CHIEF CONCLUSION

Long-time readers of our research will understand that our constant messages are the importance of risk management and avoiding losses. While this seems like common sense, our analytical team thought that we should take a few moments to explain the math behind why this is so critical. In a word, better long-term returns! We truly believe that slow and steady really does win the race, as we explain below.

“Nothing hurts worse than the loss of money.” – Livy

Everybody likes their investments to go up. Nobody likes for them to go down. The trouble is that the only way investors can potentially earn returns on their money is by putting their capital at risk. The phrase for this truism in the exercise world is “no pain, no gain.” We think that in the investing world, you could say “no risk, no reward.” The returns, if they come at all, come after investors have taken the risk. So, the key to investing, we believe is taking the right risks and avoiding the wrong ones.

We have devoted many pages to this important concept in the past, most often focusing on the type of risks that we think are the best to take, as we see them. Oftentimes, this takes the form of writing about a stock, bond or industry that we believe offers a compelling lesson. We strive to never make an investment without asking ourselves: what is its margin of safety and how might it perform during a downcycle?

However, today our research note will be different. Today, rather than exploring the merits of an individual investment, we will demonstrate in cold math why we believe that one of the most important things to get right is to avoid crippling losses to the whole portfolio. Short-term setbacks can always appear in any individual investment but the most dangerous of all losses, we believe, take place during the common disaster of periodic recessions through which the economy suffers.

You don’t have to look very hard for painful examples of this. Experienced investors will remember, I certainly do, the 50% bear market in the S&P 500 during the recession that followed the Dot.com boom. More recently of course, investors will recall a similar beating the market took during the Global Financial Crisis from 2007 to 2009.

The good news is that, in the long run, you can reasonably expect that stocks will follow earnings. Earnings have tended to rise over time. The bad news is that, during a recession, the earnings of many companies will decline at the same time, driving down many stocks, a problem which can be compounded as valuations contract during times of stress. This double whammy can set back a portfolio’s long-term growth for many years.

Think of the math: a fifty percent downturn, such as the last two bear markets, means that your investments must double just to get back to even! If you could find a way to reduce or even eliminate such a savage beating, you might be stunned to learn just how powerful that is to your money’s returns. Below we will walk you through that math. The answer may well shock you.

The Amazing Power of Consistent Returns

But before we do so, we want to stress how a more resilient portfolio can give investors’ confidence when they need it the most, when great values appear in the market, which most often takes place during periodic recessions. Its been my experience that the worst possible thing that investors can do is panic out of a well-thought-out investment plan during its most valuable time, when the environment feels the worst and fear is the highest. Make no mistake: such times are when investors really earn their returns.

Remember our framework: you take the risks first, you earn the returns later. A naively academic “ideal” portfolio that is subject to horrendous bear market losses assumes that investors can stomach watching their savings get cut in half, or possibly even more. Is this really a safe assumption? Do you want to bet your entire financial future on it? That’s a risk I would avoid if I could. Below we show what we believe is compelling math to illustrate what we think is a better way forward: a policy of trying to avoid or at least mitigate losses.

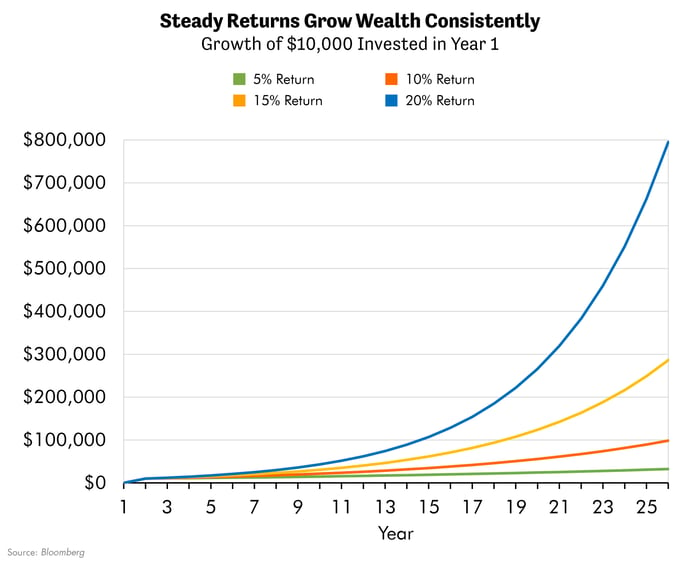

The curves below have the shape that investors love the most: un-interrupted and upward sloping to the right. Nowhere to be found are the periodic gut checks of lost money causing sleepless nights. Its all blue skies, fuzzy white clouds, rainbows, bunny rabbits and unicorns. Furthermore, the math of the ideal world of un-interrupted compounding means there is no lost time clawing back a halved portfolio after a bruising recession. What’s not to like about that? I would like to live and invest in that kind of world.

