I love movies. My favorite movies combine great actors, a riveting story line, stunning imagery and a moving musical score to create a memorable experience. Ultimately there must be one individual who is in charge of this hugely complex task of shepherding the movie from concept into reality. This is the role of the movie producer, who weaves all these disparate threads into a unified whole to deliver the movie on time and on budget – and make a profit. What a demanding job! Those rare few who do it well are rightly respected and famous for their talents.

Albert R. “Cubby” Broccoli, who produced seventeen James Bond films in thirty-two years, was one of the most successful movie producers of all time. James Bond is the most lucrative series in cinematic history, earning more than $5 billion in domestic box office revenues alone in the more than fifty years since the first film, “Dr. No,” was released in 1962. Broccoli had the creative vision to see the blockbuster potential that lay hidden in author Ian Fleming’s James Bond series of spy novels – and possessed the management acumen to deliver that potential profitably.

In the business world the closest analogy to a producer is a company’s Chief Executive Officer (CEO) who manages the creative talents of an organization and delivers the end results. Those lucky shareholders blessed with the very best executives can profit enormously. In my career as an investor I have been fortunate to identify a handful of these rare individuals, and profit from the early identification of their talent. In this week’s “Trends and Tail Risks,” I examine the movie-making prowess of Cubby Broccoli to learn how we can identify - and profit from - brilliant managers.

Overcoming Challenges

Albert Romolo “Cubby” Broccoli was born in the New York City borough of Queens on April 5, 1909. His family emigrated to the U.S. from the Calabria region of Italy. His parents faced many challenges as they fought for their piece of the American Dream, successfully scraping together enough savings to buy a farm.

The memory of how he and his whole family toiled and sweated on their knees to make the farm profitable would remain with him always. Broccoli’s cousin, Pat, continued to build upon the family’s ambitious dreams and moved to Hollywood, where Pat married a movie star and ran in the social circles of the city’s leading actors and producers. Broccoli’s love of movies drew him to Hollywood where he worked a number of odd jobs until he got a break working on films as an assistant director for 20th Century-Fox. Broccoli spent World War II in the Navy’s entertainment division, organizing stars’ visits to the troops. After the war, Broccoli was an agent and grew close to many of the leading stars and movie makers of the day, such as Cary Grant who was the best man at his wedding.

Broccoli moved to England with his first business partner, Irving Allen, where they achieved initial success as independent producers. Flushed with their success, they over-reached by expanding into new endeavors and were forced into bankruptcy as a result of two bad decisions back to back. At fifty Broccoli was broke and had no future prospects. Soon would come the additional pressure of providing for the child he and his wife were expecting. He had hit rock bottom. Many sleepless nights that year he paced the still darkness of his London home. Was this the end of the once-promising career of Cubby Broccoli?

James Bond: Birth of a Film Legend

Broccoli was a big fan of the spy novels of Ian Fleming, who wrote about the dapper English spy James Bond. In Bond Broccoli saw great promise for the silver screen. A few futile attempts had been made to coax Bond convincingly off of the page but nothing had really worked. A mutual friend connected Broccoli with Harry Saltzman, a Canadian entrepreneur who had optioned the movie rights to Fleming’s books but was unable to put together a deal to finance and produce the movie. The two formed a partnership that in 1962 produced the first Bond film “Dr. No” that marked the launch of the largest and most profitable movie series in cinematic history. Broccoli learned well from his earlier mistakes and would remain exclusively focused on the James Bond series for the rest of his career.

His focus paid off. Broccoli would be honored by his peers with the Irving Thalberg award for consistent excellence in film-making. Twenty-three Bond movies and more than $5 billion later, the world’s movie audiences still benefit from the creative talent and organizational genius of Cubby Broccoli who brought James Bond to life. No one has ever rivaled the tremendous multi-generational franchise Broccoli created.

