CHIEF CONCLUSION

The inflation versus deflation debate is one of the most important of our time to the financial markets. It impacts interest rates, which are the key to valuing all financial assets. So – with no exaggeration – this is literally a multi-trillion-dollar question. But who has the answer? With so much riding on it, we take comfort from our long relationships with astute observers whose opinions and insights we have grown to trust. In our opinion, the real bond king is Dr. Lacy Hunt. His views, which are summarized below, are that current fears about inflation are overdone. We have always been confident believers that, in any market environment – no matter how uncertain - there is a profitable way forward for those that truly understand the fundamentals. It’s our opinion that Dr. Hunt understands these fundamentals better than anyone.

Whom to trust? Isn’t that the single most important question we all face in an uncertain financial world? For my money, the Real Bond King is Dr. Lacy Hunt. I say this only after watching and studying the man and his views for more than a decade now. Keep reading for why, in my mind, he has earned his crown.

Whom to trust? Isn’t that the single most important question we all face in an uncertain financial world? For my money, the Real Bond King is Dr. Lacy Hunt. I say this only after watching and studying the man and his views for more than a decade now. Keep reading for why, in my mind, he has earned his crown.

I first met Dr. Lacy Hunt in the fall of 2009 at a meeting of the New York City based Committee for Monetary Research and Education. This educational institution was founded in the 1970s by some of the most prominent monetary scholars and professionals of the day, who – to their credit - in retrospect nailed the most important financial question of their day, how to tame inflation. So, it should have come as no surprise that there I would fortuitously meet the most insightful bond investor I have ever met, the man who I have come to call the Real Bond King.

But I did not always see it that way.

Glittering chandeliers illuminated the hushed room in mid-town Manhattan as Dr. Hunt rose to speak. His topic, appropriately for late 2009, was the monetary lessons from the collapse of the Japanese asset bubble in 1990. This was a timely topic given the calamitous and still fresh collapse of the U.S. financial markets and near-collapse of our financial system. Over the prior years, I had taken great pains to study the Japanese example of a collapsed asset bubble and how that had led to two “lost decades” by 2009. This study had served me well in navigating the carnage of the last downcycle. So, it was with the confidence of market-hardened skepticism that I flipped ahead to scour his slide deck for the errors that surely awaited exposure. Flip as I may, there were none to be found. This was new! To my great shock, I found no disagreement with Dr. Hunt’s views nor the process by which he reached his conclusion.

I was shocked because my views at the time – and Dr. Hunt’s as well - remained controversial and far out of step with the consensus thinking of the day. In late 2009, the vast scope and speed of the “unprecedented” stimulative response by the U.S. Federal Reserve had shocked most observers into forecasting the imminent breakout of inflation. This view I did not share, as my focus was rather on the diseased state of the private banking system, which is the true engine responsible for private credit growth – the real driver of economic growth, according to my analysis. My belief, which was shared by Dr. Hunt in his presentation, was that the impairment of the banking system would keep inflation from building on itself. He believed that Japan’s lost decades held cautionary lessons for the global financial system. His deep study of history and the casual dynamics of the true fundamental dynamics of WHY things happen impressed me greatly then, and still do today. After his speech, I was drawn to seek him out and shake his hand. Since that date many years ago, Dr. Hunt has been kind enough to make time for me periodically, when I have reached out to him to discuss the financial markets. I have come to understand that Dr. Hunt is as gracious as he is insightful.

Long Live the King!

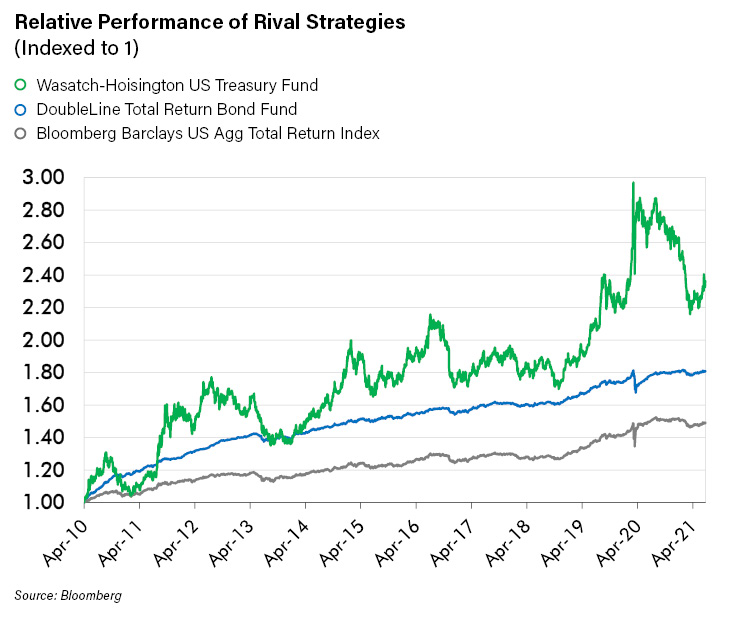

Reasonable people may disagree about the attributes that make a true Bond King. I would submit to you that performance is surely one reasonable definition. Below I show the total return data from Bloomberg, a fabulously expensive though highly useful financial software package that aids our research. Below it shows the total return from investing in Dr. Hunt’s bond strategy, as defined by Wasatch-Hoisington U.S. Treasury Fund, versus a widely used bond index and another well-known bond strategy. The total return of investing in Dr. Hunt’s strategy, according to Bloomberg, is more than 125% in the last 10 years – not bad for a bond fund! And this performance is dramatically superior – nearly twice - to that of other pretenders to the throne such as Jeffrey Gundlach, named by Barron’s as the “New Bond King” in 2011. Mr. Gundlach manages in his main strategy more than 100x the assets of Dr. Hunt’s modest though hugely outperforming offering. Examine the chart of relative performance of these rival strategies below and ask me which one is managed by the true Bond King.

