They would say, when Whitey Ford made that incredible motion to nip the base runner off first, that the man was caught leaning. The man was leaning one way, and realized what was happening, and yearned to go the other way, but he had to overcome the inertia of himself before he could move back. I was off balance. I yearned for the safety I had left.

- John D. MacDonald’s “Bright Orange for the Shroud

Readers are aware of our vigilance in studying the credit markets, because credit quality lies at the foundation of almost all other markets. Today we explore two important questions:

- have credit markets been ‘caught leaning’ and

- if so what is the appropriate strategy for our investments?

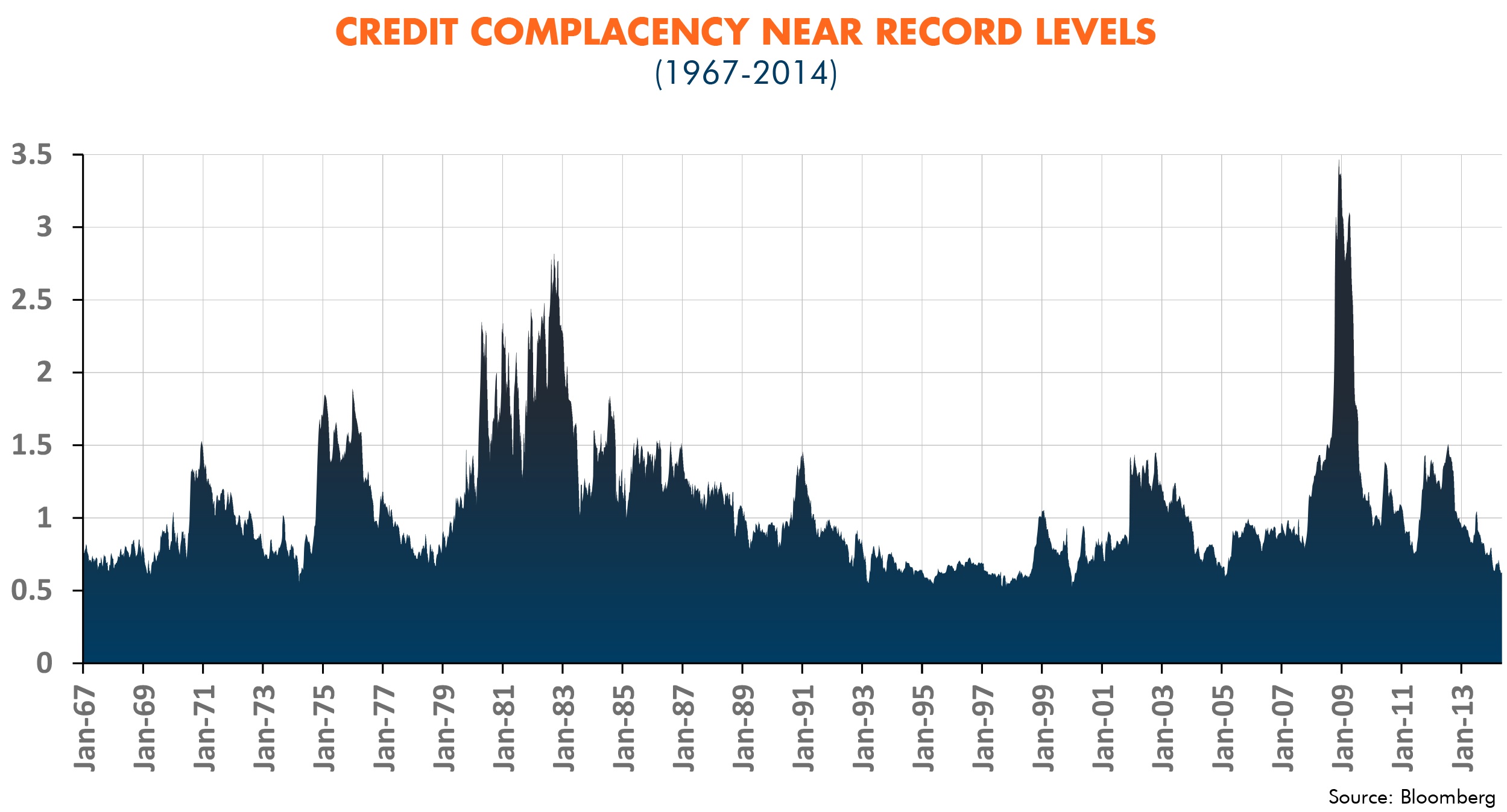

Yield spreads, such as the chart above, are the most helpful measure of credit health. The chart above shows the yield spread between two classes of debt both of thirty year duration. Specifically, this spread is the difference in the average yield of Moody’s BAA rated debts minus Moody’s AAA rated debts. The higher the yield spread, the more skeptical the market is of lower quality borrowers and thus reflects the higher interest rate that these weaker borrowers must pay relative to the strongest borrowers. Higher spreads accompany harder times, such as the huge surge during the 2008 global financial crisis. Lower spreads accompany booms. We find ourselves now enjoying just such a time.

There have been 2,484 weeks since 1967. During that entire time, credit spreads have been this tight (spreads less than .6% or 60 basis points) only 76 weeks. So credit markets are enjoying a rare sense of calm that has cumulatively taken place only 3% of the time over the last 47 years. Most - but not all - of these calm periods in credit take place during peaks in the inventory cycle. We have argued in prior publications that the inventory cycle may be approaching a peak (Making Volatility our Friend: Trading the Kitchin Cycle, May 28, 2014). How much longer will this tight level of credit spreads last?

Last week we noted that the case is building that credit quality may weaken from this extremely robust level (Is Credit Quality Peaking?, August 6, 2014). Rising credit default swaps (CDS) will be a key milestone along the catalyst pathway that will give us higher conviction that a trend change is indeed underway in credit. CDS prices rise as credit quality weakens because owners of illiquid bonds buy CDS as insurance to hedge against deteriorating fundamentals.

