Chief Conclusion

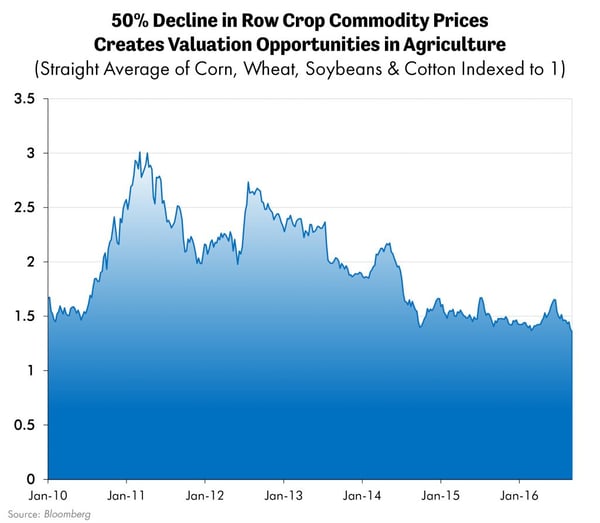

Successful investing begins with the purchase of assets with limited downside, exceptional upside, and multiple ways to win. The 50% crash in agricultural commodity prices helps defend our investments against further downside and sets the stage for a multi-year investment opportunity off the trough of this deeply distressed cycle.

Frequent readers of this publication have long known of our abiding interest in history. The study of history is a competitive advantage when investing, because investing is an exercise in decision making under uncertainty. In order to make better decisions now, we have studied the great decisions and decision makers of the past.

Investing is an Exercise of Decision Making Under Uncertainty

Investing challenges us to make the right decisions today that will result in a profitable future. That sounds simple but it rarely is.

One source from which we draw inspiration for our investing task is the study of war; of what happened on the battlefield, one of the most complex and risk-fraught of all endeavors. The largest and most costly war to date was World War II, or as it is known in Russia, “The Great Patriotic War.”

From an early age, we and other Westerners are raised to be familiar with the names of famous Western generals and military leaders: Churchill, Patton, Eisenhower, and Rommel to name a few. But what do we know about the war’s most conclusive battles that were fought on Soviet territory? It was these bloody conflicts that turned the tide of the war.

The battles of Moscow, Stalingrad, and Kursk would do what no one had done in the first three years of the war against Hitler: halt the seemingly unstoppable Nazi Blitzkrieg. The epic scope of these clashes was staggering, a million soldiers on each side fought over battlefields hundreds of miles long, that raged for weeks at a time. We can all be thankful that the human race has been spared their repetition for these many decades since.

It is no exaggeration to say that the fate of Western Civilization hung in the balance during these pivotal battles. The general most responsible for leading the Soviets to victory was Georgi Zhukov, the Deputy Commander in Chief of the Soviet army. Somehow Zhukov had survived Stalin’s disastrous pre-war purges that had cost the army half of its operational officer strength.

Stalin, who had suffered a nervous breakdown when attacked by Hitler’s forces, regained his faculties but nevertheless suffered defeat after defeat as the invaders conquered thousands of miles of territory until they finally threatened Moscow itself. With the Nazis in the very suburbs of Moscow, it was to Zhukov that Stalin turned for help in rallying his forces for a desperate but successful stand. From then on Zhukov would play a key role in nearly every major battle the two antagonists would fight. The massive battle of Kursk illustrates most clearly Zhukov’s strategic thinking.

Kursk: Zhukov’s Well-Planned Defense Exhausts the Invaders and Launches a Massive Counter-Attack

Kursk: Zhukov’s Well-Planned Defense Exhausts the Invaders and Launches a Massive Counter-AttackThe massive battle of Kursk was the most important battle of the war. It would finally break the back of the Nazi’s ability to wage offensive war and thereby set in motion trends that eventually would result in the Allied victory. At Kursk, more than a million soldiers on each side faced each other on the battlefield. It was war on a scope and scale never seen before.

