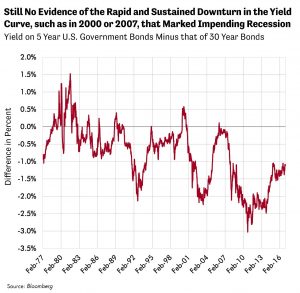

By Lewis Johnson - Chief Conclusion Today the Dow Jones Industrial Average hit 20,000. Yet we now find ourselves deep into the fourth longest expansion in recent history. For good reason, investors are asking if this[…]

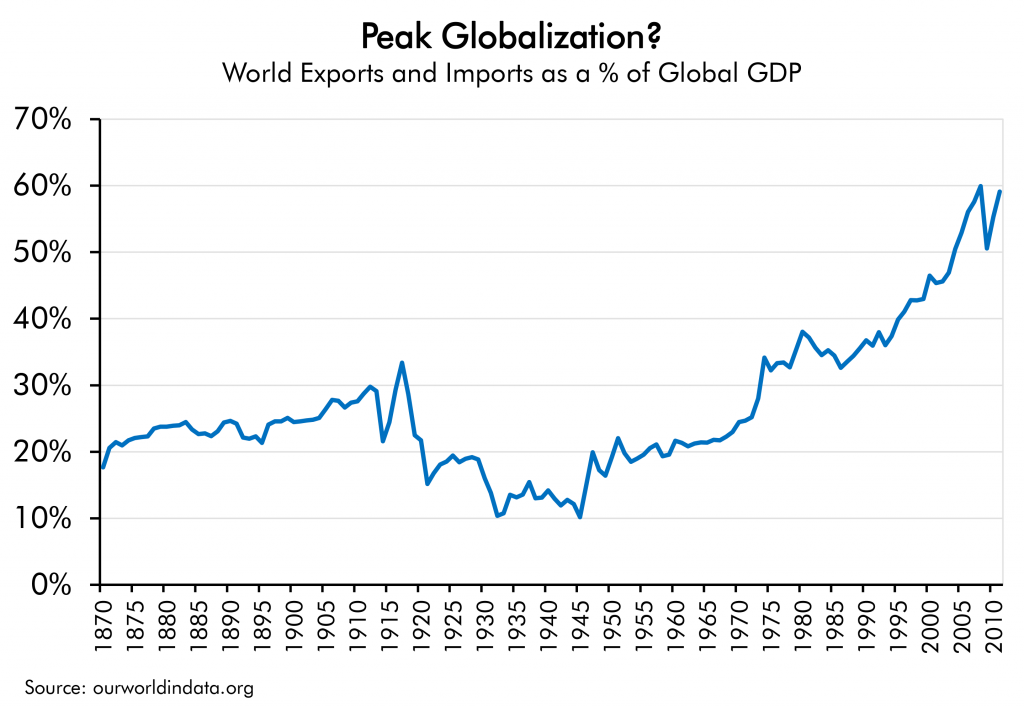

By Lewis Johnson - Chief Conclusion Do not underestimate the determination of the incoming Trump Administration to overturn the established norms of international trade. Don’t be surprised if, at the first opportunity,[…]

By Lewis Johnson - Chief Conclusion We expect that the upcoming Presidential election in the U.S. may add further evidence supporting the growth of a powerful and global bull market in populism and its corollary,[…]

By Lewis Johnson - Chief Conclusion The 54% drop in the share price of Deutsche Bank (DB) in the last year raises questions about the health of our financial system. Shareholders at many other thinly capitalized[…]

By Lewis Johnson - Chief Conclusion Notable outperformance by silver equities suggests we are just at the beginning of a new and extended precious metals upcycle. Overindebtedness is driving this bull market..