I am deeply curious about many things. I have always been driven to keep digging until I can understand why events happen as they do. My curiosity drives me to read a wide range of topics. Science is often one of my favorite subjects to study. In the entire world of science there is nothing more profoundly disturbing than the results of the double slit experiment, which sheds light on important concepts of quantum physics.

Today’s “Trends and Tail Risks” will explore the mystery and wonder that the double slit experiment reveals about the world in which we live, which as it turns out can be a very different world from that in which we thought we lived. Once we are sufficiently shocked about the reality of own physical world, we will be prepared to delve into the equally shocking financial world of negative interest rates – of governments charging us for the money that we lend to them.

The Double Slit Experiment

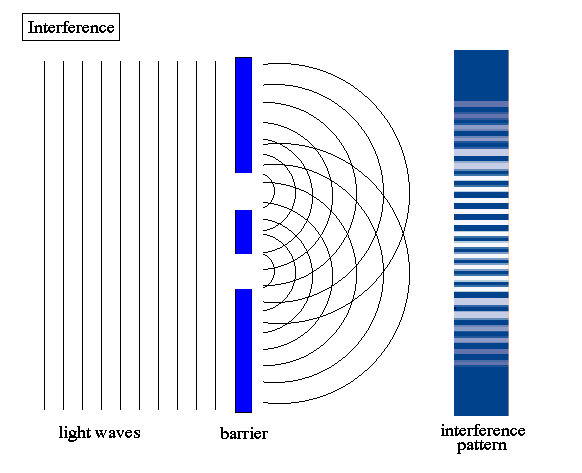

The schematic below shows the double slit experiment. The vertical lines represent light waves traveling from left to right like waves upon a pond. The blue barrier between the light and right side of the experiment blocks the light except for the two slits through which some light can pass. As the light goes through these two holes the light waves change like the waves on a pond bending around the end of a log.

These altered light waves create a new pattern within these “bent” waves. The pattern of peaks and troughs is now different from the straight running waves that existed before. As these newly “curved” waves intersect, they interfere with each other. The net result of this pattern of interference is shown to the right where rather than a uniformly bright wall we see an alternating band of light and darkness. Where two wave peaks intersect, we see a period of strong light. Where two troughs intersect, we are left with a faint band of light. When peaks and troughs combine the result cancels out so there is no light, only blackness. This is straightforward reality as we know it, as we have observed many times while watching waves on the water. Our common sense experience is vindicated.

The experiment starts to yield disturbing results if we alter it. Rather than shining a beam of continuous light, now only the smallest drops of the tiniest unit of light – a photon – is emitted one by one. Common sense dictates that by releasing only one photon at a time, the experiment eliminates the ability of lightwaves to interact and thus we should not see the interference bands of light and darkness.

very second or so a lone photon will make its way toward the wall and manage to find its way through one of the two slits to shine upon the wall. Repeated over a long enough period a detector on the far right wall will register the cumulative pattern formed as each individual photon reaches the far right. Common sense would dictate that this cumulative pattern of light on the right will not show a wave interference pattern, since we are confident that we are sending only one particle of light through at a time. Strangely enough, however, this experiment shows that the interference pattern builds, again, on the wall just as before when multiple light waves were interacting with each other, like ripples upon a pond. But how can this be!? Since the photons are emitted one at a time, there is nothing with which these tiniest units of light can interfere!

The only logical explanation is that each individual particle of light, one photon, must somehow go through both slits at once! But surely this is physically impossible since it flies in the face of all of our physical experience. Yet this is exactly what happens when this experiment is run under the rigorous conditions of a science lab.

Now if you have the same reaction that I did the first time that I read about this, this is all going to seem just too bizarre. Science must be able to explain this rationally, so scientists altered the experiment. They repeated the experiment again of firing just one photon at a time. This time scientists took the further step of using a very sensitive indicator to monitor both slits to see which slit the lone photon went through. Sure enough, when the slits are monitored in this way, the lone particle of light goes through only one slit and the pattern of light on the right wall loses its interference pattern. Finally something makes sense!