Dr. Hunt’s Framework: How the King Earned His Crown

In the paragraphs below, I will try to summarize what I think are the most salient parts of Dr. Hunt’s framework. However, I encourage you to follow the full flower of his thinking here at Hoisington. I never miss a quarterly commentary, and you shouldn’t either. One key aspect of his thinking is the primacy of the private banking system. Put another way, the borrowing and lending decisions of the private sector are more important than the eye-catching moves of the government and the central bank. When Japan’s epic boom peaked and began to recede in 1990, the pullback in bank lending drove the slowdown that persists to this day more than three decades later. The culprit then – and now – is that the weight of unproductive debt that lies heavy on the economy, sucking the life out of it and slowing it down. As these factors keep nominal economic growth low, so too do bond yields remain low. Perhaps the most profound – and most enduring – of Dr. Hunt’s views from 2009 was how long it would take for an overindebted economy to heal itself. In Japan, three decades later, they are still waiting. Here in the States, it is “only” twelve years later. Do we have two decades more to wait? It’s a sobering thought.

As you would expect from any truly rigorous thinker, Dr. Hunt’s framework is willing to embrace the opposite view from his current thinking – if the fundamentals change. Dr. Hunt has named this fundamental change as a change in the U.S. Federal Reserve’s mandate to make its liabilities legal tender – spendable cash in other words. Right now, that is not the case as the Fed’s liabilities are used to buy other financial assets, which keeps these funds outside of the real economy, cooped up in seemingly ever-rising financial asset prices. For now, at least.

A Man Who Would be Bond King: Russell Napier

If there is only one thing that more than two decades of professional investing has taught me, it’s the importance of open-mindedness – of paying close attention to views that are different from my own, especially if they are thoughtfully and logically expressed. Russell Napier, pictured left, fits this bill more than perhaps any other financial thinker today. While I believe his inflationary fears will prove to be ultimately unfounded, I value his framework. Mr. Napier, whom I have not yet had the good fortune to meet personally, has earned his spurs from two decades of thoughtful writing at the global investment bank once known as CLSA. One of the things I find the most interesting about Mr. Napier is that he only recently changed his long-standing bias towards deflation to embrace a more inflationary outlook. In my experience, it’s important to pay close attention when thoughtful people change their minds on an important topic. Mr. Napier recently did so, to his credit, with a focus on a not-unreasonable topic: growing government control over the banking system.

If there is only one thing that more than two decades of professional investing has taught me, it’s the importance of open-mindedness – of paying close attention to views that are different from my own, especially if they are thoughtfully and logically expressed. Russell Napier, pictured left, fits this bill more than perhaps any other financial thinker today. While I believe his inflationary fears will prove to be ultimately unfounded, I value his framework. Mr. Napier, whom I have not yet had the good fortune to meet personally, has earned his spurs from two decades of thoughtful writing at the global investment bank once known as CLSA. One of the things I find the most interesting about Mr. Napier is that he only recently changed his long-standing bias towards deflation to embrace a more inflationary outlook. In my experience, it’s important to pay close attention when thoughtful people change their minds on an important topic. Mr. Napier recently did so, to his credit, with a focus on a not-unreasonable topic: growing government control over the banking system.

Mr. Napier’s argument, to paraphrase it, is that many governments are now pushing credit growth policies, the risks of which are backstopped by the government. Here we believe Mr. Napier is onto a topic that should be monitored. We would submit that one of the key changes during the late 1970s that broke inflation and led to the last 40 years of falling interest rates was when the U.S. Federal Reserve started to directly limit the growth of banking reserves by allowing interest rates to spike towards 20%. Those days are long gone as the U.S. Federal Reserve – and many other central bankers like it – remain fixated on the price of money (interest rates) rather than the direct amount and flow of bank reserves. This allows the dysfunction to build up in the banking system, that Dr. Hunt has appropriately identified in our view, which is why we remain solidly in Dr. Hunt’s camp as long as the banking system data is supportive.

In Conclusion

There is no substitute for jumping in someone’s foxhole and experiencing the ups and downs in real-time of a cycle with them. I did that with Dr. Hunt in 2009. He and his fellow deflationists have been correct for more than a decade now since Central Bank policies were instituted that led some to believe inflation would explode. Even more important, the data that would be expected if he were correct in terms of growth in lending, reserves, and other banking measures have turned out to support his views. Dr. Hunt also has a reasonable framework to explain how the current course could change and enable all the central bank money creation to lead to inflation in a scenario different from what is occurring today. For those reasons, it appears more than prudent to retain our view of lower interest rates for longer and to invest accordingly. All the while, we are paying attention to the data and of course to the thoughtful experts who appear to us to clearly understand the dynamics of the situation. If the data changes, or if the current rules of the game change, you should expect our views and investments to change too.