Investment Positioning: Better to be Long the Solution than Short the Problem

Our experience successfully trading the global financial crisis, the biggest credit crisis of modern times, taught us many important lessons. The importance of trade structure is the single most important lesson we learned. This means that there is more money to be made betting on the solution than betting against those who suffer the most from the problem. If an investor identifies an overleveraged company and sells it short as a hedge to his other investments, the potential return is limited to 100%. And along the way to such a ‘successful’ outcome there will be periods of high volatility that are extremely difficult to navigate. So shorting is a useful hedge in times of rising credit stress but is definitely not a panacea.

We have spent years crafting strategies to better shepherd capital through such challenging times. Our study has revealed very underappreciated yet simple techniques that help us get long the solution to such problems, such as 1) owning very long duration, very high quality credit instruments and 2) crafting trade structures that help us to profit from the rising relative value of gold that accompanies credit weakness (Gold: Price vs. Relative Value, July 23, 2014). We have made many times the secular argument that longer term yields of the highest quality credits are headed lower (Quantitative Easing: Perception vs. Reality, July 30, 2014, Is Credit Quality Peaking?, August 6, 2014), which is a trend that weakening credit quality and its accompanying slower growth will hasten. Owning these long-dated bonds pays us a current yield (positive carry) and offers the potential for capital appreciation as growth slows and credit fears rise from very low levels. Higher gold values are also part of the ‘solution’ to worsening credit quality and slowing growth because the U.S. Federal Reserve has proven its readiness to devalue the dollar versus gold to kick-start growth and prop up failing credits.

In next week’s publication we study the counsel of economist George Warren, whose policy recommendation in the 1930s to devalue the dollar versus gold did more to relieve the credit stress behind the Great Depression than any other measure. We will then outline the secular case for gold and in particular for the gold royalty sector, which we believe offers the best way to get long the solution when growth slows, the credit cycle turns and investors are caught leaning in credit.•