CHIEF CONCLUSION

Successful investing doesn’t have to be complex. Sometimes the simplest insights can be the most powerful – if you have the conviction to follow them. We derive our conviction from our framework, built over many years, for how the world works.

The other day I was thinking back on my journey as a professional investor. So much has happened in that time. Emerging markets and value stocks went from first to worst in the Asian Crisis. Tech and growth investing dominated the world and then flamed out, crashing more than 80%. China rose, breathing new life into emerging markets and helping to create the biggest commodity bull market in 500 years while also driving a strong cycle of outperformance by value stocks. The U.S. housing cycle boomed and then burst, giving birth to the Global Financial Crisis out of whose low-growth ashes tech once more rose to dominance. Commodities spiraled lower and lower in utter despair, falling more from their peak over a ten-year period than their storied crash in the Great Depression, taking the performance of value and international stocks with them. So, the investing world has changed many times. But there is one moment, one vignette, frozen clearly in my mind that helps put all this history into context and gives me hope that we are building tools we can use to outperform in a changing world.

That moment is the first investor conference I attended as a newly minted Wharton MBA early in my first days as a young equity analyst at T. Rowe Price, which now manages north of $1 trillion. On that afternoon in late 2000, the elevator doors opened onto a penthouse vista I will not ever forget. This Manhattan investment conference was sponsored by a storied investment bank who had reserved the top floor of the most luxurious hotel in New York City. In attendance where dozens of CEOs of publicly traded companies there to meet with hundreds of investment professionals, among whom I was now numbered. The room’s high windows dazzled with a panoramic view of Manhattan’s skyscrapers. Dozens of bouquets of white roses in deep vases glowed in the light that streamed in from the floor to ceiling windows. Cologned executives dressed in expensive, impeccable suits, hurried from meeting to meeting guided by their fawning handlers. A low murmur of hushed conversation and clinking glasses filled the room. I soaked it all in. It was a million miles away from my youth in Montgomery, Alabama but it was everything I had hoped it would be. I had fought many battles and overcome many obstacles to earn my place there. I soaked it all in.

And then it hit me.

How could I hope to compete – and win – against all these people? Getting here was only the start of the contest. In the room were some of the world’s best-trained investment professionals. Hundreds of them. All bright. All hard working. They too had attended the best schools. They too now came from the oldest and largest investment firms on Wall Street. They too were backed by limitless research budgets and every tool known to the business of investment analysis. How was I supposed to see something they would miss? It was intimidating.

But then the answer immediately came to me because I had confronted the same challenge at Wharton. I was a former textile lobbyist who had never used Excel (Microsoft’s spreadsheet software) until my first day at Wharton – competing with some of the brightest young financial minds in the country. There was a long list of highly technical subjects where they had me hopelessly outclassed: econometrics, dense finance calculations, and byzantine accounting rules that seemed to be a whole other language. I had almost given up hope in my first quarter at Wharton that I could compete and win at anything there. But then I discovered, in our strategy classes, that relative to my peers I was talented in quickly seeing what mattered and in thinking creatively about complex problems – and in communicating solutions. It taught me an important lesson: if your goal is to be a world-class competitor, you must focus rigorously on what are truly your best strengths. There are just far too many bright people out there to do anything else and hope to win.

Ruthless Focus on Cause and Effect

I have dedicated these last two decades trying to learn why things happen in the markets. I would keep digging and digging until I finally got to where I was confident that I understood the forces making things happen in my investments, so I could better hope to predict the path they would take. One of the first sectors for me where this discipline really flowered was steel. As a young analyst at T. Rowe, I guided our firm to be the largest single investor in the U.S. steel industry in mid-2003. At the time 45% of the sector was in bankruptcy, so my bullishness mystified many of my peers. But I knew a secret.

