Recently John was in a financial planning session with a family where he recommended some trust and estate work. John laughed with his clients when they said, "if we trust our family why do we need a trust? What do they even do?" They went on to explain that John wasn’t the first to suggest this course of action to them, but that they never understood the machinery or terms, and why they were suggested. That got him thinking about how many families likely had documents they didn’t truly understand; or should have documents but do not because of the same kind of misunderstanding. In what follows, John will explain the common mechanics across nearly all trusts. We will also discuss good reasons to consider having one. John would like to give credit to Mr. Tim Belber JD, AEP®. Tim taught him a great deal on the topics of trust, estate, and the human element of the advisory relationship. John highly recommends Tim’s book, The Middle Way (published in 2015). Tim is an estate planning attorney and a Professor at The American College of Financial Services.

“What is a trust and how do they work?”

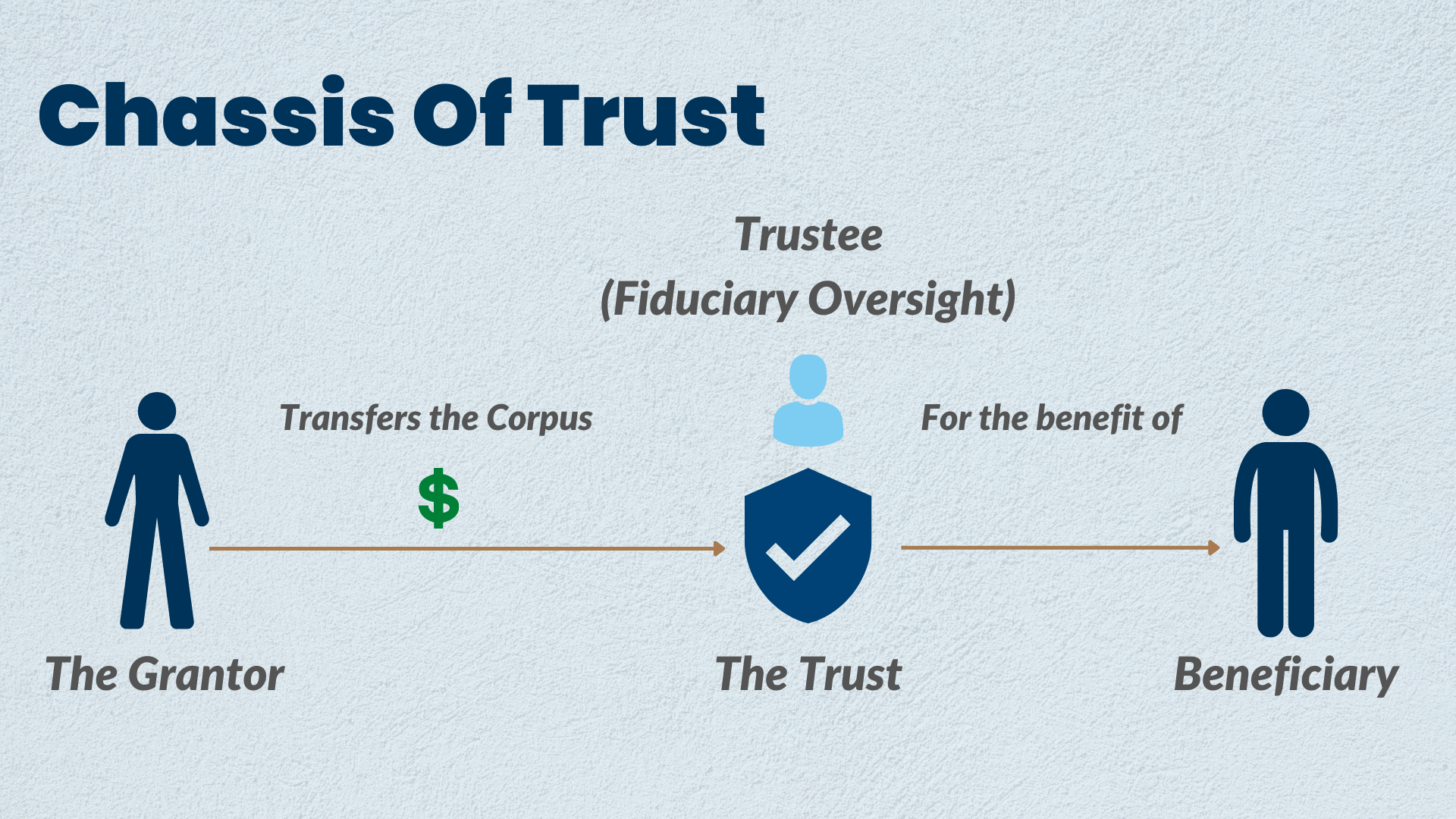

The most basic way to summarize all trusts sounds something like this. A person (the grantor) transfers property (the corpus) to an entity (the trust) for the benefit of (the machinery) someone (the beneficiary). That property (the corpus) needs fiduciary oversight by a person (the trustee). The grantor has property (of nearly any kind) that they intend to transfer at some point (or now). The giver of the property wants there to be oversight or conditions met to complete or use the transferred property. “For the benefit of” is the most powerful part of the statements above. This is commonly where most of the machinery and confusion of the trust documents happen. The usual detective questions come into play here. How, when, why, and under what conditions will the transfer take place? Those same questions apply to the ultimate usage of the property on behalf of the beneficiaries. “So, why should we start with this chassis as we consider whether a trust is right for our family or not?” Einstein said, “Things should be stated in the simplest of terms but no simpler”. Starting with the basic construct and working our way up ensures that we miss very little. How does this working chassis of all trusts help our family to decide if we need a trust? This is the question we should be looking to answer.

It is our opinion that the estate planning industry has become far too divisive. Often estate planners and legal counsels focus on preparing the money for inheritance rather focusing on the people who are involved. Not all families need or want trusts. They would rather avoid the expense and complexity because their families don’t require the intrusion of others to handle the passing of loved ones. A matron of one of our families recently talked me through her process for homemade ice cream, and summer peach cobbler. John learned that her family was deeply and mutually bonded. She