“Gold is Money, Everything Else is Credit” - JP Morgan in testimony before the United States Congress, 1912

We love Bitcoin! It’s the best thing that’s happened to money since the world was on the gold standard, which ended in 1971. I recently read a report by Fidelity Investment’s Digital Assets Group entitled Bitcoin First that reminded me why Bitcoin is so valuable. It’s not why you think.

Bitcoin itself may be valuable or it may ultimately prove to be worthless. The same goes for other cryptocurrencies. Blockchain technology is revolutionary and may ultimately transform payment systems and transactional banking. However, the most important contribution of cryptocurrencies in this first decade of their existence has been to broadly educate the investing public on what money really is. Those, like Fidelity, who believe Bitcoin is money have explained it repeatedly and very succinctly. The speculative fervor around the asset and the money that has been made through it has elevated its profile. People are listening. Everyone seems to want to know what Bitcoin is, why it is valuable, and whether they should own some. The answer depends on whether Bitcoin is money and if it will be broadly adopted as such. We think it doesn’t fully satisfy the traditional definition of money, at least not now. We are very sure however that gold is money and we think that as Bitcoin owners begin to realize the asset they own as a substitute for government money is not adequate for that purpose, they will look to gold. That is why we are buying gold now to beat the rush.

What is Money?

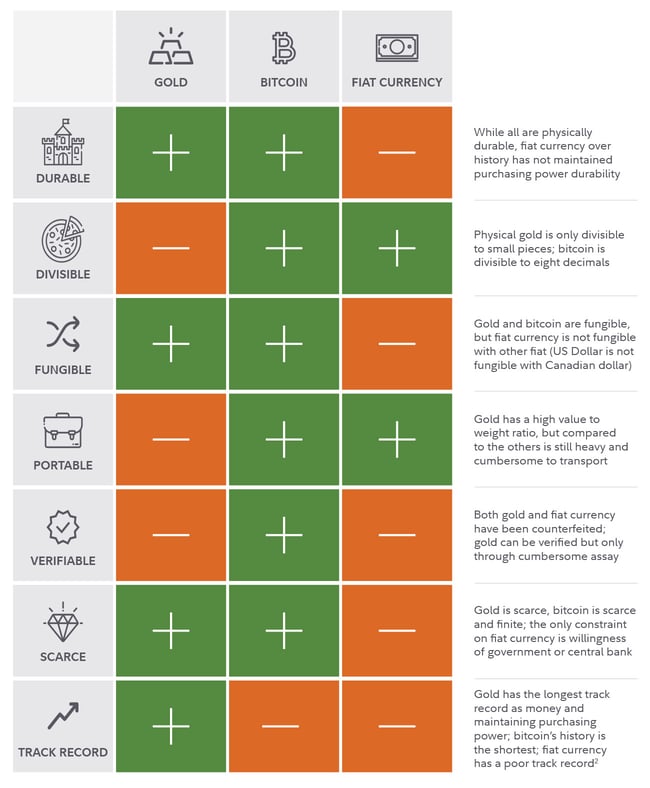

The above-mentioned report from Fidelity has a neat chart describing what money is. It is included below. The left-hand column encompasses the characteristics that are traditionally cited in the definition of money. Only thing is that the Fidelity chart is slightly incorrect in our opinion. We think it got some of the pluses and minuses wrong and its explanation around the most important criteria, Track Record, is incomplete.

Source: Fidelity Investments, January 2022

An Education in Money

We are going to explore our disagreement with the chart in more detail below. First we are going to explain the important transformation in knowledge about money that has taken place.

My understanding of money started with the study of Monetarism. That is the school of economic thought that gives justification to the current central bank-controlled money order. That system rejected the need for a gold standard or any other anchor to government money, which is commonly known as “fiat” money. Modern money is “fiat” money because it is money by government fiat. That is, it is money because the government says it is and requires citizens to use it, particularly in calculating and paying taxes. It is not money according to the classic definition of money described by Fidelity above.

In the late 1990’s when I first became a “gold bug” - as investors who espouse the virtues of gold investing are derisively called - few people, even financial professionals, were familiar with the term fiat currency. Even fewer had thought much about the shortcomings of the monetary system they participated in every day. I became a gold bug while learning about Monetarism. I was educated at the Holy Temple of Monetarism, the University of Chicago. At that esteemed institution, the Nobel prize winning economist, Milton Friedman and several lesser known economists developed the monetary theory that became known as the Chicago School Theory. It was eventually used in 1971 to justify pulling the world off of the gold standard that had been in existence since at least the 1300’s when double ledger accounting banks came into existence in Italy. In the mid-1990’s when I was at Chicago, many of Friedman’s disciples were still teaching and I learned the theory directly from some of them.

Without getting into the nitty-gritty of Chicago School Monetary Theory, suffice it to say the theory is brilliant and posits a perhaps better way of ordering the world’s money system than the gold standard except for one fatal flaw. In order for it to work, the central banks that are charged with determining the money supply must be wholly apolitical, independent of outside influence and focused solely on the money supply and nothing else. When one of Chicago’s most esteemed finance professors taught that to me in a lecture I remember thinking, “are they kidding?”. It reminded me of Marxism. It all sounds great but is completely out of touch with human nature and therefore doomed to fail. There is and can never be a world where politics and outside influences do not come to bear on the decisions of central bankers. Those bankers are human beings after all. Human bankers can never be the apolitical decision-making machines monetary theory expects them to be.

