The story of struggle, of hard work in a time of great adversity which leads through travail to eventual triumph, is an eternal human story. In all cultures and in all languages we can find examples of such stories of challenges overcome. It should not come as a surprise to frequent readers of this weekly that I see many similarities between this eternal story of struggle and the task that is before us as investors. After all, successful investing requires the patient – and sometimes challenging - navigation through an uncertain future toward a place of security and reward.

Sometimes in my course of study I come across remarkable examples of people who were able to triumph, to overcome adversity and after much patient toil to secure a place of honor and success. Two such examples that come to mind are Viktor Frankl and Abraham Lincoln. Not only are their stories inspiring but they also serve to illustrate the hallmarks of what we try to do as stewards of our investments: to safely shepherd capital through a volatile and unpredictable world to a place of safety and reward. In today’s Trends and Tail Risks, we explore what we can learn from Frankl and Lincoln that may help teach us how to be better investors.

Frankl and Lincoln: Hope and Perseverance to the End

Viktor Frankl in his book Man’s Search for Meaning explains what he learned about the key to survival in the death camps of World War II. His book recounts the unimaginable struggles that he and his fellow prisoners endured. During their time of internment he and his fellow prisoners faced overwhelming uncertainty and the constant threat of death. I simply cannot imagine a more harrowing experience. One of the key lessons that Frankl learned is the importance of hope and the powerful human imperative to find meaning in our lives and in our struggles. To me one of the most applicable of his conclusions was, to paraphrase, that life was like a movie – you had to wait until the very end to understand its full plot and meaning. While we are caught up in the midst of our daily struggles it’s very hard to have the proper perspective. It is only at the conclusion that we can look back and see the full sweep of events and hope to understand their meaning.

I pondered this insight while I turned my attention to another historic example of great perseverance through uncertainty and failure: Abraham Lincoln. The image of Lincoln that many of us have is highly colored by his enormous achievements at the end of his life, as the President who presided over a bitter Civil War to bring union once more to a shattered and divided country and loosen the bonds of slavery. But author Dale Carnegie has done history a service in more fully exploring the life of Lincoln in Carnegie’s 1932 book The Unknown Lincoln.

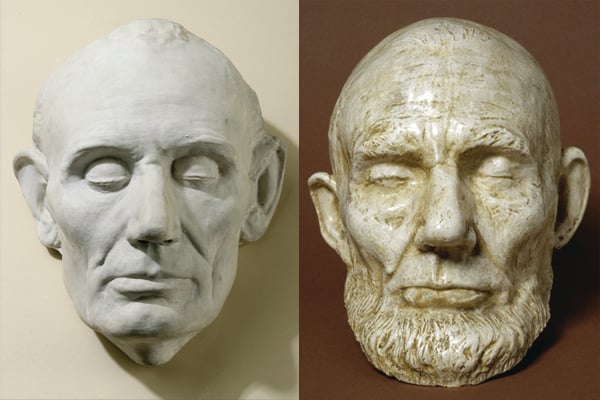

Carnegie shows us a far different Lincoln than that of which we know through our history books. Through his mid-forties, Lincoln was a repeat and abject failure. He had failed in business and went bankrupt repeatedly. His initial political efforts were soundly defeated. After the death of the love of his life, he suffered a nervous breakdown and went on to face a series of bruising political defeats. In fact, his failings were so immense that one wag of an editor felt confident in pillorying Lincoln in 1858: “Hon. Abe Lincoln is undoubtedly the most unfortunate politician that has ever attempted to rise in Illinois. In everything he undertakes, politically, he seems doomed to failure. He has been prostrated often enough in his political schemes to have crushed the life out of an ordinary man.” Two years later Lincoln would be President. However, Lincoln’s real troubles were only starting when he assumed the Presidency. The enormous pressure of the Civil War would age him tellingly. Lincoln’s life masks (see below) show how the stress of his experience aged him dramatically in just five short years.

Life Mask - Abraham Lincoln

Left: Pre Presidency 1860, produced by Leonard Volk

Right: Near End of Civil War 1865 (2 Months before death), produced by Clark Mills

Source: http://itthing.com/life-and-death-masks-of-famous-people

The common tie between Frankl’s insights and the life of Lincoln is the imperative of patience to persevere to the end – or frankly even beyond the end – to see how all the parts fit together. Let me explain. Lincoln’s mother was an illegitimate child who died young and poor, buried in the wilderness in an unmarked grave. Even at the end of her own short, unhappy life, Lincoln’s mother could not have known how impactful her life had been – what a difference she had made. After all, there is no way she could have known of the success her son would have and how he would earn the respect of countless millions by his deeds. The full meaning of her life would actually only be known and fully understood after the achievements and death of her son – many decades later. But what honor and achievement was in fact hers!

