The last few weeks have been very eventful in the markets. Many are asking what this newfound volatility means. In the following paragraphs we outline the thoughts of one insightful observer, Ray Dalio, the Chairman of Bridgewater, the world’s biggest hedge fund. His recent views are similar to those that I have held for a long time, namely, that the high burden of debt globally could delay a sustained U.S. Federal Reserve tightening cycle and create substantial volatility in financial markets.

Ray Dalio on the “End of the Debt Supercycle”

Ray Dalio on the “End of the Debt Supercycle”

The link below outlines Ray Dalio’s most recent views where his analysis and study of history leads to a controversial view. I strongly suggest that you read his views in their entirety. Below I summarize my key takeaways and outline what I am watching in the markets.

https://www.linkedin.com/pulse/dangerous-long-bias-end-supercycle-ray-dalio

Looming Fed interest rate hikes have been hanging over the market for a long time and have dominated the worries of many in the financial markets. However, Mr. Dalio’s comments note the precedent of 1937 when the Fed was forced to abort a nascent tightening cycle due to lingering global overindebtedness. Mr. Dalio’s comments highlight the possibility that China could be one potential epicenter of debt-funded growth that, if it goes awry, could spark a broader deleveraging cycle, which can oftentimes results in a sustained global slowdown.

Mr. Dalio makes the distinction in his article that the Fed may still try to raise interest rates despite these lingering global economic fears because he believes that the Fed does not understand the global economy. Dalio’s concern is that the Fed is underestimating the likelihood that the long debt-driven “supercycle” may be ending, and if so, may actually force the authorities into a renewed and sustained cycle of more quantitative easing and unconventional Fed policy measures. This is surely a controversial view but is one with which I have long agreed. He doesn’t doubt that the Fed may persist in raising interest rates; he just doubts the durability, length, and degree of upcoming Fed interest rate hikes. My fear is that, if Dalio is correct, that an overzealous Fed may create deeper problems for the equity market.

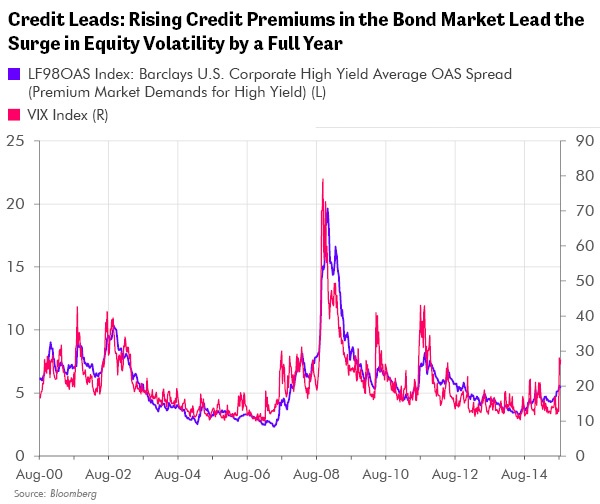

Credit Problems Led the Recent Problems in Equities by a Full Year

Because I have long shared Mr. Dalio’s concerns about global overindebtedness, I have been a constant student of the credit markets. My concerns picked up dramatically more than a year ago as I outlined the case for a peak in U.S. credit quality – and the warning sign that this represented for equities. On August 6th of last year (Is Credit Quality Peaking?) and again on the 13th of last year (Credit: Caught Leaning?) I highlighted the growing probability that the peak was in for credit. My study of history has long suggested that sustained equity market weakness almost always follows sustained credit weakness. The credit market has always proven to be a very reliable indicator of future equity market weakness – most often, however, with a long and variable lag.

A full year has now gone by since credit quality peaked in the U.S. with the peak of the inventory cycle (Making Volatility Our Friend: Trading the Kitchin Cycle May 28, 2014). Are we now reaping the delayed bitter harvest in equities? It’s too early to tell for sure but certainly cautious investors must certainly entertain this possibility now that a full year has passed since credit quality peaked.

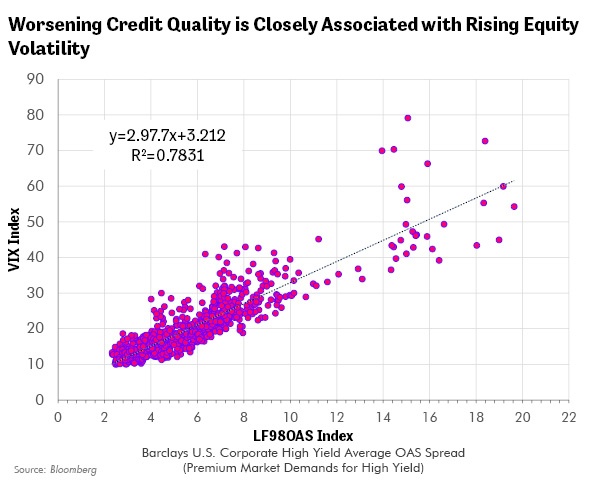

The chart below illustrates that the Barclays U.S. corporate high yield average OAS spread started to rise from mid-2014, which illustrated that the credit markets were demanding higher interest rates to fund high yield companies. This is one of the first and most important signs of rising credit stress. The chart below also shows how remarkably high the correlation is between worsening credit problems and rising equity volatility as displayed by the VIX Index. A few weeks ago the equity markets woke up to the credit problems that we identified last year. Volatility exploded as a result.

