By Lewis Johnson - Chief Conclusion Notable outperformance by silver equities suggests we are just at the beginning of a new and extended precious metals upcycle. Overindebtedness is driving this bull market..

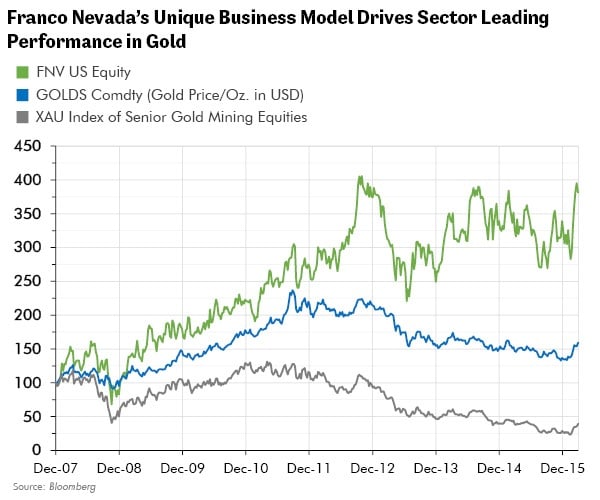

By Lewis Johnson - Chief conclusion We believe that gold is entering a new bull market. If so, the opportunities for outperformance could be the greatest we have encountered in perhaps fifteen years.

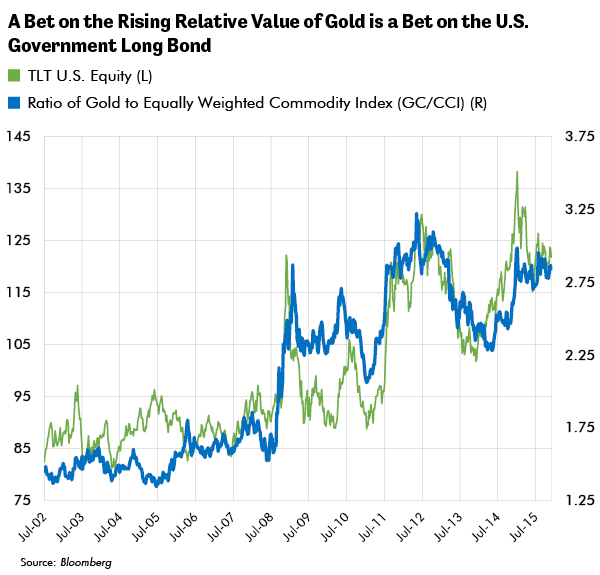

By Lewis Johnson - Simplicity should be a constant goal in investing. Note the key word: goal. Sadly it’s a daunting effort to reach a simple understanding of our increasingly complex financial world. Often it takes[…]

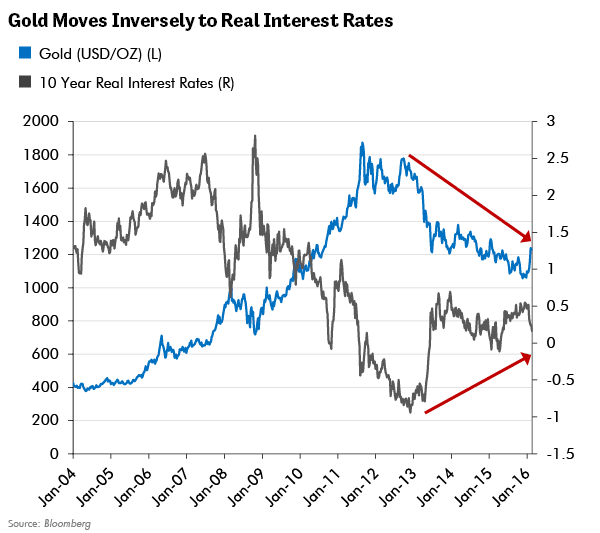

By Lewis Johnson - Gold is up 19% year to date against the backdrop of a volatile stock market. In fact, gold just clocked its strongest February since 1975. Is this the move we have been waiting for in gold? We[…]

By Lewis Johnson - Wealth cannot grow unless it is invested and therefore placed at risk. Done properly, over time, investing in the right risks can be amazingly rewarding. Choosing the right risks means avoiding the[…]