Chief Conclusion

Do not underestimate the determination of the incoming Trump Administration to overturn the established norms of international trade. Don’t be surprised if, at the first opportunity, the incoming Trump Administration delivers strongly on its promise to “put America First,” by exercising the President’s vast, clear, and established authority to change international trade rules. Investors who hope to avoid loss, or even profit from this change, should be paying attention now to this new reality. When it comes to international trade, the times they are a changing.

I suppose one sign of advancing age is that your path crosses those of the world’s movers and shakers. For me, this is the case in the form of two important policy makers on international trade in the incoming Trump Administration. I have had interesting encounters with Wilbur Ross, President Trump’s choice for U.S. Commerce Secretary, and Dan DiMicco, who is running the transition team for the office of the United States Trade Representative. These gentlemen are set to play an important part in our economic future. I thought I would share with you my experiences with these gentlemen in order to help our clients and friends better understand future developments in international trade, where the times they are a changing.

Lessons from Steel

Long-time readers may remember that early on in my career, I lead the research effort that identified a compelling opportunity in the steel sector. Eventually, T. Rowe Price, my employer at the time, would invest nearly $500m into select steel equities in 2003 when almost 40% of U.S. steel-making capacity was in bankruptcy. The rationale behind that investment will be familiar by now to long-term clients: deeply negative sentiment and undervaluation caused by long-term underperformance, resulting in assets trading at a fraction of replacement cost while unanticipated change overtook the industry.

What I Learned from My Conversation with Wilbur Ross

One of the investment ideas at the time was an opportunity in the shares of a company that had recently gone public, International Steel Group (ISG), a new company made up of formerly struggling steel companies put together by financier Wilbur Ross. I recall distinctly that at one point these assets, which would have cost $450/per ton of steel capacity to build new, traded at 1/3 of that – $150/ton. Despite many near term disappointments, I could not shake my confidence that such undervaluation was unsustainable and that patient investors would be rewarded. My investment counsel reflected this view.

Consequently I found myself the advocate of T. Rowe’s purchase of 5% of the outstanding shares of ISG. Mr. Ross would eventually sell ISG to Mittal Steel, the world’s largest steel company. T. Rowe Price profited handsomely from co-investing with Wilbur Ross on this deal. Years later, I saw Mr. Ross at a steel conference in New York City. I went over, introduced myself as one of his largest public market investors and thanked him. After all, he was the one that made it all happen. I just had the good sense to recognize the merit of what he was doing. I knew the path I had taken to reach my own conclusion that steel was worthy of investment, but was deeply curious about his own thought process. The following is what he told me.

His investment thesis for steel was that China would be a major beneficiary of trade liberalization resulting from China’s entry into the World Trade Organization (WTO) in December of 2001. His idea was that one of the most leveraged ways to benefit from this development was a large ownership position in the beaten down U.S. steel industry. I was stunned at the simplicity and the genius of this thesis. Never have I heard anything to rival its simplicity, elegance and power. Believe me when I say that there is a reason this man is a billionaire! This is not, however, where the story ends for Mr. Ross.

His incredible success in steel was followed by more challenging times in auto parts and textiles – industries that are heavily import impacted – subject to great pressure from growing international competition made possible by a trend toward more open trade. Two sides of the same coin: international trade was the key difference. My own interpretation of these events – based solely on my informed conjecture - is that he learned through hard experience the primacy of the trade regime to create and destroy value in his investments. He made a fortune owning those companies that benefited from the liberalizing rules of international trade. However, a more challenging future was the fate of those who suffered from international trade changes. I am convinced that Mr. Ross understands from this first-hand experience the importance of international trade.

Dan DiMicco and the Nucor Years

From July 2003 and for the next several years I had the distinct pleasure of helping T. Rowe Price become Nucor’s largest shareholder, while Mr. DiMicco was the CEO at Nucor. In a pattern our investors today would surely recognize, I was willing to advocate ownership of a leader in a beleaguered sector as long as I could be confident in the company’s balance sheet and low cost position. I had that confidence in NUE. During that time I became firmly convinced that Dan DiMicco was the best executive I had ever met and had the honor of backing as an investor. These pages have sung Mr. DiMicco’s praises before (Blockbuster Results, March 18, 2015).

To summarize Mr. DiMicco’s accomplishments, he increased Nucor’s capacity/share by 40% at the trough of a deep downcycle by buying competitors at 17 cents on the dollar (at a fraction of their replacement cost) and then remained disciplined in the upcycle returning excess capital to shareholders in special dividends and share buybacks. Mr. DiMicco topped off this amazingly disciplined record with a prescience I have never seen repeated anywhere: he raised $1b in equity at the peak of the cycle in mid 2008 right before the collapse of the global financial crisis. Other competitors would be forced to dance with the threat of bankruptcy in the downcycle, but not Nucor, thanks to Mr. DiMicco’s foresight.

Trust me when I say: no one allocates capital with such skill. You could live a thousand lifetimes and never see such a great job in a tough industry ever again. This short report does not allow the requisite space to outline all the reasons Mr. DiMicco’s tenure at Nucor is one of the most storied and distinguished in the annals of any CEO in the long sweep of American industrial history. So let me be very clear when I say that Dan DiMicco is one of the finest industrial executives that this country has ever produced.

Fast forward to now, and Mr. DiMicco is once again in a position of prominence – this time with the Trump Administration. Mr. DiMicco is in charge of running the transition team for the office of the United States Trade Representative (USTR). USTR is a powerful body whose major responsibility is negotiating U.S. international trade deals and monitoring their performance.

