Freedom of speech has been in the news a lot lately. Elon Musk has become the lightning rod for the subject because of his takeover of Twitter, the proverbial modern day “town square” that had been moderating (or censoring, depending on your politics) speech over the past several years. Mr. Musk has taken the position that Twitter had been inhibiting speech that should be allowed because transparency and freedom of expression are important for society. After all, advocates of those things insist that it’s impossible to find the truth and be able to make good choices without freedom for differing opinions to be debated openly. This concept has been referred to as the “marketplace of ideas” where views compete for acceptance as the truth through open debate. This is, of course, similar to the concept of a market for security prices where buyers and sellers bid on securities and come to an agreed upon value. The more bidders there are with different opinions on the price the more likely a fair price will be reached.

Interestingly, Mr. Musk seemed to show less enthusiasm for transparency and freedom when it came to competing views in the marketplace for the share price of his flagship electric vehicle company. He regularly criticized short sellers and pushed for curtailing their freedom to express their opinion of his company’s stock price and valuation. Similarly, he refused invitations to engage in open debate about his company’s accounting practices and financial statements with well-known value investor David Einhorn and others.

It tends to be a good policy in twenty first century America to avoid discussions about politics and religion so we will refrain from giving our opinion on the current debate about political speech in this publication. However, when it comes to the question of whether there should be freedom of speech on the value of companies, we are happy and eager to share our view. We are unequivocal; we strongly support the suppression of information! A surprising point of view? We have our reasons.

Poorly Informed and Biased Investors Help Good Active Investors Thrive

To understand our view on the subject requires a short review of the Efficient Market Hypothesis (EMH). This theory was developed in the 1960’s and early 1970’s by MIT’s Paul Samuelson, University of Chicago’s Eugene Fama and others. It suggests that one cannot outperform the stock market through active management because all investors are rational actors who have access to the same publicly available information. Therefore, the market price for each security will coalesce around a price that accurately reflects all that information and rational thinking. No investor with publicly available information has an advantage that will enable them to consistently outperform other investors. This theory spawned an entire new subsector of investing – passive fund management – and continues to significantly influence the financial services landscape today.

Interestingly, during the same time period that EMH was being developed and taking hold in economics, psychology researchers were making great strides in understanding human decision making in what is sometimes referred to as the cognitive revolution. Psychologists began to explore and understand how behavioral biases impact decision making. The general conclusion was that people are far from rational. Rather they make decisions based on a variety of emotionally driven behavioral biases. In the 1980’s, led by three economists Amos Tversky, Daniel Kahneman and Richard Thaler, who met while teaching at Stanford, the economics profession began to investigate how cognitive behavior impacts decision making in financial markets. The field is known today as “behavioral economics.” It hypothesizes that security prices may, after all, not be efficient because investors can collectively be swayed by all sorts of biases that make them come up with wrong conclusions. Someone who understands these biases and takes them into account can therefore have an advantage and outperform the market.

We are convinced that EMH is wrong and behavioral economics is correct. We believe that through our study, research and understanding of other investors’ biases we have an advantage. In our opinion, our many years of technical training in school, outside study of general and economic history as well as professional daily emersion in several market cycles over the past 25 plus years enables us to have an informational advantage over most market participants. Further, it is also our view that our study and understanding of behavioral biases enables us to recognize and adjust for them better than other investors. Everyone has emotional biases including us. They are impossible to expunge. What is possible however is to recognize them and recalibrate investment decisions to take them into account.

Nevertheless, as we have noted many times before, investing is hard (see Investing is Hard). The advantages we believe we have are small and far from infallible. So, we are happy to get any extra help we can get. Unjustified hype about companies or industries and or suppression of information about them are more than welcome; So is propaganda that emphasizes erroneous narratives that impact investor behavior. All of these make our job much easier.

Information is the Opportunity

An important bias in our opinion is what is known as availability bias. This bias circles back to the EMH by refuting the notion that all information is readily available to all investors. Availability bias posits that certain information is not as readily available as other information and therefore may not be known by the majority of investors. There is some information that is not reflected in stock prices that can be gathered by doing old-fashioned research. Think, for example, of a small company with no Wall Street research coverage with valuable information on it “hiding in plain sight.” It is all there for anyone to see if they look hard enough, but more importantly, know what to look for. On such smaller and under-covered companies, share prices are more likely to be mispriced than for well-known mega-cap stocks such as Amazon.com or Apple Inc., for example. Those companies are covered by 58 and 46 sell-side analysts, respectively according to Bloomberg as well as hundreds of buyside analysts.

