CHIEF CONCLUSION

Are tariff announcements breaking the market’s “animal spirits” that are necessary for the health of a historically extended bull market in equities? We examine some important relationships which suggest to us that the market seems quite sensitive indeed to tariff developments. Also, we explore the hypothesis that changes in tariffs may quite possibly be only the most visible of what could be a far larger global change underway in the post-World War II order. If so, the market may be suggesting to us that this trend is the most important thing to understand in the world right now.

“The markets are moved by animal spirits, and not by reason.” – John Maynard Keynes’ 1936 General Theory of Employment

John Maynard Keynes, pictured above, is widely recognized by many as a foundational economic thinker. The role he played in shaping economic thought peaked during the 1930s to the 1950s, though many still hold his interventionist bias in high regard today. Keynes had an interesting journey, blowing himself up as an investor in the 1929 crash with an 80% decline in his net worth and re-emerging as a value investor.

John Maynard Keynes, pictured above, is widely recognized by many as a foundational economic thinker. The role he played in shaping economic thought peaked during the 1930s to the 1950s, though many still hold his interventionist bias in high regard today. Keynes had an interesting journey, blowing himself up as an investor in the 1929 crash with an 80% decline in his net worth and re-emerging as a value investor.

Lord Keynes got a lot of things right, for which he is appropriately respected. Probably the most prominent examples of such include his interwar views. For instance, Keynes’ clear vision into an uncertain future was unrivaled on the topic of the fate of the German economy and its people after World War I.

Keynes believed strongly that the unduly oppressive burden placed on Germany by the Treaty of Versailles, which many people believe led directly to the destruction of the German economy and the rise of Hitler, would end in tragedy. He turned out to be correct.

Keynes was also dead right, and almost alone in his view, that in 1925 while Churchill was Chancellor of the Exchequer, the English currency was pegged at too high a value, which led to an extended stagnation and depression. Thanks to such insightful analysis, Keynes’ standing rightfully grew in the economic community.

I must admit, however, that I have never been a fan of Keynes.

Keynes would in time, come to share my own dubious view of his own contributions to economic thinking. He retrospectively observed that “I find myself more and more relying for a solution to our problems on the invisible hand [of the market] which I tried to eject from economic thinking twenty years ago.” Keynes had also once famously said that he changed his mind when the facts change – perhaps this was such an example!

Keynes is known as the founder of “Keynesian” economics which advocates aggressive expansion of government driven activity during a slow down, with an eye to stimulating demand and “managing” the economy. This includes running government budget deficits in times of economic weakness, to support aggregate demand. His theories gained traction in the seemingly widespread failure of markets during the Great Depression. In time, his views fell progressively out of favor particularly after the inflationary 1970s, a failing to which Keynes himself alluded in his quote above.

Nevertheless, Keynes played an important role in many policy forums, probably the most important of which were the famous Bretton Woods meetings, that created the gold-linked global monetary system. This system would guide the world from 1944 until its collapse in 1971 when Nixon defaulted on the promise to honor United States dollar debts with payments in gold.

I thought it particularly relevant to highlight Keynes today, despite my disagreement with many of his theories, for one important reason. The ultimate failure of Bretton Woods, in which Keynes played such a prominent role, was to me only the first pillar to fall of the post-World War II rules-based era that we as the victors constructed. This failure, once conspicuous by its loneliness, is now seemingly being followed by the quickening failure of the prevailing international trade order, once guided by the GATT and its successor the WTO, but which now is increasingly seen by many as outdated or even outright harmful. This conclusion seems warranted given the increasing instances we are now witnessing of unilateral actions and tariffs which are taking place outside of the rules-based system that once guided trade disputes. Is what we are witnessing now really the acceleration of such a powerful and destructive trend – the end of the post-World War II system? I think the answer could be yes.

“Lead the ideas of your time and they will comfort and support you; fall behind them and they drag you along with them; oppose them and they will overwhelm you.” - Napoleon

Failure: Not just for the WTO anymore

Frankly, reasonable people can point to other cracks widening in the formerly foundational institutions of the post-World War II period. Just look at the problems now within the NATO security alliance, the splintering of Europe via Brexit, as well as the widespread reversal in the once dominant mantra of the benefits of the free movement of people and goods across borders. Right, wrong or indifferent, this appears to be the trend of the world today. Disagree with it if you like but fight this trend to your detriment. To me, successful investing is about taking the world as it is, not as you want it to be.