Hitler anxiously sought to regain the strategic initiative after the setbacks of Moscow and Stalingrad. Kursk was his intended target, the key town in a bulge thrust brazenly into Nazi-held territory by a Soviet offensive after their victory at Stalingrad. Zhukov’s first goal was to defend this important territory. His bigger and more strategic goal, however, was to draw his enemies into exhausting their force by attacking his well-fortified positions, and to follow quickly with a massive strategic counter-attack of his own.

There were risks to this strategy. Zhukov needed Hitler’s armies to attack “the obvious” opportunity presented by the Kursk bulge. At first the Soviets were vulnerable to a quick German counter attack, but as time passed the Soviets fortified their position. Zhukov’s experience in the fight protecting Moscow taught him the importance of multiple lines of defense to which the Soviet army could retreat while containing the force of the German onslaught. Soviet defense lines were accordingly prepared that ran as deep as six successive lines, each which benefited from Hitler’s delay. Weeks of preparations strengthened the Soviet position. Zhukov gathered a central reserve to meet potential breakthroughs.

When the Germans finally attacked, a pitched battle raged for days. But the heavily fortified Soviet positions held. Exhausted from a maximum effort, the invaders tried to regroup. The Soviets then launched their strategic offensive “Rumiantsev” with almost a million soldiers, beginning at last the offensive effort that would eventually result in an Allied victory.

Successful Investing Begins by Focusing on Defense, and Only Later Going on the Offensive

Cycles and the investment opportunities that they create are a common theme of this publication. Countless investors have been forced to deal with unexpected change in their investments. Booms turn into bubbles with few noticing, only to share the fate of all bubbles and suffer “unanticipated” crashes. These down cycles may last longer and plunge more deeply than anyone could have imagined, leaving even the most practical and level-headed investors wondering if “this time is different?” Almost every major industry has at one time or another found itself the unwelcome subject of this dark and brooding question. Most investors do not specialize in cyclicality, which creates an opportunity for those that do to add value in these situations.

We choose to willingly embrace the uncertainty and volatility of cyclical investing when the odds are solidly in our favor, chiefly at the trough of a big cycle through investment in industry leading companies. Our goal is to enjoy the high returns generated by sector leaders, and hopefully add to those returns through purchasing these leading businesses at bottom of the cycle depressed prices and therefore at compelling discounts to intrinsic value. This week we examine the agricultural sector to ask the question: is the cycle bottoming?

Is the Agricultural Sector Bottoming?

We believe that the agricultural cycle is bottoming now for a number of reasons. First, row crop prices have crashed 40-75% from their peak of four years ago. The chart below shows the price trend for the average prices of corn, wheat, soybeans and cotton indexed to 100 at the beginning of 2010. This index shows the dramatic decline suffered by these prices, falling 50% from their highs only a few years ago.

A recent history of dismal and disappointing news is always a helpful place to start when evaluating the prospects for cyclical change. Low prices, as they say, are the cure for low prices. Low crop prices depress returns for farmers and weigh upon their investment decisions for everything from tractors, to seeds, chemicals, and fertilizers.

Second, higher gold prices suggest a brighter future for commodity prices, an argument that we will not duplicate here (“The Message of Gold,” March 23, 2016).

Third, the outline of improving fundamentals may be beginning to clarify with the near record high profitability of corn-based ethanol. Back in 2006, this development kicked off a powerful wave of ethanol driven demand for corn that powered the last multi-year bull market in that commodity. Corn is the world’s most important agricultural commodity. As corn goes, all of agriculture goes.

Fourth, in the beleaguered agriculture sector, even the best managed and lowest cost producers are trading at fractions of replacement cost. Even the prices of the best companies have fallen an incredible 85%! The undervaluation at which these companies currently languish is a clear statement of investor apathy. Investors clearly think better returns have deserted agriculture for good. Cyclical stocks are unique in that they are most profitably purchased at sky high price to earnings multiples (on low trough or even non-existent earnings) and sold on low multiples of peak earnings. This paradox is just one reason why we use multiple valuation metrics to gauge the risk/reward of investing (“From the Analyst’s Toolkit: Replacement Cost Valuation,” June 11, 2014).

