The Fed made a mistake in raising interest rates. The consequences of this mistake could be far-reaching. Frequent readers know that I strive to follow the advice of Bismarck and study history to learn from the mistakes of the past. Thankfully, the information we seek is out there, waiting for us to find it.

Today’s “Trends and Tail Risks” outlines why we think it’s a mistake for the Fed to hike interest rates. We will highlight our forward-looking indicators, those we wish the Fed would watch, rather than the backward-looking indicators the Fed uses. Finally, we will draw upon the lessons of financial history to illustrate the fallibility of the world’s central bankers. History suggests that they too are only human. Our conclusion? We cannot rely on them to “save us” in the markets; rather, we have to save ourselves. That starts with educating ourselves, especially about the credit markets.

We Fear That the Credit Markets Are Not Healthy Enough to Withstand Fed Interest Rate Hikes

Those of us who profitably navigated the 2007 – 2008 Global Financial Crisis did so by studying the credit market. As we watched credit weakness spread, we knew that we couldn’t rely on the Fed to save us. Frankly we knew the Fed was just as confused as everyone else. This we knew because it was clear from the Fed’s communications that it was not focusing on what mattered. Spreading credit distress drove waves of volatility crashing from one market to another, revealing in unfathomable ways, how interconnected everything had become.

What was it about credit that connected these seemingly disparate events? When credit quality is getting better, the tide is coming in, so the market amply funds growth opportunities. The free and generous flow of credit allows individual securities to stand on their own unique fundamentals. But if that incoming tide of rising leverage from generous funding should ever reverse into an outgoing tide of deleveraging and falling funding, suddenly correlations move toward one. All at once, none of the old rules seem to matter as the tide of receding credit flowing out threatens to overwhelm company specific fundamentals. That sounds like a pretty accurate description of the way the markets have traded this year, doesn’t it?

Those of us who invested the time to understand the credit markets had no illusions about what we were facing from 2007 to 2008. We knew that we had to rely on ourselves. Thankfully we were prepared. A rich history of financial markets dating back centuries was fully available to anyone who took the trouble to inform themselves. How could a thinking person fail to take advantage of such a treasure trove of information? After all, the events of the time were unprecedented in living memory. We needed to make the most of any advantage that we could find!

I understand that poring over musty tomes of obscure financial history, searching for parallels and pertinent lessons, is not everyone’s idea of a thrilling evening. I get that. People’s lives are complex and busy enough from day to day. But those of us who are charged with the duty of managing other people’s money can’t hide behind that excuse. Don’t we have to go the extra mile? Isn’t that what our clients pay us for? To be trusted to worry for them, and to invest accordingly, so that they can get on with their normal lives without worry? Thankfully, it’s not a foregone conclusion that all small credit problems will go on to become large ones. But it’s a prudent investment in safety to understand the process!

The Fed Makes Mistakes Too

The media would have you believe the story of Fed omnipotence, of financial superheroes saving the day. But don’t be deceived. When you think about the Fed, don’t imagine they are the characters in this poster…

Consider instead the fact that the Fed is made up of academics on the government payroll. We do not doubt that the Fed is composed of well-meaning and civic-minded public servants. One also finds such people at other government agencies too, such as the Department of Motor Vehicles (DMV), the United States Postal Service (USPS), or the Internal Revenue Service (IRS), just to name a few examples. However, it is not to these government agencies to which the financial media begs that we pray for supplication in times of financial distress: it is to the Fed.

Consider instead the fact that the Fed is made up of academics on the government payroll. We do not doubt that the Fed is composed of well-meaning and civic-minded public servants. One also finds such people at other government agencies too, such as the Department of Motor Vehicles (DMV), the United States Postal Service (USPS), or the Internal Revenue Service (IRS), just to name a few examples. However, it is not to these government agencies to which the financial media begs that we pray for supplication in times of financial distress: it is to the Fed.

True, the Fed plays a vital role in the financial economy: to set interest rates which are the rental price of money, the world’s most important commodity. But does the financial media not question whether the Fed, or any group of humans (without superpowers), can actually do that impossible job without making mistakes? Maybe even lots of mistakes? And when the stakes are high, mistakes can matter. I think often on Thomas Jefferson’s thinking: that revolutions happen when we do precisely the wrong thing at just the right time. Are we now at just such a time?

What the Fed is Missing: More Effective Forward Looking Credit Indicators

These pages have illustrated a number of the forward-looking indicators we watch: credit spreads (Equity Market Volatility (Finally) Catches Up to Credit Market Volatility, 09/09/15; Credit: Caught Leaning?, 08/13/2014) and precious metals (Gold: Lessons from the Depression, 08/20/14; Gold: Price vs. Relative Value, 07/23/14). However, there are other forward-looking measures of risk that look at the risk of the system as a whole. These we find in the credit default swap market, which we discuss below.

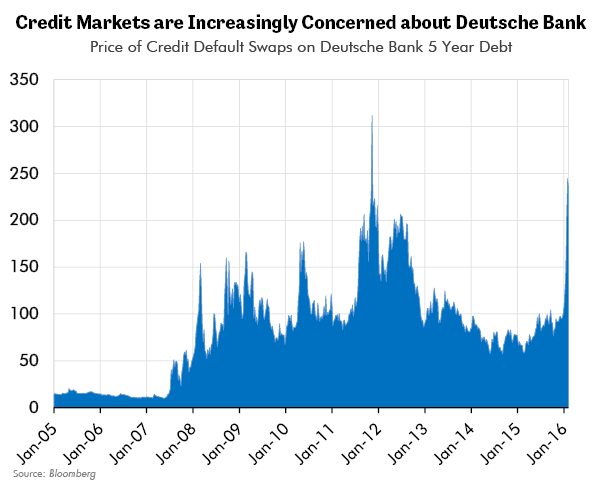

As indicated in the chart above, the market is growing much more concerned about the credit quality of Deutsche Bank (DB). The credit default swap (CDS) market has one job and one job only: to forecast the probability and severity of default of various credit instruments. Those who buy CDS are buying protection to insure against default of a specific credit, such as a company’s debt or even sovereign government debt. CDS prices rise when willing buyers and sellers price in the rising probability and severity of default.

