"You shall have the fiftieth year as a Jubilee; . . . it shall be holy to you."

-Leviticus 25:11-12

The Bible provided for a reset of debts every fifty years in what is called the “Jubilee”. In biblical times, fifty years was roughly three generations. Perhaps the Bible, more than five thousand years old, understood the same thing a few economists and theorists have noticed again recently. Every three generations or so the financial system needs a reset. Russian economist, Nikolai Kondratiev, is the best-known modern economist to have espoused the concept which he did in his 1925 work The Major Cycles. He claimed that economies go through a 40-60 year cycle due to debt accumulation, technologic innovation, and other factors. He called this the “long cycle” but a later economist coined the term the “Kondratiev Wave”, which is the widely used name for the theory today. We wrote about it back in 2015 in Interplay of Cycles: Inventory Restocking vs. Long-Term Debt Cycle. More recently authors Neil Howe and William Strauss introduced the “generational theory” in their 1994 book Generations and the newer and better known Fourth Turning. This theory posits a three-generation cycle of social and societal change. It concentrates more on the psychological and sociological reasons for the change rather than the economic ones, but the theory complements substantially the Kondratiev Wave argument. All three books mentioned are worth reading. However, perhaps all you really need to do is read the Bible and understand the current economic situation to realize the world needs a Jubilee every three generations or so and may be getting one now. Our job at CWA is to navigate the capital entrusted to us through markets whatever forces may be acting upon them. We think challenging markets offer unique opportunities, albeit, unfortunately, with greater risk.

Too Much Debt; Not Enough Real Collateral

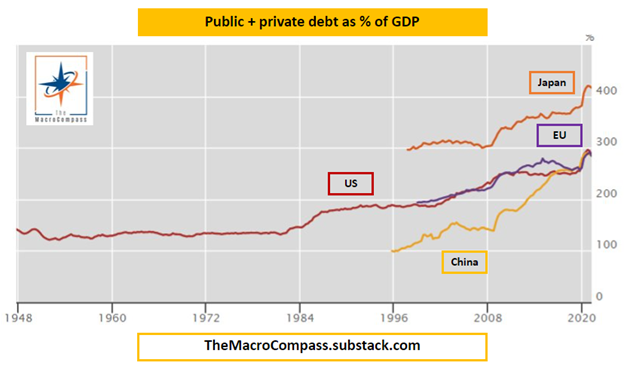

It's pretty obvious that over three generations the world has accumulated too much debt and other obligations. So much that it is mathematically impossible for all those obligations to be honored under any reasonable economic and productivity growth scenario.

The debtors are spread out pretty much everywhere but are concentrated in the developed world and certain emerging markets including Chinese private companies and property developers. Notably, the Chinese government, Russian government, and its corporate sector carry relatively little debt. The creditors are the governments that have been running chronic current account surpluses (with some notable exceptions, like Japan), central banks, other financial institutions, and the world’s wealthy individuals.

The biblical Jubilee provided for a peaceful way to settle the conflicts that would arise from three generations of debt accumulation that needed restructuring. The debts would simply be forgiven, and everything would start anew. It seems the Bible understood that the other ways of determining who was going to get what in the re-adjustment often ended in violence. Kondratiev Waves and Strauss & Howe turnings have almost always ended with major wars. It seems the biblical way of doing things is preferable but that has not been the path often chosen by man. This time, given that many of the potential belligerents are nuclear armed, the violent choice appears to be a particularly unwise way of resolving the issues. The war in Ukraine appears to be an ominous start to what we think is the Jubilee process.

The War in the Ukraine is About a lot more than the Ukraine

Given the precarious debt hole the world has dug itself into, it is no surprise the tensions arose between the developed world and producing countries with low debt, like Russia, and high current account surpluses like China. We fear the pushing back and escalation have only just begun. In fact, much of what appears to have just started was predicted in a 2015 book by Russian economist, Sergey Glazyev in The Last World War. He argued that a primarily economic but also military conflict was inevitable, and it would begin in the Ukraine. So, what are the problems we speak of? The debtors, in general, are not only debtors without the ability to pay, they are often also consumers. Not only do debts need to be paid, but also money is needed to continue consuming. The United States and Europe (not including Germany) are debtors and consumers. They have been able to maintain this situation because they are able to create liabilities (be they currency or government debts) that other countries will hold easily. Why? Because of the perception that those liabilities are safe stores of value because of the issuing countries’ prudent financial management, rule of law, military power and political stability. Additionally, the producing economies, have, in general, been supportive of the existing regime because they benefited from selling to the developed economies and growing their reserves of the foreign exchange accumulated.

