CHIEF CONCLUSION

Sometimes the strength of the whole can be dependent upon what may seem an unimportant or even paradoxical piece. Investing can be like that too. In our opinion, the best portfolios are those that are designed to stand the test of time. This means that they are diversified - made from components that do not rise and fall together. Rather they have a different pattern of returns. Those responsible for managing other peoples’ money must be able to explain why each part of the portfolio is valuable, especially when it’s controversial or doesn’t seem important. Higher quality, longer-dated bonds are performing a valuable risk management function right now in a weak equity market. We should talk about them.

“There are years when nothing happens and there are weeks when years happen.” - Lenin

In the past week I - and no doubt many others - have been watching markets grow volatile. I have made my living in financial markets every day for the last two decades, but even I am seeing things that I haven’t seen in a long time. I thought this was a great time to explain how we build our portfolios, because we build them with volatile markets like these in mind.

But first, a story.

One of the first things I did when I moved to the shores of the Chesapeake Bay in May of 2000 after graduating from Wharton was to build a boat lift on our dock. In Alabama, I had grown up fishing in small farm ponds because we didn’t have the money for a boat. But I loved to fish anyway.

So, when my family bought our modest waterfront house on the Eastern Shore of Maryland, I couldn’t wait to buy a boat and start fishing. But first I needed a boat lift to hold the boat! I paid for the addition of a boat lift to our dock shortly after moving in.

To build our boat lift, I chose what seemed to be a reputable builder who specialized in boat lifts. But I mean, what did I really know about boat lifts? I had never owned a boat nor paid for a boat lift in my life. I specialized in investing, not in marine construction. How do normal people make intelligent decisions when it concerns something totally new to them?

So, I made the best decision I could. I asked for multiple quotes from reputable builders. I chose one that had a lot of experience building boat lifts and came recommended. I even called customers as references, and they agreed that this builder had done quality work for them. So, I signed the contract, paid the man, and days later got a new boatlift. I forget the exact price, but it wasn’t cheap. I paid several thousand dollars for my new boat lift.

Fast forward ten years into the future, and one day my boat lift collapsed while my ten-thousand-pound boat was on it. The boat and what was left of the lift clanged down about six feet onto my dock. It was a miracle that my kids weren’t playing on the dock or on the boat at the time. Its collapse could have killed them.

To fix my boat lift, I asked another expert – this time I chose a different contractor – to help me. He showed me what had failed on my old lift. The steel through bolts that held the lift, that went through the wooden pilings, had rusted clean through. My first builder had used cheap carbon steel bolts that had proven inferior to their task over ten years in the harsh saltwater environment. Their failure was, in retrospect, fully predictable.

To make matters worse, to save himself maybe $20 on a several thousand-dollar order, the first builder used this cheaper part rather than a more expensive and durable stainless-steel bolt. But the inferior part worked fine for ten years - until it failed completely and catastrophically.

I was angry. Twenty bucks! Surely an experienced builder should have known that such an inferior bolt was doomed to fail. How could anyone be so short sighted as to risk my family’s safety to save a few bucks? I would have paid another $20 to not have my lift fail. He put the whole project, his reputation, and the safety of my family at risk for less than 1% of the cost of the entire project!

His one small decision among hundreds in the project brought the whole thing down and could have killed someone. How could I have known? I mean, I hired him to do a job for me. He was the specialist, not me. I trusted him to know these things and to have my best interests in heart and to price his project accordingly. After all, couldn’t he see that an inferior job, much less a catastrophic failure, could ruin his reputation? I would have gladly paid the twenty bucks more. Certainly, his mistake cost me hundreds of times what he may have “saved” on an inferior part. What I was looking for was quality construction that would stand the test of time, not a quote that was 1% cheaper than his competition.

Higher Quality, Longer Duration Bonds are Proving Their Merit in Volatile Markets

My heart goes out to investors in today’s markets. Investors are trying to make sense of things, in an area in which they have not specialized. How do they know whom to trust? My simple story above was just about a simple boat lift. That pales in comparison to the importance of someone’s portfolio. Think of all the people, present and future, that depend upon that money that was so hard to save and is now at risk in the markets.

My job as a risk manager who creates portfolios has been made harder, not easier, by much of the “financial entertainment” that masquerades as financial news. Television, and much of the financial media frankly, appears to be an arms race to grab viewers’ attention. The folks who run the networks get paid to draw viewers, not to educate anyone, in my opinion. So, it should come as no surprise if financial TV is an endless parade of good looking “experts,” each sounding very professional, striving in vain to fill the endless 24 hour void each day.

I have never once turned on the TV in my office. I made the decision to ignore financial TV because I have studied this topic for decades and have the conviction of my experience in the field. But what do others do? How do they go about making informed decisions?