As self-evident as that may seem, I was mocked by my professors for suggesting their theory was unworkable. After all, in the early 1980’s hadn’t Paul Volcker proved them right when he tightened monetary policy and caused the worst recession in the post-war period (up to that time) when he set out to whip inflation? That argument was not convincing to me because it was a sample of one and the politics of the time, as personified by Ronald Regan, were amenable to recessionary pain to quell inflation. I reminded my teachers of the famous story of just a decade or so earlier when Lyndon Johnson purportedly threw Federal Reserve Board (FED) chairman Arthur Burns up against the Oval Office wall and demanded he loosen monetary policy. Not influenced by politics, sure! “That is just myth” was the typical response despite it having been corroborated by several witnesses.

Technological Innovation Meets Scary Money Supply Growth

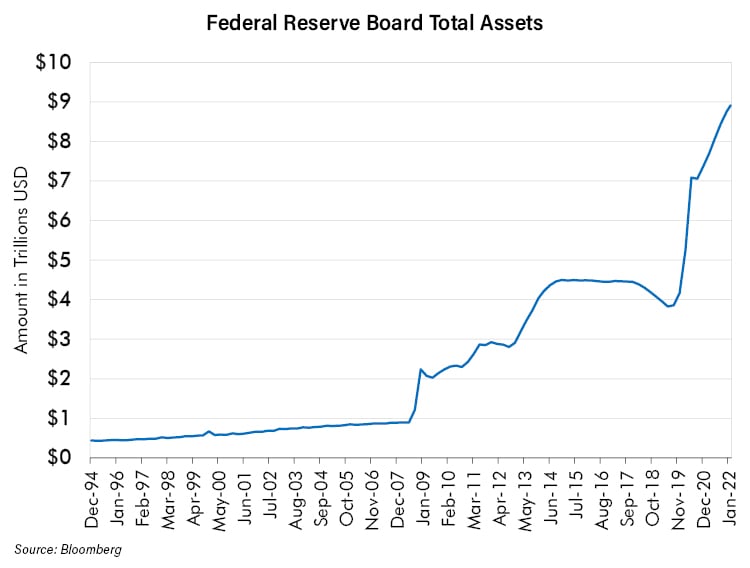

Modern central bankers are almost all Monetarists. As such they should be aware of their responsibility to limit money supply growth. They are supposed to not print too much money. But it's not against the law for them to do so. They can legally print as much money as they want subject to several constraints that have proven over the last few financial crises to not be very constraining. So, when the economy has taken on too much debt and the only way out is to print money, that is what they have done. Below is a graph of the assets of the FED. Asset growth comes from new money printing as the FED creates money out of thin air and buys assets (principally government debt) with it. Note the big jumps (relative to trend) in early 2000, late 2008, in 2013 and then in early 2020. These coincide with times of acute financial stress.

In these times of stress the monetarist bankers come under a lot of political and social pressure to “do something” to stop falling asset prices from continuing their downward slide. It's pretty clear that during these times, shockingly excessive money growth is expediently ignored for political necessity.

These monetarists who failed to limit money supply growth perhaps have gotten lucky over these past few crises because inflation has remained relatively benign despite their exorbitant money creation. The money made its way into inflation for sure, but inflation in asset prices rather than consumer prices that are measured by the CPI (Consumer Price Index). It should be noted though that changes in CPI calculation methodology appears to have hidden some inflation and helped the monetarists as well.

This straying from the monetarist rulebook did not go unnoticed though. Some financially literate software geniuses who had developed blockchain technology knew the rules of money were being violated and they set about to create a new kind. The blockchain technology they developed could enable digital money that would by computer code design be unable to violate the rules of money. No central bankers or politicians could stand in its way. Thus Bitcoin was born.

We thought Bitcoin was not needed. Good money already existed – it was gold. However, since 1971 and earlier it had been purposefully vilified by those who supported (and benefited from) fiat money. Gold was called a “barbarous relic” as early as the 1930’s by John Maynard Keynes. Keynes was the famous Twentieth Century British economist who founded the school of economic thought that bears his name. Keynesian economics was the first to argue for doing away with the gold standard. Keynesians were generally liberals so when conversative monetarists came into the picture the gold standard was doomed and gold was attacked by both the left and right as a barbarous relic and just a “pet rock”. Generations of investors forgot what real money was and accepted fiat money as the untouchable real thing.

Without substantial inflation to pique anyone’s concern, and asset prices inflating, there was, temporarily, not a lot of demand for the different kind of money that gold represented. Bitcoin was interesting though for other reasons. It was a new technology that appealed to the Silicon Valley crowd that loved innovation and whose reason for existence was to find disruptive technologies that would change the world. So, it was not crucial whether or not the money system was in dire need of change. Tech entrepreneurs generally think anything that has been around for a long time can be disrupted by new technology. So they grabbed onto the arguments about why blockchain Bitcoin money was better than fiat money. As the Bitcoin craze intensified the definition of money and why it needed to be improved upon became mainstream conversation. First in financial media and then in the broader media. Bitcoin, what it is and why it was needed as a substitute for fiat money has been explained on every type of media all over the world. The world got educated on money!

