One of my greatest joys is to rediscover the wonder of the markets when I rediscover them anew through the eyes of the younger analysts that I train. The best way to learn a subject is unquestionably to teach it! Their relentless questioning “why” forces me to constantly revisit first principles about what I truly believe and why I believe it. Time and again our conversations outline that there are two kinds of companies in which to invest:

- those that are challenged in the short run, where the investor has to be the smart one to see the diamond in the rough and

- world-class, powerhouse businesses with superb financials that make us look smart over time.

This publication has outlined many examples of the first sort of investments, where cyclical events have conspired to create a previously unimaginable environment that pushes a company’s valuation far below its fair value. Everyone loves a bargain! As a value investor I spend much of my time working on such situations.

But it’s also important not to neglect the second category of incredibly competitive, world-beating companies that have emerged triumphant after a long struggle. These rare but incredibly remunerative companies demonstrate their superiority in their financials. Not only are their financial results amazing - but more importantly – they are sustainable! These companies have fought their way to the top and have every intention of remaining there.

In my conversations with the young analysts that I train, I often call such companies “grinders” because every day these companies are hard at work, grinding away at making their shareholders look smart. Time is our friend with them. These companies each have something special in how they operate that makes them, and their investors, so successful. Both types of companies have a place in a well-diversified portfolio. Of course, the single best - and most rare opportunity – is when I can find one of these powerhouse companies under pressure. Those are the opportunities that make investing so interesting – and potentially so lucrative! In today’s “Trends and Tail Risks,” I outline the characteristics that I so often find in my “grinder” investments.

What Makes a “Great” Company Great: By Their Fruits Shall Ye Know Them

Three characteristics distinguish world-class businesses. They are:

- high returns on investment,

- large excess free cash flows, and

- the sustainability of these characteristics.

Warren Buffett, in more folksy terms, describes these attributes as the castle and its “moat.” The quality of the castle is in the first two characteristics – returns and free cash flows of a business. The durability of the castle is in how well its moat defends it – what keeps the financial health of the castle safe from competitors who would threaten it.

Return on investment is the amount a company earns on each dollar it has invested in running its business. It’s not unusual to find sustainable returns on investment in the 20% range or even higher in the best businesses. This is a truly amazing statistic as money invested at a 20% return will double in only four years! Such companies can run very efficiently, generating lots of excess cash flow that is not needed to run the business, making this cash available for shareholders. Companies can use this excess cash flow to pay a dividend, buy back stock, make acquisitions, or grow at a faster rate. Of course the very best businesses combine these impressive financial results with a large and quickly growing market for its products.

Many lesser quality businesses may find themselves by chance enjoying a boom time of temporary high returns on capital and strong excess free cash flow. All too often, boom turns to bust as profitable investment opportunities get overwhelmed by the temporary flood of cash that companies earn at the peak. As companies and their competitors plow their profits back into the business, oversupply often results, which pushes down the return that investors earn on each new dollar invested in the business. I see this very often in the commodity markets, for instance, where differentiation among competing products is more difficult. I can still make money buying companies suffering through such temporary downcycles when a fearful and overly pessimistic market values them at too great a discount. But this example shows why sustainable high returns are so rare.

Sustainability of high returns is usually a function of high barriers to entry or some other enduring competitive advantage, such as a strong brand or highly differentiated product. True world-class businesses must have something special about them if they are to successfully defend their “castle.” Everyone wants to earn very high returns but competition naturally lowers returns. That’s why great companies, with enduringly strong financials, are so rare.

Under Pressure: Secular Decline or Only Temporary Trouble?

Even among truly world-class businesses, few are so robust that they never encounter any meaningful setback. When, invariably, such difficulties arise, the question investors must answer is: are these challenges short term – or long term? Jack Laporte, the famous growth investor of T. Rowe Price’s “New Horizons Fund,” who tragically passed away recently from cancer, told me once that his biggest mistake was selling Starbucks (SBUX) when he feared the impact of rising coffee prices. Jack clearly believed that, in retrospect, he sold a great company for a bad reason.

My experience has been that it’s quite challenging to know the difference between problems that are temporary versus those that are more permanent in the real-time crush of the moment. Trust me when I say that there are always thoughtful observers who believe that the difficulties a business is facing are permanent. If investors could master only one skill this would be it: to discern the temporary from the permanent! How many potential fortunes have been lost for this reason!?