Below I show this data in another way, a scatterplot, which takes the data above and displays it as a single data point per day on an X, Y axis. Each data point represents the prevailing values of the VIX and the Barclays High Yield Credit Spread at each date in the series. This treatment is a helpful way to get a sense for the correlation of these variables. The R-Squared value of .78 demonstrates a remarkably high correlation. Basically this suggests that if you know the value of the Barclays High Yield Credit Spread you can explain 78% of the variation in the VIX. Rising credit stress means rising volatility.

Credit Stress: Where Did it Come From and Where is it Going?

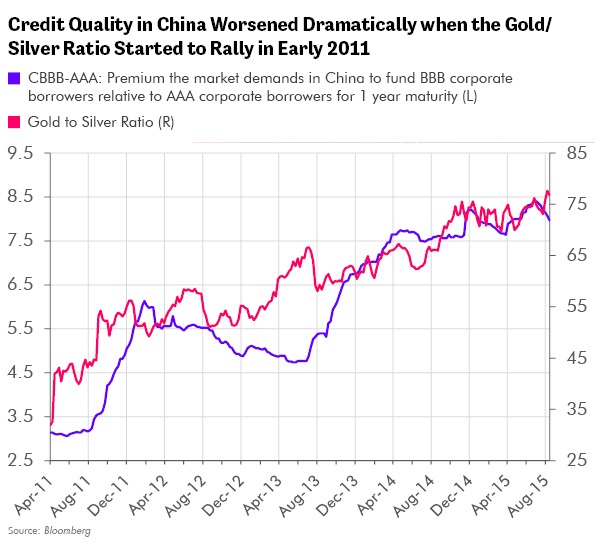

I am a big believer in indicators. Indicators help to distill complex dynamics and their inflections in trends into lines that are easy to follow. One of the best all-around indicators I have used successfully is the ratio of the gold price to the silver price (the gold/silver ratio). I have found over time that when gold is rising relative to silver, a more industrial metal than gold, that global liquidity and growth is often falling. One knock-on effect of falling global liquidity is rising global credit stress. The reason I believe as causality is that falling liquidity constricts the free flow of credit and hence can weaken credit quality and drive credit spreads higher.

The gold/silver ratio, as I display below, is at a very deflationary level. In fact, this ratio now resides where it did in September of 2008 after the failure of Lehman Brothers! To me this suggests that Fed interest rate policy is deflationary – at least it is so for the rest of the world – and possibly increasingly so for the U.S.

Certainly the evidence of such a high and rising gold/silver ratio seems to reinforce the concerns of Mr. Dalio – that the Fed may make the mistake of running an overly tight interest rate policy. The rally in this ratio in July of 2008 suggested trouble ahead for many markets. Also, the gold/silver ratio was literally the first of all the indicators that I watched to declare the “all-clear” for the markets in late 2008. For this reason the gold/silver ratio is never far from my thoughts.

A reasonable question to ask is what else has been correlated to the gold/silver ratio? One answer is credit quality in China. I have been watching rising credit stress unfold in China for years now. This trend began, as the chart below demonstrates, with the inflection in the gold/silver ratio in 2011.

In March of 2012 I spent a full week in China researching the credit stress unfolding there by studying China’s shadow banking system. The results of my research there were disturbing. The credit problems I identified were both deep and pervasive, perhaps even more troubling than I understood at the time.

The chart above of rising credit stress suggests that if anything, the problems I identified in China more than three full years ago may have actually gotten worse. Perhaps these credit problems in China lie at the root of the recent stock market crash in China?

Certainly history would suggest that sustained credit problems lead to sustained equity problems. A reasonable question to ask is does recent U.S. and global equity weakness finally (!) suggest that these long-brewing problems in China are now the world’s problems as well?

In Conclusion

How will authorities react to changing developments and increasing market volatility? The remarkable rally in many markets since the dark days of 2008 is testament to the ability of the central banking and government authorities to wield a power that few would have believed possible even a few short years ago. Global coordinated campaigns of unconventional monetary policy by central banks and unprecedented government stimulus seemingly brought back the world from a very dark place in 2008. Can our monetary and government leaders maintain their newly found hegemony over the forces of market distress? Or perhaps is there simply a time for everything in the unchanging cycle of greed and fear that so often seems to drive markets? Global growth has always been a cycle of several steps forward followed by one step back.

One of my most important jobs is to act as the watchman upon the bulwarks - ceaselessly looking out for the next big sign of global trouble in the financial markets. This leads me to be very early in many of my observations. For more than four years now I have watched with unease the rising ratio of gold to silver as a slow simmering harbinger of rising global deflation. This ratio forecasted the damage that would befall emerging markets and commodities, for instance, yet left the U.S. and other developed markets largely alone – at least until now. For more than three years now I have watched credit problems mount in China – perhaps the earliest indicator of rising deflation risk and credit stress in the world. For a full year now I have watched credit quality worsen in the U.S.

Now, for the first time in the longest time, the U.S. and other developed markets stopped bucking the dismal downtrends suffered in the rest of the world. Is this part of a new and darker trend? Or only a passing scare? Only time will tell for sure.

I have always believed that the key to outperformance is rigorous fundamental analysis of individual securities plus intelligent asset allocation. These tools can work together to structure portfolios that can adapt and even thrive in any challenging environment. These tools may yet again prove their worth if the world is embarking upon another sustained cycle of rising volatility. Thankfully, we have trusted indicators such as the gold/silver ratio and our understanding of credit to help guide us through uncertain markets.•

Source: Ray Dalio, Time.com