The economy is composed of many different cycles, each operating with varying degrees of influence at any given point in time. This may sound confusing but it’s really no more complex than our progress through the typical seasons of the year. For instance now in the month of November the winter season is approaching. Winter is a medium-term trend of cooling temperatures that should persist for months. But the shorter term, daily volatility in temperature will be dominated by the cycles of sunshine as night alternates with day. The warming sunshine will raise temperatures in the short run, during the day, while the cooler temperatures of night will prevail once the sun goes down. So all around us the environment that we perceive is a function of many different cycles working at once. Sometimes these cycles move in the same direction and reinforce each other to create a doubly powerful trend, and sometimes they work at cross purposes to weaken and confuse the prevailing trend.

The biggest and most sustained economic trends are driven by the biggest and most sustained cycles. One of the biggest economic cycles, and one that is perhaps subject to the greatest controversy, is the Kondratiev Cycle, named by Joseph Schumpeter for the tragic Russian economist Nikolai Kondratiev. In today’s “Trends and Tail Risks” I examine the work of this brilliant economist to see what lessons it may hold for today’s markets.

Not much is known about Nikolai Kondratiev. We know that in March 1931 he was one of thousands of Russians swept up and condemned to prison by Stalin’s sham trials. Kondratiev was imprisoned for supposedly agitating against communist rule through the non-existent “Working Peasants Party.” In happier days, Kondratiev was a respected member of the interim Kerensky government that followed the fall of the Tsar and preceded the bloody Bolshevik coup. After the revolution, Kondratiev was the founding director of the Conjuncture Institute. There his job was to study capitalism, from a Marxist perspective of course, in order to be able to pinpoint the date of capitalism’s “inevitable decline.”

Not much is known about Nikolai Kondratiev. We know that in March 1931 he was one of thousands of Russians swept up and condemned to prison by Stalin’s sham trials. Kondratiev was imprisoned for supposedly agitating against communist rule through the non-existent “Working Peasants Party.” In happier days, Kondratiev was a respected member of the interim Kerensky government that followed the fall of the Tsar and preceded the bloody Bolshevik coup. After the revolution, Kondratiev was the founding director of the Conjuncture Institute. There his job was to study capitalism, from a Marxist perspective of course, in order to be able to pinpoint the date of capitalism’s “inevitable decline.”

Kondratiev’s research, however, was so unpolitic as to suggest that capitalism was remarkable for its ability to renew itself and adapt despite even brutal down cycles. This view did not endear him to his communist superiors.

Kondratiev examined the empirical history of growth beginning in the 1780s and the progress of long-term price indices to reach his conclusions, very much like another pioneering economist, George Warren (Gold: Lessons from the Great Depression, 8/20/15). Kondratiev’s work suggested that down cycles were an inevitable part of the cyclical growth of the long-term economic cycle and that these trends expressed themselves not just in the economic sphere, but socially and politically as well. Kondratiev’s most lasting research was The Long Wave Cycle published in 1925 in which he predicted that the cycle had peaked and was headed downward into depression. Of course, this was a remarkably prescient forecast just four years ahead of the Great Depression.

After his imprisonment, the world would lose all knowledge of the fate of this brilliant economist until he was briefly mentioned in Aleksandr Solzhenitsyn’s The Gulag Archipelago which told the story of life in Stalin’s prison camps. Sadly, Solzhenitsyn reported that Kondratiev was rumored to have been driven mad and died from his long-term solitary confinement in one of Stalin’s endless number of prison labor camps. Other sources suggest that Kondratiev was shot by one of Stalin’s firing squads in 1938. No one really knows for sure. Either way such a brilliant mind deserved better treatment.

Kondratiev’s research suggested that his Long Wave cycles were on average 56 years long. More contentious was the cause of these cycles. Schumpeter, a brilliant economist in his own right, believed them to be cycles of innovation. My own view is that I believe them to be credit cycles, with rising debts additive to growth during the more auspicious upcycles and credit stress and subsequent deleveraging subtracting from growth during the long down cycles. I do wonder if this is the cycle to which Ray Dalio, Chairman of Bridgewater, alludes when he mentions the “long-term debt cycle” and his fears that we may be nearing its end (Equity Market Volatility (Finally) Catches up to Credit Market Volatility, 9/9/15).

The Long-Term Debt Cycle: Does this Simple Framework Make Sense of Today’s Markets?

Mr. Dalio, the Chairman of Bridgewater, the world’s largest hedge fund, is concerned that we may be nearing an end to the “long-term debt cycle.” He traces the start of this growth in debt to 1971 when the U.S. cut the last ties to the Gold Standard when President Nixon made the decision to no longer tie the value of the U.S. dollar to the value of gold. From then on, debt could be created out of thin air and the corresponding increase in the money supply did not need to be met by a corresponding increase in gold reserves to back the dollar. As one would expect, the growth rate of debt outstanding went parabolic. This explosion in debt pulled forward future consumption. After all, the purpose of going into debt is to borrow from our future earnings to consume now just as saving defers consumption from now to the future.