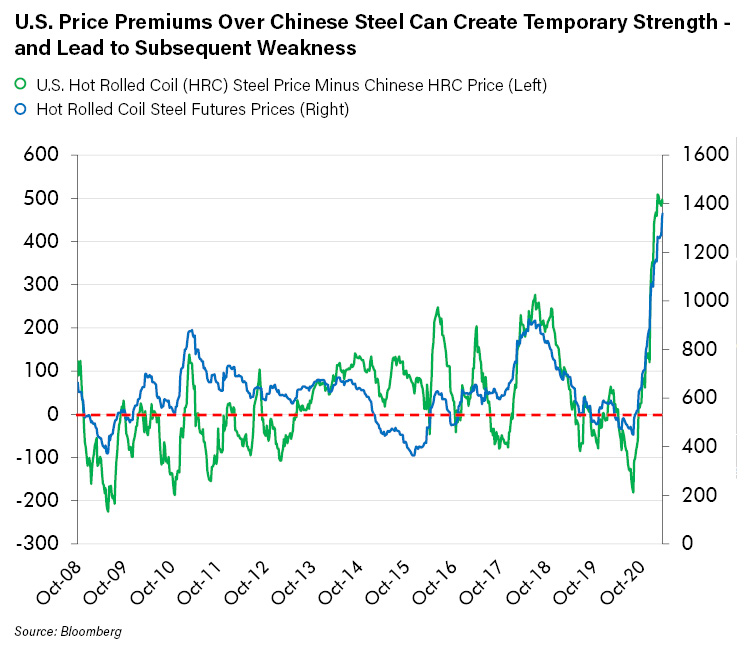

My one powerful insight, that proved to be so valuable was what drove U.S. steel prices. I had concluded that U.S. steel prices were driven by the gap between our prices and those overseas, particularly those in China, the world’s largest steel producer. This happens because the U.S. cannot internally make all the steel it needs. This excess demand must be met by external supply - by imports. This requires a sufficient incentive price to attract those imports to our shores.

So, when such as now, our prices trade at a huge premium to those overseas, our market is offering a lush arbitrage profit for a trader or steel producer to deliver steel into the U.S. market to capture that price premium. This attracts steel imports which can oversupply the market and crash prices. Conversely, when U.S. steel prices trade below those of our competitors – as they did in mid-2003 and were especially below the Chinese prices – this low U.S. price and the losses that would come from selling steel in the U.S. repel imports and lead to falling total supplies in the U.S. relative to demand and thus higher prices. The chart below is a perfect example of these forces at work.

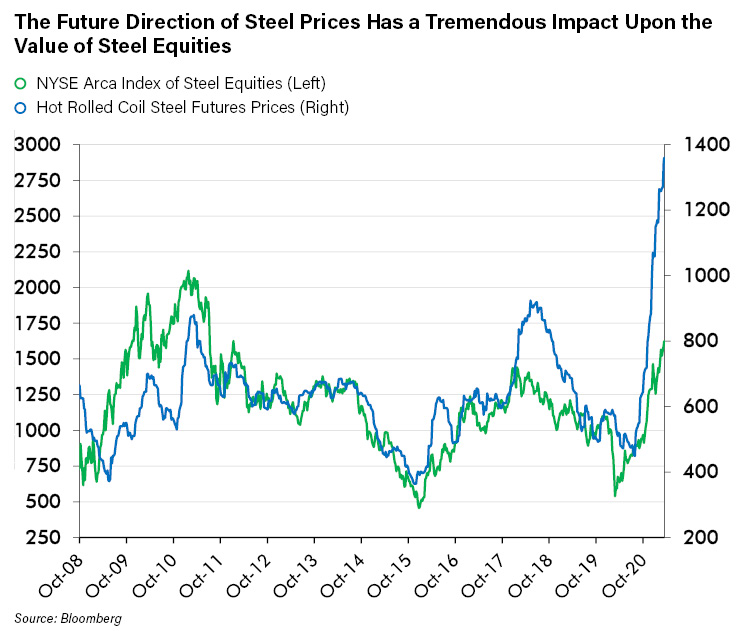

Isn’t that a simple insight? You would not think that this simple insight would have been worth billions in future profits in 2003, but it was. I just kept at it until I figured it out. And I did not underestimate the power of an obvious and simple truth. When I saw how obvious it was, I invested aggressively to match my conviction. The chart below shows how closely an index of steel equities moves with U.S. steel prices, and how valuable this insight was – and still is I would argue.

I wonder why others missed this truth then and are missing it again now. Now, of course, this short-term inventory cycle (also known as the Kitchin cycle seems to be peaking. What is so hard about this to understand? Maybe others do not dig deeply enough? Maybe they lack conviction in the causality behind this relationship? Or maybe they get it but lack the courage to invest? Or maybe their biases or intellectual inflexibility keeps them from being able to be bullish when the data says they should be, and bearish when the data says they should be? Maybe they just cannot believe investing can really be this simple sometimes? For whatever reason, as long as investors do not understand what drives steel prices, and the equities that make them, there should be a profitable opportunity for investors that do understand the forces. We think those forces will drive down steel prices, and steel equities too, – at least in the short run. However, we do believe that steel prices will work higher over the long run, for reasons that we describe below. So, we may be getting ready to buy that dip.

