“You do not really understand something unless you can explain it to your grandmother.” Albert Einstein

Sometimes it’s very difficult to get down to the simple fundamental truths that underlie even the most complex situations. Nowhere in the financial world is this more challenging than when we seek to understand and explain the financial and currency system. Those who took the time to study and understand this system could have anticipated and even profited from the financial crisis of 2008, which took so many by surprise. Our current financial system was never designed but rather was thrust upon the world in August of 1971 when President Richard Nixon broke the US government’s promise to exchange gold for a fixed amount of dollars. Our leaders have quite literally been making it up as they go along since then. This week’s Trends and Tail Risks outlines this system in a way that we can see the simplicity at its core.

Everything changed with a stroke of Nixon’s pen in August of 1971. Gold had been the ultimate means of settling a transaction for hundreds of years because gold was an asset that was not someone else’s liability. Gold closed out the chain of counterparty risk (who owes what to whom) in any transaction. With gold removed from the system after 1971, debts were now ‘settled’ by more debts. The quantity of debt expanded dramatically - and with it so did counterparty risks. We now have the largest and most complex series of counterparty risks the world has ever seen. Can debt rise perpetually without lowering the quality of the underlying debt? The best place to explore this question and monitor counterparty risks is in the credit default swap market, as we explain below.

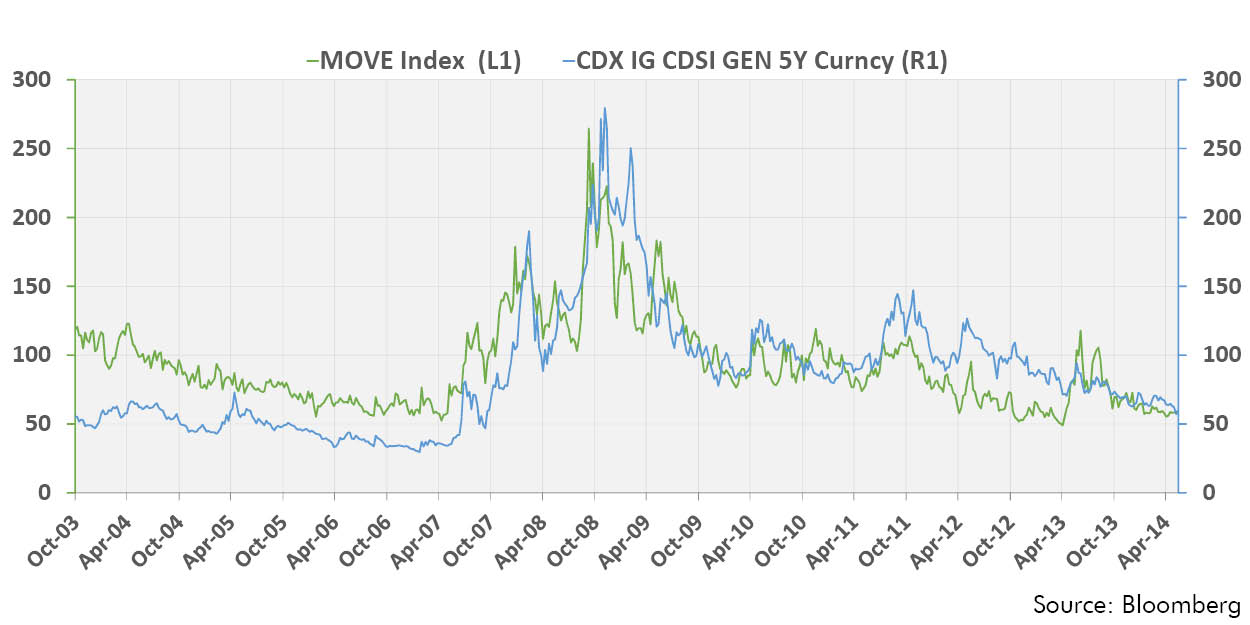

