By Lewis Johnson - Last week’s Trends and Tail Risks noted that there is more money to be made being long the solution than there is in shorting the problem. We are convinced that over indebtedness is the world’s[…]

By Lewis Johnson - They would say, when Whitey Ford made that incredible motion to nip the base runner off first, that the man was caught leaning. The man was leaning one way, and realized what was happening, and[…]

By Lewis Johnson - "Formal education will make you a living; self-education will make you a fortune." -Jim Rohn The U.S. stock market just suffered its worst week in more than two years. Is this just short term[…]

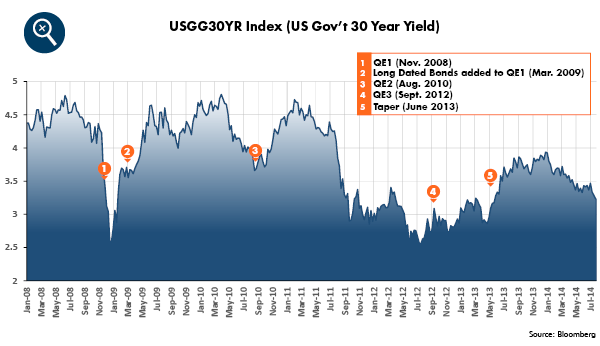

By Lewis Johnson - The US Federal Reserve’s Quantitative Easing (QE) program of bond buying has been one of its most controversial policies in recent years. In this week’s Trends and Tail Risks, we examine QE by[…]

