Gold is up 19% year to date against the backdrop of a volatile stock market. In fact, gold just clocked its strongest February since 1975. Is this the move we have been waiting for in gold? We believe that it is. But there are hundreds if not thousands of gold-related investments. How do we decide which is the best to own? Our research process is focused on understanding two things: 1.) which sectors should outperform; and, 2.) within sectors we favor, identifying the best investments. The most powerful results come from getting both right.

Long-term clients have seen gold-related stocks such as Franco Nevada (FNV) in their portfolio for the last few years as we waited for what we believed was the inevitable resumption of gold’s bull market. If FNV can hit a new all-time high during one of the worst commodity bear markets in 500 years, what might FNV do during a bull market? In today’s “Trends and Tail Risks” we summarize our thinking about FNV.

Not All Gold-Related Investments Are Created Equal

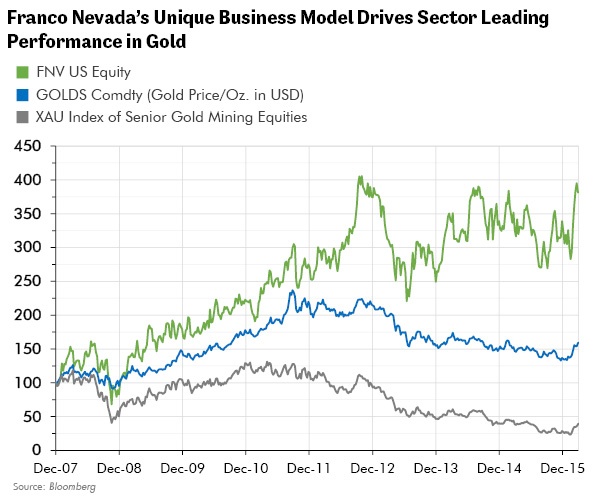

The gold sector has been incredibly challenged over the past four years. The metal itself fell 40% from peak to trough while the more volatile gold stocks fell 85%. Both remain well under their old highs, despite strong rallies in recent weeks. The chart below shows the relative performance of gold, gold stocks and FNV from its IPO in 2007. In the past eight years FNV has quadrupled, gold has risen 50%, and gold stocks have fallen 60%. How is it that FNV hit a new all-time high just a few days ago while so many other gold investments languish so far beneath their old highs? The answer is that FNV has a unique business model and incredibly talented management team that creates value. Below we do a deeper dive on why we chose FNV as our go-to gold investment and why we remain patient owners of the company for the long run.

Franco Nevada's Unique Business Model Drives Sector Leading Performance in Gold Mining is a tough business. Miners often make investments that end up costing more than expected. After all, they may dig a mile into the Earth chasing a thin, elusive vein of ore or shovel out millions of tons of rock from an open pit mine to seek gold that even in the richest reserves are counted only in grams per ton of rock or less. This is approximately 1 gram of gold per 999,999 parts of useless rock! Many bad things can happen at this level of complexity. This is not even counting the risks from striking mine workers, changing environmental regulations, or government tax treaties that get thrown out when a new government is elected.

To overcome these challenges, miners need to make great decisions and remain disciplined with their investments, and above all, their balance sheets. Sadly, this rarely happens. Even worse, when times get tough for overleveraged miners, they often resort to issuing equity at panic prices near the trough of the cycle. The company’s assets may live on to fight another day, but the interest of long-suffering shareholders in those assets is reduced on a per share basis by the company’s newly issued, and lower priced, shares. Such mining companies underperform the gold price over the long run. For all these reasons, mining is a highly cyclical business where returns often turn out to be lower than investors’ expectations. Thankfully, investors can find better ways to get exposure to the gold sector – if they know where to look.

FNV Is Not a Mining Company, It’s a Royalty and Streaming Company

Unlike mining companies, FNV, has a business model and management team that has consistently generated cash flows that give a higher return on investment than expected when taking into account the actual gold price. Over time this means that FNV has outperformed gold – by a wide margin.

How does FNV do it? FNV’s management team is brilliant. It understands its role is to make investments that are low risk yet have the potential to generate outsized returns. This is easier said than done.

Pierre Lassonde, FNV’s Chairman, co-founded the company in 1985 with a unique idea: to invest in the gold sector through royalty interests. A royalty interest is when a mining company pays a fee to the royalty holder in perpetuity as a percentage of any revenue from mining the land’s mineral rights. The royalty holder makes a small, one-time payment upfront and is not responsible for any of the capital, maintenance or operating costs of the mine. The royalty holder merely collects the royalty checks.

FNV diversifies its investments over the mineral rights of many existing mines and other natural resources. This includes a large number of interests where no mine may be currently operating, but the odds favor the future development of a mine. The cash flow that returns to FNV is consistently redeployed to additional royalties and streams or is returned to shareholders through dividends, which have grown 23% per year over the last five years.

FNV’s Disciplined Management Team Knows How – and When – to Put New Money to Work

I have known and admired FNV’s Chairman, Pierre Lassonde, for the last fifteen years. The team he has assembled has done a brilliant job navigating the brutal commodity down-cycle, which is when all truly great management teams distinguish themselves. Thanks to FNV’s iron clad balance sheet and opportunistic management team, the company invested $2 billion into the depths of the commodity crash from 2013 – 2016.

For mining companies, this was a time of panic asset sales and urgent financing deals as overleveraged companies cut desperate deals at fire-sale prices to stay afloat. For FNV, it was likely a once in a generation opportunity to put money to work aggressively at exceptionally attractive returns. Opportunistic investing like this tends to result in dramatic outperformance once the cycle turns. But an investment in FNV is far more than simply a bet on the cyclical recovery of gold prices.

In Its Own Words: FNV’s Management Team on What Makes the Company Unique

FNV’s Chairman, Pierre Lassonde, outlined what he thought was important for investors to understand about FNV during an interview on August 19, 2014:

They don’t understand what we have when we create a royalty. I’m not talking about a stream; I’m talking about a royalty... We get a free perpetual option on the discoveries made on the land by the operators, and we get a free perpetual option on the price of gold. Think about this – if someone hands you a free perpetual option on 6 million acres of land, and you don’t have to put up a penny, don’t you think that at some point, you’re going to get lucky?

That’s what it is. We have put together a land package by purchasing and creating royalties where we end up with a free perpetual option. It’s the optionality value of the land, the value of the operator spending money on our land, and the optionality to higher gold prices. And that is worth so much money.

FNV exemplifies the many attributes we seek out in our research: 1.) management that is a disciplined allocator of capital; 2.) a unique business model and sustainable competitive advantage; 3.) bullet proof balance sheets that management uses to opportunistically invest; and, 4.) a sector that we believe will go from fighting headwinds to enjoying tailwinds. Believe me, it may take years of looking to find all these qualities in a single security. Thankfully, our analytical team has been hard at work for years to find companies like this in which we may confidently invest.

In Conclusion

Make no mistake: when we invest it is first and foremost because our company-specific research leads us to favor the individual companies in which we invest. However, our analysis does not stop there. We believe in taking the additional step of asking ourselves whether these companies may benefit from positive, unexpected change.

To answer this question, we use our forward looking framework of indicators and knowledge of cycles in an attempt to understand when it’s the best time to own the individual securities that we favor. We want to have multiple ways to win in our investments. Our experience is that getting both of these right: owning the right securities at the right time, is the source of the best investment results. •