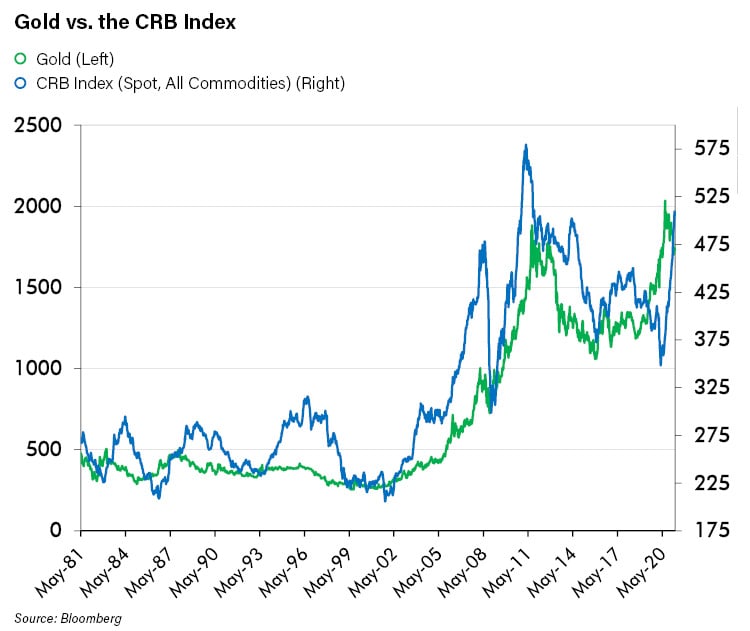

Gold Leads and Commodities Follow

Our long study of gold and the commodity markets have given us tremendous long-term conviction in a simple insight: gold leads and commodities follow with a lag, as the chart below suggests.

The fundamental causal reason that gold leads is, as a currency, gold’s moves reflect the changing value of the dollar. A rising gold price in dollars means that the value of the dollar is shrinking. Microeconomics teaches us that the long run price of any commodity reaches equilibrium where its price is equal to its marginal cost of production. So, a higher gold price now is a forecast for higher commodity prices later, as the marginal cost of production rises with a lag to adjust for currency depreciation. People who understand this causality will be bullish on commodities when gold is high and rising, and bearish on commodities when gold is low and falling. Although this insight does call for favorable tailwinds for the entire commodity complex, certainly some commodities will benefit more than others. Our research seeks to identify the best ones, which will be a function of many variables such as supply and demand, future supply growth, and other drivers.

Where We Are in the Cycle: We Could See Short-Term Weakness as the Kitchin Inventory Cycle Peaks, but Believe Higher Gold Prices Suggest a Longer-Term, Structural Bull Market for Commodities.

We have a bullish long-term view on commodity prices and on the equities that produce them. Gold’s near doubling off its lows gives us that long-term conviction. However, we must note that many prices have moved very far, very fast. Lumber prices are up 330% from their lows in March 2020 and prices for hot rolled coil steel are up 200% in the same period. Cycles rarely proceed in a straight line – that is why they are called cycles! If the gold price were to meaningfully decline and remain depressed, this framework would lead us to reconsider our longer-term bullishness. That is not our current view.

The next move in many commodities, however, especially more industrially sensitive ones like steel, may be lower – in the short run. The real driver of short-term weakness is unlikely to be sentiment, or seasonality, or management actions or whatever else observers may mislead themselves into believing. We prefer a simple and more elegant insight, one that we think the framework above supports.

That framework sees the driver in steel as crystal clear: U.S. prices are in the zone to be unsustainably high and could reverse as their premium to the rest of the world grows to levels that will attract higher import supply sufficient to overwhelm demand – in the short-term. Furthermore, our experience is that volatility in steel prices is often driven by changes in the industrial economy’s Kitchin inventory cycle, where extra demand from hoarding extra inventory may help drive prices up, and a reversal to dishoarding from overly inflated inventories may help drive prices down. If so, then one could expect short term weakness to spread beyond steel to other industrial commodities. Our causal framework would lead us to buy that dip – should gold prices remain high and rising, which is our current expectation.

In Conclusion

Our framework is that things happen for a reason. Our goal as a research team is to understand the causal drivers behind why these things happen. Above we outline two conclusions that have served us well over time in the steel market and in gold. We have spent decades trying to perfect a simple and transparent framework for how the world works and the role that cycles play. When the data that runs through our framework is bullish, we are bullish! And when the data that runs through that framework is bearish, we are bearish! Our framework does not change but the data changes. Oftentimes the drivers of this change are forces that investors could reasonably predict if 1.) they focused on the simple truths that really matter and 2.) understood how the world works. As of now, this is our simple game plan as the Spring turns to Summer. As always, you should expect our investments to be guided by our framework and the changing data that runs through it.