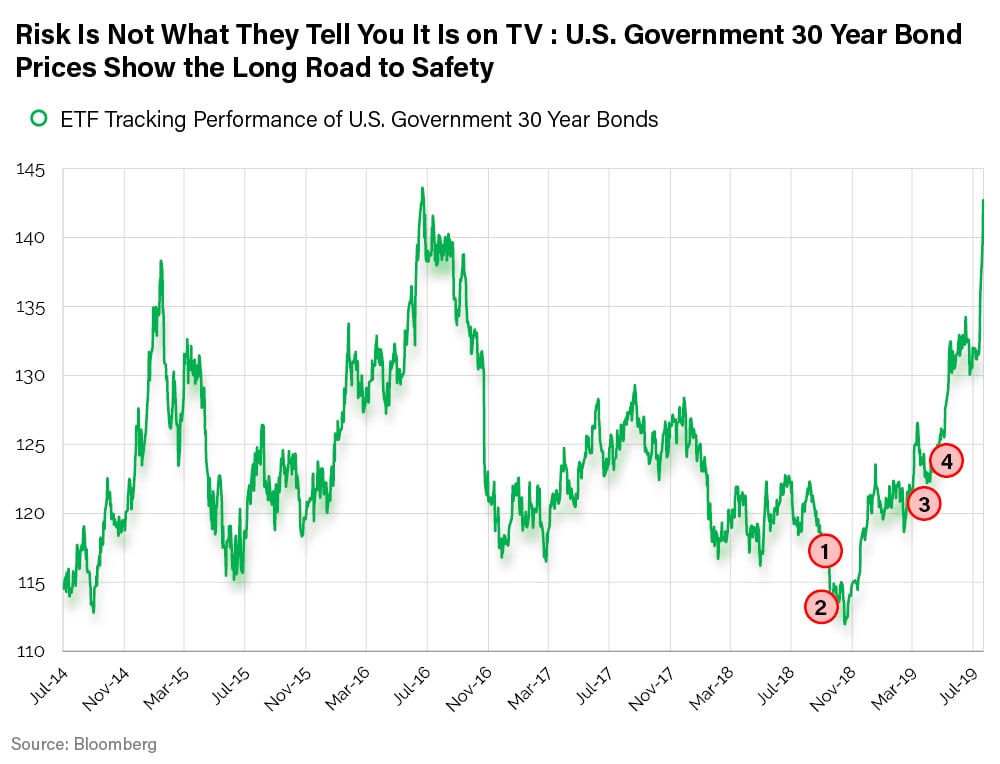

The chart below illustrates the challenges that so many investors face in making better decisions. It shows just a few recent examples of the extreme bond-bashing that until recently overwhelmed the popular financial media. These people, who I have no reason to believe meant ill, have in retrospect been proven wrong by the markets. But they were the experts! They were on TV! It appears that the common failing among almost all of them, is that they were reacting to what was happening now in the markets, as the chart below shows. Whom do you trust, especially when their advice seems to make sense and seems to be confirmed by recent price action?

- DoubleLine’s Gundlach Warns US Treasury Yields are Headed Higher, CNBC, September 20, 2018

- Rise in Interest Rates Spooks Investors, CNBC, October 8, 2018

- Fed Will Hike Interest Rates Before the End of 2019, Strategist Says, CNBC, March 15, 2019

- Avoid Buying Bonds Amid Negative Yield Environment, Asset Manager Says, CNBC, April 12, 2019

This is an important question for me and for our entire team. Oftentimes “the experts” advice is just wrong. It can threaten to interfere with our task of designing thoughtful, durable portfolios for our clients. Durable portfolios, by their very definition, need to be designed to endure for many years through many different environments. Their merit cannot be judged on performance in a single day. In most cases, it takes a long time to judge quality.

This means, to me, that the best portfolios should be diversified, so that not all of their holdings move together. I have said many times that a “happy face” portfolio that outperforms in a rising market, can quickly turn into a “frowny face” portfolio that under-performs in a falling environment. I believe what matters is the mix of risks in the portfolio. In the markets, you take the risk first, any profit you may earn comes later.

For quite a while now, a meaningful – and growing – part of our strategy to build a more durable portfolio has included investments in higher quality, longer duration bonds. Our view for years has been that such bonds represent great value, not only in their own right, but also for their diversification merits. For quite some time the market did not see the merit of this view, and these investments under-performed.

This led to many long conversations, and hundreds of pages of our published research explaining our views and why they were so different from those of so many experts on TV. I don’t see how we could ever have a problem with that. We aim to make the best decisions we can for our clients and to help them understand those decisions. We could create the best portfolio in the world, but if the client doesn’t understand it, it could still fail to bring success.

