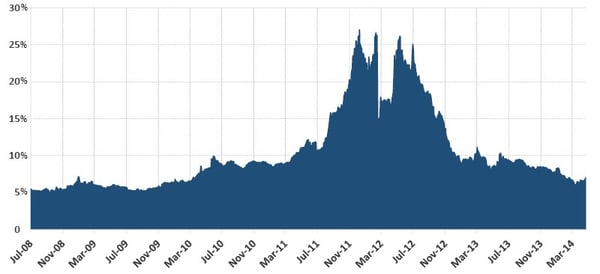

Last week the Greek bond market took a beating after almost two full years of constant improvement. This week’s Trends and Tail Risks explains why you should care and what we are watching for next. The chart below shows the yield the market demands to hold Greek bonds, which peaked intraday at over 30% two years ago.

Greece Gov't Bond Benchmark 30 Year (GGGB30YR Index)

Source: Bloomberg

We like to keep things simple. One of the most important ways we practice this discipline is to understand relationships across different markets. This is why in these pages we so frequently talk about the bond market. After all, bonds are just that: a bond, a promise to pay that may not be broken without consequences – some of them very severe such as bankruptcy. Equities have a right to only the excess left over after the company fulfills its promises to its debt holders. So we can learn a lot about the relative health of the equity market by watching the bond market. As long as inflation rates are stable, as they are now, confidence in the bond markets drives yields lower which means bond prices rise. When bond prices fall during a time of stable inflation it reveals that the market may be starting to question the promise represented by the bond. If the market is worried about the stronger promise of a bond, shouldn’t the market be even more concerned about the health of the equity? This is one of the most important reasons we are always watching the markets for corporate bonds as well as government bonds.

Remember that it was only two years ago when the yields on Greek government debt were north of 30%, so deeply did the market distrust the promises of the Greek government. When the situation appeared hopeless, European politicians managed to band together to bail out Greece – under the condition that Greek politicians pass deep budget cuts. Yields reversed course last week from a trough of 5.9% for the biggest, fastest rise in a year.

Does this recent bond price weakness suggest that the market is questioning the promises of the Greek government again? Greek elections are now underway and with unemployment near 27% disgruntled voters are venting their frustration at Greek politicians. The anti-austerity parties gained a big victory in the first round of voting, with the second vote due in a week. The widespread support for these extreme political parties could undercut the uneasy political equilibrium of the last two years that had reassured investors in Greek bonds.

Could this weakness in Greek bonds herald a broader reappraisal of credit risk, and therefore, equity risk?

We don’t know how this will turn out in the near term, but in the long term there are a few things about which we are confident. First, that the world’s debt burden is very high and will continue to be a recurring theme in the markets and thus in these pages. Second, that by watching these otherwise obscure corners of the credit markets we may see and understand small problems before they turn into large problems. •