Overindebtedness is a Global Problem

It is not controversial to note that the U.S. and its leadership position are not what they used to be. How then to explain the newfound strength in our currency, the dollar? Perhaps we need look no further than the even faster collapse in the rest of the world! Surely the weakness in many emerging markets, for instance, makes the U.S. look stronger by comparison! The flight to safety underway from capital fleeing weaker countries with weaker creditor safeguards can easily explain the strength of the dollar. Or perhaps more precisely we should say the overwhelming weakness of other currencies versus the dollar. Does this trend not also explain interest rates in the U.S. that remain otherwise “inexplicably” low? However, look no further than the even lower yields in Japan – and negative yields in Europe – to get a sense of how profoundly overindebtedness is weighing upon the markets. Might this relative flight to safety also explain the ongoing concentration of wealth into U.S. large capitalization stocks, and the brutal punishment suffered by companies who disappoint near-term earnings expectations, even slightly? Surely extreme events are afoot when investors are content to loan money to sovereign countries such as Switzerland at negative interest rates for a full ten years. Think of it: investors paying borrowers to take investors’ money. Maybe Dalio is right. Maybe we are nearing the end of a long-term debt cycle. Certainly we are all now seeing things in the market that no one would have believed possible even a few short years ago.

Are Europe’s Sovereign Debt Problems Spreading beyond Greece?

If Dalio is right, we should remain alert for more evidence of spreading debt problems. We can find such evidence not just here in the U.S., where I have been concerned about worsening credit market fundamentals for a long time now (Is Credit Quality Peaking,? 8/6/14) but also in Europe.

On May 21st of 2014, I began the first of a long series of articles on what I saw as the leading edge of an unfolding debt crisis in Greece (Big Problems Start Small, 5/21/14). Over the next year, the 2012 Greek bailout would fall apart with the collapse of the political consensus that first made it possible. When far-left Alexis Tsiparis was elected the new Greek Prime Minister as a protest against austerity, the Greek credit markets had already been in decline for months. Before we get into how these events worked their way through the markets, let me take a moment to explain a key indicator that may help us understand these events: the Target 2 System.

What are Target 2 Debts and what is Their Message for Investors?

The Target 2 system in Europe stands for Trans European Automated Real-Time Gross Settlement Express Transfer System. This is a system whereby payment claims for trade and capital flows accumulate at the local central bank level within Europe. As these liabilities rise, it indicates that Europe’s legacy national central banks are further and further indebted to the European Central Bank.

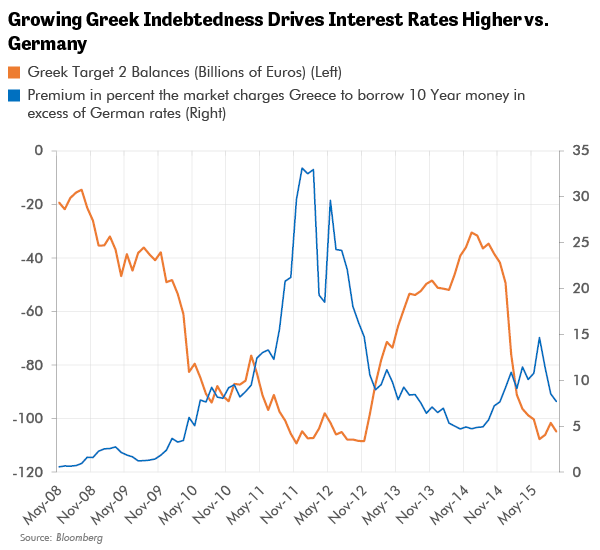

One potential driver for growing Target 2 debts are recurrent balance of payment problems, from countries such as Greece, Italy, or Spain needing to pay more for imports than they earn from exports. These deficits can be financed by temporary borrowing. Another, more disturbing, potential driver of rising Target 2 debts is capital flight. The example of Greece in mid-2014 as shown by the chart below demonstrates this example quite clearly.

Here the logical driver would be depositors reaching the conclusion that they are no longer comfortable retaining large balances in local banks and moving these deposits to other banks, such as banks in Switzerland or Germany, where depositors feel safer. As private capital flees local banks, government funds from the local central banks and European Central Bank take its place as banks become more and more reliant on central banks for funding.

The chart below displays credit stress on the right axis as the premium, in percent, that the market charges Greece to borrow money for ten years over and above the yield at which Germany borrows. In mid-2012 Greece was on the edge of the precipice as the premium that the market demanded to fund the Greek debt market was more than 30 percent higher than similar rates in Germany! The subsequent bailout led to falling Greek interest rates. This trend was further helped along by the promise of the European Central Bank’s (ECB) President Emilio Draghi to “do whatever it takes” to fix Europe’s sovereign debt woes and his launch of a European “quantitative easing” campaign to buy the sovereign bonds of European countries.

