“Forward, the Light Brigade!”

Was there a man dismayed?

Not though the soldier knew

Someone had blundered.

Theirs not to make reply,

Theirs not to reason why,

Theirs but to do and die.

Into the valley of Death

Rode the six hundred.

-Alfred Lord Tennyson, The Charge of the Light Brigade, a poem about the battle of Balaclava, Crimean War, 1854

We have all been watching in horror the events that have been unfolding on the world stage the past month as war has raged between Russia and the Ukraine. I think I know a little about the area since my father grew up there and I have some strong feelings about what is going on. However, capital and economics do not necessarily follow what we think is right or wrong. There are laws of economics that will create winners and losers from this situation regardless of our opinions. Our job as fiduciaries of client capital is to do what we think is most likely to protect and grow that capital. So, this note is going to explore the likely economic and financial impact the situation will have and what we are going to do as a result. We will leave an exploration of the moral arguments and what can be done to right the wrongs committed for others to opine on.

Nevertheless, since economics are impacted by geopolitics and social science, it’s worth understanding the current situation as best that we can. Alfred Lord Tennyson’s poem quoted above is about a battle in the Crimean War which was a war for dominance over much of the same territory that the Russians and Ukrainians are fighting over today. It was during a time when tensions were rising around the world. Just a few years later those tensions exploded in our own country in the brutal and bloody Civil War.

A bit on personal and regional History

Although my father grew up in what is now Ukraine, it was in the Carpathian Mountains an area far from where the fighting is taking place now. The Carpathian Mountains are in the western part of the country where the sovereign has changed multiple times throughout history, even just since 1900. My father learned to speak Russian, Ukrainian, Slovak, Czech, Hungarian, German and Yiddish. I think he understands Polish pretty well too. The Slavic languages are very similar and therefore it is not hard to know all of them. When he lived there his home was located within the territory of Czechoslovakia and later Hungary. Before the first World War, it was part of the Astro-Hungarian empire for whom my grandfather fought against the Russians in that conflict. He was beaten to death in 1944 by local anti-Semitic thugs and soon after the rest of the family was shipped off to Auschwitz were three of the remaining six family members were murdered. The Russians liberated my father and he eventually made it to what was then the British territory of Palestine which, in 1948 became Israel. He later immigrated to the United States, so a proximate cause of me being here and writing for Capital Wealth Advisors is conflict in that part of the world.

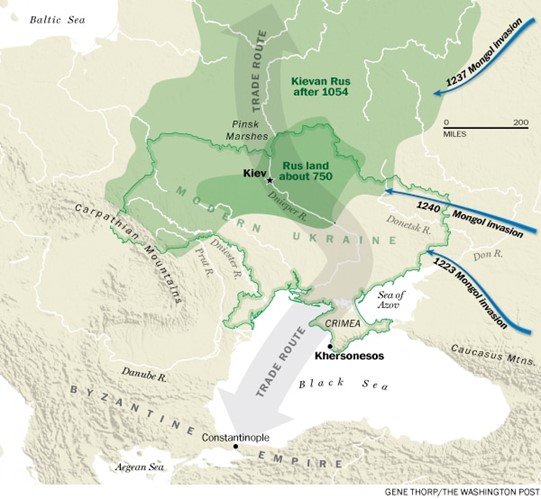

After World War II, the victorious allies, including the Soviets, re-wrote the borders of much of central Europe. Those borders have changed a lot over the thousand years since the Rus, a Slavic tribe from Scandanavia first took control of the area. The Rus are known today as Russians. Their first center of power was an empire based in Kiev that was known as the Keivan Rus as the map below depicts.

The Rus capital was eventually forced to move to Moscow due to mongol invasions in the 1200s and that is where it has remained to this day. Kiev and parts of Ukraine have been under Moscow’s control for most of the past 500 years but other parts of the country have had to switch allegiances due to seemingly endless wars and invasions.