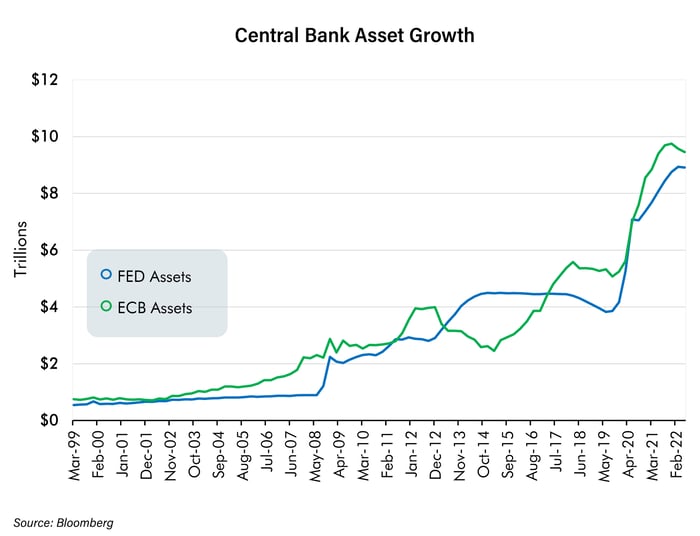

Unfortunately, in the past decade and a half, the prudent financial management leg of the developed world story has become exceedingly wobbly. Rather than embrace the pain of an adjustment in the value of unpayable debts, the developed world embarked on creating additional money to prevent widespread defaults and the continued flow of spending from government coffers. Below is a chart of the balance sheet growth for the Federal Reserve Board (FED) and the European Central Bank (ECB). As Mario Draghi, the head of the ECB stated in 2014, they did “whatever it takes”.

Of course, the producing economies have acquiesced in this system partly because they have been afraid of the short term upheaval that would result from disturbing the existing arrangement. For example, it has seemed for many years that the paramount interest of Chinese authorities was to keep unemployment low. Any abrupt adjustment could create dangerous dislocation and likely social unrest due to rising unemployment, even if in the long term it might be beneficial.

Unfortunately, with all the machinations to keep things going, the world is now at a point where it appears there is too much debt to pay back and the balance between who consumes and who produces is untenable. Of course, the developed world, led by the United States wants to maintain control so that it can issue dollars and make sure its creditors and consumers are provided for. However, the Eurasian world (Russia/China/India) has become powerful enough both economically and militarily to contest that status quo. The resistance has manifested itself in a hot, war over the Ukraine, but the war is really over much more than the Ukraine. One could argue, as Glazyev has, that the war is the first military confrontation in what will likely be a long cold, and sometimes hot, war between the producing economies of Eurasia and the consuming Atlantic world. What is at stake is nothing less than how the current set of seemingly unpayable Jubilee debts are going to be divvied up and the future relations between the creditors and debtors.

We Make No Predictions

The sanctions against Russia and threats against countries who were reluctant to go along with them may have been an error. As noted in our last Risk On | Risk Off report on April 4, 2022, the sanctions may harm the sanctioning countries more than the sanctioned one. A prime example is Germany. That country is one of the few left in the developed world that is a producer. In fact, its producing economy is the engine of economic activity for all of Europe. However, Germany is highly dependent on raw materials and energy from Russia. With the disadvantage of higher cost energy and raw materials, German industry is likely to suffer dramatically. This may be exacerbated because China, one of its principal manufacturing rivals, will be getting energy at a discount from Russia and thus will have a cost advantage. It is very possible that Germany could see deep economic problems that lead to political instability. Might this not be part of the Eurasian strategy of Russia and China? Sir Halford John Mackinder, an early Geopolitical scientist at the London School of Economics, and others have argued that those who control the Eurasian landmass control the world. Germany is at the heart of the western edge of Eurasia. Might Putin and Xi’s strategy be designed to peel Germany out of the Western sphere into their own? Given its geography, economic interests, and history of rivalry with the French/Anglo world; would that outcome be impossible? We argue that a lot of unforeseen political changes are possible as the Jubilee adjustment plays out.

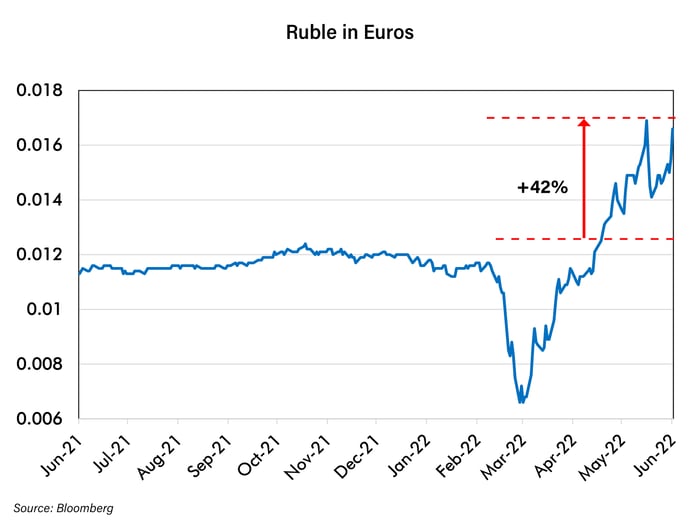

Certainly, the insistence by Russia that it be paid for its resources in Rubles was a watershed moment. The United States and its allies explicitly stated that the goal of the sanctions was to devastate the value of the Ruble and the Russian economy. That goal, at this point, appears to be failing. The Ruble is trading 42% higher against the Euro than it was prior to the invasion. In addition, Russian commodity receipts are up because prices have risen.