Confidence returned to Greece’s debt markets through falling interest rates, and improvement in Greece’s Target 2 indebtedness, as the axis on the left displays. However, in 2015, the chaotic administration of Mr. Tsiparis bungled the situation and renewed capital flight from the country. Rates began to rise again as Target 2 debts expanded again. Greece’s banking system would soon have to close its doors and forbid depositors from withdrawing their money. If depositors had monitored ballooning Target 2 balances, however, they would have been forewarned of the impending crisis.

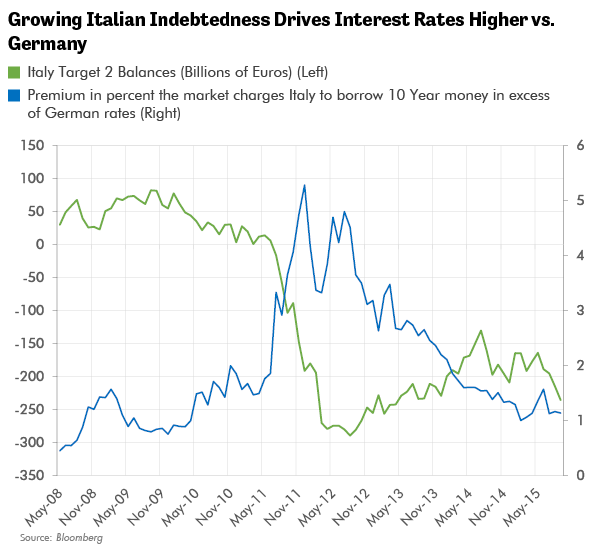

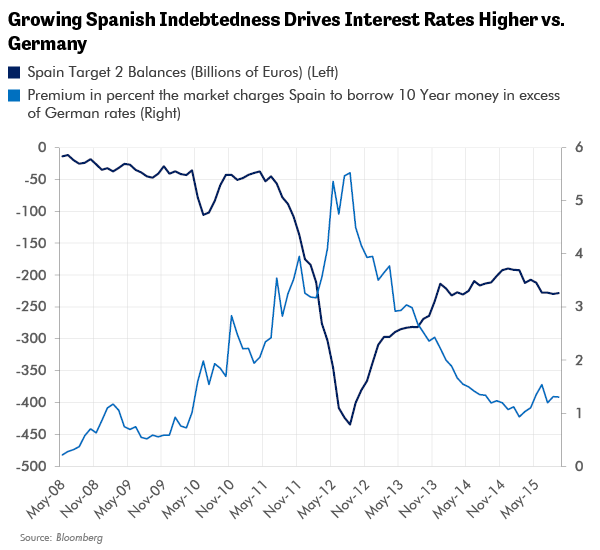

The Paradox of Rising Target 2 Debts: Why are They Rising (Again) in Both Spain and Italy?

I have puzzled over a confusing set of circumstances in Europe. The prevailing narrative in the European markets is that the ECB’s reflation efforts are gaining traction through vigorous quantitative easing and Draghi’s promise to follow it up with more stimulus if necessary. Certainly, with the benefit of hindsight, this was a successful formula in the U.S. It makes perfect sense to me that this should also be the case in Europe.

One would think that this would all be very bullish for European markets and in particular European banks. Yet many European banks, especially those in Spain and Italy, are underperforming their local stock markets. Why? And is there a worrying message in this underperformance when viewed in the context of Spain and Italy’s rising Target 2 balances, an indicator which so presciently identified the worsening in Greece’s credit markets?

In Conclusion

The world has been suffering through the down phase of the Kitchin inventory cycle that peaked with credit quality and commodity prices in late summer of 2014 (Revisiting the Inventory Cycle, 10/1/14). This peak took place 42 months after the prior peak, two months longer than the long-term average of 40 months for this cycle when measured from peak to peak or trough to trough.

Accordingly, we should expect the inventory cycle to move upward off of the trough, as we are now approximately 48 months past the last trough in this cycle. In fact, one might argue that such a turn may be already underway following a punishing swoon in markets in August that drove many observers to be overwhelmingly bearish. There are a few suggestive signs of at least a tepid stabilization in other markets, such as a rallying equity market, rising scrap steel prices in Turkey, and rising inflation expectations in the TIPS market. These moves have been weak by historic standards. Notable early indicators of a reflationary turn in this cycle are still lacking, such as an improvement in gold prices.

But just as our weather and the seasons are not simply driven by one cycle, but rather are a cumulative expression of the interaction of many cycles operating at once, so too are economic cycles. One issue that is never far from my mind is the haunting question raised by Bridgewater’s Ray Dalio: are we nearing the end of the long-term debt cycle? If the answer is “yes” then we could expect to see a more muted rally than one would otherwise anticipate off of the lows of the destocking trough due to the dead weight of overindebtedness. Are we seeing in rising Target 2 balances more signs of credit stress in the European sovereign debt markets of Spain and Italy in particular? Is this overhang of debt suppressing the usual strength in commodities, for instance, that we would normally anticipate in a rebound off the lows of the trough of the inventory destocking cycle? Only time will tell for sure. One thing is clear however: the imperative to learn the lessons of history and to apply them with an open mind has never been greater.•