“Over? Did you say over? Nothing is over until we decide it is. Was it over when the Germans bombed Pearl Harbor?” -Bluto Blutarsky, “Animal House” 1978

Is the bear market over? Is the monetary tightening cycle over? Nobody knows for sure but we think it’s unlikely. Surprisingly, despite the recent market rally, some very seasoned professionals feel the same way. Jamie Dimon, the man who runs the biggest bank in the United States, JP Morgan, recently predicted a 20-30% chance of a mild recession, 20-30% chance of a “harder’ recession and the same percentage for “something worse”. It's probably better to plan for the worst and hope for the best. That does not mean though that there are not positive returns to be made! There is always a bull market somewhere is one of the mantras of our investment philosophy. Those returns, almost by definition, are not where most people think they are going to be. Widespread belief in something being a good investment is more often a sign that it is fairly priced or perhaps even over-valued. Regardless, to determine what investments are likely to work you have to have a realistic view of the current situation. That view is not rosy in our opinion.

The quote above is from the iconic movie Animal House that I watched the other day for the first time in many years. According to Wikipedia, the 1978 movie was “largely responsible for defining and launching the gross out film genre.” The United States Library of Congress deemed it “culturally, historically and aesthetically significant” and selected it for preservation in the National Film Registry. As a junior high school student watching it for the first time myself - and all my friends - thought it was the funniest movie we’d ever seen! Of course, that might have been because “Airplane” and “Caddyshack” had not yet been released. More on that another day…

The movie’s inspiration was National Lampoon writer Chris Miller’s fraternity life experience at Dartmouth College in Hanover, New Hampshire in the early 1960’s. The protagonists in the film are members of the fictitious Delta Tau fraternity at Faber College, who engage in all sorts of self-destructive behavior. One bad decision led to another until their fraternity is finally kicked off campus and they are all expelled from school. Even then the brothers don’t back down and bring their destructive behavior to the rest of the school and the town beyond.

Surprisingly, everything turned out okay for most of the Delta house brothers, as we learn at the end of the film. Bluto Blutarsky, who had a zero-point zero GPA and guzzled entire bottles of Jack Daniels whiskey goes on to become a United States Senator. “Flounder” with his 0.2 GPA and the Dean’s admonishment that “fat, drunk and stupid is no way to go through life, son” turns out to have a respectable career as well. Times have changed for sure as that line and many other parts of the movie would not make it past politically correct censorship today, which is interesting but not what struck me about the movie at this time.

Recently, the Speaker of the U.S. House of Representatives, Nancy Pelosi, and her entourage made a semi-official United States Government trip to Taiwan. As everyone knows, relations with Taiwan are extremely complex and sensitive these days. China insists that Taiwan is its sovereign territory and most of the rest of the world acknowledges that. However, the island has been self-governing and operating as an independent country since 1949 when Chiang Kai-Shek and his Chinese nationalist army, defeated by the communists, took refuge there.

Today there is no greater flashpoint for great power rivalry than Taiwan. Perhaps there has never been in history. At this time the two main rivals for global power are the United States and China. China’s ultimate control of Taiwan is existential to its claim to be a rival to the United States as a super-power. However, at present Taiwan may be existential to the United States as well. Nearly 20% of all semi-conductors are manufactured there. Together with China the total market share is nearly 45%. Keep in mind that virtually nothing in the modern world can be made without semi-conductors. With control of Taiwan, China’s importance to the world economy through this dominance would, in our opinion, exceed the importance of the Arabian Peninsula countries in the 1970s when crude oil was the lifeblood energy source on earth. Even Saudi Arabia and its neighbors never had 45% market share, like the Chinese and Taiwanese do! The United States and its allies cannot cede control of Taiwan at this time because that would cede dominance of chip manufacturing to their chief rival.

Nevertheless, the most likely resolution of the problem in our opinion, and a palatable one to both sides, would be for Taiwan to peacefully transition to Chinese rule over several decades. China would get what it wants, and the West could shift substantial semi-conductor manufacturing to more hospitable locations over many years in anticipation. It seems that forcing a confrontation at this time is in no one’s interest and could create mayhem in the world economy and even possibly a shooting war whose outcome could be disastrous. Nancy Pelosi, by going to Taiwan, was engaging in what is in our opinion self-destructive behavior.

Animal House?

