Chief Takeaway

Panic early: beat the rush! We are winning the investment battle because we have studied for years how to profit in volatile markets. Here’s how we are positioned and what we expect to happen.

What an amazing time to be alive and investing! Events now underway will find their way into the history books. What will the verdict of history be for those with the responsibility to shepherd capital safely through the markets? Will we answer proudly for our service, as General Patton encouraged his men in the Third Army to do? Or will we suffer in shame the verdict of the writing on the wall – having been weighed and found wanting? Make no mistake: this is the choice before us today. Long time readers of this research publication can no doubt guess at the legacy for which we are striving.

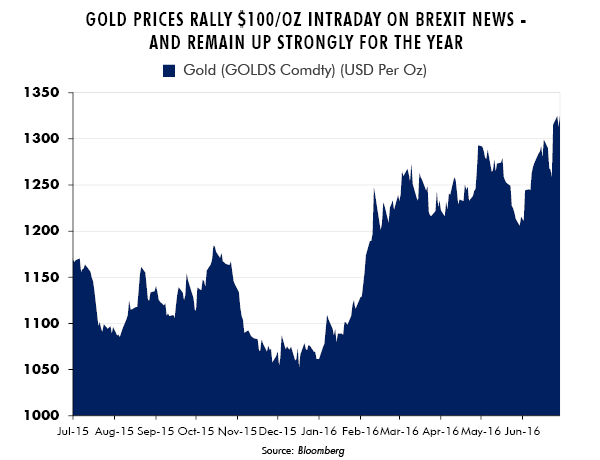

We believe that our portfolios are positioned appropriately. For more than two years now we have been adding gold related investments, higher-quality longer duration bonds, reducing our exposures to the leveraged financial sector and shifting into increasingly defensive holdings. Clients need only examine their portfolios to see many instances of such investments, and the cumulative benefit of these decisions. We made these investments early and at the risk of underperforming the markets should our concerns have been unfounded. Recent price action suggests that our decisions were sound.

Panic Early – Beat the Rush!

Our long time readers are by now very familiar with our motto: panic early – beat the rush! Panicking when others are panicking does no good. In fact, it is harmful to the success of our investments. The trick is to do so early, when the skies are clear and blue, because it’s the investment decisions made then that prove to be so profitable later when scared investors confront howling skies that are menacing and black. Our experience is that today’s successful investments are really driven by yesterday’s controversial decisions.

We have little doubt that prior editions of this research publication have taxed our readers’ patience with literally dozens of pieces over the last two years written about the merits of defensive investments in gold and higher quality, long duration bonds. ("Gold: Price Vs. Relative Value", July 24, 2014; "Our Bond Strategy: The Power of Duration", October 8, 2014; "Franco Nevada: The Art of Stock Selection in the Gold Sector", March 9, 2016; "The End of the Blanche Dubois Market?, May 18, 2016) Patient readers have also been subjected to dozens of missives on the dangers of our overindebted world and the risks that reside in the European banking system. Events of the last week have demonstrated the gravity of our concerns and the merit of these investments.

Brexit Reveals Credit Weakness in European Banks

“Brexit,” or the recent referendum during which the United Kingdom voted to leave the European Union, triggered the wave of volatility now erupting in the markets. Seldom have we seen the market so misprice an event.

In advance of this referendum, we wrote two weeks ago on this topic, (“Brexit: All eyes on European Banks”, June 15, 2016). We noted that the real risk in Brexit was Europe’s tottering system of huge and overly-leveraged banks. Below we quote from this note at length:

The Euro as a currency is not just flawed; it’s also the financial equivalent of a thermonuclear debt bomb...Europe’s banks are bigger, more leveraged, and more indebted than U.S. banks. This means a smaller cushion to guard against unexpected losses. Furthermore, the EU’s fragile financial system of massively overleveraged banks is choking on cross-border liabilities from other banks in a way that almost no one can truly quantify and even fewer understand.

In that note we cited seven research pieces we had authored since May of 2014 highlighting the inherent weaknesses in European banks. We would encourage investors who would like more background on our thinking to examine that research.

The market awoke to these risks on Friday. The carnage was both amazing and instantaneous: the share prices of many of the biggest banks in Europe declined as much as 30%. Even more eye-opening were the crashes that took place in the European markets as entire national indices fell nearly 20% in dollar terms. This is the equivalent of a 3,000 point crash in the Dow Jones Industrial Average. Many investors who didn’t understand these risks have sought to shrug off these events as a political over-reaction. This is a mistake. Do not be deceived.

