It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way - in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only. - Charles Dickens, A Tale of Two Cities

The financial world has been interesting the past few weeks. Perhaps, paraphrasing Charles Dickens’ quote from his classic A Tale of Two Cities, we are seeing the best of times and the worst of times for investing. We believe pockets of unbelievable value are developing while, at the same time, investors appear to be questioning frothy valuations prevalent deep into this extended economic cycle.

Our research team was not surprised when the world of “unicorn” investing recently took a big hit. A “unicorn” is a term used for a venture stage company that is valued in the private market at greater than one billion dollars. The name was coined in 2013 to signify a very rare phenomenon, like seeing a unicorn. Just six years later there have not only been many unicorns but $10 billion plus unicorns .

The latest recent disappointment from a unicorn has been the postponed initial public offering (IPO) of an office space leasing venture that masquerades somehow as a high tech company that transforms peoples' work experience. In its last round of private financing one of the supposedly leading venture capital firms in the world valued the company at $47 billion. It appears the company was having trouble convincing IPO investors to value it at even $10 billion and thus the offering was cancelled. That valuation would represent a big capital loss for the venture capitalists who invested at $47 billion. We suspect $10 billion might even be a stretch when and if the IPO finally arrives. It appears unicorns do not always gallop upward. It may be the worst of times for them.

The latest recent disappointment from a unicorn has been the postponed initial public offering (IPO) of an office space leasing venture that masquerades somehow as a high tech company that transforms peoples' work experience. In its last round of private financing one of the supposedly leading venture capital firms in the world valued the company at $47 billion. It appears the company was having trouble convincing IPO investors to value it at even $10 billion and thus the offering was cancelled. That valuation would represent a big capital loss for the venture capitalists who invested at $47 billion. We suspect $10 billion might even be a stretch when and if the IPO finally arrives. It appears unicorns do not always gallop upward. It may be the worst of times for them.

Producing Oil and Gas Wells

Contrast this potentially problematic valuation with a recent conversation I had with an old colleague, who invests in energy. He told me “I am being offered proved developed and producing (PDP) oil and gas wells at PV-15 or better, which could generate 10-12% returns with 8-10% yields!” For those readers unfamiliar with the lexicon of oil and gas investing let me explain.

Just like accountants have very specific rules on how to measure and evaluate a company’s financial reporting, petroleum engineers have rules on measuring and evaluating oil and gas company assets. An audit generated by a top accounting firm is believed to be very reliable. The same could be said for reserve and present value reports by top reservoir engineers such as Netherland Sewell and Ryder Scott.

In fact, unlike most other industries, the Securities and Exchange Commission (SEC) requires firms that engage in Exploration and Production (E&P) of hydrocarbons to not only have their reserves audited but also to provide investors with an audited net present value of those reserves using certain very specific rules. This is known as the SEC PV-10. The “10” is because the present value calculation must discount future cash flows by 10%. A simple definition of the SEC PV-10 is the value today of future cash inflows (minus outflows) that will likely be derived if the company produces its existing proved reserves under these assumptions. This number does not include any drilling for new reserves or any other activity. It includes only producing and developing existing proved reserves. It is sometimes referred to as a “blow down” calculation. It is what the company would likely be worth if it simply were to blow down its existing assets (and presumably return the profits to shareholders).