Which gets us back to “Animal House” the movie. Like the Delta House brothers at Faber College, it seems that the political leadership of the collective West has been engaging in ever escalating self-destructive behavior lately. The examples are endless so we will name just a few: A pandemic policy that crushed small businesses and gave prodigious amounts of newly printed money to people long after they could have gone back to work. An unnecessarily chaotic and haphazard end to the long war in Afghanistan. An ill-designed and too-rapid strategy of decarbonization (which we called out as misplaced more than a year ago – before it was in the headlines “Think Things Through!”

Lately, our political leaders’ bad decisions appear to be escalating. Rather than exhaust every avenue of diplomacy, the West thought the threat of sanctions might deter Russian action against the Ukraine. That did not work and a war started. The resulting sanctions caused an energy crisis that put all of Europe in a precarious situation while not having a material impact on Russia’s behavior. Just as this situation has become plainly evident over the last few weeks, Nancy Pelosi’s trip to Taiwan emerged as an issue and caused tensions with China to flare. To what end? To us, this appears to be more self-destructive behavior.

The European Energy Crisis

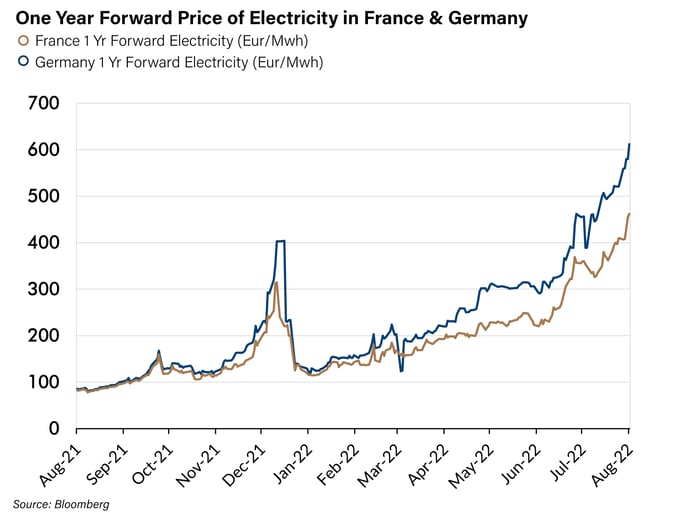

Below is a chart of the one year forward price of electricity in France and Germany. This dramatic price increase is a direct result of the above-mentioned self-destructive policies of the United States and its Western allies. Not a good look.

In France, the price of electricity is up nearly eight times since last summer. Germany is not far behind. A modern economy cannot operate with electricity priced like a luxury good. After all, isn’t an implicit assumption of modern civilization that everyone can afford electricity? That is debatable now in Europe.

Approximately 33% of Europe’s electricity is produced by natural gas and coal, two commodities that are being severely impacted by the response to the Ukraine war. Natural gas accounts for 18% all by itself and Russian gas is critical to keeping the price of that commodity low in Europe.

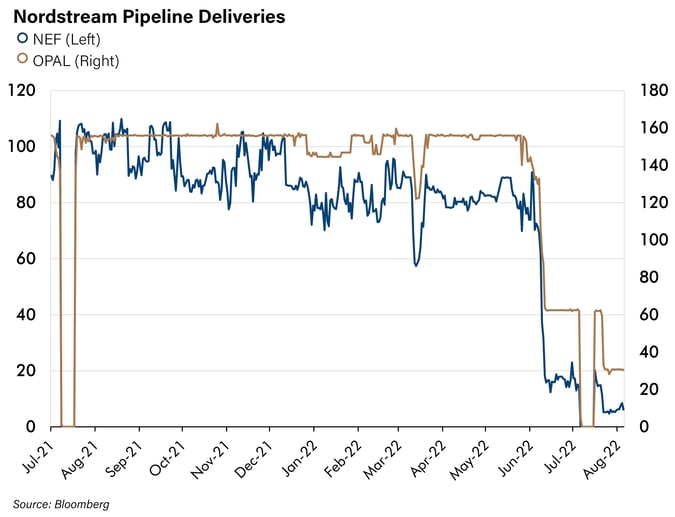

Russian natural gas is not being delivered sufficiently into Europe anymore. The following chart with the flows on the two Russian pipelines tells the story:

Why is this? It has to do with the sanctions on Russia due to the war in the Ukraine. Poking the Russian bear might be comparable to the Delta House guys snubbing their noses at Dean Wormer. Dean Wormer may have been a distasteful guy, but the actions of the members of Delta House were only harming themselves. The argument that the sanctions on Russia for invading the Ukraine are necessary because we had to respond to the unprovoked Russian aggression seems incomplete. Assuming one agrees that the Russians were not justified in their actions and deserve a negative response, the fact remains that Russia does not appear to be particularly harmed by the response and Russia certainly does not appear to be changing its behavior. So, why harm ourselves with no impact on our adversary? If the West’s political leaders were graded for the actions and sanctions, they perhaps would be given an ‘F”. Zero-point Zero GPA. Just like Bluto’s. Will our outcome be less fortuitous than his? We fear it might…

What About China?