went on to tell me that the prior generations of her family had complex legal documents and that she flat out didn’t want that aggravation for her children. She had faith in them and felt they could and would handle things without all of that. While John’s heart was warmed by the family and his palette jealous of the cobbler a la mode, this is a rare family indeed. One possible reason the industry leans toward a supposition of trust is that families normally contain very different people, with very different sensibilities about life and death. The passing of a loved one and handling of estates is an emotionally charged time. When death, money, and high emotions find themselves together, people can easily behave below their usual best. This is where the trusts and legal machinery come into play.

The most common and basic form of trust has a few names, but they are mostly synonymous. Revocable, living, and inter-vivos are common names for this trust. Using the chassis above, parents or grandparents (grantors) have property (corpus) they wish to transfer (for the benefit of) to younger family members (beneficiaries).

“Why should we use a trust instead of beneficiaries?”

There are a few possible reasons here:

- The type of property to be transferred may not be one where a beneficiary may be applied. Real estate cannot (in Florida) have a simple beneficiary title, so to avoid probate costs and complexities, trusts are often used. This is especially true if you own more than one property, in more than one state.

- Special circumstances often require a trust. Once a will is executed and the probate completed, a trust may live on to serve the family. Metering the pace of spending or defining the terms of access to inherited assets are very common reasons to build a trust. Parents may dictate that heirs achieve life goals of education, family, career, income, or philanthropy before accessing dollars. Some families also forbid access to wealth after certain actions like criminal or drug related offenses.

- Having a family member with special needs usually requires careful planning. The government provides many financial and community benefits to people in this group. Being too wealthy can limit participation in this community. Most often, trusts are needed to ensure needs are met without encumbering the beneficiary or preventing them from accessing government benefits.

- Blended family issues and divorce are becoming a highly common reason for trust usage. Let’s say that you want your legacy to stay in the family versus become marital property. Perhaps you feel the marriage will not be a lifetime commitment or you prefer your wealth to follow your bloodline instead of passing into a blended family. By leaving your inheritance in trust for your heirs, there is a supposition that these inherited dollars are not marital property. If your heirs take an inheritance and deposit into the de facto joint account for the family they both use, it can be more difficult to keep those assets safe from divorce.