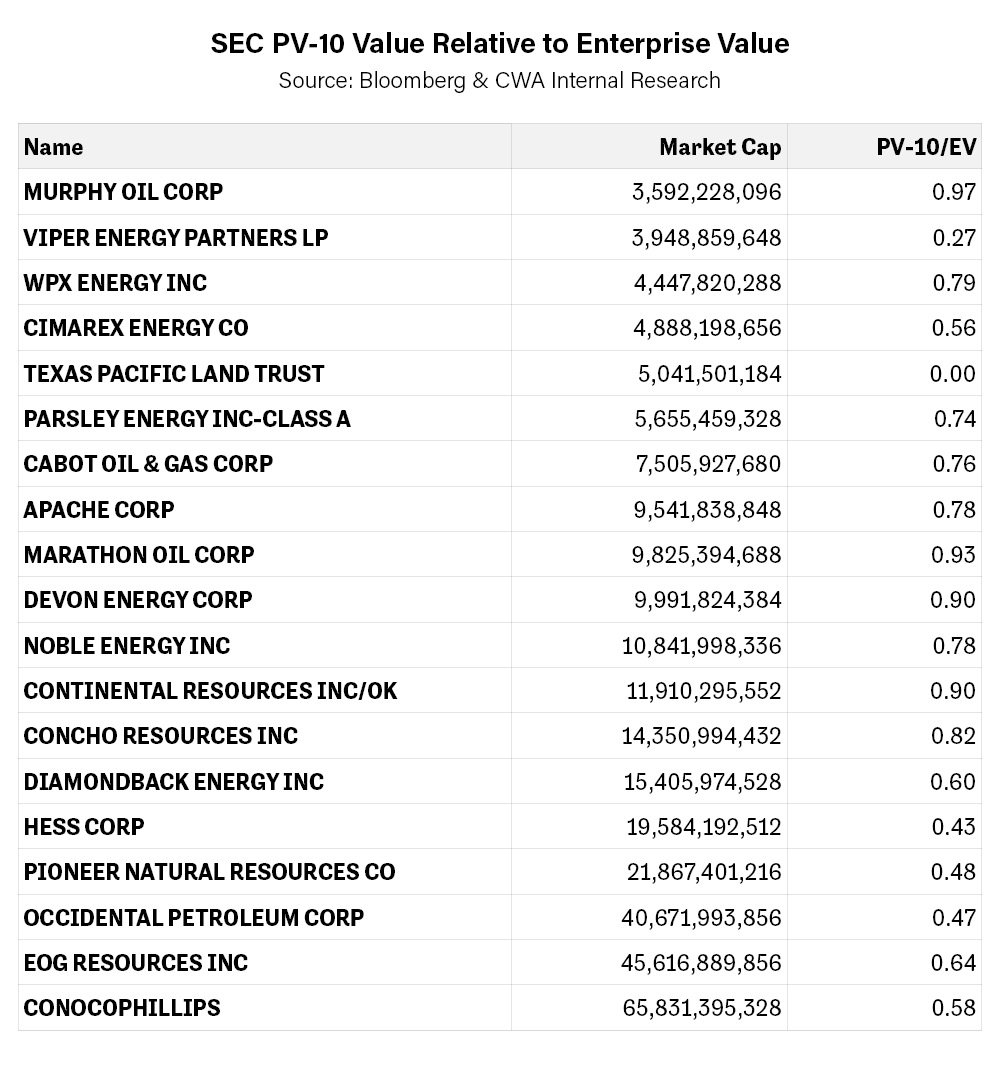

What my former colleague was excited about and described as PV-15 was industry jargon for using the SEC PV-10 calculation but with a 15% discount rate. A higher discount rate results in a lower price than a lower discount rate. In my experience PV-15 is extremely cheap. In fact I had never heard of values like that for proved reserves in my career. During most periods few if any publicly traded E&P companies trade below their PV-10 blow down value. Even at today's prices there are no public companies with a greater than $3 billion market capitalization that do, as illustrated in the table below. For public companies there is usually a premium built into the current market price that anticipates additional value above and beyond proved reserves through new drilling or through the luck of higher oil and gas prices for instance.

Furthermore, understand that my former colleague was speaking of only PDP wells which are the portion of proved reserves that require no additional capital spending beyond the maintenance and repair expenses of which a reasonable estimate is already included in the SEC present value calculation. PDP reserves audited by a top reservoir engineer are, in our opinion, amongst the least risky cash flow streams an investor can find. That cash flow stream could be de-risked further if the owner were to hedge the risk of price declines using the oil and gas futures market.

We must admit that much of this sounded too good to be true. So, we checked in with some extremely seasoned and well-regarded energy investors we have known for a long time and who we have watched perform well over many cycles. Our contacts confirmed what we heard but they thought we were being told conservative estimates. They were seeing offers for properties they believed could be purchased at discount rates of even greater than 15%, some possibly near 20%. One described it as “things are so bad in energy right now they are good”. Truly the best of times and worst of times.

