The financial world is a confusing place. Those of us with significant experience that pre-dates the Global Financial Crisis of 2007 - 2009 can easily see how much more complex the world is now than in the halcyon pre-crisis days. Back then, “all” the successful investor had to do was correctly anticipate a fundamentally driven future. This meant properly analyzing a company’s competitive position, successfully forecasting it’s financials for many years, and then correctly valuing its cash flows – arriving at the proper conclusion in advance of everyone else. What could be simpler, right? Well those were the good old days, when the market was free to allocate resources based upon fundamentally derived prices. Now? Not so much.

The biggest change between then and now is the enormous increase in government involvement in the markets, particularly by activist central banks. This change came about because of the incredible downdraft in prices during the worst of the crisis' forced liquidation. The market was in the process of using the tool of free price discovery, the most efficient resource allocation tool known to man, to match supply and demand. The problem was that the authorities did not like what the prices were saying! Prices were so low that they were forcing bankruptcies, especially throughout our highly leveraged financial system. So not liking this new and unpleasant reality, the government decided to change reality. And that is how we got to where we are now: a world of managed prices. Prices are now mostly set by the market, except when they are not. Welcome to the post-crisis world of investing, where as Mr. Murrow notes, “Anyone who isn’t confused doesn’t really understand the situation.” Today’s “Trends and Tail Risks” takes a look at the bond market, where investor confusion in this post-crisis world is perhaps the greatest.

The Bond Market: Where Hope Goes to Die

You will never fully understand the bond market until you understand this: a successful outcome for a bond investor is that he gets one hundred cents on his dollar back at the end, with a reasonable income stream along the way. This is why the market for bonds is one of the most sensitive and important markets in the whole world. Because a bad outcome for a bond investor is that the company to which he has loaned money goes under and he loses everything. So a bond investor’s ratio of upside/downside is very different from that of an equity investor. An equity investor too, can lose all of his investment in a company that goes under, but the potential pay-off is much greater. One huge success can make up for many failures in equity investing. Not so in bonds.

For this reason bond investors are a cautious lot. The returns that they are willing to accept in exchange for financing commerce therefore generate one of the most important prices in the world. Similarly important are the returns that bond investors are willing to accept in financing governments, which is generally seen as a less risky proposition than loaning money to commerce.

How are we to think about the message of bond prices when the U.S. Federal Reserve, and other central banks, have literally bought trillions and trillions of dollars of them? I can empathize with those that throw up their hands in frustration and proclaim that these prices are no longer “real.” But I have also studied the history of the markets that shows long-term patterns and logic that defies such excuses. Where does reality lie? Somewhere in the middle I suppose. Hence the overwhelming sense of confusion many have about the bond market. As always in this publication, we turn to the lessons of history for the clues that they may offer us about today.

The Lessons of Japan: There is no Free Lunch

Japanese central banking authorities reacted as one would have anticipated when the country’s property bubble, perhaps the world’s biggest one ever, burst in the early 1990s. They cut interest rates aggressively. They took steps to keep overly-leveraged companies from bankruptcy by keeping them alive with new loans, despite the fact that these companies were – in the cold light of day - insolvent. Debts were not allowed to be written down quickly but rather were refinanced and stretched out. In Japan during this time such a more painful, if shorter, period of distress was deemed “unacceptable” by Japan’s central planning authorities. The central planning authorities who ruled Oceania in George Orwell’s 1984 would have called such prices “doubleplusungood.”

Many of these overindebted Japanese companies came to be known as “Zombie Companies;” neither living nor dead but somewhere in between. So rather than a quick plunge and rapid restructuring, Japan entered what would first be described as a “lost decade” of slow growth, deflation, and de-leveraging. Then that decade turned into a second lost decade. There are many lessons that we can learn from the Japanese experience.

Every Benefit has a Cost

Clearly I would submit that there was a benefit to Japanese central bank intervention. For instance, I have no doubt that, in the aftermath of the huge Japanese property crash, in order to match supply and demand in the short run a truly free market would have lowered prices to such an extent that it would have bankrupted the entire Japanese financial system. That would have been bad. I get that. But if something has a benefit, must it not also have a cost? What was the cost of the Bank of Japan “saving” Japan?

Now, after the passage of more than two “lost decades” in Japan, can’t we look back and answer clearly that the cost of saving the Japanese financial system was decades of slow growth? Japanese companies – and government - are still among the world’s most highly indebted. And yet interest rates in Japan are also among the lowest in the world! Isn’t it more risky to be more indebted? How is it possible for interest rates to be so low in Japan? The answer is because Japanese growth has been abysmal.