This latest in a long history of wars for control of the area is tragic. Many people are suffering immensely. I have particular sympathy because my own family suffered so much from war there. However, as mentioned above, our job is to preserve and grow the capital that we have been entrusted with by our clients. The war has massive implications for asset values and is likely to speed up important changes that were already underway. So, that is our focus.

It appears from an economic point of view, there are three broad and intertwined themes to consider. First, the “West” has imposed sanctions on Russia designed to punish it for the war. These sanctions have profound implications. Second, the West perhaps belatedly has realized that the sanctions and other potential changes are going to require massive investment to insulate the sanctioning countries from reliance on Russia and other geopolitical competitors. Lastly, the war and the response of China and India is a continuation of the de-globalization that we have been writing about for years (A Bull Market in Populism and De-Globalization, The Blind Men and the Elephant: De-Globalization Accelerate as Tariffs Rise, The Best Offense is a Good Defense). War is often the end result of this type of trend. Therefore, it is our expectation that preparation for more war will gather steam. This may usher in a new arms race and re-armament of certain countries that have not participated materially in defense spending since World War II.

The Sanctions and What to Expect

The West has unilaterally imposed the most draconian international sanctions ever imposed on a major world power to punish Russia for its actions. This includes cutting the Russian Central Bank off from interactions with the Federal Reserve, the European Central Bank, the Bank of England and some others. These banks have frozen Russian Central Bank reserves and are no longer allowing Russia to trade currency through them or clear transactions, among other activities. Notably though, the sanctions have not included those things that Russia produces that the world desperately needs, i.e., seemingly every natural resource used in anything.

Sanctions have had a mixed historical track record. They have served to change behavior in certain instances, but they often have not achieved that goal. In fact, two of the previously most sanctioned nations ever, Iran and Venezuela, have regimes that have survived despite draconian sanctions. Indeed, these very sanctioned nations are now in negotiations with the United States to end the sanctions since the West so desperately needs their resources to offset the Russia situation. However, Russia is not Iran or Venezuela. It is a much more formidable country both economically and militarily. The notion that these sanctions will deter Russian behavior or cause Putin to lose his grip on power seems fanciful.

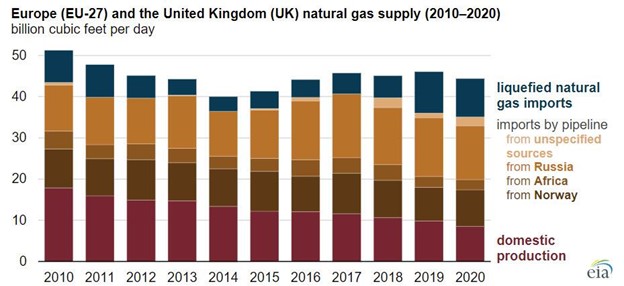

This is true especially if one considers that international trade is not charity. Trade between nations is the same as any other form of trade in business. Theoretically an exchange takes place if fair value is both given and received. If that were not the case, there would not be any trade. The theory pretty much works in practice. So, if one party to a trade decides to stop trading both parties are suffering equally. Of course, this may not always be the case. Often one side has leverage in terms of having something the other side needs and can not get elsewhere. In the case of Russia sanctions, it is unclear that the sanctioning party is not worse off than the sanctioned party. It seems to us that at present Europe needs Russian natural gas more than Russia needs Vente Skim Latte’s from the Starbucks in Moscow. Russia supplies approximately 25% of Europe’s natural gas needs as per the chart below.

Source: Energy Information Agency

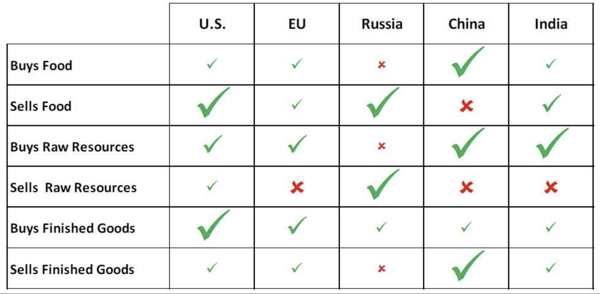

Europe needs that gas badly. Without it, people could literally freeze next winter and industry will grind to a halt. The same is largely true for a whole host of other things Russia sells. Below is a table that gives a decent synopsis of the current situation.