Some assets Get Cheap While Others Get Expensive

Why are such values available to energy investors at this time? The answer lies partly with the unicorns, valuation and the froth of an extended up cycle. In order to save the world from the great financial crisis the Federal Reserve made financing plentiful and cheap. With oil prices high, investors poured billions into the equity and debt of energy producers, especially the domestic shale ones. Many companies took on a lot of debt. Those producers promised rosy returns and permanent growth. In 2014 when the price of oil collapsed things got tough. With continued cheap money the game went on a bit longer. However, the long term returns of oil and gas production from shale, particularly with lower prices, has been miserable and growth has been tough and very expensive

Something else unique to this cycle also happened. The cheap money fueled many unicorns whose mission was to disrupt an existing business. Businesses that would impact energy were often targets for disruption. Investors financed new companies that aimed to replace gasoline vehicles with electric ones, taxi fleets with private cars, trips to the gym with a workout at home and provide more energy efficient office space closer to workers' homes. If these business models succeeded demand for gasoline and other energy was going to decline substantially. Wall Street, excited about the unicorns, began to discount a bleak future for E&P companies.

This, along with the low prices and returns has led to what appears to be an extremely difficult financing environment for the E&P industry. With high debt, many in the sector are at risk of bankruptcy and those that are not are having trouble raising new capital to keep growing, something their valuations depend upon. Therefore desperate companies are trying to sell their older producing wells to raise money. There is so much desperation and so much aversion from investors who have been convinced hydrocarbon usage is going the way of the buggy whip that prices of these assets are plummeting. You won’t find a lot of energy holdings among our investments. Not yet. However, better days may be coming based on what we are starting to see in certain valuations in the private market and, even in the public market, where for the first time since the great financial crisis there are a handful of small E&P companies trading below their SEC PV-10 value. Could we be entering the best of times for a value investor?

Valuation

The situation is different for the unicorns. Some of these companies have created real goods and services that are disrupting the transportation, energy and other businesses. Ride share companies have changed the way we get from place to place and have in some places wreaked havoc on the traditional taxicab monopoly. Electric vehicle start ups are producing vehicles that have far lower carbon footprints than traditional automobiles. However, in some cases, like the recently scuttled real estate IPO, the business model may not have been as new, unique and disruptive as some believed it to be. The same is true for other private value high-fliers such as an exercise equipment company that is soon to go public.

Regardless of whether these unicorn operating models make sense or not, most of these companies appear to be lacking credible valuation. Is it sustainable to have an investment program that consists of companies that burn billions of cash every year with no reasonable prospect of change? That is what we believe to be the case with many unicorns.

It seems that things are changing in that regard as evidenced by the underwater IPO’s of several unicorns and the recent travails of the office space company discussed above. Perhaps the most telling indication is that the premier venture capital firm we spoke about above just initiated a search for a Director of Valuation. Part of the job description is excerpted below.

The Valuations Director will be primarily responsible for determining the fair value of investments for quarterly financial reporting and providing valuable and timely insight to management on our investments. This role reports to the Corporate Controller.

To us, as professional investors, we would have thought that prior to investing hundreds of billions of dollars the company would already have someone with that skill set on board?

Conclusion

Investing is always about risk and reward. The job of the prudent investor is to take the right risks. On one side are venture type investments where the probability of failure is high but the rewards can be great. Certainly, some new ventures succeed and go on to become the leading companies of the next generation. Unfortunately, many more often fail. Without a crystal ball how can investors know? During frothy periods, such as like now late in the longest business cycle in post World War II history, investors appear to value prematurely too many companies as if their success is assured. In this cycle even the supposed experts in private investing are in the news, with much of the media questioning the “experts'” investments.

But we agree with the market saying that “there is always a bull market somewhere.” If our recent research is correct, we may start to see great values emerge in areas where our recent investments have been more limited, such as in the energy sector. As value investors, we need to be prepared to embrace the controversy and short-term distress sometimes required while waiting for others to see the value our research has identified. For now, this means that we prefer to avoid many high-flying unicorns and spend more time researching out of favor sectors, such as the energy sector. We feel fortunate to know smart, experienced investors deep in the weeds of energy. Don’t be surprised if many of our future notes return to the theme of emerging value in energy! We seek to find the right investments whether we are in the best of times or the worst of time.