CHIEF CONCLUSION

The Fed is overtightening. It is advancing interest rates at a faster pace than that currently priced into the market. The stock market’s recent plunge, the worst December performance ever, and recent strong rallies in long-dated US Treasury bonds and gold-related investments, suggest the market is starting to price in rising odds of a Fed policy blunder. Now, more than ever, it’s time to understand what really matters to the markets.

"This isn’t right. It isn’t even wrong.” - Wolfgang Pauli

Wolfgang Pauli was a towering figure in the early days of quantum physics. Einstein thought so highly of him that Einstein even called Pauli his intellectual successor. Tall praise indeed! The Nobel Prize awards committee clearly shared Einstein’s glowing view of him when it awarded Pauli the 1945 Nobel Prize in Physics.

Wolfgang Pauli was a towering figure in the early days of quantum physics. Einstein thought so highly of him that Einstein even called Pauli his intellectual successor. Tall praise indeed! The Nobel Prize awards committee clearly shared Einstein’s glowing view of him when it awarded Pauli the 1945 Nobel Prize in Physics.

Pauli lacked Einstein’s graciousness and could be scathing in his criticism. Pauli never hesitated to bark “totally wrong” at inferior work. This was not his most withering criticism, however. Pauli reserved that for thinking so ill-constructed and so poorly focused that it failed completely as scientific thought: it could not even be tested or disproved. To describe such a tangled travesty, Pauli would say “It’s not even wrong!”

Fed Policy is Not even Wrong

Pauli’s quote crossed my mind last week as I listened to the Chairman of the US Federal Reserve, Jerome Powell, outline his committee’s views on future interest rates and the forward path of quantitative tightening, (the reversal of quantitative easing) to shrink the Fed’s multi-trillion-dollar balance sheet. I didn’t like what I heard. Apparently, neither did the market. The market rendered its verdict by printing the worst December in stock market history.

What is going on? I heard Chairman Powell name many things that he and his fellow committee members were watching: household spending, business fixed investment, etc. All of it was backward looking. That’s the problem.

While Chairman Powell noted that “policy decisions…will change if incoming data materially change the outlook,” the incoming data has already changed. The Fed is, seemingly, not monitoring what really matters. What is the Fed missing?

Markets Look Ahead, Always Attempting to Price in an Uncertain Future

This may “only” be the third business cycle I have traded in twenty years of professional investing, but the way I see it, the cycles I have traded number in the hundreds: bonds, crude oil, steel, gold, petrochemicals, pulp and paper, corn, copper, iron ore, soybeans, potash, ocean freight, ammonia, natural gas, and airlines just to name a few. If its fate is dominated by the economic cycle, I have probably traded it. Many times.

The chief lesson from these hundreds of trading campaigns? Markets look ahead. They attempt to price in, not today’s news, but the news of an uncertain future six months or even twelve months from today. If you are determined, like I am, not to be a victim of the cycle but rather to profit from it, then buy and sell dispassionately. Ground your decisions on valuation. Don’t wait for “the news.” In my experience, the news has never been worth the price I had to pay for it.

The forward-looking markets, however, especially the expectations markets, can reward their most ardent students. I believe the most relevant such market right now is the LIBOR interest rate market to which trillions of dollars in debts is linked. This market has been flashing its concern since September. The Fed has missed this message. Recent volatility is the price of that mistake.

“What you don’t know can kill you." -Dave Ramsey

Shades of 1937? Is the Fed Overtightening?

I cannot shake the precedent of the 1937 market. Tell me if this sounds familiar…

A handful of years had passed since a crash tested the faith of market participants in a brighter future. Both the US Federal Reserve and the President stepped aggressively into the void of confidence to stimulate the economy through “quantitative easing” and the fiscal stimulus of huge budget deficits. As these “unprecedented” efforts seemed to gain traction, fear of inflation overtook fear of deflation. Memories of the crash faded. Extraordinary stimulus, especially in monetary policy, seemed somehow superfluous and was cut short to wide acclaim. For one brief shining moment, hope returned. The danger, seemingly, had passed.