It could be that the sanctions boomerang and hurt the sanctioner more than the sanctionee.

Source: Peter Tchir, Academy Securities, 3/20/22

If that is the case the investment implications become clear. Western economies will slow and those companies in the West that supply what is needed as substitutes for Russian exports will fare relatively better during the slowdown.

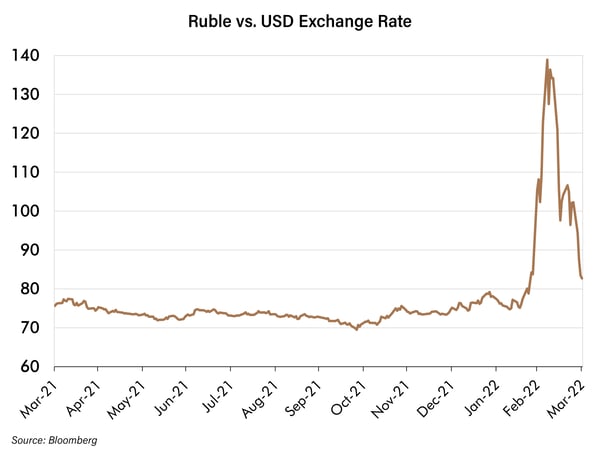

After approximately one month of hostilities and sanctions it is notable that the Russian Ruble has recovered nearly all of its initial losses. This was not the expected course of events as many experts predicted a collapse of the Ruble followed by the Russian economy. It seems, based on the value of the Ruble, the sanctions may not be having their intended effect.

A second and related point is that whatever the future holds for Ukraine and the resolution of the military confrontation, an economic war between the west and Russia (plus China?) may very well be with us for a long time. If that is the case, the West is going to have to dramatically change its economic circumstances. It is going to need to find new sources of energy and raw materials and have much greater redundancy of many manufactured goods on which it currently relies from potentially unfriendly countries. Make no mistake, this situation is not close to the world vs. Russia. Below is a map of the world segregated by countries that are sanctioning Russia and ones that are not.

Source: @ggreenwald, Twitter

The United States is likely to invest in making sure everything it needs it can get from the countries colored in yellow on the map or others that will very certainly remain friendly (such as Central and South America and certain parts of Africa).

Lastly, as we have noted above, war is the ultimate form of de-globalization. The fear of more proxy wars and even direct combat between the new economic rivals is growing. That fear will spur greater defense spending around the world. In the early days of the Ukraine conflict, Germany announced that it was going to materially increase its defense budget. That is unlikely to be the last announcement of that kind. Defense contractors have the profile of good businesses. One might consider them similar to utilities, because they are “cost plus” businesses. That is, they are quasi monopolies that are able to sign large contracts with governments that provide them the opportunity to pass costs to the customer and ensure a healthy profit margin regardless of costs. So, in times when defense spending rises, they are able to grow earnings sharply. That should be the case now. We have owned a number of such investments for many months now and are likely to increase them in the future for this reason.

Conclusion

We believe the armed conflict in the Ukraine is an expected result of historical grievances intertwined with economic tensions that have been simmering for years. In the larger picture, this is a further step in the de-globalization that has been picking up speed for several years. A hot war and the sanctions of a G-20 nation is a crossing the Rubicon for the world economy. We think that the world will increasingly place a premium on natural resources, supply chain redundancy and defense, among other emerging leadership sectors that we will discuss next week in a subsequent report on this same topic.

The old world is dead. Welcome to the new one.

We plan to invest accordingly.