Mr. DiMicco is wondrously blunt and straight-shooting. Simply observe Mr. DiMicco’s blog (http://www.dandimicco.com/blog) or his Twitter feed to get a sense for what Mr. DiMicco’s views are or what he wants to achieve. The inescapable conclusion is that Mr. DiMicco believes that the historic norms of U.S. international trade policy have worked against U.S. companies and their workers. He wants to see change, huge change, and see it now. With his position on the USTR transition team, he is on the threshold of having the ability to execute on his long held views. I tell you now that Trump couldn’t stop Mr. DiMicco if he wanted to. If Mr. DiMicco assumes the role of running USTR I can promise you that he will push for change, real change, with every fiber of his being. And I think he will achieve it.

What does this mean for today’s investors?

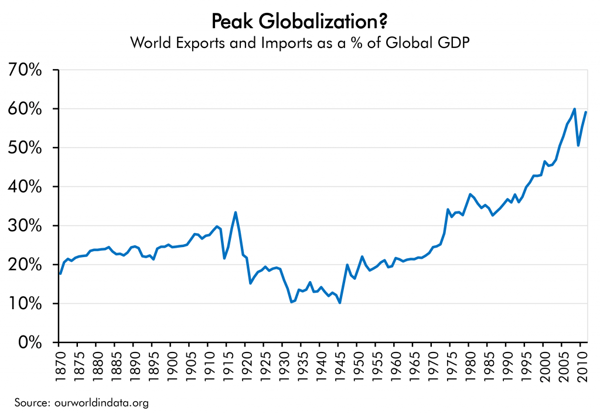

The stock market has rallied since the election with a euphoria seldom seen in our markets. Mr. Trump has not yet assumed office but the market has been willing to give him and his policies the benefit of the doubt in “making America great again.” One aspect of his incoming administration that has not received similar attention is his decidedly negative views on the current “free trade” regime. Ever since the end of World War II, international trade rules have moved consistently in one direction: to be more free and open, as the chart below illustrates.

Mr. Trump’s public statements suggest that he prefers a change in that trend. My own conclusion is that Mr. Ross and Mr. Dimicco agree that a change is needed. These are all serious people who are used to achieving their goals. I think it would be foolish to bet against them.

Who would benefit from a change to a more protectionist international trade policy? Team Trump is convinced that the U.S. and its manufacturing workers will benefit the most. Who has the most to lose from such a change? I would submit that among those with the most to lose are China and other emerging markets who have been able to export their way to prosperity through the free and open trading system that has prevailed to date. Their lower cost labor, and lack of environmental standards etc. and export subsidies, have given them an advantage in competing in developed markets. Job losses in the U.S. heartland have been at least one partial consequence of this decades-long policy toward trade liberalization, a policy that Mr. Trump and his Administration seems determined to reverse.

My experience is that the biggest changes are often, paradoxically, the hardest to see. I believe we may be looking at such a change underway in the markets right now. Of course, Mr. Trump’s Administration has not yet assumed office. Many are downplaying today’s protectionist rhetoric as hollow empty words. I can assure you that Mr. DiMicco’s words on the matter are not hollow, nor are those from Mr. Ross. Rather we are watching a sea change of incredible magnitude.

In Conclusion

The true extent of these changes from a new Administration will be clear only in retrospect. But it is the unknown future that the market is constantly seeking to anticipate and discount. So it’s not unreasonable for us to follow the lead of Einstein and try to ask better questions.

What U.S. industries might benefit from this change? Certainly those with the highest amount of import competition would number among them. Other beneficiaries should be industries that are unable to meet the scope of domestic demand from their own output here in the States.

How would China react to the prospect of a less free and open trading system? Would they retaliate directly on the trade front and threaten U.S. exports, or perhaps militarily in their own sphere of influence? Many times it seems to me that today’s China is not that different from the U.S. at the end of the Roaring 1920s: an export driven powerhouse completing an epic capital spending boom whose goal was to compete and win in the world’s free and open international trading system. The problem for the U.S. in the 1930s, and perhaps the problem for China in the years to come, is that if the world changes and becomes a more protectionist place, then many of those investments in expanded capacity are at risk of becoming severely impaired.

One of the unintended consequences of the collapse in international trade in the 1930s was a wave of insolvencies not just at the corporate level, but at the country level too. There was also a viral trend away from centrist governments toward those with more extreme views. Will such a pattern repeat in our time? Maybe such a trend is already underway? Doubtless this contributed to the rise of military conflict in the 1930s in a way that perhaps few anticipated earlier in that decade.

What would be the likely currency impact of changing international trade rules? My own sneaking suspicion would be that a strengthening U.S. dollar could be the unexpected paradox arising from a successful protectionist strategy to shrink the U.S. trade deficit. Let me explain. The U.S. dollar is the world’s reserve currency. Trillions of dollars in debt are owed by foreign countries and foreign companies who would find it extremely difficult to service these U.S. dollar debts if their previously open access to our markets were taken from them. If not through trade, where else would they earn these dollars with which to repay their dollar debts? What would be the unanticipated consequences from their dwindling access to our markets? Germany in the 1930s, under Chancellor Bruening, found itself unable to repay U.S. dollar debts when denied access to our markets after the rise of the Smoot Hawley tariffs. Hoover’s forgiveness of German debts would come too late to halt the rise of Hitler.

The one thing I know for certain is that the world is always changing. Navigating such volatile markets is an incredible challenge and presents those who can do so successfully with a reward truly worth earning. Such an award awaits those who can ask the right questions to understand how these complex issues will interact in an uncertain future. We believe that investors who invest the time to study changing international trade rules will find themselves more prepared for this uncertain future. •