Chief Conclusion

We believe that in the coming months we may see rising steel prices in the U.S. The power of arbitrage, one of the strongest forces in the markets, is now set up to make this happen. Below we explain why and outline our causal arbitrage framework. The biggest threat to this thesis would be falling raw materials prices in China.

Prevailing conditions are such that we may see a steel shortage in the U.S. in the next few months. Our views on the steel market have changed a number of times over the last year or so. In fact, they have changed from bullish, to bearish, and now too bullish again. I can see how that might sound confusing to many. However, it’s really just the consistent and logical application of our arbitrage framework for steel pricing in the volatile steel markets. When these drivers are bullish, we are bullish. And when they are bearish, we are bearish. If your goal is to lose a lot of money, there is no better way to do it than to ignore the iron logic of arbitrage and to fail to change your mind when the facts change.

Don’t underestimate how challenging this is. Experience from almost twenty years of investing has taught me all too well how the market punishes those who cannot develop this flexibility of mind; the total transparency and willingness to change your mind literally in an instant – when the facts change. Should you choose to invest in the steel industry, or in any other industry with such powerful causal drivers behind it, then you had better understand arbitrage, willingly follow its dictates and change your mind when the facts change.

Supply and Demand in the Global Steel Market: America’s Steel Deficit

China’s dominance is the first thing to understand when analyzing the steel market. China produces nearly half the world’s annual supply. To put this into perspective, the U.S. steel industry is only 1/8 the size of China’s. U.S. steel capacity is about 100 million tons per year but is only operating at about 75% capacity utilization, producing approximately 80 million tons of steel per year. The U.S. typically consumes around 100 million tons of steel per year, approximately 20 million tons more than it is now producing. Where does that extra steel come from? Imports.

The U.S. is dependent upon imports of steel to “balance the market” as we say in commodity investing. How does the market incent the steel we need to come to our shores? Prices. Prices in the U.S. are typically some of the highest prices in the world, chiefly because of our structural production deficit in steel. Accordingly, U.S. prices must be high to provide a sufficient incentive for foreign steel producers to ship their steel to our shores. However, prevailing steel prices in the U.S. are now less than prices in China (including VAT) and certainly do not contain a sufficient premium to attract the steel imports that the U.S. needs to meet demand. We think it’s likely that prices will rise to incent the steel imports to the U.S. upon which we have historically relied to meet that demand.

U.S. Steel Prices Relative to Chinese Steel Prices: Changing Your Mind When the Facts Change

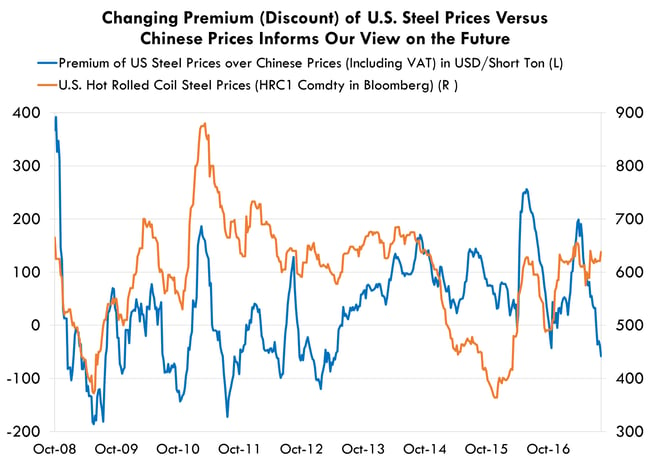

In fact, as the chart below illustrates, the discount of U.S. steel prices to those in China is now among the deepest it has been in years. If this price discount continues, the U.S. steel markets will likely be undersupplied relative to demand. The most logical price signal the market could send to balance this market would be for U.S. prices to rise. Higher prices would solve the problem of insufficient supply by incenting domestic producers to make more steel and by encouraging foreign producers to ship their steel to the U.S.

Steel pricing cycles peaked at the highs in 2008, 2011, and 2014 when a high price premium in the U.S. relative to Chinese prices “opened the arb” to steel imports into the U.S. Steel pricing cycles troughed at the lows with the collapse of those price premiums in 2008, 2011, 2015 – and now?

We believe that this arbitrage framework promotes a superior understanding of the future direction of prices. This construct is simplicity itself, suggesting a trading strategy that is bullish when the spread is low and bearish when the spread is high.

Simple is not the same thing as easy! This framework requires frequent changes to how investors are positioned in steel, and the communication of why changing views are justified by changing facts. Many unfamiliar with its discipline find it too demanding – but those who recognize and welcome its clarity can find it extremely rewarding.

Alternative, Less Likely Means by Which the U.S. Steel Market Could Find Balance

There are, of course, other ways that the market could balance supply with demand in the U.S. For instance, if demand collapsed such that imports were redundant, U.S. prices would not need to rise. This seems unlikely given the recovery underway in U.S. manufacturing.

If Chinese prices collapsed and U.S. prices remained unchanged, that too would be a scenario under which the U.S. market could find balance without higher prices. This is a risk but the odds of this scenario occurring are low, at least in the short run. Chinese steel production just hit a new all-time high despite rising prices, which suggests that Chinese demand is proving sufficiently robust to require high prices. China’s steel exports have also fallen almost in half as booming demand calls steel back to China’s market that had once been available for export when prices were lower.

Should this change and, in the future, Chinese production overwhelm domestic demand, we would expect this oversupply to lower prices in China and to re-open the outward flow of steel to other markets. This is a risk, however, the odds seem low at this time with China actually beginning to import billet, an intermediate form of steel that China had dumped on the world when its steel market tipped into painful oversupply in 2014. We monitor these markets daily for signs of change.

In Conclusion

For the reasons above we are constructive on the near-term outlook for steel prices in the U.S. We expect them to remain firm or to rise as the market uses price to balance supply and demand. Note that this argument has nothing to do with the pending result of President Trump’s ongoing Section 232 investigation to determine whether steel imports into the U.S. threaten our national security, a new gambit in international trade policy. However, it’s unlikely that this investigation’s results can harm the U.S. steel industry, since such protections were never available to it in the past. This can only support our expectation that prices should rise.

Karl Popper, a disciplined observer of logical thinking, wrote that the best scientific theories could be easily falsified. The point he was making was that the clearest thinking was structured such that its expectations could be easily tested. The steel arbitrage model we describe here is a clear example of this kind of thinking. It tries to explain a complex reality simply with clear and powerful signals about when to be bullish and when to bearish. Its construction required decades of experience in the steel markets, some of it quite painfully earned.

I hope that this deeper study of the U.S. steel market has explained the simple yet powerful principle of arbitrage, the process by which the market moves prices to balance supply with demand by either attracting or repelling U.S. steel imports. Furthermore, this framework also shows how we are able to change our minds when the facts change. We think John Maynard Keynes would approve. •