“Fear is a disease that eats away at logic and makes man inhuman.” – Marian Anderson

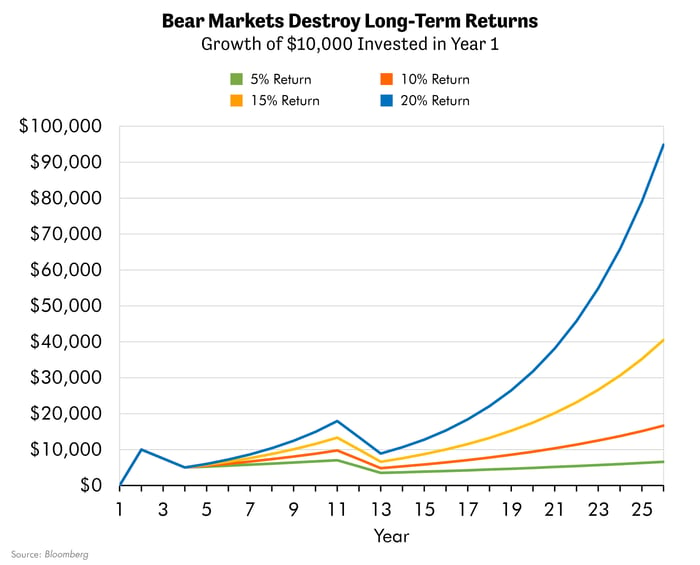

Sadly, the world we all too often live and invest in is a more cyclical world. Its booms are often followed by busts, such as the last two bruising recessions and 50 percent drops in the broader equity markets. Investors suffering through such losses are losing not only sleep, but more importantly time and money. The returns shown by the graph below show losses comparable to the market’s bear market losses of 2000 to 2002, and again from 2007 to 2009. You can see the damage that such interruptions wreak upon a portfolio’s return, as the long-term returns in this illustration are more than 87% less than the returns earned in the more peaceful portfolio above. What a difference! As the saying goes, when you find yourself in a hole the first thing you should do is stop digging. We suggest than an even better outcome is to avoid finding yourself in a hole!

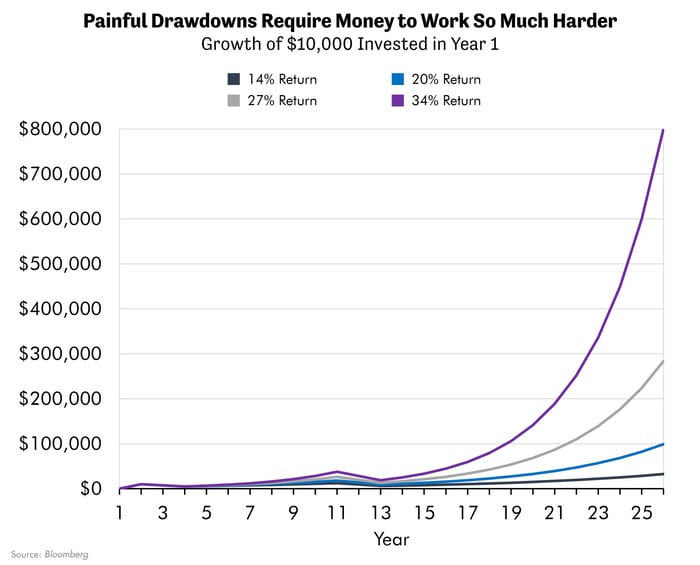

The graph below we believe is equally powerful and instructive. It shows that, after suffering through this example of painful bear markets, investors would require much higher returns, from 68% to 175% higher in fact, to end up with a comparable amount of money shown in the smooth and un-interrupted returns of the first graph. That’s the power of avoiding losses. So, it’s our conclusion that one of the best strategies should include both solid long-term returns during an upcycle buttressed by strong downside protection during the most painful drawdowns, as the chart below demonstrates.

I can think of no more compelling example of the cost of wasted time and lost money. I think it’s a clear example of the power of the ancient fable of the tortoise and the hare, that “slow and steady wins the race.” Thought of another way, don’t put yourself in a position to have to earn the same money twice. Earn it once – and keep it!

In Conclusion

For the reasons we outline above, the goal of our research team is to construct defensive portfolios. If our analytical team does its job correctly, such portfolios should have a different pattern of return. This is not a bug – it’s a feature!

Such portfolios, if they are truly defensively constructed, can be expected to lag the market into the heat of a white-hot boom. However, when the heat of that boom fades, they may also award their owners by mitigating the debilitating downside that robs investors of both time and money, such as in the graphs above.

We believe that more defensive and resilient portfolios provide useful psychological benefits. How? By mitigating the very real risk that manic and stressful portfolio swings may not only rob investors of valuable time and money but, worst of all, break their owners at the worst possible time. For its my belief that it’s during the crucible of the downcycle where the next upcycle’s returns are truly forged.

The tools to achieve this goal include both disciplined selection of individual securities and risk management in constructing portfolios. No one said this would be easy but thoughtful and profitable investing never is.