The Investment Implications of Replacement Cost Valuation: Perseverance Until the End

As value investors we often find ourselves in the most obscure parts of the market. We end up there by design, because we are constantly seeking to limit downside risk by investing in securities that are the most undervalued. After many years of experience we have become accustomed to tuning out much of the rhetoric that accompanies low valuations: controversy, fear, and sometimes outright revulsion. Such sentiment should be expected because, after all, disappointment and doubt must shroud the prospects for these securities to make them cheap!

But how do we discern a compelling opportunity from just another broken story? Valuation is our reliable guide. Our valuation work drives our own independent view for what a security is worth and gives us confidence to see opportunity where others see only disappointment. We have long been advocates of using multiple valuation metrics to “triangulate” a company’s fundamental value. Among these metrics our favorite is replacement cost (“Replacement Cost Valuation,” 6/11/14).

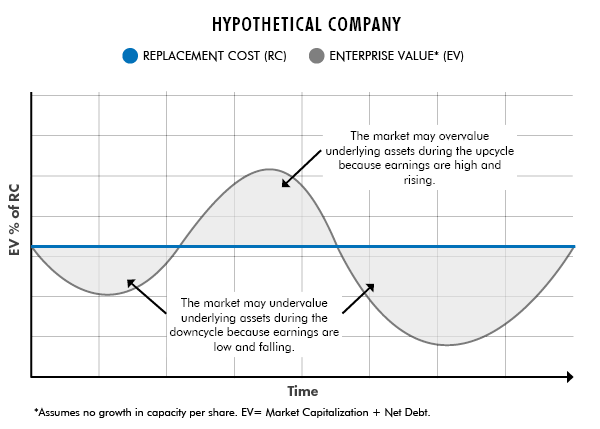

Replacement cost valuation helps from the very beginning to focus on the end game: what price we can reasonably expect to achieve for our investments at the conclusion of the cycle, at the very end of our holding period. To us a company is simply a collection of assets moving through time. Sometimes, as the chart below illustrates, surprisingly good fundamentals at the peak of the cycle will lead a company’s assets to produce very strong earnings. Strong earnings, no matter how temporary, never cease to attract Wall Street’s attention. Such casual observers are all too often heedless of a company’s true replacement value and often overpay for the stock, sowing the seeds of future disappointment. Conversely, as the cycle’s peak recedes and weakening fundamentals take over, the same assets may earn only a fraction of what they earned at the peak. The asset base of the company, however, changes only slowly. It is on the value of this asset base that we focus our attention when we use replacement cost valuation.

Replacement cost is the cost to replace, from scratch, the assets of a company. Replacement cost is an exceptionally useful methodology for us for many reasons. There is typically a valid fundamental reason for a stock to trade at a discount to the value of its underlying assets. Perhaps the economics of the business have collapsed because too much new supply is chasing too little demand. Perhaps inventory levels are too high or trade flows are changing in unanticipated ways to drive earnings far under normal levels and far indeed from the levels a company may enjoy at the peak. The wonder of cycles, however, is that they are self-correcting. This means that, however serious the short-term challenges, the fundamentals of market balance are hard at work to correct them and to restore a time of prosperity. This gives us hope for the future and keeps us focused on the higher price at which we can expect to exit our investment.

As previously explained, challenging economics oddly enough will work over time to improve a sector. For instance, hard times drive weaker players from the arena, which constricts supply. Low or falling prices help to stimulate higher demand which can soak up excess supplies. Low valuations encourage industry consolidation where more and more production gets concentrated in fewer hands. Higher industry consolidation gives producers a bigger say in the fate of their sector, allowing them to make better decisions such as curtailing excess capacity or slowing the pace of supply growth. Industry concentration can thus reduce cyclicality in a sector and promote better economic returns throughout the cycle.

Accurately Estimating the Peak Even While Languishing at the Trough

Perhaps the most magical attribute of replacement cost valuation is that it can help us estimate a reasonable downside and upside price target even in the presence of great volatility and uncertainty. A company may even at the trough of a cycle have no earnings at all. Replacement cost is worthy of this task. The example below of Lenzing AG (LNZ AV) shows the power of replacement cost valuation.