His focus paid off. Broccoli would be honored by his peers with the Irving Thalberg award for consistent excellence in film-making. Twenty-three Bond movies and more than $5 billion later, the world’s movie audiences still benefit from the creative talent and organizational genius of Cubby Broccoli who brought James Bond to life. No one has ever rivaled the tremendous multi-generational franchise Broccoli created.Investment Implications: One Key Method by Which CEOs can Add Value

The story of Cubby Broccoli shows the incredible results that may happen when the right person is in charge. Excellent CEOs can create lasting franchises through the exceptional returns that they earn for their shareholders. I have been fortunate in my career as an investor to develop close working relationships with some of the best management teams in the business. My job as an investor has always been far less demanding than theirs. All I must do is identify greatness. CEOs have to create it! Thankfully we as investors can purchase shares in the companies that they run and profit from their genius – if only we can identify the hallmarks of that genius early enough, before they are obvious.

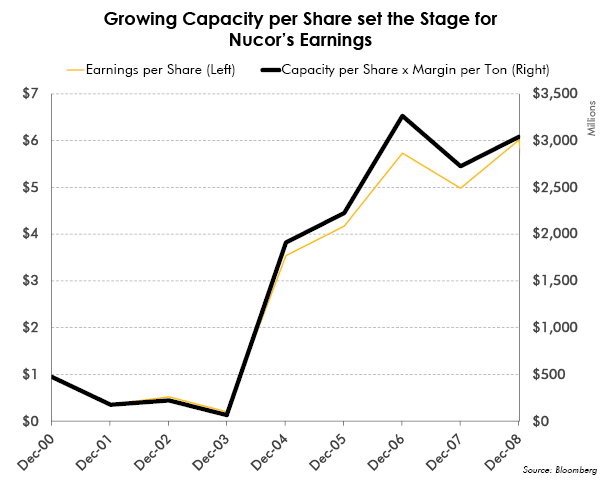

One of the most important ways a CEO can add value over time is to increase the company’s earnings potential – its earnings power per share. For instance, a steel company such as Nucor will do so by adding steel capacity that will become actual steel production. Per share is the magic phrase here in that our ownership of these companies takes the form of shares. Growth for growth’s sake is pointless or even harmful if it reduces our claim as owners on the larger asset base. I would rather see rising capacity on a flat number of shares outstanding or even flat capacity on a falling number of shares. Either one benefits the equity owner by increasing the pro-rata ownership stake of a share in the company’s productive assets.

Nucor’s Dan DiMicco Creates Incredible Value

One of the best managers I ever had the good fortune to work with was Dan DiMicco, since retired, who at the time served as Nucor’s (NUE) CEO. NUE is the largest steel producer in the U.S. Dan took over leadership of NUE just when the U.S. steel industry was entering its most challenging period since the Great Depression. Almost forty percent of steel-making capacity in the U.S. would go bankrupt by 2003, when I began to accumulate the shares of Nucor. Nucor was the obvious choice for my investment in the steel sector because of the margin of safety from its large and much undervalued base of assets which limited my downside. Furthermore, Nucor’s rapidly growing capacity per share would quickly translate into rising earnings should the steel cycle improve. Dan’s thoughtful capital allocation created in Nucor’s shares a strongly asymmetric investment for his shareholders.

Dan knew that earnings do not grow on trees but rather are a function of a company’s utilized capacity per share multiplied by the margin earned per unit of that capacity. For instance, in Nucor’s case, its earnings power is the number of tons of steel it sold multiplied by its margins per ton of steel divided by the number of its shares outstanding.

I had a very powerful money making opportunity in Nucor’s shares because steel margins per ton were falling faster than the pace at which Nucor was adding tons of production per share. So earnings were falling despite the company’s rapidly expanding production. Falling margins masked the tremendous growth in Nucor’s production capacity per share. Should margins stop falling, or even improve, Nucor’s earnings would accelerate dramatically on its growing base of production.

Dan was ready to put this logic to work because he had positioned Nucor to succeed. Nucor was a low cost producer with a sound balance sheet. This meant that Nucor was profitable despite the harrowing condition of the steel sector. Dan took advantage of the downcycle that temporarily depressed Nucor’s short-term earnings to grow earnings exponentially once the cycle turned. The manner in which he did so is worthy of study by even the most experienced CEOs.