At such key junctures the outcome hangs upon a slender thread. Investing is truly a game of inches! What the investor wants to know of course is: what does the future hold for this investment? Investors can spend endless time asking this question but the answer is shrouded in the mists of an uncertain future. At times like this investors have to pivot from asking the question that they want to answer to addressing the question that they can answer! That is where valuation comes in.

Valuation is the art of determining what a business is worth. I can use a host of valuation techniques to arrive at an intelligent guess as to the assumptions embedded in the price of a security. Then I ask myself if I agree or disagree with the assumptions that lie behind that value. This is a key step in the process of investing. Investing is much more than finding great businesses – investing is about valuing those businesses! Valuation of world-class businesses with strong, sustainable returns is a long and important discussion that I will leave for future research notes. But let me say again that the art of finding a way to answer the question that you can answer is one of the most important lessons that any investor will learn.

Getting it Right: the Amazing Rewards of a Job Well Done!

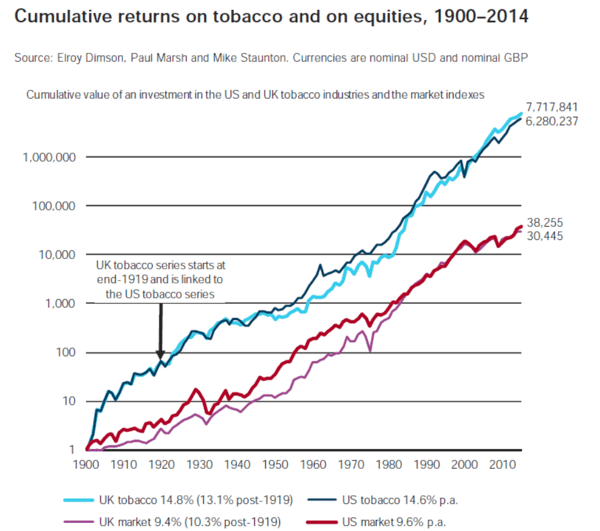

Frequent readers of this weekly know that I am a fan of history for what it can teach us. Below is a remarkable chart I recently ran across, published in Credit Suisse’s “Global Investment Returns Yearbook for 2015.” The chart shows the incredible cumulative returns earned by investors in the tobacco sector versus the equity market from 1900 to 2014. One dollar invested in the U.S. tobacco sector would grow to an incredible $6,280,237 by compounding at 14.6% for more than a century! More than twenty times the returns of the U.S. market! Now that is powerful long-term growth!

Source: Credit Suisse Research Institute, Feb 2015

The tobacco sector’s stocks, for all their well-known shortcomings and baggage, display many of the characteristics I named above that are found in the strongest of businesses. I remember quite well my early days as an analyst at T. Rowe Price when thoughtful investors debated the future of these stocks when the uncertainties of the day weighed heavily upon the valuation of these equities. In particular, investors worried that the huge and unprecedented litigation settlements that the sector faced could finally bring an end to its century-long performance run. Who could have anticipated at the time that tobacco companies would raise prices nearly five-fold to continue to earn strong returns? The wisest of investors who made money on these equities focused not on the imponderable and unknowable future but rather on the black and white assumptions baked into the valuation of these stocks. These investors answered the question that they could answer – and profited!

In Conclusion

Investors have a wide world of opportunity from which to choose. Some investments, particularly those in more cyclical sectors, can really pay off when short-term pressures lead fearful investors to underestimate the long-term value of a business. As value investors we relish such opportunities when boom has faded to bust and pessimism – and undervaluation is rampant. I am finding many such investments right now.

But no thoughtful investor should ignore the benefits of owning “boring” grinders that generate world-beating long-term returns. These companies, the very best of businesses, may be held patiently while earning incredible returns in the long run. Such businesses earn sustainable high returns and generate strong excess free cash flows. Oftentimes the patient ownership of these grinders can play a hugely important role in earning excellent long-term returns in a diversified portfolio. While oftentimes this can be as exciting as watching the proverbial paint dry, the rewards can well be worth the boredom!

Thorough research and valuation discipline are the necessary tools investors can use to uncover such over-looked opportunities in both beaten down value stocks and grinders. The key is to find a way to ask the most important questions in a way that investors can answer! •