China has devalued its currency by almost 4% in two days. What does it mean for China and global asset markets? This week’s “Trends and Tail Risks” takes a walk down memory lane back to the Asian Crisis of 1997 to explore this issue.

Memory Lane: Past Currency Devaluations

It’s funny the things that pop into your head when news first flashes across the wire. When I first learned of China’s “one time” currency devaluation on Tuesday – which was devalued again today - I thought back to the beginning of the 1997 Asian Crisis. I was in Bangkok, Thailand at the time in October of 1997. I was in the process of applying to graduate school programs to get my Master of Business Administration (MBA). I wanted to translate my passion for investing, at that time only a hobby, to a full-time paid career. In fact, I was at that moment finishing up my application for the University of Pennsylvania’s Wharton School, from which I would graduate in 2000 with my MBA in Finance.

The unfolding crisis caught my attention very vividly. I had just arrived into the still oppressive October heat and humidity of Bangkok after a long flight from the States. I was drained from the trip but was excited to be in Bangkok and to stay at the luxurious Sukhothai hotel, which I could only afford because I received the diplomatic rate as part of an official U.S. international trade delegation. Despite the fact that it was near midnight local time, my body thought it was still on Eastern Time. I was unable to sleep. I switched on the TV to watch CNBC and pass the time. That was a bad idea.

Bob Pisani was walking the floor of a totally quiet New York Stock Exchange – this is back when people and not machines did the trading. The exchange had fallen so dramatically that day that it had been halted! It made for an eerie scene. CNBC’s talking heads were speculating as to why the market had crashed. Opinion seemed to center upon the unfolding currency devaluations underway in Asia – with Thailand as ground zero!

I looked down at the handful of Thai Baht I was holding and wondered at the fate that had put me at the center of such tumultuous financial times. I remember having a tough time sleeping that night – partially from the jet lag but also because I was pondering the timing of my transition into the investment arena. Could the seemingly fragile market hold together until I could graduate with my MBA and become a professional investor? Or would the crisis spreading from Asia derail my plans? Of course the Asian Crisis did spread to become one of the dominant themes of the day. Emerging markets got pounded while the U.S. market soared. It would be a strange time in the markets. While finishing my Finance degree at Wharton, I received a job offer from T. Rowe Price on the last day of the millennium. Within three months the Nasdaq would peak and fall almost 80% - but my new career in investing was secure!

Lessons from the Asian Crisis

Of course, the Asian Crisis didn’t really start with the huge, panicky 1997 devaluation of the Thai Baht, although this certainly grabbed everyone’s attention! I would submit that the real beginning of the Asian Crisis took place three years earlier when China devalued its currency by 33% early in 1994. With this major devaluation a new trend of Asian currency devaluation began – although few knew that at the time. Quietly, as they always do, a small trend became a big trend while few were looking. Currency devaluations were no different. Devaluations can be particularly corrosive to financial stability because when a country devalues its currency, it lowers its cost position relative to its competitors. A newly devalued currency makes exports more competitive and makes imports more expensive. Little wonder that so many countries resort to currency devaluation!

The Current Cycle of Asian Currency Devaluation

It was Japan, not China that kicked off the current – still developing (?) – trend of currency devaluation. A strong Japanese Yen had for years mired Japan in deflation with no nominal growth and the world’s lowest bond yields. The new administration of Shinzo Abe in Japan won a landslide election in 2012 and kicked off a forceful policy of currency devaluation. In fact, Japan even went so far as to appoint an official “Minister of Yen Devaluation” to make clear its commitment to weaken the Yen. While many traditional economists applauded this orthodox policy move to break Japan’s cycle of deflation, this devaluation nonetheless stole growth from Japan’s trading partners.

At the time, when only Japan was aggressively devaluing, it appeared as though the world’s economy could take it. But were there really no unintended consequences? Surely the lessons of the Asian Crisis would have suggested that if there was indeed a benefit from Japan’s devaluation, there must also be a cost. And there was. The cost was that in devaluing its currency, Japan exported its deflation problem to the rest of the world.

Now – almost three years later – I can easily identify the growing list of countries seeking to devalue their way to prosperity: Japan, Europe, now China. Who is next in this unfolding global trend? Where is the tipping point? How much deflation can countries export to their trading partners before the world itself turns deflationary? Where is the point that an increasingly deflationary world slows down enough to break the back of the already weakening U.S. credit markets? For more than a full year this publication has been highlighting the spreading weakness in U.S. credit. (Is Credit Quality Peaking?, 08/06/2014; Credit: Caught Leaning?, 08/13/14).

As always big trends started small. This publication first highlighted the growing risks of a Chinese currency devaluation on September 24, 2014 (The Dark Side of China). There we noted that China’s currency was linked to the dollar, and that extreme U.S. dollar strength – and therefore strength in China’s currency – was literally the last thing that the country needed. Below is a more extensive quote of my thinking at that time:

Europe has now joined the ‘beggar thy neighbor’ policies of Japan, which has cut the value of its currency vs. the US dollar by more than 30% in the last few years to ‘stimulate’ the Japanese economy. These competitive devaluations by our trading partners harm not only the U.S. but also threaten China – as long as the Renminbi remains relatively fixed in value to the U.S. dollar. In time it would be very rational for China to respond to these competitive devaluations by guiding a policy of Renminbi devaluation versus the U.S. dollar. I can see both the compelling logic and enormous political and economic consequences of Renminbi devaluation. China may be ready for a Renminbi currency devaluation – but is the world ready? A devaluation of the Chinese currency could set off a cycle of economic distress around the world as other countries would be likely to respond with devaluations of their own.