Even the Russian stock market, which first declined precipitously due to forced selling by westerners and the imposed sanctions came back. It is now underperforming European markets by just 6% year to date (as indicated in the graph below). The jury is certainly still out on the sanctions strategy, to say the least.

%20vs.%20Europe%20Stock%20Index%20(USD)-Jun-13-2022-08-28-31-51-PM.jpg?width=700&name=Russia%20Index%20(MOEX)%20vs.%20Europe%20Stock%20Index%20(USD)-Jun-13-2022-08-28-31-51-PM.jpg)

However, arguably worse, is that by essentially stealing Russian public assets and private assets of many of Russia’s wealthiest citizens, the West may have undermined another pillar of its ability to continue consuming beyond its means. That action showed that not only is the West purchasing goods and materials from producing nations with the currency it creates, but it will take those dollars and euros back (or make them unusable) if it chooses to. Is this a smart thing to do? Time will tell.

Not surprisingly, some Middle Eastern oil producing nations, including long time American ally Saudi Arabia appear to be hedging between the West and Eurasia if need be. For example, Saudi Arabia has been negotiating with China to sell oil for Yuan rather than dollars, which has been the prevailing method of payment up to now. It is notable that Saudi Arabia and every other Middle Eastern country except Israel abstained or voted with Russia on the final vote against it at the United Nations, which was a resolution to expel it from the Human Rights Commission.

What else may be contemplated in capitals around the world to protect assets should the United States and Europe deem a country’s actions unacceptable? Our guess is a lot of things are being discussed by a lot of countries. However, in the meantime, the dollar has enhanced its safe haven status during this opening round of the Jubilee re-adjustment when one looks at it against the United States’ main trading partner currencies such as the Yen, Euro, and Renminbi. However, in addition to the Ruble, the dollar has been weak against some commodity currencies such as the Brazilian Real, the Mexican Peso, and even the Canadian Dollar. The adjustment is in its early stages and there is a lot of uncertainty about its path. We have been talking about this adjustment for years with respect to our bullishness on gold. Wealth seeks out safe stores of value. It seems that governments around the world may determine central bank reserves, even relative to safety in dollars, are better kept in gold. Similarly, wealthy individuals may feel less safe about Western bank accounts and London or New York real estate. What will replace those things? We are not sure but gold and certain other commodities could be a reasonable alternative.

Crowding out of capital

As the above-mentioned store of value re-think is being undertaken, the West will need to transition its economy away from dependence on raw materials and finished goods from its Eurasian competitors. At the very least the West will have to invest in greater supply chain redundancy. As Barry Lynn, a journalist and writer who covers globalization and economics stated, “corporations have built the most efficient system of production the world has ever seen, perfectly calibrated to a world in which nothing bad ever happens.” Well, now bad things are happening, and that system is not working. Forget the energy transition, we need a supply chain transition first. That is going to require an immense amount of capital and the new system will be higher cost than we were accustomed to.

Where will this capital come from? Many countries are carrying way too much debt. How can this massive capital outlay be funded without further exacerbating the debt problem? The first thing that is likely to suffer is other less important uses of capital. Gone are likely to be the days of betting huge amounts of capital on Silicon Valley startups that promise to be cash flow negative for years. On balance, we expect the need for investment in real supply chains and raw materials may crowd out the speculative mania in many areas that have been prevalent recently. This leads us to expect certain natural resources, raw materials, engineering services, industrial and other “real” investments to outperform the kinds of technology, media, and communications that have been the winners over the past decade.

Conclusion

What lies ahead for the world in the unfolding Jubilee struggle we describe above is hard to forecast. The equilibrium that results may create an outcome that fundamentally alters the economic and geopolitical power in the world. Our research department has been vigorously studying cycles for years and had a view that the world would come to the point it is at now. The roadmap was fairly clear as debts accumulated, problems were kicked down the road and unrealistic policies were implemented in an accelerating manner over the three generations since the last great upheaval. Unfortunately, we do not have a crystal ball and are unable to know which way this incredibly complex situation will ultimately go. However, in many ways, we are more comfortable shepherding capital through this environment than through the speculative mania that preceded it. We expect this period to reward investment in definable, real assets based on traditional valuation metrics and current cash flow. We have been and are continuing the process of searching for and adding to companies that fit those characteristics. At the same time, we have limited our exposure to many of the last cycle winners who we think are unlikely to regain their former market dominance. We expect that with rigorous study and hard work we can thrive during this situation despite it being unprecedented in our lifetime.