CHIEF CONCLUSION

We think that a disciplined investment process is the investor’s most valuable tool in a cyclical, changing world.

"Many who are first will be last, and the last first."

- Mark 10:31

One of the great things about having home-schooled kids is their curiosity. You really do rediscover the world through their eyes.

The other day my oldest son asked me “What happened to all the statues’ noses?” He was curious about why so many statues from antiquity were missing their noses. It’s a question I had never considered. Frankly, when you do, everywhere you look you see noseless statues!

|

|

|

|

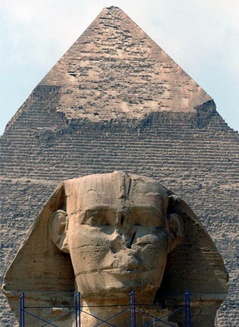

The SphinxSource: People's Daily Online |

In the Jungles of Cambodia's Angkor WatSource: Bpsphoto.com |

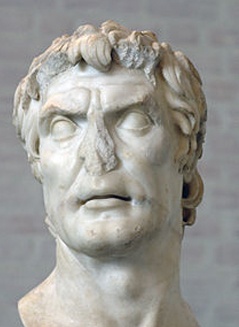

Roman Consul and Dictator, SullaSource: History Stack Exchange |

The massive Sphinx crouching in the Egyptian desert? Noseless.

Sweltering in the jungles of Cambodia’s Angkor Wat? Sans Nose.

Roman Consul and Dictator, Sulla – ditto.

|

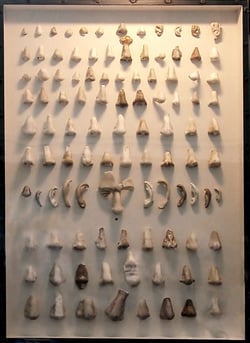

Nasothek Nose CollectionSource: Atlas Obscura |

In fact, statues’ rhinological problems are so common that there is even an exhibit devoted just to the “stunt noses” that stood in for their originals in Copenhagen’s Ny Carlsberg Glyptoteket, the “Nasothek,” shown on the right.

Is there a common driver, over these many thousands of years and in statues of every civilization from every corner of the globe? I think the answer is yes, and that it’s driven by the ceaseless ebb and flow of cycles and leadership changes, as this week’s “Trends and Tail Risks” explains.

First, You Have to Earn Your Statue

It’s a big deal to have someone make your likeness into a statue.

It might demand a lifetime of striving to earn a place of glory commensurate with a statue of your likeness. Former presidents, great generals, philanthropists, poets, statemen – those who have been exalted – is what one needs to be enshrined in marble. Some great contribution, worthy of remembrance.

How then, do such worthies, find themselves desecrated, scorned…de-nosed? Such indignity seems the very abnegation of the original honor. What gives?

I think the answer lies in the timeless reality of change through cycles, and the ceaseless rise and fall of leadership.

De-nosings: Old Leadership Falls Away, Discredited by the New

If there is one thing that my study of history has taught me, it’s everything can change. Politics, economics, war, revolution – all these forces conspire to drive ceaseless change. It’s little wonder that these changes would also leave their mark upon statues as well. After all, statues define a civilization’s ideals, leading traits, and the individuals who epitomize them. This makes them worthy of being memorialized in stone.

One of the easiest paths by which new leadership may establish its own credibility is to discredit the old. Whether driven by deliberate action or the slow erosion of respect, each new era creates its own legitimacy. Nothing succeeds like success!

The financial markets are part of the great sweep of history too. They change as their societies change. Old leadership loses its legitimacy. That of the new rises.

The chart below illustrates perhaps one of the best examples of this cycle in the pattern of returns between two very different equity market segments: small capitalization value stocks versus large capitalization growth.

I have been a professional investor through most of these periods of alternating leadership. Isn’t it remarkable to see how enduring each cycle of leadership can be? For years and years one of the two may dominate the headlines with its performance…until it falls from grace.

With each cycle of leadership change, investors inevitably question: what happened!? This is understandable given how very different each cycle’s outcome may be from the prior one. Such long, alternating cycles of performance can exceed the tolerance of even patient investors.

Long-Term Underperformance is the Price of Impatience

You can tally the price of patience’s failure from the Dalbar studies- a study of investor returns and behavior. It’s enormous. The 2016 Dalbar study showed stunning underperformance of investors’ long-term returns relative to the products in which they are invested – 30% less in equities and a stunning 90% less in fixed income. The psychological pressures described by Dalbar are real. They are the hardest to resist when their pressures are the most acute. Staying disciplined is, I believe, the answer. The data above, suggest patience can improve returns. This demands two things: patient investors and patient clients.

“Momentum” is Not a Strategy it’s a Pathology

When I think back upon these alternating cycles of leadership, perhaps the most trying of all, to me anyway, was the epic run that large cap stocks concluded into the peak of what came to be known as the Internet Bubble in 2000. At its end, the markets had been downright silly – not for a few weeks but for years. Out of favor small caps were incredibly undervalued. Investors seem to have thrown them away in the mad pursuit to “own what was working.” No matter how richly valued they became, investors’ enthusiasm for these “momentum” stocks appeared to remain undimmed.

True to form, Wall Street’s Dream Machine dignified this psychological pathology as “momentum factor investing.” I don’t understand how it can be considered “investing” to buy more of what is working, because it is working, regardless of its value. A more accurate term for that is gambling.

Investing is About Owning Businesses

To me, investing means owning a real stake in a living, breathing enterprise that produces cash flows and seeks to grow over time. Reasonable people attempt to value these businesses by studying their strategies and current financials to understand how their cash flows may change and what those cash flows may be worth in the future.

All this is easier said than done. Thoughtful investors may execute a disciplined investment policy consistently over the years yet still find their efforts alternatively supported or challenged by cycles of leadership. Asset classes can swing in and out of favor, as the data amply suggests, for years.

As investors, we build the best analytical team we can to prepare for the inevitable challenges we will face from these cycles. I couldn’t be more proud of our team. We also scour every corner of the market to find what we believe are the best investment opportunities from which to build a diversified portfolio.

Truly, however, this is only half of the battle. The other half is the open and honest communication of what we are seeing and why, and the decisions we are making on behalf of our investors. Our investment publications therefore play a vital role.

In Conclusion

Despite long cycles of outperformance and underperformance between such opposites as small cap value and large cap growth, it’s noteworthy that their returns for the last quarter century are so similar. I think this is important. For years one style can dominate, casting doubts on the credibility of its predecessor, only to see its opposite successor put it in the shade. In the long run, however, they have both rewarded their patient owners.

The record of the last quarter century suggests that the noses of both small cap value and large cap growth investors can breathe easy. Neither one of these two deserved to be “de-nosed” despite their temporary, albeit prolonged, periods of underperformance. The cycle of disfavor was never eternal. What was old was eventually new again.

The longer I have been at the business of professional investing, the more patient I have become. Perhaps this is progress?

I think we can count on two things. The first is that the market tends to overdo even a good thing. Expect change. Expect an extreme in one direction to be followed by an extreme in the opposite direction. Neither one discredits the other. The second is that my conviction has never been higher that the best foundation for long-term investment success is a disciplined approach to valuing real businesses and holding them for the long run. We cannot expect consistency from the market, but we strive for it in our investment process.