Capital Allocation at its Finest

Nucor sat comfortably on a large cash position while waiting until the cycle had broken all but the strongest companies. This deep steel downturn created distressed selling of assets at very depressed prices. Through well-timed acquisitions, Dan grew Nucor’s capacity per share by 40% in just a few years while buying assets at an 83% discount to replacement cost! (From the Analyst's Toolkit: Replacement Cost Valuation, 6/11/14) Dan could name his own price because he was the only one who was buying assets and could pay cash.

Nucor would then improve these assets through its unique team-based culture and find innovative ways to expand the capacity that it purchased. In fact, my analysis showed that Nucor increased its capacity per share five fold since the last cycle peak! Put differently, should steel margins double off the lows, Nucor’s earnings would rise ten-fold. No one anticipated earnings growth of that magnitude because they were ignoring growth in the company’s underlying asset base. The graph below shows how strongly earnings per share exploded as rising steel margins per ton quickly translated into an 18 fold (18x) increase in Nucor’s earnings in only one year, thanks to the rapid growth of Nucor’s steel production per share.

The Cycle Turns: Margins per Ton go from All-Time Lows to All-Time Highs – in Just One Year!

Nucor’s earnings would rise almost eighteen fold from $.20 to $3.54 from 2003 to 2004. Earnings would remain at that much-advanced level for the next four years in a row. Much of that increase was driven by margins per unit of production, which were the welcome gift of a cycle that could be quite volatile and difficult to predict. Nucor’s shares responded to the rapid improvement in earnings and rallied strongly for years. Clearly all of NUE’s shareholders benefited from the strength of the cycle but it was the CEO’s brilliant decision making during the downcycle that super-charged the company’s earnings.

Dan took advantage of the downcycle to lay the groundwork for incredible earnings growth. Those investors who took the time to study Nucor’s capacity per share could see evidence of Dan’s brilliant capital allocation. Further, Nucor’s shares were trading at a 50% discount to the costs to replace its own profitable assets, an almost unheard of discount for such a strong and well-managed company. Nucor’s earnings at the time were deceptively low because steel margins per ton were falling even while Dan increased capacity. Nucor’s earnings did not yet reveal the scope of Dan’s brilliant strategy. This would change when the cycle turned.

Conclusion

I am always on the lookout for the next Dan DiMicco, the CEO who is making all the right moves to lay the foundations for blockbuster growth. Sadly, there is no “CEO of the Year Award” award for Dan that may compare with Broccoli’s well-earned Irving Thalberg award. Dan has nonetheless earned his place in the Pantheon of brilliant CEOs who in their lifetime achieved incredible results for their shareholders.

Future editions of “Trends and Tail Risks” will expand our work on CEOs whose remarkable value creation is worthy of emulation. Dan DiMicco’s brilliant work at Nucor sets a high standard to which all CEO’s should aspire. Like Cubby Broccoli, Dan DiMicco has earned a place of honor among his peers.

Truly world class CEOs can make all the difference in the investing business but are exceptionally hard to find – especially in advance of their great achievements. Thankfully we do have a way to clearly identify them – their own history of capital allocation. By disaggregating a company’s earnings power into its drivers we can see the stamp of brilliance in real time, before the market comes to fully recognize it.

If one was paying close attention, the future huge performance of Nucor need not have come as a surprise. How much more profitable it is to anticipate such a huge run through logical drivers rather than wait for blockbuster results! The search for such managers is an important part of our research process. Thankfully, our research team has the amazing achievements of Cubby Broccoli and Dan DiMicco to inspire our efforts.•

Picture Sources:

1. Albert R. "Cubby" Broccoli, Source: telegraph.co.uk

2. On Set - Sean Connery & Cubby Broccoli, Source: filmuforia.co.uk

3. Dan DiMicco, Source: Dailyfinance.com