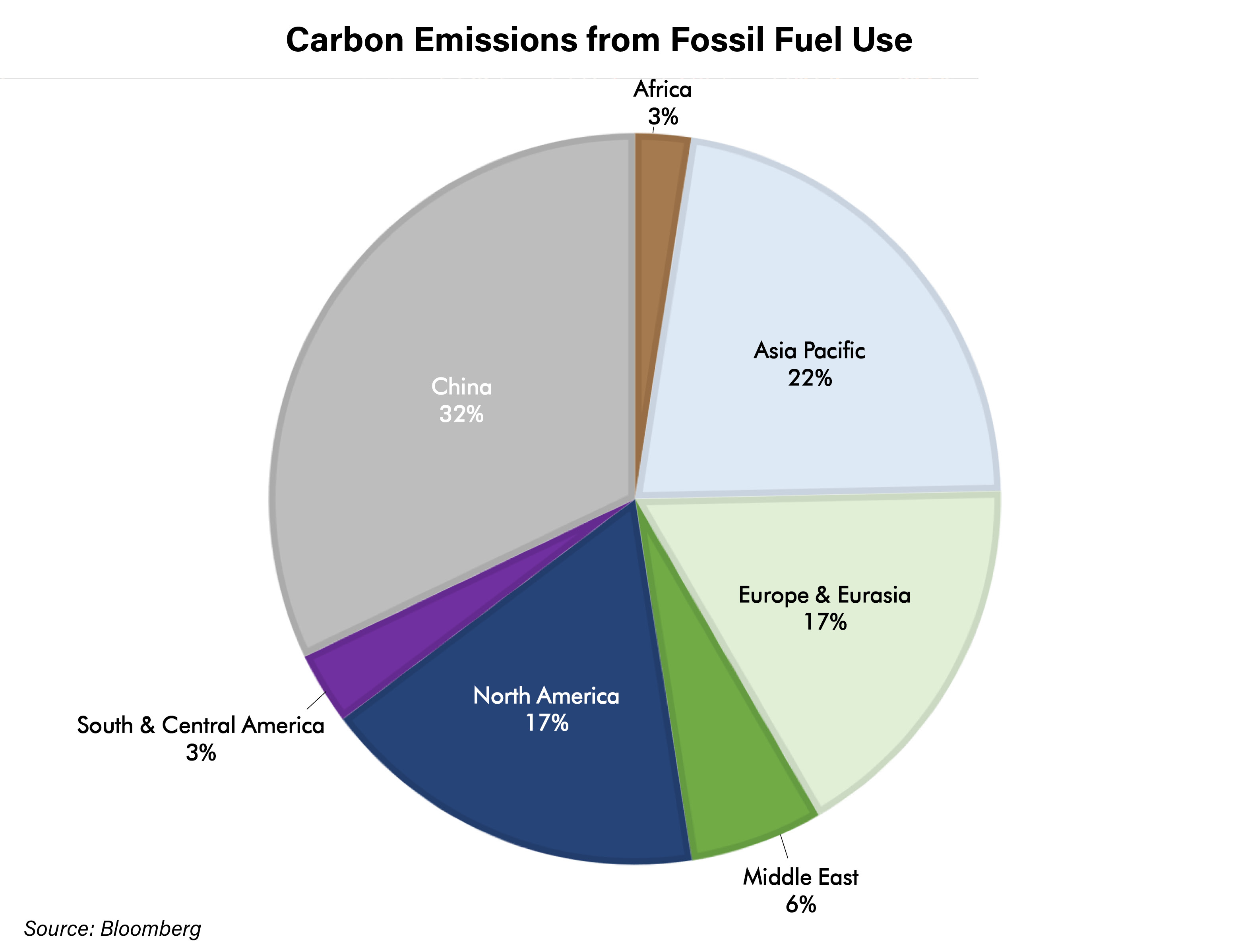

Poking the dragon at this point may end up far worse than poking the bear. As mentioned, the West’s dependence on China and Taiwan dwarfs its dependence on Russia for some critical things. Besides the semi-conductor manufacturing issue our dependence on China covers many critical areas. Rare earth metals are overwhelmingly sourced from China as are solar panel and windmill components. More than 95% of antibiotics and approximately 80% of APIs (active pharmaceutical ingredients) - which are required to make all pharmaceuticals - also come from China. Additionally, we depend on China for fighting climate change, since China is by far the world’s largest producer of carbon emissions.