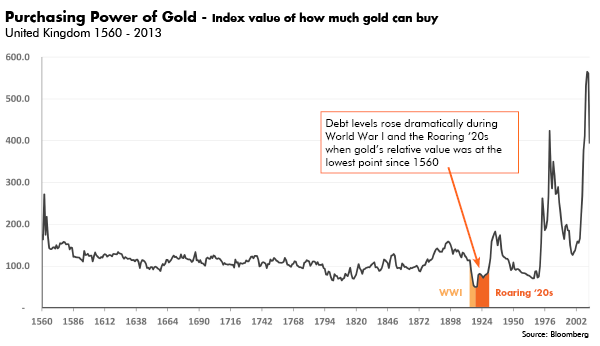

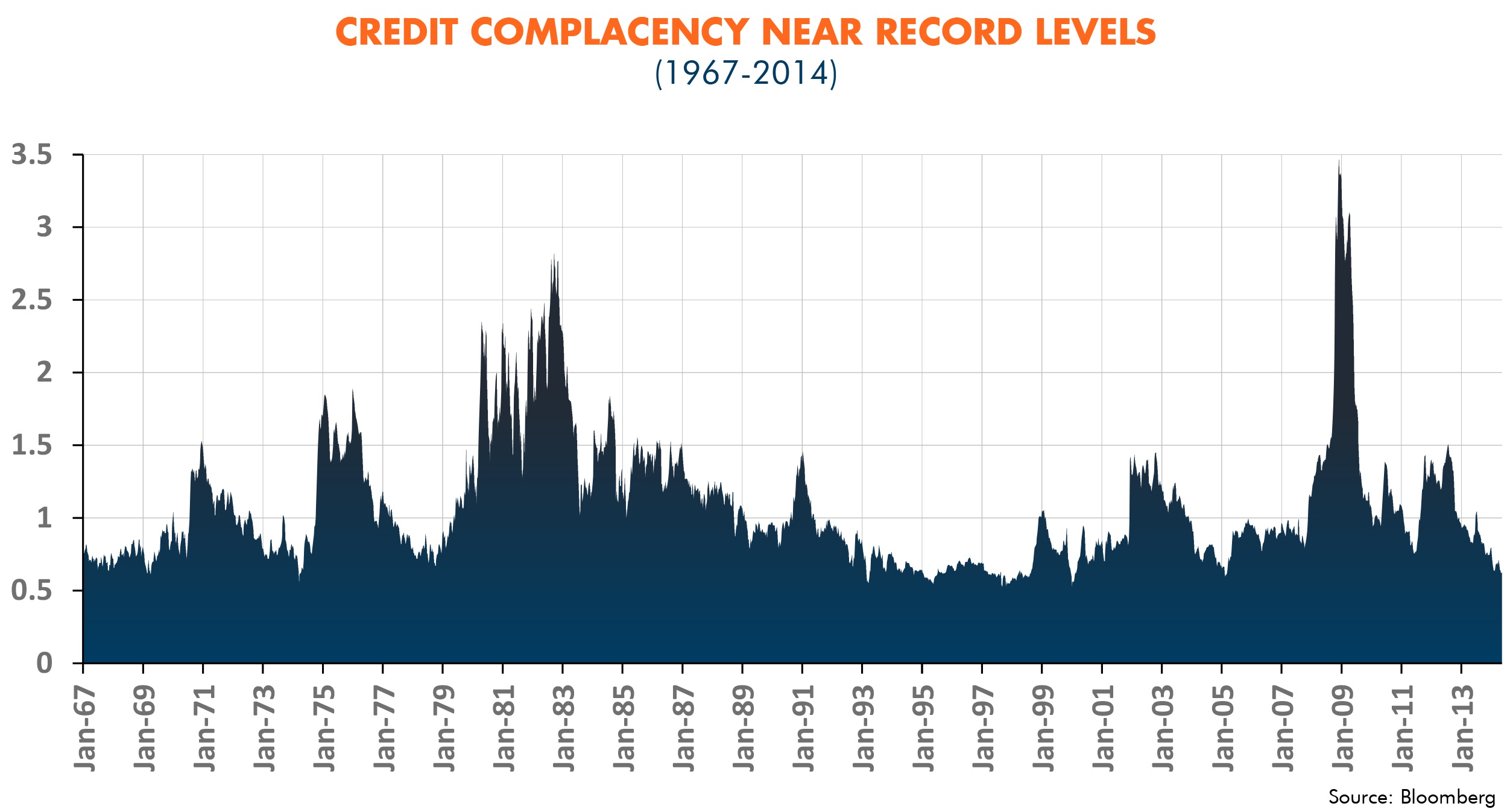

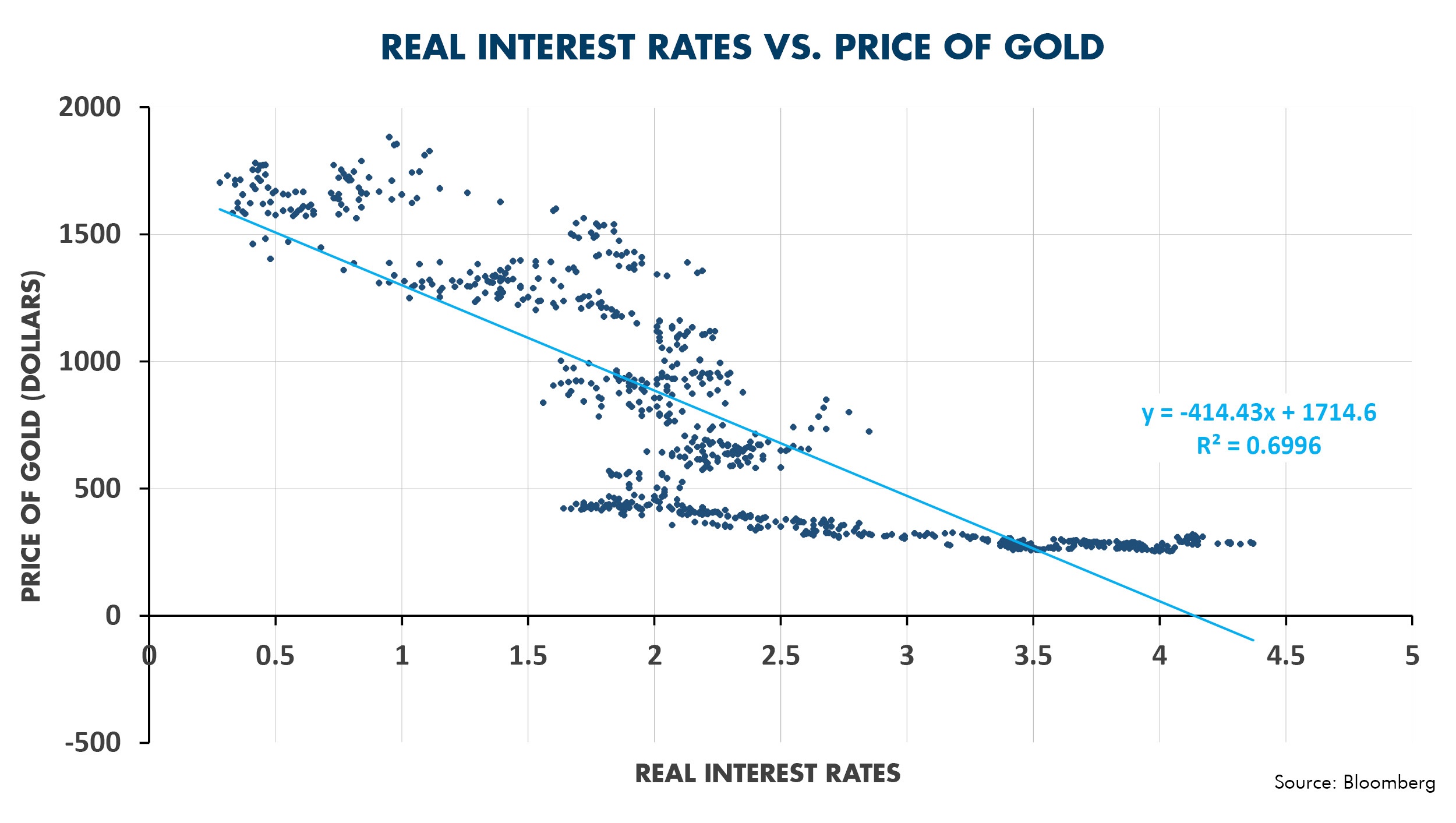

By Lewis Johnson - After a long hiatus, gold’s quiet outperformance (up 9.6% YTD) is slowly working its way back into the financial pages. However, gold took its time getting back there. After all, the price of gold[…]