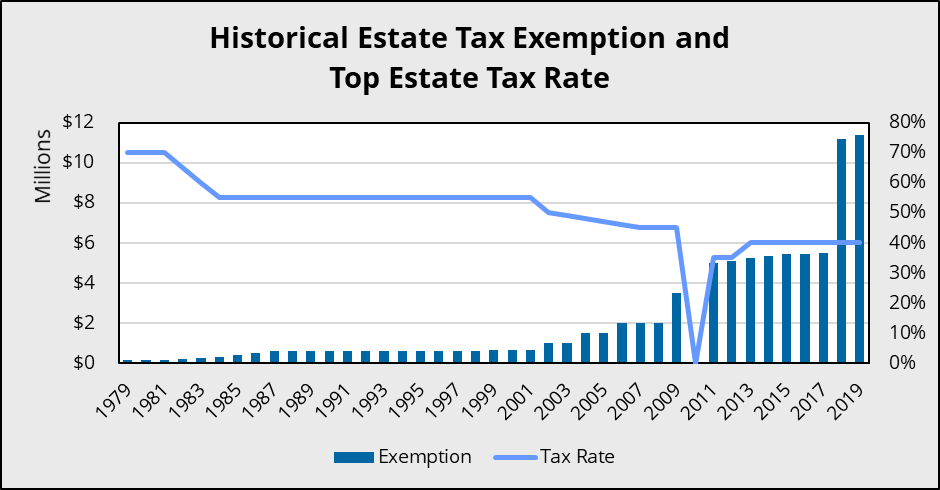

The US Federal Estate Tax has changed many times over the last 25 years. Today, each individual can transfer $11.58 million tax free at death. A married couple can pass $23.16 million. The latest levels of the estate exemption (Unified Credit) were put into place in 2018. The exemption is coupled with the current estate tax rate of 40%. As you will see in the chart below, the tax rate and exemption amount have varied over the years. We believe the current rate and exemption are very favorable. However, the current rates and exemption expire in 2025. At that point, they will revert back to $5.49 million. Many speculate that the changes would accelerate under a Democrat controlled Congress.

Source: ValueScope, Inc.

In a 2016 study by Wealth-X, it noted that ultra-high net worth families over the age of 80 have only 34% of their net worth in liquid assets. If you exclude retirement/qualified assets, the liquidity is even lower. I have always taken the position when evaluating an estate that the retirement/qualified assets should be viewed differently due to the high taxation to convert to cash.

One common mistake in estate planning is to only think in terms of tax. I believe that liquidity in many cases is just as, if not more, important. If you think about it logically, as we age, we spend down our liquid assets while our illiquid assets continue to appreciate. Basic financial planning teaches us to take our income from our “least taxable” pocket. As a result, many people only take the Required Minimum Distribution out of their retirement accounts. Unfortunately, this compounds the tax issue at death. Prior to the SECURE ACT, your beneficiary could “stretch” distributions out over their life expectancy. Now the balance must be taken out over 10 years, resulting in higher taxation.

One common mistake in estate planning is to only think in terms of tax. I believe that liquidity in many cases is just as, if not more, important. If you think about it logically, as we age, we spend down our liquid assets while our illiquid assets continue to appreciate. Basic financial planning teaches us to take our income from our “least taxable” pocket. As a result, many people only take the Required Minimum Distribution out of their retirement accounts. Unfortunately, this compounds the tax issue at death. Prior to the SECURE ACT, your beneficiary could “stretch” distributions out over their life expectancy. Now the balance must be taken out over 10 years, resulting in higher taxation.

Other assets that can be considered semi-liquid are certain private equity, hedge funds, and private investments. These asset types are not bad. However, it is important to understand the liquidity profile and how it fits into your estate plan.

When you couple the semi-liquid assets with illiquid assets such as real estate, private businesses, collectibles, etc., it is important to focus on the liquidity profile of your estate.

So many times in my career, I have heard the quote “My kids can live on half,” when discussing the confiscatory nature of estate taxes. Certainly, we may have different views on how much is enough to leave to our children and grandchildren. But the question to consider is, if you plan to leave half will that actually result in your heirs getting half?

Timing can be everything….

After the financial crisis in 2008, I was hired to consult with a family on the estate of their recently deceased father. For the purposes of the story, I will call him Mr. Jones.

Mr. Jones was a very successful entrepreneur that amassed a very large estate valued in the hundreds of millions of dollars. Mr. Jones was in his 70’s and was divorced with two children. As he was completely self-made, he told his estate attorney that his children would have far more net of estate taxes than he had. As a result, his plan was simple: pay the estate tax and give the balance to his children.

Problem 1 – Unfortunately, Mr. Jones unexpectedly passed away in December of 2007. The Financial Crisis was upon us. No asset class was immune to declining valuations. The Federal Estate Tax was due 9 months from his date of death – August 2008. Bad timing to say the least.

Problem 2 – Mr. Jones loved real estate and art. He had over 80% of his net worth in illiquid commercial and residential real estate as well as art. Much of the real estate was in New York and Miami.

Problem 3 – Monthly carry costs for Mr. Jones’ estate were substantial. Most of the cash flow from the estate was needed to cover costs for the properties and personal employees maintaining his personal real estate.

Thinking back to 2008, it was virtually impossible to get a good bid on real estate. Lending had dried up. As the estate settlement progressed, not only were the values crashing, but there were no buyers for the illiquid assets. To compound the problem, the liquid assets were quickly eroding. Cash flows from the commercial properties had fallen and the carry costs continued.

In my opinion, wealth is only as valuable as its liquidation price. In the end, Mr. Jones’ plan to have his children receive half of his estate was impacted by timing. He had good intentions but failed to see the risk in his asset concentration.

So, what is the cost of the Estate Tax? 40%? Is it 60%, 70%, 80%? Unfortunately, in the case of Mr. Jones, his children received about $0.15 on the dollar after the forced sale of the illiquid assets during arguably one of the worst times in history for valuations. If Mr. Jones had established a plan that provided liquidity, his heirs could have avoided the loss by using the liquidity to pay the tax while holding the illiquid assets until values recovered.

Liquidity and estate planning are not just for mega estates. The same problems can occur with estates of all sizes. It is important to focus on the liquidity profile of your estate and plan accordingly.

|

What to Look For Concentration of Illiquid Assets:

Liquid, but not really....

Estate Plan:

|

Conclusion

- Analyze the liquidity profile of your estate.

- Calculate the carry cost of your estate that will be needed during the estate settlement.

- Establish liquidity minimums that will help meet your planning goals.

With technology, we can analyze your estate focusing on the liquidity net of your spending and tax. There are many planning ideas to help manage the estate illiquidity. We believe shifting your thoughts on how you evaluate your plan will pay dividends in future.