Lenzing AG (LNZ AV) is headquartered in Austria and is one of the world’s largest and lowest cost producers of rayon staple fiber, a fiber used to make fabric for clothing and upholstery. Rayon fiber has been a secular share gainer for the last twenty years, growing at 8% per year, as rayon gains market share and cotton loses market share among fibers. In 2011 a number of influences came together to create the “super-peak” above in Lenzing’s share price at more than 100 Euros per share, during which the market in its enthusiasm dramatically over-valued Lenzing.

Our valuation work suggests that at the peak of the cycle in 2011, Lenzing traded at 187% of the cost to replace its assets. The company’s underlying assets would have cost $2.2 billion to replace yet the market valued the entire enterprise value of the company at $4.2 billion. Lenzing’s overvaluation was driven by the high price of cotton. Cotton and rayon are in many ways substitutes, meaning that when the price of cotton rose it created an umbrella under which the price of rayon staple fiber could also rise and where the pace of substitution of rayon for higher priced cotton could accelerate. This rayon “super-peak” led to a dramatic over-expansion of rayon capacity which in turn depressed the economics of producing rayon fiber. The crash in cotton prices from $2.20/lb. to $.60/lb. hurt rayon prices as well. At the trough the market’s valuation of Lenzing’s assets valued the company close to 50% of the cost to replace its underlying assets.

Our valuation framework assumes that 50% of replacement cost for such high-quality assets is a reasonable downside support, which would value Lenzing at 55 Euro per share. Lenzing at its “super-peak” was over-valued at 187% of the cost to replace its assets, but even a more normalized 120% of replacement cost on the company’s growing base of assets still would value Lenzing at 135 Euro per share. Our prospective estimated downside from the current price of 65 Euro would yield a loss of 10 Euro while our prospective upside would yield a gain of 70 Euro. The ratio of upside/downside for an investment in Lenzing is thus 7/1, meaning for each dollar we risk in loss we stand to make seven!

I have been investing in cyclical and commodity equities professionally for more than fifteen years now. During all that time I had never, until recently, invested in rayon fiber. But this certainly did NOT mean that I was at a competitive disadvantage when investing in the rayon fiber sector, far from it. I actually began my career (very long ago!) in the textile industry so I am no stranger to the sector. But my real insight was my familiarity with replacement cost valuation, which is a methodology I have used successfully to trade more than a hundred different cycles in almost every commodity or cyclical/industrial sector one could imagine. Even with this long and varied experience I can only name a small number of opportunities where the temporary – but scary – forces of a vicious down cycle conspired to create such a compelling investment opportunity as that which we still find today in Lenzing.

It is this experience across many sectors and through many cycles that gives us the confidence to invest globally in sectors suffering tremendous stress. These sectors often languish in a vacuum of good news, staring awful short-term fundamentals in the face while we yet invest undeterred. We do so because our eyes are fixed, as they should be, on the long term, at the conclusion of our investment program. We hold our investments patiently with the confident knowledge that the forces of self-correction are always hard at work to bring balance to markets ("Price Allocates Resources," 5/25/14). By the force of rigorous simplification we strip out the non-essentials to focus on the ultimate goal of our investments. For this we can thank the discipline of replacement cost valuation.

In Conclusion

In this life there are many things for which we can be thankful. One of the most important gifts that we can enjoy is the opportunity to learn from the experiences of others. The profound experiences of Viktor Frankl and Abraham Lincoln teach us that in the stress and confusion of the moment we must not be distracted from the successful conclusion of our journey. It is only at the end when we may hope to understand – and in the case of Abraham Lincoln’s mother – even at the very end of her life she could still not have known what a difference she had made.

Investing is all too often a not too dissimilar experience: frequently frustrating and confusing along the journey! Many are the times – when you have been doing this for as long as I have – that you constantly ask yourself if all the trouble was worth it. Thankfully, however, we can use our replacement cost driven valuation goals to understand – even at the beginning of our journey – the ultimate goal that we may hopefully anticipate for our investments. It is for this reason that we constantly underscore the need for patience along the way.

The path to ultimate investing success is often challenging and frustrating. No one said it would be easy! What a temptation it often is along our journey to get distracted from the simple truth and powerful result that we seek to achieve through our investing. But at least in the markets the insight of replacement cost valuation can guide us toward a hopeful future. For it is only in the future, looking back, that we will see the true meaning of our investing, which is an insight with which I think Viktor Frankl and Abraham Lincoln would agree. Replacement cost is one of the most powerful tools to get us there, if only we have the patience to follow its lead! •