Chief Conclusion

Portfolios fail when discipline fails. I believe the best discipline is to create a detailed financial plan and use its goals and constraints as the guidelines to construct a portfolio that meets those needs while taking the least amount of risk possible. Successful long-term investing is not about being brilliant, it’s about being disciplined. With many markets at all-time highs, now is the time for clients to educate themselves about what may go wrong. We are in this together. I need your help.

After reflecting upon the experience of nearly twenty years of professional investing, I have concluded that investing is a strange way to make a living. It requires the daily safe operation of a task that will take years to complete.

Accordingly, successful investing is a like a journey to a far-off destination. The goal is to arrive at your intended destination, safe and on-time. Any problem along the way, if it is severe enough, can keep you from a safe and timely arrival. So in preparation for the journey, we need not only a map that we can use as a guide but also the tools to overcome the difficulties we may face.

To Get Where You Want to Go: Start with a Road Map

Before being software that was loaded on our smartphones, maps were made of paper or plastic and showed the web of roads, highways, and landmarks that help us get from our origin to our destination. In our investing analogy, the best map is a financial plan. The plan takes into account all the twists and turns we can foresee along the way: monthly income needs, emergency funds, and goals for the journey such as charitable giving. I know this sounds both boring and deceptively simple but, make no mistake, there is power in simplicity. Be sure you get this part right if you want to succeed.

Months of Boredom Punctuated by Moments of Sheer Terror

If you travel long enough, the months of monotony are sure to be punctuated by moments of sheer terror along the way. A split second swerve to avoid an accident may make all the difference between a safe arrival and a painful delay – or something far worse.

The movie “Sully,” one of my family’s favorites, illustrates how important this can be. This movie stars Tom Hanks as Captain Sullenberger, the pilot who glided his plane to safety on the Hudson River after losing all of its engines during takeoff. It was a miraculous landing. Captain Sullenberger’s forty years of experience and 20,000 hours of flying time no doubt helped him make a split second, unorthodox decision that saved everyone on US Airways Flight 1549.

I admire the captain’s nimble reflexes and creativity but admit that in one respect Captain Sullenberger’s task, as amazing as it was, is actually easier in one way than the burden faced by investors charged with managing other peoples’ money. He was the sole decision maker piloting his plane for the benefit of his passengers. They had no role other than to sit and hope for the best. Investing other peoples’ money is more complicated than that, because in our analogy, the passengers are clients that get a say in the piloting and can veto the pilot’s decisions! After all, it’s their money that we are managing.

I admire the captain’s nimble reflexes and creativity but admit that in one respect Captain Sullenberger’s task, as amazing as it was, is actually easier in one way than the burden faced by investors charged with managing other peoples’ money. He was the sole decision maker piloting his plane for the benefit of his passengers. They had no role other than to sit and hope for the best. Investing other peoples’ money is more complicated than that, because in our analogy, the passengers are clients that get a say in the piloting and can veto the pilot’s decisions! After all, it’s their money that we are managing.

The Importance of Communication and Education

This is why it is so important that we communicate so frequently with our clients along our shared journey to their portfolio’s destination. Even if our research team is making all the right decisions, our clients need to understand those decisions. Otherwise, we could have multiple conflicting hands working at cross purposes at the controls of our investments and, in the confusion, risk a rougher landing than Captain Sullenberger’s “Miracle on the Hudson.”

If this were to happen at the wrong time, such as during the chaos of the market’s periodic “tail risk” events, it could seriously compromise our ability to affect the best outcome. In the financial markets, “tail risks” are both rare and catastrophic. They are unlikely events which happen unexpectedly from time to time, with the most severe of consequences. The time to study them and prepare is when the markets are hitting new all-time highs, as they are now.

Recommendations for Further Study

Accordingly I wanted to recommend two books to our clients that can help promote better outcomes especially during those rare but tumultuous times through which we will have to navigate together at some point. These books focus not on the mundane day to day management of a portfolio as we travel on our journey together, but rather on those inevitable brief but chaotic moments when financial tail risks arise that can make or break the journey.

These times will come. These are part of the challenges that we will face together. We have studied them. You should too.

The first is by Charles Kindleberger, the dean of financial crisis literature. If you read only one book on this topic, read his “Manias, Panics and Crashes: A History of Financial Crises” published in 1978. He outlines how cycles of envy, greed and fear drive the never-ending cycle of boom and bust, and makes his points by drawing from past crises. This book’s study of history was a lifesaver during the financial crisis for those who took the time to educate themselves.

The second must-read book about the known and unknown risks in the market is “The Black Swan: The Impact of the Highly Improbable” by Nassim Nicholas Taleb. Taleb is an investment professional who polished his craft by the study of risk, in particular how to devise portfolios that would profit from extreme and unexpected events - from financial tail risks. Taleb’s take on risk is different from that of Kindleberger’s in that Taleb encourages us to think more expansively about the future, to contemplate how to deal with risks that have never happened before. Certainly my investing during the financial crisis benefited from Taleb’s work.

Educate Yourself Before Your Journey: Don’t Be a Turkey!

The best part of Taleb’s book is his story of the Thanksgiving turkey. Below we quote extensively from his book:

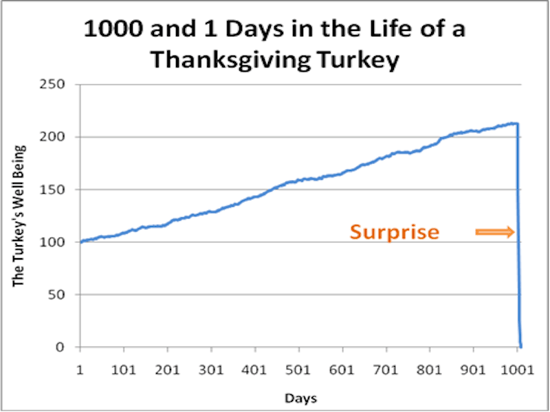

Consider a turkey that is fed every day. Every single feeding will firm up the bird's belief that it is the general rule of life to be fed every day by friendly members of the human race looking out ‘for its best interests,' as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief…Consider that [the turkey's] feeling of safety reached its maximum when the risk was at the highest!

But the problem is even more general than that; it strikes at the nature of empirical knowledge itself. Something has worked in the past, until — well, it unexpectedly no longer does, and what we have learned from the past turns out to be at best irrelevant or false, at worst viciously misleading.

The chart below shows in a graph a Thanksgiving turkey’s well-being from birth until the day before Thanksgiving. With low volatility progress marches inexorably upward and to the right – until it fails catastrophically.

In Conclusion

If successful investing were easy, everyone would do it. It takes a combination of continued skillful, if boring, execution that will be punctuated by brief but intense periods of sheer terror. Even those investors who have been fortunate enough to find the rare Captain Sullenberger to pilot the plane of their portfolio must educate themselves to stay disciplined to their financial plan through markets both good and bad.

We learn from Taleb that, even at new all-time highs, we should remain vigilant to the risks in our world. Some we can predict by the study of the past, as Kindleberger encourages us to do. Others lie in wait for us in the future, unseen. Will we be worthy of what is demanded of us? There is a lot riding on that answer. We have educated ourselves to improve our odds. You should too. •