So, I am open to considering that what we are witnessing is the most serious fracturing of the Post World War II order since the 1971 collapse of Bretton Woods, calling into question the trend of 75 years of increasing globalization. The collapse of Bretton Woods defined markets for the next decade. Are we witnessing a similar decade-defining change now as tariffs proliferate? If so, such a sea change in the prevailing global framework strikes me as sufficiently powerful to put the peak in the market’s animal spirits. Time should eventually render its clear verdict. Perhaps, though, the market has already spoken? Is that the message of the charts I display below?

I would reiterate here, as I have many times before, that my job as an investor is neither to opine about the policy choices I want to see, nor their outcomes. That job thankfully belongs to others. My job, rather, is to shepherd capital through uncertain times, making the best decisions I can make for our clients in the face of a largely inscrutable future. I think our time is well spent if we take a few moments to do a deeper dive to study events that I am monitoring, as explained below.

“Once doubt begins it spreads rapidly.” – John Maynard Keynes

What happened in September? That is the question I have been asking myself, especially as I examine the chart below, which shows me that we are now experiencing something which has only happened five times in the last 30 years.

The chart below shows the spread between the market price of short-term LIBOR interest rates now versus the interest rates the market expects to prevail a year from now. (In Bloomberg this is ED1 Comdty – ED5 Comdty). You can see how rare this event is, as indicated by the red arrows below.

All four prior instances preceded interest rate cuts relatively quickly. That’s the first takeaway. The first such occurrence preceded Fed interest rate cuts by about 100 days during 1989. In 2006, this event led rate cuts by about a year – for the first instance – and in the second instance of 2007, by about 45 days during the August 2007 liquidity panic.

These prior instances also anticipated the onset of recessions, albeit typically with varying lead times. For instance, in June of 1989 this occurrence led the onset of an official recession by about 12 months. Later, in December 2006, again interest rates moved like this 12 months ahead of a recession. During 2007 the two instances led a recession first by 4 months, and again the second time in 2007 a recession began almost immediately. It appears to me that what’s going on is a big deal.

I ponder this topic because in my opinion, one of the chief risks the market now faces is that we are ten years into a cycle that, in our now-fading Post-World War II system, has historically lasted no more than ten years. So, the question of “where are we in the cycle” is a key risk management question.

So, again, what really happened when this ratio peaked back on September 17th? It wasn’t just the above ratio that peaked and reversed. Many other important market-based indicators would reverse and move lower. It’s a reasonable hypothesis that Keynes’ “animal spirits” rather than any other fundamental change were at work. This was quite possibly a reaction to the escalation of our current trade dispute with China, which the Trump Administration made official that very day with its announcement of the 301 trade dispute with China (read more about this announcement at this link.)

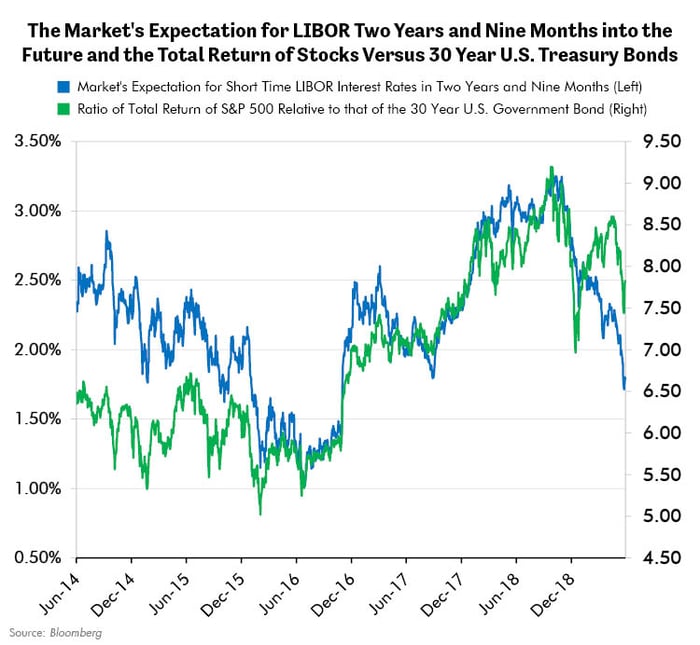

Below I explore a few more market-based indicators that I monitor that may shed light on this important topic. Within two weeks of the above tariff announcement, LIBOR expectations expressed in futures 12 contracts out (in 2 years and 9 months) would also peak in early October and begin to decline. Was that spurious or is it suggestive evidence of a turn in “animal spirits?”