“Alright, a few of those apply to us, now what?”

This is really where we look back to the discovery phase of financial planning. What are the goals of the family? Who are the beneficiaries, and what are their sensibilities? How do we treat them fairly albeit maybe not equally? Once these goals are settled, you need the documents that formalize the arrangement. “What should my documents say?” This is the tough part. At CWA, we review these documents often and no two are constructed the same way. John will try to cover some of the absolute essentials. Please note, John is not an attorney, and this is not an exhaustive list of the elements a trust document may be built of. Please seek appropriate counsel or allow us to connect you.

- Title – We need a name so we can “Title Assets” to the trust entity. We also need the date of trust.

- Grantors- As mentioned above, we need to know who is giving the property.

- Trustees- For the revocable trust, the trustee is normally the grantor. There are many trusts where the trustee cannot or should not be the trustee.

- Successor trustees- This is a big one. Once the grantors (or other first-generation trustees) pass away, who will act as the fiduciary for the benefit of the beneficiaries? Careful selection here can cause or prevent family battles. Rarely do I see adult beneficiaries come together for the harmonious good of the family when named co-trustees. Also, it can be incendiary to the family for siblings to be the trustee for other siblings. We usually suggest a neutral third party to serve like a professional trustee, attorney, or fiduciary.

- Ability to replace a successor- Things sometimes do not work out. The trust needs a device in place to allow the release and replacement of trustees. Having a “trust protector” can be a huge help here. This person may have the right to name or remove a trustee or adjust certain terms of the trust to ensure it gets used in the way the grantors intended.

- Dispositive devices- This is the “for the benefit of” segment. How is the trustee instructed to use the assets of the trust (corpus) for the benefit of the beneficiaries? These devices can be as simple or as complex as your family requires. It is very common to divide assets into equal shares/dollars across heirs. Grantors may also place conditions on the access. Incentive trusts, or Life Skill trusts reward things like attained age, marriage, education, or entrepreneurial enterprises. Very careful consideration must be given here. We cannot guess the life situations of beneficiaries decades from now. Many beneficiaries express negative feelings about the terms of the trusts they are bound to.

- Signatures- These documents must be signed to be legal.

- Notary/witness- In Florida, two witnesses and a notary make a document “self-proving”. This generally prevents the witnesses from being called to testify to the authenticity of the documents.

As you get these documents into place, we highly suggest a family discussion. John met with a New Hampshire attorney who said, “At its best, the trust should be built in a way where the trustees would say yes or no in the same circumstances that the original grantor would have.” Time to acclimate is essential. As Parents and heirs look onto each other, we are all imperfect. Communication and understanding are critical to creating wealth transfer plans that bond a family generationally versus tearing them asunder irreparably. We also suggest a discussion over the methodology of family meetings and the communication of family goals with your advisor. Having help with family meetings can ensure that the agenda gets presented in a neutral way, while preserving the integrity of the family gathering. No one wants things to get overly emotional and cause a cavernous family rift. The industry uses a phrase called family governance to describe this process. Even a cursory look at families of generational affluence will show that they all share systems to grow and steward family wealth. The further away from the original grantors the family gets, the more room there is for disagreement. We can happily help you get and stay organized in the communication process.

One last thing that we believe is critical is a preamble to the trust. This may seem farcical to some but having your voice echo through the legalese of the documents can be comforting and give a compass to the trustees and beneficiaries. Writing a letter to your family that lays out your thinking at the time the documents were made is often beneficial. The ability to explain your deepest motivations and wishes in the crafting of the documents can provide critical insight in tough moments. You can pass along your dearest life lessons, biggest triumphs, and toughest defeats. It can be seen as a way to give scope to those who may never have met you and might otherwise feel bound to an inflexible trust vehicle. Depending highly on the facts and circumstances of the family, these trusts can be in place long after the person who wrote them. Hopefully, you now have a better handle on the basics of trust construction and mechanics. Please use care, caution, and intentionality as you consider these vehicles. Even the brightest families experience confusion, and unrest at the outset of these planning techniques. Allowing time and participation of the proper people at the table remains the key to generational success. As always, please let us know if you would like your documents reviewed or have questions about the possible usage of such techniques in your family.