We noted almost a month ago (“Is Spain the Next Greece?” June 1st, 2016) the dangers of the complex web of interlocking debts in Europe and noted the power of political unrest to kick start a self-reinforcing cycle of price declines and deleveraging.

In fact, our deepest concern is that the Greek tragedy may repeat itself in time across Europe – Spain, Italy, even France….Frankly, in our entire investing career, we have never seen a situation more pregnant with reflexivity: highly leveraged European banks, with local sovereign debt as a reserve; and, sovereign governments who – due to the rules of the Euro – are unable to print money to backstop their financial systems. This is an accident waiting to happen.

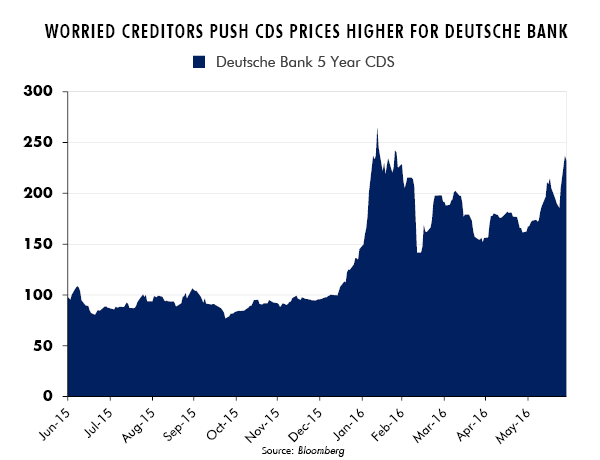

Europe’s financial regulators have made a terrible mistake. They have exposed equity shareholders in European banks to a rising risk of dilution. Rising prices in the credit default swap (CDS) market, in which the market prices the probability and extent of potential debt defaults, shows increasing concern about the health of these bank debts such as the chart of Deutsche Bank's CDS below.

Equity capital, which stands as the greatest buffer against credit distress, is eroding quickly as share prices spiral down. The further these prices fall, the more shares banks must sell to raise the same amount of equity capital - should they seek to recapitalize themselves. This dynamic creates the incentive for current shareholders to panic early and beat the rush. The more investors that reach this conclusion and decide to sell their shares, the faster share prices decline. The more these prices decline, the greater the prospective dilution that would be suffered by remaining shareholders who now eye with envy those who sold earlier.

Investors who had first-hand experience trading the Global Financial Crisis in 2008 will recognize this reflexive dynamic as the toxic death spiral that crushed the prices of financial institutions such as AIG, Fannie Mae and Freddie Mac. The prices for these financial companies declined so fast that their management teams missed their window to recapitalize them with private funds. The government was left as the sole remaining actor capable of recapitalizing them, dealing crushing blows to their long suffering shareholders. One alternative was to let them fail and throw our overly leveraged financial system into chaos through a multi-trillion dollar default. The Fed tried to do that with Lehman with disastrous results.

How Far Might These Forces Run?

This is chief of all the questions that we would dearly wish to answer! Clairvoyance is the province of charlatans and scam artists. All we have to offer is our best guess based upon our own experience and the exhaustive study of history.

Our answer is that, now that it has been revealed, we should expect rising credit distress to run until one of two things happens. We could ultimately and finally resolve the global overhang of debt that took decades to build that now looms over the world. Don’t hold your breath for this. Rather, the more likely outcome is that the threat of debt contagion that is now rearing its head in Europe will continue to loom over the markets.

A wave of jolting revelation, such as Brexit, that shakes consensus beliefs that credit weakness is “contained” will be followed by a quieter and drawn out interlude of hope. Expect to hear many times the rallying cry that “the authorities have fixed it!” Likely this will take longer than most anticipate.

Eventually we can anticipate that government resources will be marshalled aggressively enough to put an extended pause to credit driven problems. Until their next outbreak, that is. Frankly all of these roads we believe lead to markedly higher gold prices. We expect that the sooner gold prices rise, the more manageable the adjustments will be that are now underway in the credit markets.

Let us be crystal clear: we expect gold to be the greatest ultimate beneficiary of trends now underway. We have spent years researching how to profit during such increasingly volatile times. Client portfolios are already benefiting from these investments.

At least for a while, the higher gold prices go, the more manageable our debt related problems are likely to be. Eventually, we anticipate uncomfortably high gold prices will create new problems of their own, such as higher commodity prices and political instability in many countries now deemed to be “safe.” That will be a problem for another day.

Along the way, what constitutes a “safe” investment will change. Many of those deemed to be safe now may not remain safe later. This is the nature of change. Ultimately much will depend on the progress of events. Our pledge to our clients is that we are committed to an open and honest reading of the fundamentals and an equal willingness to act when we need to act – before the crush of events. •