future - have done a solid job of catching inflections in the global economy. I show only the past five years here in the interest of conserving time and space, but let me take a moment to highlight other important dates. In May of 2000 and June of 2007, interest rate expectations would also reach a cyclical peak.

Students of market history will recognize those periods of time as peaks in fundamentally driven growth. They were NOT necessarily peaks in the stock market however. The tech-driven NASDAQ had already peaked in the U.S. by March of 2000, but by September of 2000 the broader S&P 500 index was challenging its old highs – and there it would fail. Similarly stocks in 2007 would go on to hit higher highs in October of 2007, even after a severe mid-year correction, driven by falling interest rate expectations.

What Does This All Mean? Has the Dead Weight of Overindebtedness Shown its Hand? Are the Days Over When the Fed Could Hike Interest Rates Aggressively?

Ray Dalio, the Chairman of Bridgewater, the world’s largest hedge fund, has been one of the few voices in the wilderness to point out the danger that we may be near the end of what he calls the “long term debt cycle.” The most important – and controversial – takeaway is his expectation that the next sustained policy action by the Fed is not tightening monetary policy but rather loosening and more stimulus! We first outlined his fears on September 9th (Equity Market Volatility (Finally) Catches up to Credit Market Volatility), but frequent readers of this publication will recognize that this has been one of the most enduring themes of this publication for over a full year now.

Let me be very clear: I am not saying that the Fed will never hike interest rates. Rather I am saying, in agreement with Mr. Dalio, that I think the next “sustained” move by the Fed is more stimulus. I share with Mr. Dalio an abiding fear of the debt overhang with which the world is now struggling. I believe that overindebtedness will keep interest rates a lot lower for a lot longer than almost anyone anticipates.

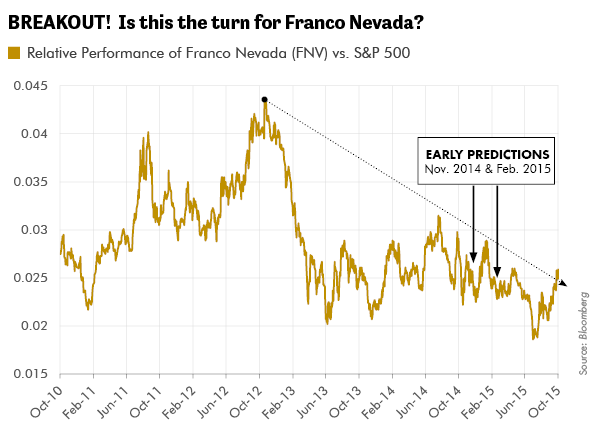

My long-abiding fear has been that overindebtedness is a serious threat to global growth. For this reason I monitor many indicators, such as the chart of interest rate expectations above, that can inform my view on the all-important question of: where are we in the cycle? Also for this reason I have favored the gold royalty sector – and Franco Nevada (FNV) in particular, as an important part of a defensive portfolio. Many of these strategies have proven their merit over the last year, such as favoring high quality/longer duration bonds (Our Bond Strategy: the Power of Duration, October 8, 2014) and emphasizing high quality, dividend paying stocks (Long Term Outperformance, 8/19/2015) while we wait for the cycle to bottom. Yet the gold royalty sector – which is also a defensive sector – has underperformed until just recently. Perhaps that is changing now? Let me explain.

Franco Nevada (FNV) – Long Favored by My Research but Nonetheless I Have Been Early. Is now Franco’s Time to Shine?

I have highlighted in these pages many times what I see as the merits of owning the sector-leading gold royalty and streaming company Franco Nevada. Frequent readers are very familiar with this name and why I believe it’s one of the best-positioned companies to own in an overindebted world. I will not repeat my prior arguments here, but would refer those who want to explore my thinking back to: (Balancing Insight with Timing, 11/19/14, Luck Favors the Prepared, 1/7/15, Art of Contrary Thinking, 5/6/15). Frequent readers are also aware that I have held this view for more than a year. Until just the last few weeks, frankly, this view has not been particularly profitable. That is starting to change now. Will that continue? I am comforted by the fact that there was also an extended time when my view favoring higher-quality, longer duration bonds, and many of my other views, were also very controversial.

Patience is one of the Most Important Attributes of Successful Investing

As this last year has unfolded, and many of my fears about slowing growth have become real, Franco and the gold royalty sector to my surprise continued to languish. Few seemed to share my concerns, which made attractively valued stocks even cheaper: the curse of the value-driven manager! The market kept expecting that those Fed interest rate hikes were imminent! That overindebtedness was not a real concern. In retrospect, the market was clearly wrong. Yet my once-controversial views were not rewarded. This is not how it’s supposed to work!

Still, however, the foundation on which the best future returns are built always spring forth from a profitable disagreement with the market. This has two components: 1.) being right and 2.) staying true – and patient – to my fundamental analysis. In some instances, profitable disagreements with the market may pay off quickly. I wish that this were always the case! Sadly I can promise you from long experience that it is not. I am now well into my second decade of professional investing and can promise you this: in the course of my investing I will be early. Yes, it will be frustrating. And yes – it’s an unavoidable cost of doing business. I use my own set of proprietary indicators to try to minimize the risk of being early, but I will never totally eliminate this risk. That is not how the real world works. As investors we must all live in the real world, and for this reason my counsel is always: patience!

In Conclusion

Are we now at an important juncture in the markets? A year has passed since the peak in credit quality and since the peak in expected interest rates. Have we seen the peak more broadly in equities? Or are we nearing that peak? I think this is one of the most important questions that investors need to answer right now. I continue to monitor many indicators that have proven their worth over many market cycles. It is too early to say for sure, but we could be nearing a time that the signals from these indicators begin to agree with each other. I always have the highest conviction when multiple indicators express a consistent message. Waiting for that consistent message also sometimes takes patience!

But I can tell you that one of my own “internal indicators” is often my own level of frustration. It can be very frustrating in the short run to see the scope of disagreements I have with the market begin to multiply. But from long experience this is also an important sign that my views are getting closer to driving sustained outperformance!

Is the market finally starting to price in that Fed rate hikes, and the level of long-term interest rates as well, may be more subdued than most currently anticipate? The chart above of interest rate expectations suggests that maybe this time is at hand. If it is, then I can safely say that this is one of the most important developments in the market for many years. Also, if this is the case, I could see the market repricing many other assets, such as commodities or emerging markets, where valuations are very depressed.

My chief frustration in the last two to three years has been the unanimity of opinion that the market seems to have about the ease with which the Fed might “normalize” interest rate policy. I understand the market’s desire, and those of the investors who are active in it, to want to go back to the simpler days of pre-2008, when the world seemingly made much more sense. I am just not sure that is possible. We as investors are thrust – like Charlie Brown - into a frustrating world. Still, I will never shake my belief in the merit of rigorous fundamental analysis to shape my understanding of how the world really works, nor will I doubt the benefits of disciplined value investing. •