Importantly, it seems this change in the market’s expectation for the trend in future interest rates also marked the peak of the returns of the stock market relative to that of the U.S. government 30-year bond, shown in the chart below side by side. This suggests to me that the market very broadly began to shift its expectations at this time, across many different asset classes. Animal spirits at work?

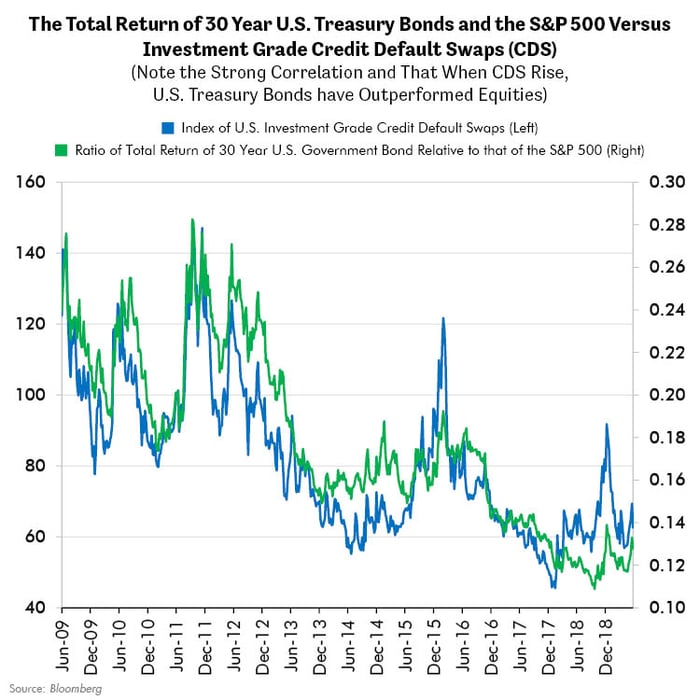

Finally, the chart below examines another important market, that for an index of investment grade credit default swaps (CDS) which are insurance against credit default. When CDS are rising, it is reflective of the market pricing in what it believes to be a rising risk of credit defaults. You can see that while the most recent and lower low took place in early 2018, a more rapid acceleration of the market’s credit fears took place in October. Furthermore, you can also see that October represented an important change when the performance of U.S. government 30-year bonds began to outperform the S&P 500 index, a trend that continues to this day. In fact, its pretty amazing how closely these two track each other. This makes perfect sense to me given my faith in John Exter’s “inverted pyramid” framework of cycles, which we have explained in earlier pieces.

It’s my opinion that a causal relationship is at work in this chart. Credit is the senior tranche of a company’s capital structure: credit is senior to equity. Accordingly, the prospect of growing risk of default in the senior tranche - credit - should naturally express itself even more strongly in risks to the junior tranche - equities.

No one knows what the future may hold, but to me this is a consistent message thus far across many important markets: something happened in September, beginning the very day of the tariff escalation with China. Is it really our tariff dispute with China that is weighing on animal spirits? I think the signs above suggest that it may be but perhaps the market is onto a bigger theme, something far larger.

“The heart has its reasons which reason knows nothing of...” - Blaise Pascal

In Conclusion

I believe the single most important risk management question today is how best to position our investments this late into what is now a historically extended cycle. We must guard against the flawed approach of managing by datapoint, trusting that we alone will recognize the fatal day that this cycle follows the well-worn path trod by all other cycles, and turns.

Our preferred approach is to proactively manage risk by pruning investments our research believes to be expensive while reallocating to investments that we believe carry less risk with better prospective returns. This process has been underway for many months now and continues to this day. However, we are monitoring the markets for the progress of Keynes’ “animal spirits,” and how they may be driving asset prices this cycle. As we do so we ponder if many observers are missing one of the biggest global trend changes in the last seventy-five years as the entire post-World War II order itself may be dying in plain sight. What will succeed it? I wish I knew. But in any event, I think it’s best to face that future with what we believe to be a meaningfully de-risked portfolio.