Other behavioral biases of investors are rooted in emotion. These include the recency and trend bias we described in Anti-Trend and Recency Bias. They also include important other biases such as the very impactful confirmation bias. This is the notion that when one has an opinion they seek out and weight more heavily information that confirms what they think compared to information that contradicts it.

The bottom line is that we believe the academic literature and our own experience show that investors, whether through lack of information or emotional bias, can get things very wrong from time to time. In retrospect, they certainly did during the late 1990’s technology bubble or during the Global Financial Crisis. We are not saying it is easy to recognize when the market is making a mistake. We are, however, clear in our opinion that those who successfully do so can outperform. Which gets us back to suppression of information…

Is the Financial Information Sphere Awash in Propaganda?

Despite the best efforts of regulators to ensure companies disseminate objective truth, information about companies and markets is prone, at the very least, to half-truths. The amount of money at stake both on a micro level and a macro level makes maintaining objectivity difficult to say the least. On the micro level, insiders and managers of companies are rewarded obscenely if they are able to convince the market to raise the stock price of their company. On a macro level financial professionals are more likely to be paid well from the rising tide of bull markets, so their bias tends to be in that direction. Even financial journalists and the media benefit more when markets are good, so they often end up being financial cheerleaders rather than objective finders of truth.

Example: The Energy Transition – Emotional Decision Based on Propaganda – Our Opportunity?

We wrote extensively a few years ago about the problems with the climate change-driven energy transition in Think Things Through. Trying to decarbonize western economies in the way that is being attempted is folly, in our opinion. It is such folly that we find it hard to believe those espousing it do not recognize it as such. As George Orwell once said, “Some ideas are so stupid that only intellectuals believe them.” In that vein, we believe the massive disinformation campaign to convince the public and investors that it can work and is a good thing is, to us, nothing more than pure propaganda that would make even Edward Bernays blush (for those that do not know, Bernays is widely regarded as the father of modern propaganda through the publication of his two famous works, Crystallizing Public Opinion (1923) and Propaganda (1928)).

The propaganda is so well accepted and entrenched that it would be futile to endeavor to have the policy changed even if that was our goal. Regardless, we are advisors and investors. Our professional goal and obligation as a fiduciary is to help our clients navigate challenging markets. As explained above, we believe that one key advantage we have stems from having an informational or biased advantage over “consensus opinion”. The heavy propaganda around decarbonization makes that challenge easier than usual. In our opinion, this propaganda has distorted the prices of many resources related companies.

