Chief Conclusion

Our recent research trip to Ireland’s “Kilkenomics” Conference strengthens our belief that the recent lull in Europe’s ongoing sovereign debt crisis will prove temporary. Countries that have adopted the Euro as their currency are especially vulnerable to nationalistic populism. Divisive politics are paralyzing governments, disabling them from answering the challenges of their citizens, and have led to an explosion of asset buying (quantitative easing) by the world’s central banks. The great paradox of our time, how we can have the politics of the 1930s yet the markets of the 1990s, may be explained by central banks “overcompensating.” Watch this space as central bank purchases decline in 2018.

What I Learned at Kilkenomics in Ireland

Last weekend I attended the “Kilkenomics” economics conference in Kilkenny, Ireland. David McWilliams, the brilliant Irish economist who foresaw the 2008 Global Financial Crisis, has sponsored it for the last eight years. The goal of the conference is to explain simply how economics impacts our daily lives and what we may reasonably expect the future to hold.

Numerous leading economists and financial experts have presented at this unique conference in the past, such as the author of “The Black Swan” Nassim Nicholas Taleb and the former chief economist of bond giant PIMCO Paul McCulley. This year’s speakers included Yanis Varoufakis, the former Greek Finance Minister, Patrick Honohan, the former Governor of the Bank of Ireland, and Dr. Steve Keen, who I consider to be the world’s foremost expert on debt’s impact on the economy.

Their work and actions have been at the heart of some of the most important issues and events in global finance. So it was with much excitement and anticipation that I boarded my flight in Fort Myers to begin the eighteen hour journey to a tiny medieval Irish village, half a world away.

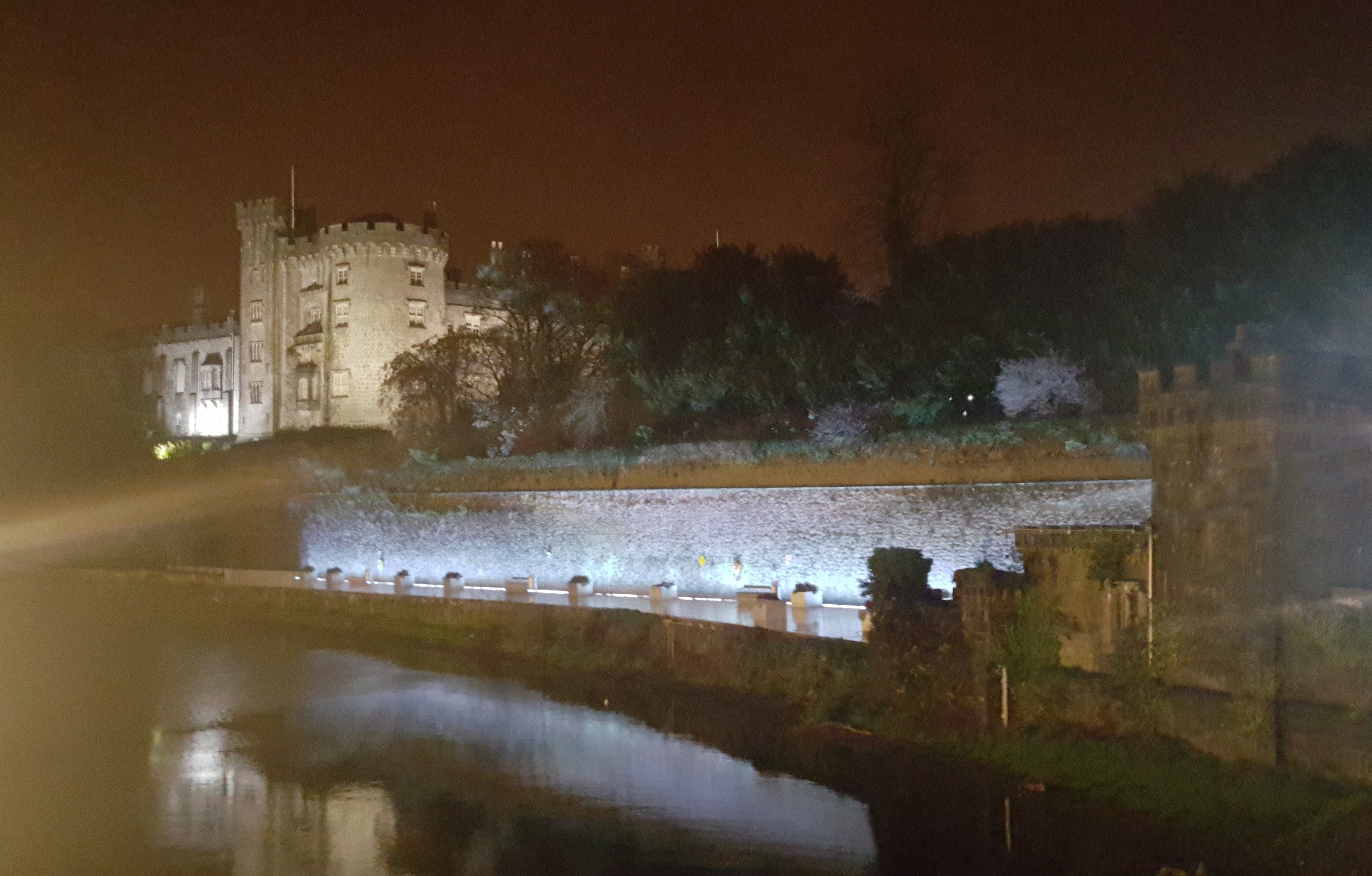

Kilkenny Castle in Kilkenny, Ireland. Source: Lewis Johnson

Europe’s Debt Problems Are Not Over

I made the long trip to Kilkenny to continue my long-running research into the toxic debt situation of countries in Europe who have adopted the Euro as their currency. The research pieces I have authored on this topic are too numerous to recount here, but have grown to a length of almost 100 pages over the last three years. Shoot me an email if you would like the full white paper on this topic.

