“October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.”

-Mark Twain - Pudd'nhead Wilson's Calendar

Inventory Destocking Cycle Kicks Off with a Bang

The inventory destocking cycle that we have been anticipating since May (Making Volatility our Friend: Trading the Kitchin Cycle, May 28, 2014) is kicking off now with a bang. In this week’s Trends and Tail Risks we outline the driving forces behind the accelerating deterioration of the global steel markets. We will outline the forces of arbitrage making this occur and highlight why we believe it’s increasingly likely that the global industrial economy is now entering a period of decelerating growth over the next few months.

Hiding in Plain Sight – A Wealth of Information in the Steel Market

Yesterday one of our best contacts in the scrap steel business explained to us that his business suffered a meaningful reversal, from the best environment since 2006-2007 to the worst conditions since the global financial crisis. Scrap steel is one of the best indicators of real world economic activity and can turn on a dime. When it does so it’s time to pay close attention to the message of steel.

Our framework for thinking about cycles and the forces that drive them is intensely driven by micro-economics. This is critical for our competitive advantage in the markets. We drill down deeply into the fundamentals of supply and demand to forecast the price changes that are inevitable for the market to reach balance, which is a goal the market so tirelessly seeks (Prices Allocate Resources, June 25, 2014). We then position our investments to profit from the price changes our research has concluded are inevitable. What we learn about the cycle in the steel markets can also inform our thinking about other sectors as well.

We study the steel market carefully, for two reasons. First, steel is dominated by physical trading, not financial or screen based trading, so we can trust the information content of the market’s price signals. Second, steel ‘s $1 trillion global market closely tracks the global industrial cycle. To understand steel is to read the pulse of the industrial economy. Right now that pulse is unhealthy.

Our story starts in China, as do so many important stories these days. Iron ore and coking coal, key raw materials for making steel, are in free-fall. Prices are now off by nearly 70% from the peak. China’s steel consumption is flat year to date, which is the first time in 14 years that China’s demand for steel has not grown. Excess Chinese steel capacity finds itself increasingly unprofitable bottled up within China. Chinese prices have fallen throughout the steel chain in order to facilitate the flow of excess steel from China to the rest of the world, alleviating Chinese oversupply.

Past research (Unsustainable Steel Premiums, September 3, 2014) has highlighted the growing premium at which steel trades in the US versus Chinese prices, and underscores the rising odds that the US steel market is likely at its peak. This does not require Chinese product to flow to the US. The market uses price to solve problems and is often ingenious in finding many ways to balance supply and demand!

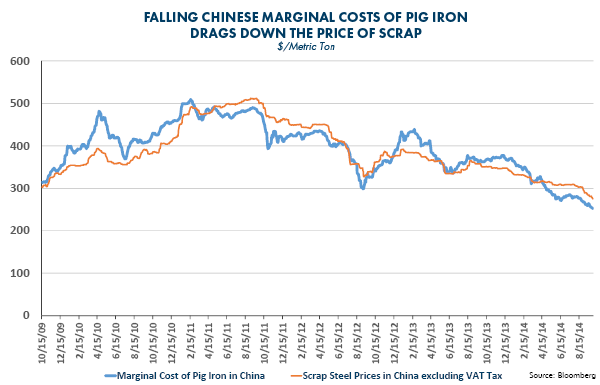

Chinese exports of billet and pig iron, intermediate forms of steel production, are increasingly displacing overpriced scrap steel in the key Asian and Turkish markets. Billet and pig iron as intermediate forms of steel production effectively compete with scrap as steel making raw materials. As substitutes, the prices of these products must orbit around each other, one following the other as the chart below demonstrates.

Identifying that which is Inevitable – Scrap Steel Prices must Fall, especially in the US

The US is the world's largest scrap exporter, which means by definition that we are a price taker. We are always selling scrap and will sell at whatever the prevailing price happens to be. Turkey is the world’s largest scrap steel importer. Turkey is the price maker.

Our scrap prices have to fall to keep product flowing to Turkey or otherwise scrap supply in the US will rise dramatically as scrap inventory remains overpriced and unsold. To balance supply with demand the market will direct US scrap prices to fall as Turkish prices fall. This will clear an oversupplied US market by keeping open the arbitrage profit that incents US scrap steel to flow to Turkey. US scrap prices may have to fall very far indeed if low cost Chinese billet and pig iron become ever more disruptive in the Turkish scrap market. In fact, I think it’s possible that US scrap prices may need to fall by $100 to $150 a ton, quickly.

Such a deep and sharp move would chill the currently euphoric sentiment in the US steel sector and kick off a wave of precautionary inventory destocking as producers, consumers, and traders found themselves sitting on high stocks of overpriced steel inventory. Such a rapid deterioration would help explain the simultaneous weakness we are now seeing throughout the global commodity complex, deteriorating credit markets about which we have been writing (Is Credit Quality Peaking?, August 6, 2014), disappointing ISM data today, and rash of earnings warnings from leading industrials such as Ford (F). Inventory cycles tend to be global events. Agreement from multiple sources of supporting data helps to raise our conviction level, especially when the pattern of the inventory cycle is now so familiar to us.

This is the beauty of price allocating resources in commodities. In constant motion we see the harmony of the market using prices to allocate resources. Behind it all are predictable, causal drivers using prices to solve problems, to insure that supply and demand balance. Whether prices bring plenty or pain, the market sets the truth before us. If we thoughtfully heed its message we may profit and avoid loss. Right now that message is one of caution in steel – and likely will remain so for large sections of the US industrial economy until the inventory destocking cycle has spent its force.•