Already Speaker Pelosi’s visit to Taiwan has prompted China to declare it is suspending cooperation on climate issues. Twenty years of progress and trillions of dollars of investment on decarbonization looks like it is down the drain. Why persist in this farce? Yet our political leadership persists, nonetheless. That might be the least of our problems should we continue to a full diplomatic break from China. It feels to me like our relationship with China was, in “Animal House” the jargon, already on double secret probation. So, what did Nancy Pelosi do? She threw a Toga party in Taiwan!

Bad Domestic Decisions?

The United States too, not just the Europeans, need commodities from Russia and certainly needs manufactured goods from China. Is our political leadership making self-destructive decisions like the Delta House boys?

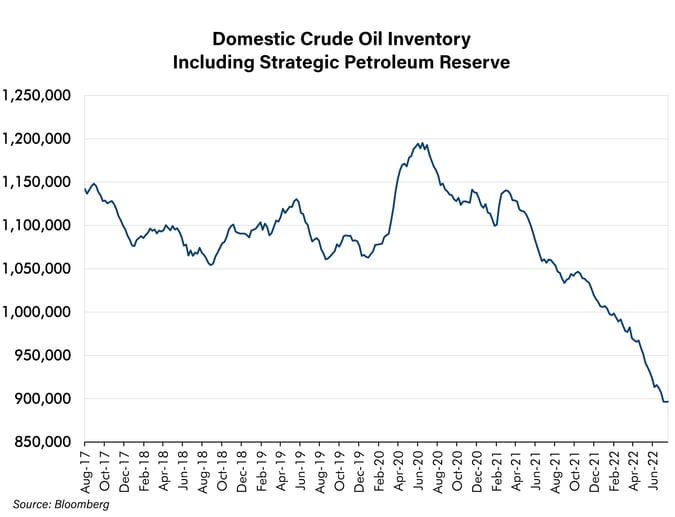

Oil prices have recently come down and taken pressure off of gasoline at the pump, but why? Perhaps it is because we are depleting the Strategic Petroleum Reserve (SPR) by five million barrels per week. In the future these reserves will not be available in an emergency, which is what they were there for. More self-destructive decisions by our political leaders? It would seem so. The additional oil may be temporarily helping prices but at the cost of ever tightening inventories. Below we show the current level of domestic oil inventories with the SPR included.

What if China curtails our access to the materials we need to build solar panels and windmills to fuel our hoped for “green” electric vehicle fleet that is expected to replace our need for gasoline? What if war breaks out and we really need those emergency oil inventories? Is the Delta House gang running our energy policy?

The World is changing, we fear that everything will not work out the way it did for Bluto blutarsky

As mentioned above, at the end of “Animal House” the audience learned what was going to happen to the main characters in the future. Most of the Delta House brothers were going to end up with pretty good careers. So, despite consistently bad decisions, everything ended up OK. From personal experience, it seems to me that many from that generation (which is my generation) have that underlying belief: it will all work out. No matter how bad the decisions our political leaders make on our behalf …. No matter how much our political leaders turn what was once a model of smart decision making into an “Animal House,” things will turn out fine. The U.S. economy will remain the strongest in the world and our markets will always go up. The past few weeks the stock market has embraced that sunny outlook. It has rallied nearly 18% from the May low, on the expectation that the FED will engineer a soft landing that will tame inflation, keep jobs plentiful and create conditions to end monetary tightening soon. After that, it will be off to the races again for the economy and the markets. Anything is possible, but we think as fiduciaries that hope is a poor investment strategy. Hope all you like – but don’t forget to plan for the worst too.

Conclusion

Our political leaders’ poor decisions are aggravating an already difficult situation. In particular, their recent decisions are accelerating de-globalization rather than forestalling it, which is what is needed most at this time. The recent Chinese live fire military drills in the vicinity of Taiwan and its 20% of the world’s most important manufacturing production capacity speaks volumes to the precariousness of the current situation. The world is too interdependent to solve its problems without cooperation between the great powers. The window for cooperation appears to be dwindling. So, we think its prudent to plan that things may not return to the way they were and that includes in the economic and financial sphere. Its our view that the winners going forward will be different sectors and strategies than those of the last cycle. Our aim as a research team is to limit exposure to the old winners and profit from the new. While doing so we think retaining a cautious stance is necessary because there seems to be no end to the fraternity prank antics in which our current political leadership is engaging.