One of the most powerful observations from the conference was that I was the only American in attendance! We Americans are a notoriously insular people, but I still find this shocking if, sadly, unsurprising. It is the nature of tail risks, such as this cycle’s evolving European debt crisis or last cycle’s subprime mortgage crisis, to fester in plain sight until it explodes to the near universal surprise of observers and pundits. This paradox of inattention means that the near total absence of interest among my fellow Americans is strong confirmation that my fears are well-grounded. I have seen this movie before. It has a bad ending.

Calling Things by Their Proper Names: The Arc of Nationalistic Populism Globally

Another realization from the conference was that you could trace the now roaring conflagration of nationalistic populism in western democracies to the small embers that began to glow in Greece in 2014. The rise of SYRIZA and its mandate to re-negotiate the terms of the Greek bailout was the first spark to kindle the tinder left behind by the Global Financial Crisis. What fueled its fires globally was the seeming failure of the status quo, of centrist governments, to meet the economic expectations of their citizens.

Discontent is now leading to full regime change in the U.S. and abroad. This is one of the dominant trends of our time. “Brexit,” the rise of Trump, and - most recently - the separatist movement in Catalonia all owe their heritage to the regime change in Greece. The key difference is that some economies have institutions that can weather these political shocks better. These economies tend to have their own currencies, central banks, and unified taxing authorities. The United States and England have these. Those countries who have adopted the Euro as their currency do not. That’s the problem.

Europe’s Hotel California, the Euro

This important distinction means that formerly sovereign nations in Europe that adopted the Euro as their currency find themselves in the Hotel California, where “you can check out any time you like, but you can never leave!” This includes France, Italy, Spain, Portugal and many other smaller countries.

Sadly, Europe’s politicians have not explained this distinction to their angry voters. I know, it’s shocking that their politicians lied to them. This could become toxic should nationalistic populism continue to rip the status quo apart and increase the odds of some kind of “exit” from the Euro. The reflexive, deflationary contagion that would spring from any Euro “exit” is something I hope never to witness, though I fear we will be charged with steering client wealth through that very storm.

I was shocked to hear from people who should know better, like Patrick Honohan, former Governor of the Bank of Ireland, that he believed that Britain will “come to its senses” and, in time, may reverse its decision to “exit” the Eurozone. I found it profoundly depressing to witness the quiet desperation with which he and so many others among the status quo clung to this hope – and the (temporary) stemming of the populist tide from the election of France’s young centrist Emmanuel Macron.

More realistic and insightful voices were on hand, however, outside the status quo, to call events by their proper name. One such speaker, Dr. Harald Malmgren, summarized his perception of events by saying “Integration is over. Dis-integration has begun.” I agree with his minority view.

Dr. Malmgren and His Daughter, Pippa, Discuss the Politics of Disintegration at Kilkenomics. Source: Lewis Johnson

We Have the Politics of the 1930s yet the Markets of the 1990s. Why?

Perhaps Dr. Malmgren’s perspective explains one of the great paradoxes of our time, how we can have at the same time the politics of the 1930s but the markets of the 1990s. Could it be that the destructive centrifugal forces of political dis-integration have, through paralyzing all other political action, driven the world’s central banks into a frenzy of activism through global quantitative easing? Now that is a profoundly disturbing thought.

Read These Books to Educate Yourself

If you want to educate yourself further on this topic, which I believe to be one of the most important of our time, you should take the time to read the four following books. The first is George Soros’ classic “The Alchemy of Finance” which explains the principle of reflexivity, which factors so strongly in European debt dynamics. The remaining three are “Adults in the Room” and “And the Weak Suffer What They Must?” by Yanis Varoufakis and Dr. Steve Keen’s “Can We Avoid Another Financial Crisis?”

It is in the nature of tail risks to have a seemingly low probability of happening yet, if they should occur, to create a devastating outcome. You have three choices. The first is to cross your fingers and hope while doing nothing. The second is to take the time to educate yourself now so that, if these tail risks do occur, you can navigate that darker future more profitably. The third is to seek out the advice and counsel of professionals who have studied this issue and are already worrying on your behalf so that you don’t have to. I know which choice I have made.

In Conclusion

As fiduciaries, we are charged with putting our clients’ interests first. To me, a key part of that effort is investing the necessary time and resources in our research - not only into the stocks and bonds that go into our portfolios but also examining the most important tail risks of our day. After all, our investments do not exist in a vacuum. Should these tail risks, such as a re-intensification of Europe’s debt crisis, erupt again; we need to be prepared to take informed actions to defend our clients’ wealth.

This determination led me to Ireland and, sadly, to report back to our clients and friends that this risk remains very real despite whatever you may have read to the contrary. Look no further than Brexit and Catalonia to see the continuous festering of the gangrenous wound that is the Euro. I expect future events in Europe to grow in intensity and danger.

The experience during the last financial crisis showed that even the smartest investors could not hope to master the confusing labyrinth of complex debt dynamics in real time. If you had not studied these issues in advance, you remained hopelessly behind the curve and thus a victim of the cycle. Our pledge to our clients is that, even with many markets at new all-time highs, our research team is not ignoring what can go wrong in the world. I truly wish it were different, and that the world was such that we could with impunity confine our thoughts and research to only the bright and happy things. But this is not that world. Now is not that time.•