Fifth and finally, the survivors of this brutal down cycle are now moving to take the future into their own hands through industry consolidation. Cycles have a way of sneaking up on managers of cyclical companies, just as cycles sneak up on their investors. All it takes is one bad decision for a down cycle to be lethal for a cyclical company. No one said managing a cyclical company was easy!

Consolidation Begins Anew in the Agriculture Sector

Mergers and acquisitions can make or break cyclical companies. Poorly timed, poorly financed and expensive acquisitions kill returns. Such mistakes often forced these companies to sell assets at the trough. The sales are nearly always at distressed prices, dumped on the market by desperate sellers dashing to raise cash to make it through the trough of the cycle. Management teams that make this often fatal mistake, even if they survive, end up diluting the equity interest of their long-suffering shareholders. The wanton destruction of capital that comes from such ill-timed buying of expensive assets at the top and selling of cheap assets at the bottom continually dilutes an investor’s per share interest in the enterprise as claims multiply on a shrinking asset base. This is how cheap stocks get cheaper.

Great Management Teams, However, Add Value Through Smart Consolidation at the Cycle’s Trough

Thankfully, the rare insightful and opportunistic management team can use the volatility of the cycle to increase shareholder returns. They often do this by consolidating at the trough of the cycle when asset values are cheapest and it is abundantly clear that costs and production must be cut. We continually scour the markets for such management teams. They are out there but they are rare!

We can see this most prominently in agriculture right now specifically in agriculture chemicals and fertilizers. The biggest consolidation so far took place in chemicals, with the combination of global titans Dow Chemical (DOW) and DuPont (DD). Quickly this trend snowballed to include Bayer’s bid for Monsanto (MON) and, more recently, it was disclosed that fertilizer giants Potash Corporation of Saskatchewan (POT) and its competitor Agrium (AGU) are engaged in merger talks. Many other smaller consolidations and deals also abound. This is great news for the agriculture sector. These consolidations can lower production costs and concentrate more market share in fewer hands, promoting higher more sustainable margins over the course of the cycle.

In Conclusion

Our investment research can draw upon the wisdom of Marshal Zhukov. With patience, a knowledge of cycles, and the discipline of valuation we can launch our own investment offensive from a highly defensible position. If we have properly done our homework, our defenses, like that of the Marshal also have multiple layers to protect our investments. These are 1.) depressed valuation, 2.) negative sentiment, 3.) unforeseen and unexpected fundamental changes in the cycle, and finally 4.) opportunistic consolidation among competitors. All these attributes limit our downside while we await a turn in the cycle and the launch of our own offensive attack.

The goal of all our efforts is simple: a durably growing portfolio. Our research is our tool – choosing in which securities to invest. Its all an exercise is decision making under uncertainty. Success is by no means assured.

Our research is identifying downtrodden companies in cyclical industries, particularly the still-depressed commodity sector, moving now out of the nadir of one of the most devastating bear markets ever recorded. Our attention is certainly piqued when we can identify numerous and dependable hallmarks of cyclical troughs, such as our research is now uncovering in agriculture. Clients should expect to see their portfolios carry an increasing investment in this beleaguered industry. Long time clients and friends will recognize that we seek to invest not when the “news” is getting better but frankly when the news has been sustainably disastrous. This methodology, executed properly, limits potential downside while we wait for the cycle to turn. It’s a simple but effective form of risk management.

In agriculture we find ourselves at the happy intersection of an industry at a time of great stress, with management teams who are rolling up their sleeves to improve their lot. We are excited about these developments and believe select agriculture investments may represent a compelling part of a diversified portfolio.•