There is an extremely strong relationship between nominal GDP growth and long term government bond yields. If nominal GDP growth is going to be “lower for longer” then so will bond yields. Real growth in the U.S. in the last decade is already the slowest recorded since reliable data was kept in the 1790s. The facts are pretty clear – and not very encouraging. The Fed’s “rescue” of our own financial system has a cost. We are paying that cost now in the form of lower growth, which is reflected in lower interest rates.

Is the U.S. Bond Market Turning Japanese?

If we are to avoid the definition of insanity, then we must embrace the reality that repeating the same strategy is going to result in a similar outcome. The response of the U.S. government to the collapse of our own property bubble is largely the same as the path trodden by Japan. Should we not logically expect the same outcome in our own bond market? What is the verdict of the bond market, so far, about where we are now and where the markets may go? The evidence, as shown below, suggests that we are in fact “turning Japanese.”

Not only are U.S. nominal yields on U.S. government 30 year bonds converging down to Japanese yields…

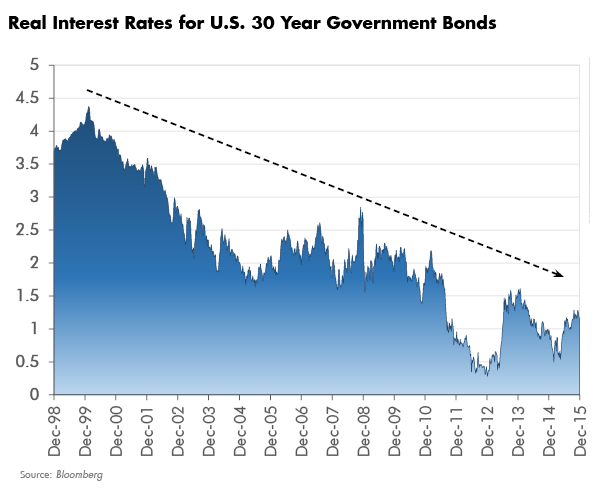

But also U.S. real interest rates are in a secular downtrend.

A Word About Market Psychology: Has it Embraced the Reality Suggested Above?

Let us for one moment put aside my own fundamentally driven view and examine this issue from the perspective of market psychology, which is always an important consideration. I have never seen a bull market, especially a long-enduring one such as the bond bull market that started back in 1981, that failed to end in total euphoria and universal acceptance of the prevailing trend.

Sidney Homer, legendary historian of the bond market and author of A History of Interest Rates, writes of the prevailing psychology in 1946, the last secular peak in the long-term bond market:

“It was a period when a large part of the liquid capital of the country attempted to crowd into the always limited area of riskless investment. The sharp recession of 1937-1938 had destroyed the last hopes of some of the most stubborn optimists that 1932 was only a traditional crisis and that the United States would, as always, recover to resume its climb to new heights of prosperity…When the war ended, some people thought that the Treasury would not always be offering as much as 2.5%. Perhaps rates as high as 2.5% would vanish forever (my emphasis).”

It is not the savvy disbelief of a few skeptical shorts that calls an end to a bull run but rather the exhaustion of all buyers and the universal embrace of the long-prevailing trend. Basically the market runs out of new buyers. A comparison between sentiment toward bonds in 1946 versus now clearly shows that we are not there in bonds. Not by a long shot. If I did not have the lessons of history to fall back upon, and if I did not have the recent confirmatory verdict of the market, I would still believe that the secular bull market in bonds is still alive simply due to the universal disbelief in bonds!

In Conclusion

The market’s continuing refusal to countenance the long-term reality described above has proven to be a recurring source of profits for those who are willing to buck the crowd and embrace the trend in falling long-term bond yields of the highest quality borrowers. Investors over the past few years who had the foresight to lock in yields that are far better than they are now currently have been rewarded. Will that trend continue? I believe the answer is “yes.”

However, surely the future is foremost among all the things about which reasonable people can disagree. Clairvoyance is ever an elusive trait – especially in investing! I believe, however, that the lessons of history and the message of the markets are quite clear that we should expect lower interest rates for longer. That does not imply that the path that leads to this result is guaranteed to be smooth - far from it. But if I have learned only one thing about successful investing, it’s that patience is always one of the most important raw materials.

As always, we will monitor the markets for their message and be willing to change our minds if the facts change. But I believe the burden of proof is on the bond bears. They are fighting against the lessons of history and psychology, which are both formidable adversaries. I realize that being secularly bullish on high-quality, long-dated bonds places me in a tiny minority of investors, but frankly that is always where the profits are greatest.•