What is the Best Money?

So, Bitcoin has made us all examine what the best money is. Many say it is Bitcoin. Fidelity agrees and its reasons on the chart above are the consensus opinion for those who believe in it. We think gold is better. In our opinion, Fidelity is wrong on the divisible, portable and verifiable categories in the chart. Everyone agrees that these characteristics are determinants of “moneyness.” It is, however, a matter of degree. Gold is pretty easily divisible, portable and verifiable. Perhaps not as easily as Bitcoin when electricity and the internet are working but good enough to satisfy the requirements to be money. When there is no access to the internet, Bitcoin is not divisible, portable or verifiable at all. Without electricity it is impossible to prove it even exists. So, on those characteristics we think it’s a wash between Gold and Bitcoin being the better money.

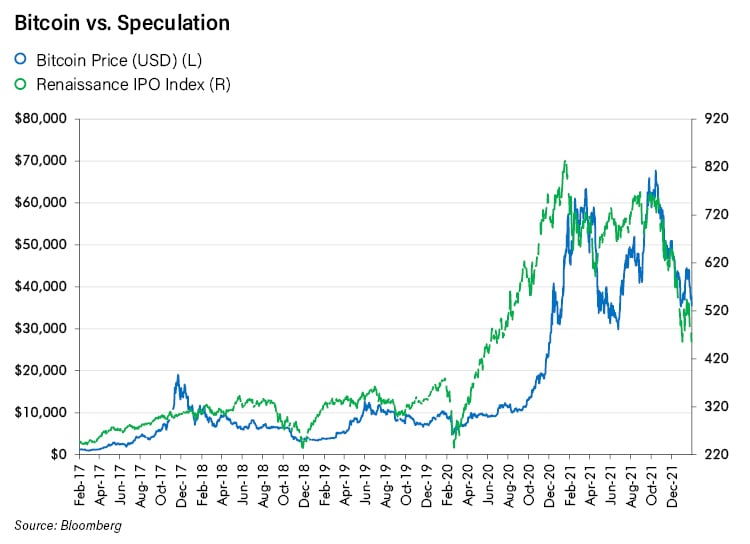

However, the real drawback of Bitcoin and the allure of gold is a characteristic of money that Fidelity mischaracterized in the chart as “Track Record”. That category is more commonly known as “Store of Value”. This means that the asset must have a long track record of stable value. When someone deposits their paycheck into a bank account they need to be reasonably sure they will be able to pay their next month’s bills with it. This is arguably the most important characteristic of money. On the store of value measure Bitcoin not only earns a minus, in our opinion, at least in the short and medium-term, it is failing as miserably. In just the past five years Bitcoin has lost more than 50% of its value four times. Once it lost nearly 70% and once nearly 80%. That is not a store of value. What is worse is Bitcoin is trading alongside the speculative fervor of what may be a bubble - enabled by the wrongheaded inflationist monetary policy described above. Below is a chart of Bitcoin’s price in dollars against the Renaissance IPO Index (IPOUSA). That is an index that tracks the price of IPO’s, a part of the stock market that has seen valuations that, in our opinion are indicative of substantial speculative excess. IPO valuations on certain measures have far exceeded the tech bubble IPO craze of the late 1990’s.

Sure looks similar, doesn’t it? We think as the speculative mania reverses because of central bank tightening or recessionary conditions, Bitcoin will prove to be just that – a speculative mania. Its price will decline along with certain grossly over-valued hi-flying equities.

Over the long term Bitcoin may be even more vulnerable as a store of value. Blockchain is a technology that is secure today because it is based on algorithms that are too sophisticated to be hacked. If the blockchain could be hacked and Bitcoin stolen it would be worthless. It is our understanding that powerful quantum computers are being developed that will be strong enough to do the calculations necessary to hack into a blockchain. So, unlike gold, for which every ounce that exists on earth has been here for billions of years and will be here for billions more, blockchain may prove to be a bit less durable.

Conclusion

Blockchain technology is likely to be a disruptive innovation and Bitcoin’s ultimate fate as money is still unknown. We think, at the very least, its value in the short to medium term is tied to the speculative forces of this cycle. However, Bitcoin has done investors who have paid attention a great service. Those who have argued for its adoption as a new form of money have enlightened a generation of investors who were unaware of the pitfalls of fiat money and the assets dependent upon it. Those investors are now focused on alternative money. When they become disillusioned with Bitcoin due to its downside risk, they will seek an alternative. That alternative is gold, as it has always been throughout history when other forms of money have failed. We keep coming back to gold as money and probably always will. To understand why, all you have to do is read up on what proponents of Bitcoin give for the reasons it is money. We think this will help the price of gold immensely in the defensive cycle unfolding. We are positioning accordingly.