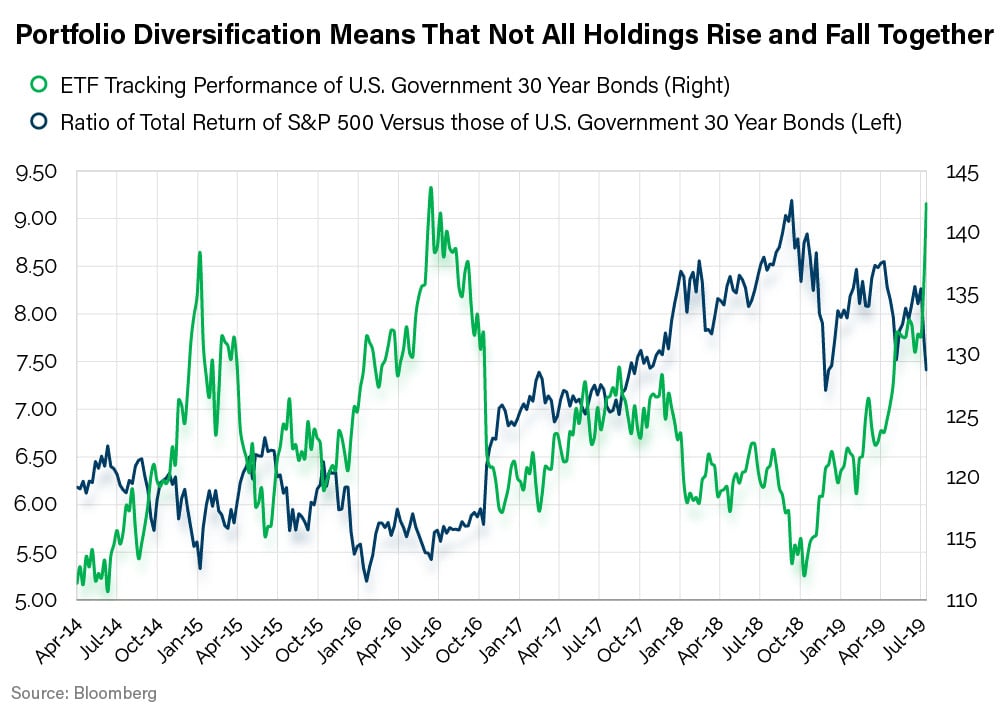

When we publish our thoughts, our goal is to educate our readers on why for instance these bonds play such a key role in our investment thinking. We have employed the chart below many times to illustrate this point, and it’s a powerful point indeed, especially in recent days.

It shows how the price of U.S. government thirty-year bonds tend to be best when equity returns are doing their worst, as the ratio below illustrates. It’s during volatile equity markets – like those today - when such bonds can best prove their merit.

But this chart also shows that there may be, and certainly have been, long stretches where bonds performed poorly. In almost every instance, this poor performance took place during a strongly rising equity market.

Yet the qualities which caused under-performance during strongly rising equity markets can provide better performance in weaker equity markets. Is this not the very definition of diversification? Should we really fear the “awesomeness” of a strongly rising market? Or is it more impactful to investors if we take strong markets as the opportunity to plan and prepare for darker times, and find what investments can help then?

Our task as risk managers was made more difficult by the constant harping of the financial media. It’s my experience that the media over-hypes the here and now while neglecting the unknown future. Yet it is this very future that holds the key to all asset prices.

Our brand of quality craftsmanship has the goal of creating portfolios that outperform when you need them to, especially in weaker markets. If we are to meet this goal, we must be willing to invest early when the news of the day, and “expert opinion,” suggests that this seems a stupid thing to do. It requires us to willingly suffer public ridicule at the hands of the popular financial media, who do not have the responsibility that we do to shepherd investments thoughtfully through a volatile cycle. On TV, they just need to sound interesting, they don’t have to be right.

In Conclusion

My goal in this research piece is simple. I want our readers to know what we have long understood: that each part of the portfolio matters. Some parts that seem trivial can be the link that hold the whole thing together. This is what doing a quality job means for us.

Our research team partners with our team of financial advisors every day with this one goal in mind. We believe that to build a healthy long-term business we must craft our portfolios with the right parts. This means not skimping, even on the small parts, even when “the experts” on TV disagree with us.

One of the most important aspects of my job is to make the thoughts of our research team available to you. We do so every two weeks in this publication. I want you to avoid the mistake I made with my boatlift. I didn’t know what was important. I didn’t know the right questions to ask. I didn’t realize how important small decisions were. Maybe I should have been explicit: I would gladly pay another twenty bucks for quality construction to avoid danger and potential disaster later. There was a lot I didn’t know and it cost me.

So, I understand the desire for investors to seek to make more informed decisions. We want that too! That’s the purpose of these pages! But be careful to whom you listen, because risk isn’t what they tell you it is on TV.

Is your portfolio neglecting risk? Speak with one of our Financial Advisors today. |