“Out of nowhere,” volatility returned. Beginning in March of 1937, the market began a collapse that wouldn’t end until twelve months later, with the Dow Jones Industrial Average 50% lower. Longer-dated U.S. Treasury bonds would become, to universal amazement, the investment of choice for the next ten years, despite the second World War and double-digit inflation. Hmmm….

When I survey today’s investing landscape, I am haunted by the history above. I find little comfort when I survey the recent fact pattern below.

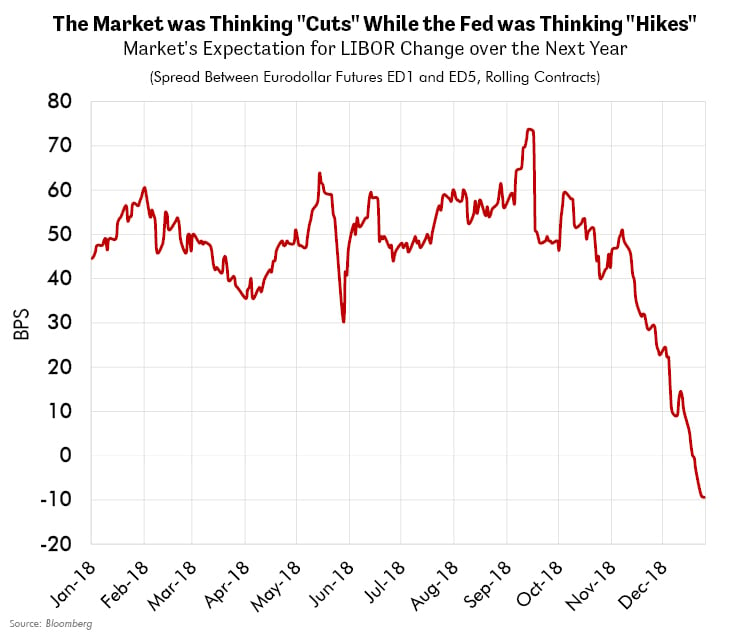

The chart below shows the recent collapse in the expected future path of short-term interest rates in the Eurodollar (LIBOR) market, one of the world’s largest and most liquid markets. In September, this market was pricing in roughly three interest rate hikes of 25 bps each over the next year, which was also the Fed’s view at that time of the appropriate pace of interest rates hikes in the coming year. (These numbers are derived from the spread between the rolling Eurodollar contracts ED5 and ED1 in Bloomberg). Since September, the market quickly lowered its expectations to zero hikes by the time the Fed met in late December. This number is now (as of December 26th) negative, suggesting that the market expects short-term interest rates to fall by the end of 2019. Wow.

Clearly however, the Fed either wasn’t watching this market, or didn’t care, or both. Why? The Fed’s expectation for 2019 was for two interest rate hikes. Some commentators joined the Fed Chairman in focusing on the wrong thing, noting the incremental moderation from three proposed hikes in September to two in December as “dovish” or favorable news. The stock market apparently knew better and promptly crashed. Longer-dated US Treasury bonds and gold related investments, our long-favored portfolio hedges, rallied strongly.

This market is now pricing in that future 90-day interest rates will fall by the end of 2019. While the Fed is thinking hikes, the market is thinking cuts. The December stock market crash is, to me, the market’s damning verdict on a Fed that is not even wrong.

“There is only one side to the stock market; and it is not the bull side or the bear side, but the right side.” –Edwin Lefevre

In Conclusion

Recent price action seems to be a resounding endorsement of John Exter’s “Inverted Pyramid” framework, a foundational framework to our risk management principles. While equities retreated, more creditworthy assets (stronger credits with lower default risk), located nearer the pyramid’s apex, rallied.

While it’s still early days yet, cautious investors may see in the market behavior above the evidence of a cyclical turn, from upcycle to downcycle. If so, such investors may count themselves fortunate that they embraced such [formerly] controversial investments such as long-dated U.S. Treasury bonds and select gold-related investments as formidable equity hedges.