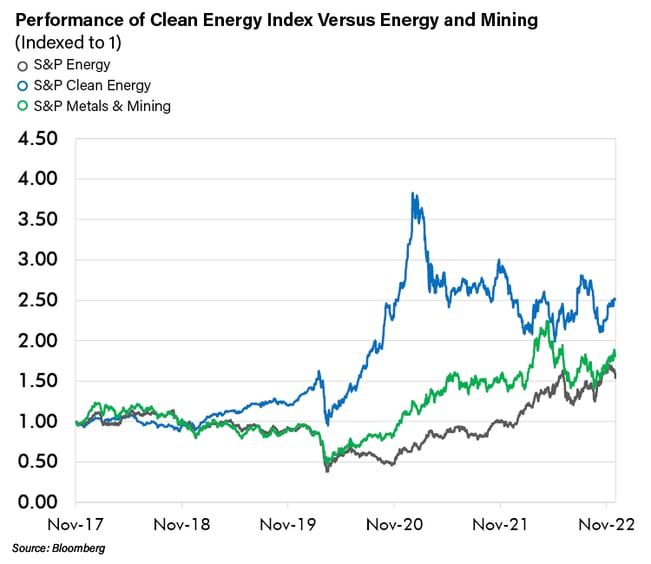

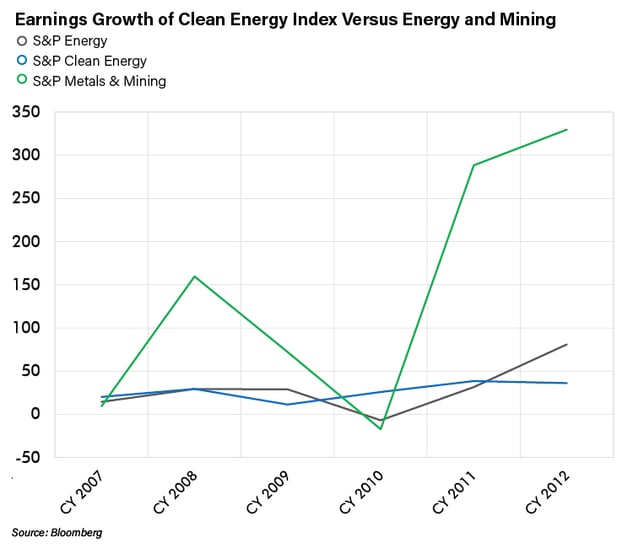

The following charts illustrate the point. The first chart shows that over the past five years the S&P Clean Energy Index has nearly doubled the performance of the Metals & Mining index and has more than doubled the Energy Index. The second chart shows that the clean energy companies are not growing earnings much.

A Current Investment Example

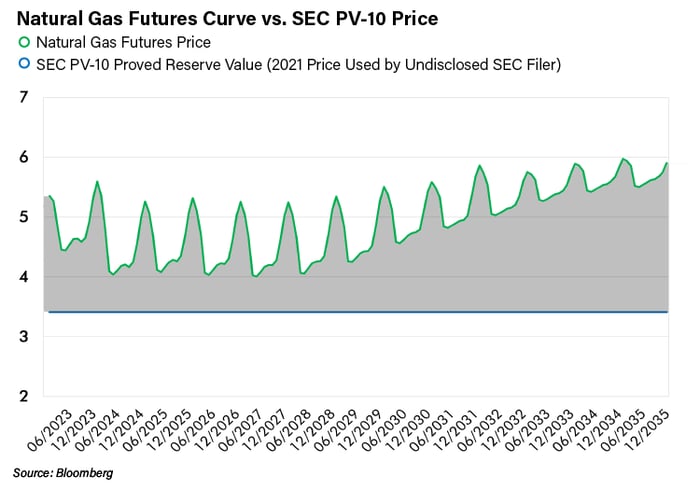

The company specific valuation anomalies that have arisen around this are historic in our opinion. Just to name one type of company as an example, we are finding domestic natural gas producers that are trading near or below their SEC PV-10 value. That value is the SEC mandated calculation of the present value of a hydrocarbon producer’s cash flow from proved reserved using a 10% discount rate (see A Tale of Two Investments for an in depth explanation of the SEC PV-10). The market, in our opinion, is not pricing in that the SEC PV-10 is calculated on last year’s lower natural gas price and that many companies have probable reserves far in excess of those used to calculate the SEC PV-10. Below is a chart of the current curve for New York Mercantile Exchange (NYMEX) natural gas futures contracts juxtaposed against the price used by one of our favorite gas producers in its 2021 PV-10 calculation. The shaded area is value that would be in the PV-10 if the NYMEX price were substituted in the calculation. Shhhhh, don’t tell the market!

Conclusion

For a long time, unfettered free speech was deemed to be a social good. In fact, free speech is enshrined in the basic documents governing most democracies around the world. Today, things are not so clear. Some companies that appear to be attempting to adhere to traditional free speech approaches are being attacked on ESG grounds. On the other hand, there are companies that are lauded as champions of ESG who appear to be engaging in questionable behavior at the behest of repressive foreign regimes that are important customers. Judging what is a social good is not easy. Numerous methodologies are being used to help identify and quantify ESG. Like politics and religion, ESG is very difficult to agree on. Therefore, we default to the traditional metrics of potential risk and reward of our investments. We look deeply for information that others might be getting wrong, including the possibility of propaganda and emotional bias on social goods. When we find undervalued companies on that basis, we invest in them. Due to the current state of the information space (or rather - misinformation space) both in the general and financial news, we are finding many interesting opportunities now. With that, we are content. Our clients can choose for themselves how best to invest in charities and other causes that reflect their own view of what is a social good.