DB is the largest bank in the third largest economy in the world. Bloomberg shows that DB has more than 1.6 trillion (trillion with a T) in assets on its balance sheet. Presumably the German economy has been one of the strongest in the G20. So, why would the concerns of the CDS market about Deutsche Bank intensify so quickly in the last few weeks? DB’s credit default swaps certainly seem to be pricing in a material degradation in the market’s estimate of the health of DB’s credit. The Fed seemingly does not share this concern. Whom to trust? No offense to the Fed, but long experience has taught us that we should go with the CDS market.

Few financial analysts, no matter how skilled, would debate how difficult it is for an outside analyst to understand the value of the assets on a large, complex bank’s balance sheet with any precision. Anyone who has studied Deutsche Bank knows its leverage is much higher than other money center bank. High leverage means that only a small buffer of capital remains once the company’s liabilities are subtracted from its assets. High leverage in a bull market can generate spectacular returns. In a bear market, however, high leverage can quickly take a bad situation and make it catastrophic, creating the emphatic need for additional capital to shore up an otherwise weakening balance sheet.

So why might the price of default insurance on DB’s credit rise? One hypothesis could be that those who are the best informed, such as insiders at Deutsche Bank’s counterparties, are getting nervous and buying protection. This is a pattern we have seen in the markets before. One thing is for sure: clearly the buyers of default insurance for DB are willing to pay a much higher price for this insurance than they were just a few short days ago. Perhaps the Fed should take note. We certainly have.

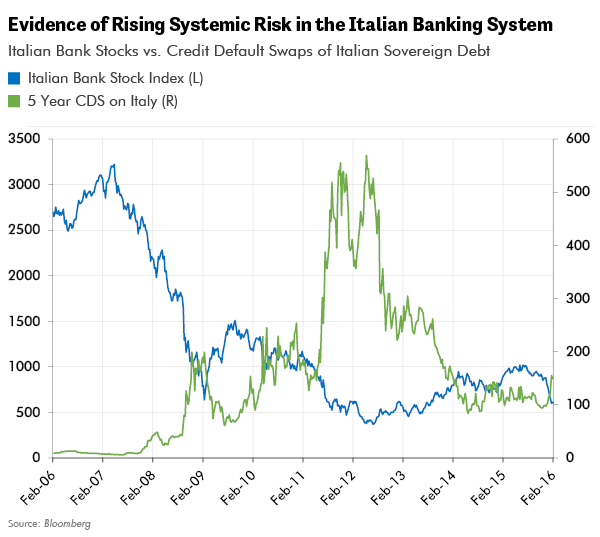

Italy too has some very large banks – some of the world’s largest in fact, many of whom have near trillion dollar balance sheets buffered by precariously small and shrinking slivers of equity. Concerns about these banks are rising, as we can tell from their falling equity prices and recent steps to ban the shorting of many Italian bank equities. Again the theme is one of spreading credit distress. Will credit distress stop here or does it have further to go?

We fear that we have not yet seen the end of this trend and will be forced to return to this topic in the future. The toxic recipe of high leverage plus an opaque balance sheet plus rising distrust did not play out well for many banks during the last bout of credit stress through which the world suffered. Should we expect a different outcome this time? What is even more disturbing is to watch the CDS market begin to price in ever more aggressive estimates of the probability of default of many European sovereigns, such as Italy. If Italy itself should ever get in so much trouble that it could default without a bailout, what would that mean for Italy’s banks? Who would be left to backstop them with an infusion of extra capital? As uncertainty rises, what actions will Italy’s bank shareholders take, or its creditors, or the banks’ depositors? We fear these questions will be less than academic in the future.

Further Reading: How to Educate Yourself About the Credit Markets and Their History

Below we outline the top five books that we suggest you start with should you care to begin a course of study on these topics:

- Manias, Panics, and Crashes: A History of Financial Crises by Charles Kindleberger – If you only read one book on the subject, this is the one to read.

- The Debt Deflation Theory of Great Depressions, Irving Fisher in 1933

- The Midas Paradox, a recently released book (2016) by Scott Sumner

- History of Financial Disasters 1763-1995 in 3 volumes edited by Benedikt Koehler

- The Crash and Its Aftermath by Barrie Wigmore

These books profile the credit market during times of stress. These are the times to see credit’s raw power, which can be so often hidden from view. Of course, there are many other great books on this subject, only a fraction of which I could mention here. Email me at the address at the bottom of this paper if you would like a more complete list – or if you have others that you think have earned a place on it.

Investing successfully in an unsafe world

No one can guarantee a successful outcome in these increasingly disturbed markets. But we owe it to ourselves to be prepared, especially those of us in the business of managing other peoples’ money. Thomas Jefferson said it best, when he said that the harder he worked, the luckier he got. We strive to increase our luck too.

We have worked hard to understand how credit expansions and credit contractions have behaved in the past. We have worked even harder to understand which indicators to follow. Our goal is to identify at which point in the credit cycle we may find ourselves, so that we can own the most appropriate investments at the right time. No one knows the future but armed with the lessons from the past we should have a better chance of profitably navigating even the most challenging of markets. Our study of the credit markets is a key part of our strategy as we strive to reach that goal. •