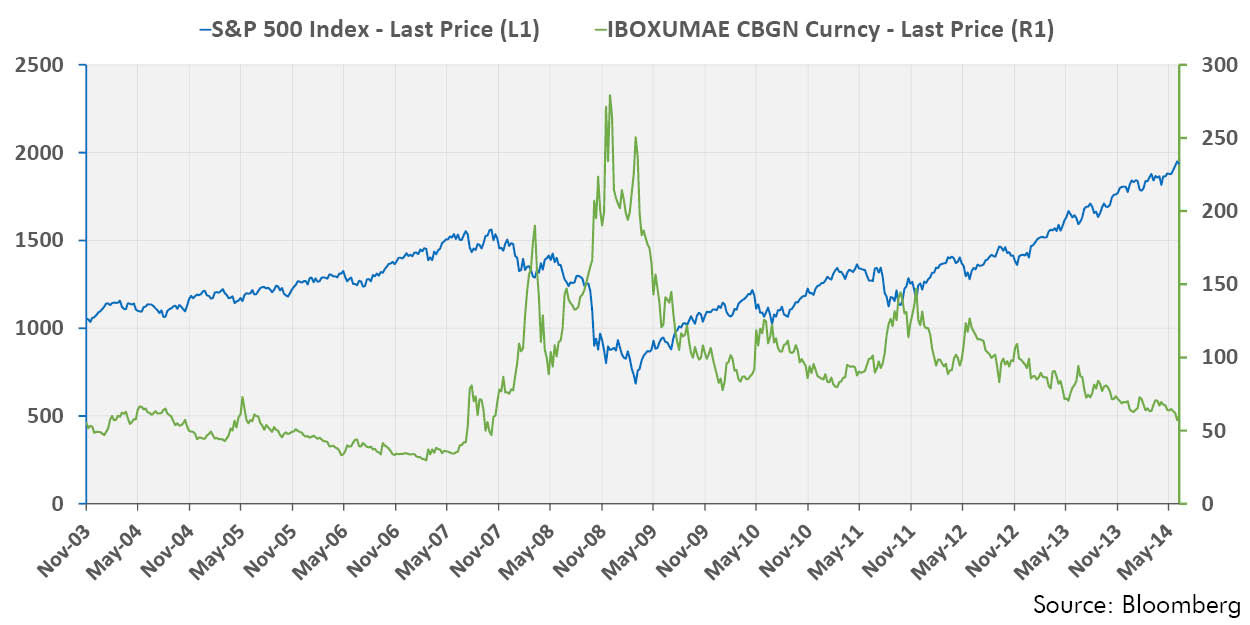

The chart above shows a strong correlation between the MOVE index of bond volatility and an index of credit default swaps (CDS) for investment grade debts. CDS reflect the market’s best estimate of the probability of default and severity of loss should debtors default. Plunging volatility and dramatically improved CDS immediately preceded the worst crisis since the Great Depression! No wonder so many market observers were caught unaware. They had overlooked that growing debts, while dangerous in the long run, are helpful in the short run – at least up until the point where debt levels become toxic. We suggest that falling volatility positively reinforced falling CDS. Lower volatility allowed leveraged investors to expand their portfolios of bond holdings, adding speculative leverage in the market to financial leverage in the economy, in a self reinforcing cycle that George Soros has called ‘reflexive.’ Equities are the junior tranche to bonds in the capital structure and responded as one would anticipate, falling as credit risks rose, as the chart below illustrates.

How does the thoughtful investor construct a sound portfolio in such a strange world, where at the heart of the system gold has been replaced by unstable credit? Are there indicators that forecast a turn in the debt cycle, when rising debt stops being ‘stimulative’ and becomes toxic? Answering these questions will be the subject of many future articles that build upon our understanding of how the system works. We will explore such investments as gold and the US long bond, both of which we believe remain in secular bull markets, where the simple reality driving them is vastly different from consensus thinking.•