“Life is not a spectacle or feast; it is a predicament.”

-George Santayana

Investing is an exercise in decision making under uncertainty. How do we reach an intelligent conclusion now, in the present, about an investment whose performance can truly only be known in the future? This is the goal of our global research effort: to better understand the stocks and bonds we own and to better understand the future. Today we find ourselves at one of Santayana’s predicaments. Our expectations for an inventory-led decline in steel prices are playing out, with weakness spreading to crude oil prices as well. Are these declines worrisome leading indicators of economic deceleration? Or should we welcome them as a “tax cut” that can boost consumer spending and, more importantly, boost the profits of companies whose results were previously pressured by rising energy prices? This week’s Trends and Tail Risks weighs the evidence around this predicament.

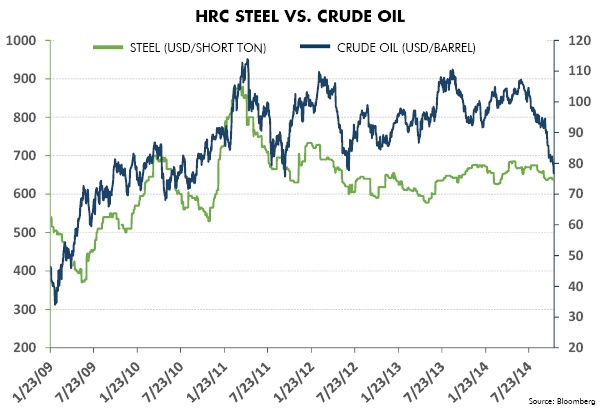

Frequent readers of this research publication are by now long familiar with our concern about an inventory led slowdown in steel (Making Volatility our Friend: Trading the Kitchin Cycle, 5/28/14, Unsustainable Steel Premiums, 9/3/14, Revisiting the Inventory Cycle, 10/1/14 ). This inflection from restocking to destocking kicked off eight weeks ago with a plummeting scrap steel price in Turkey. Commodity price weakness was, however, not confined to the $1 trillion global steel market. The huge crude oil market, the largest commodity market in the world, has also come under substantial price pressure, as the chart below reflects. It’s long been our experience that the strongest inventory destocking cycles express themselves across many markets at the same time. So it comes as no surprise that crude oil would share steel’s decline.

Clearly, falling steel prices are bad for steel producers just as falling crude oil prices are bad for oil drillers. Thankfully that much is simple! But might these trends have an ever more powerful positive impact on other sectors of the market - sectors that lagged during the prior decade of high and rising commodity prices? Our mantra has always been to seek out companies who may benefit from the trends we anticipate, for whom falling input prices are good! Our experiences is that there is often much more money to be made profiting from a company who BENEFITS from falling prices rather than in simply betting against companies for whom falling prices are bad. So while the obvious trades have been to bet against the equities of high cost producers in steel and crude oil, what are the less obvious beneficiaries of this trend that may disproportionately profit from falling prices?

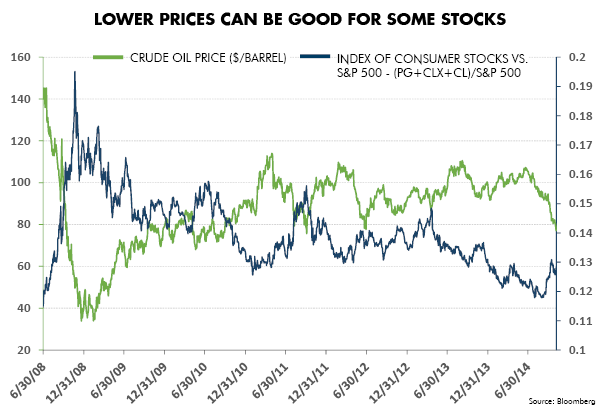

The most obvious beneficiary of falling energy prices are the airline companies, who only two years ago languished in obscurity and bankruptcy. What a difference just a few months can make! Other companies however benefit in more subtle ways. The chart below illustrates the performance of high quality, dividend paying, US consumer stocks Proctor and Gamble (PG), Clorox (CLX), and Colgate-Palmolive (CL) relative to that of the S&P 500 index. Note that these big capitalization, powerhouse branded stocks have underperformed the market consistently for the last five years. But note too how these stocks outperform the market during times of falling crude oil prices.

Our recent research trip to China (A Question of Confidence, 10/29/14) complements our work on the inventory destocking cycle underway now, to make us very open minded toward investments that can benefit from these trends now underway. Furthermore, we still are wrestling with the (for now) unanswerable question of whether these falling prices may suggest an economic moderation that calls for a more defensive portfolio. Thankfully equities such as those above can outperform under either scenario while we research our way through the data to find the ultimate answer we seek.•