Individual countries are devaluing their currencies to deal with the ongoing global problems of disappointing growth and overindebtedness, but collectively we may all suffer. That was one of the chief lessons of the competitive currency devaluations of the 1930s.

The Most Important Question in the World: Where is the Tipping Point Where U.S. Credit Quality Becomes Bad Enough to Break the U.S. Economy?

The biggest surprise to me in the markets for the last year has been the ability of the U.S. stock market to shrug off spreading global credit weakness. While it’s certainly natural for the equity market to lag the very sensitive credit markets (What Does the Bond Market Know?, 05/07/2014), it would be unwise to assume that the lag between credit and equities can extend indefinitely. History suggests that pervasive credit weakness is always followed by equity weakness. Credit spreads right now are at extremes seen only 13.9% of the time since 1977. Will this worsening continue? At what point might such credit stress cause a recession?

On April 22, 2015 (Why Credit Matters), I outlined what I believed to be the causal link between credit and the stock market: changes in employment. In this piece I asked the question of why credit spreads remained so high, a classic indicator of credit stress. A reasonable hypothesis at the time was “flight to quality” buying from scared money pouring out of Europe due to the obvious problems of Greece. Yet in recent weeks bond prices have stabilized in Greece while U.S. credit spreads continue to worsen. Is it time to conclude that a different causality is driving credit spreads higher? With the recent Chinese devaluation, do we have a new currency devaluation cycle underway – another “race to the bottom” where trading partners lower their currency values in order to gain export market share? Is this the message of the markets?

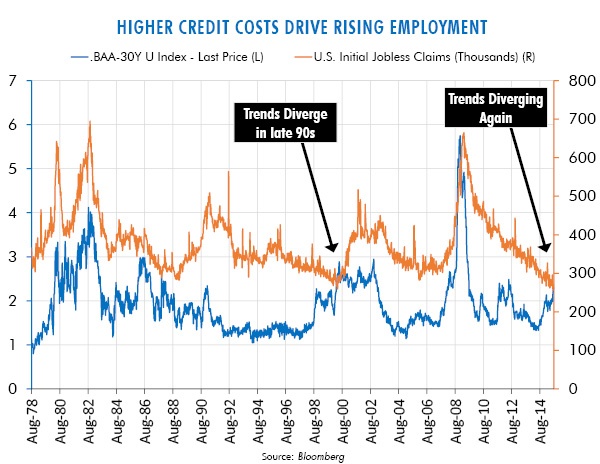

The chart below is an updated version of the chart I first profiled back in April. Two trends continue to diverge. Credit continues to worsen while initial unemployment claims are still improving. In fact, you have to go all the way back to the boom-times of 1973 to find lower unemployment claims. I always pay especially close attention when I see important financial indicators at extremes. From now on I will be monitoring unemployment claims closely for signs that weakness in credit is beginning to weigh upon U.S. economic fundamentals.

In Conclusion

Today’s markets are increasingly defined by volatile and hard to predict changes and linkages among seemingly obscure global trends. Thankfully history is filled with precedents to study! The Asian Crisis in retrospect took forever to unfold and impacted the world’s financial markets very unevenly. Emerging markets were plunged into turmoil while U.S. equity markets, after a nasty 1998 sell-off, powered into a final top. The average stock in the U.S. would cease to rally between 1997 and 1998, reflecting the growing global turmoil, even while the U.S. stock market’s leadership narrowed dangerously to a handful of mega-cap tech stocks that drove the final stages of the rally.

Global weakness at the time stayed the Fed’s hand during its campaign of raising interest rates during the fall of 1998; indeed the Fed actually cut rates in the face of the growing collapse in emerging markets. Many old stock market hands believe these interest rate cuts created the fuel that hyper-charged the bull market in the U.S. into a full-fledged tech bubble that eventually burst in mid-2000. Surely the price action of the last year has been roughly analogous between then and now. But markets don’t die of old age – something kills them. That something is credit.

Has this trend already run its course? Or will this pattern continue? Are we nearing the tipping point in U.S. credit quality, and therefore U.S. employment trends? If so then perhaps the market’s expectations for Federal Reserve interest rate hikes may – once again – be frustrated. Could investors develop a newfound appreciation for gold as a beneficiary of the spreading global trend of currency devaluation? These are the questions I seek to answer. Finally, last but not least, we must monitor how China’s back-to-back devaluations impact the U.S. elections. China has long been lambasted among U.S. political circles as a currency manipulator whose undervalued currency has cost the U.S. jobs. Surely such rhetoric can only intensify as we near the elections – and China devalues its currency. The world has enjoyed enormous benefits from a free and open trading system. The last thing we need to see is a protectionist backlash driven by election year politics.

Where all this goes will be a challenge to anticipate. Certainly the twists and turns of the unfolding Asian Crisis in the late 1990s had its share of unexpected events! For me, my timing in finishing my MBA at Wharton got me settled into my new career as a professional investor just under the wire – only a few weeks before the U.S. equity bubble peaked and crashed. Investing is always a game of inches. That at least never changes.

What I believe also doesn’t change is the truism that a well-constructed portfolio of thoughtfully chosen stocks and bonds is the key raw material for long-term outperformance. From time to time – and perhaps now may be such a time – I seek to draw upon the lessons of history to shelter assets from the storm and find ways to benefit from “unexpected” global financial events. This is the promise of intelligent asset allocation, ideally combined with bottoms-up company specific research. The best performing portfolios will benefit from both. Delivering upon that promise will always be a challenge, but that challenge is what drew me into investing in the first place, many years ago! •