But remove the detector, or leave it there and simply cut it off, and the light pattern on the far wall reverts again to an interference pattern that can only be formed by waves, light somehow going through both slits at once! The only logical conclusion is that the very nature of reality itself changes based upon whether or not it is monitored! The photon “knows” it’s being observed and changes its behavior based upon how we try to measure it. The observer of the experiment changes the reality that he observes! There are strange quantum mechanic forces at work that help explain this paradox. What I find so remarkable is the huge contrast between what our common sense “knows” reality to be, and yet how sometimes the physical world proves us wrong. How can reality be so far different from that of our own objective experience?

Investment Implications

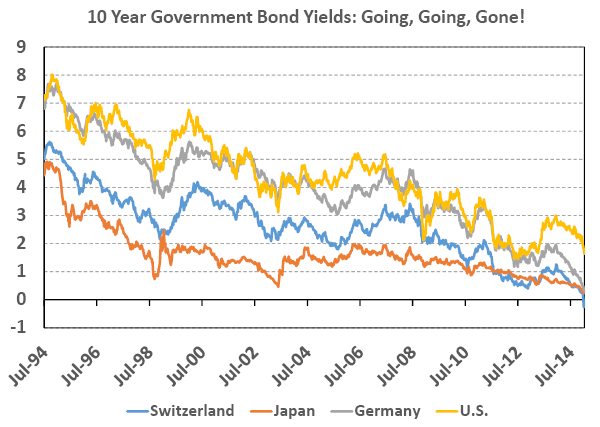

The reality behind quantum physics is the strangest phenomenon I can think of, and is thus very appropriate to introduce the concept of negative interest rates that we are seeing in the market. Bloomberg estimates that $2.5 trillion is now invested in bonds with negative yields. Take a close look at the chart below and you will see that Swiss bond yields for a full 10 years are now negative. And you thought that U.S. ten year bond yields under 2 percent were low! And it’s not just Switzerland either. Germany and a number of other countries have negative yields as well. How on earth did it come to pass that so many investors are now paying governments for the privilege of loaning money to the government?

Thank the misguided policies of decades of central banking for negative interest rates. Economy slowing down? “Don’t worry,” say the central bankers – borrow MORE! And if we as consumers refuse to borrow more, they will borrow for us through “quantitative easing” programs. Through the transformative power of financial jargon our greater indebtedness is now called an “economic stimulus.”

The tragedy of decade upon decade of mistaken policies has been finding expression in more and more toxic ways over the years. Some have been subtle. For instance, the decade of 2000-2010 was the slowest period of growth in the U.S. since the 1790s. Now a more threatening expression of our overindebtedness is springing forth in negative interest rates around the world. Can the U.S. be far behind? Perhaps a day not that far in the future will arise when American savers may suffer the indignity of paying the government for the right to lend it money! Stranger things have happened, as we just learned from the double slit experiment.

How Can We Help?

We have been worried about overindebtedness for years. It’s no exaggeration to say that for the last decade we have specialized in the study of how to make money in a low growth, volatile economy with falling long term bond yields. After much study, we advocate a four part strategy.

The first and most paradoxical strategy is to buy the longest maturity bonds – but only those with the highest credit quality (Credit: Caught Leaning 08/13/14; Our Bond Strategy: The Power of Duration, 10/8/14). These investors not only lock in higher yields without taking more credit risk, but they also have the potential for capital gains. For instance, owners of the U.S. government thirty year bond last year enjoyed a greater than 20 percent price appreciation of their securities – while also locking in a 4% yield for a full thirty years! How lush do those yields now appear with new yields on such bonds now nearly half that level just a year later. We believe that yields may yet go lower in the years ahead.

Second, we have been advocating the ownership of stocks in the gold royalty sector for many months (Gold: Price vs. Relative Value, 7/23/14, Balancing Insight with Timing, 11/19/14). We believe that as government bond yields shrink, gold becomes an ever more attractive asset to hold since its lack of interest becomes less of a penalty. Furthermore, we believe the gold royalty stocks, such as Franco Nevada (FNV), can be a yield vehicle for our clients. Franco’s dividend per share has nearly quadrupled since 2007. Over the long run we believe very strongly that gold prices will benefit from falling interest rates and that FNV is the premier stock to own in the sector.

Third, our own in-house, independent research is constantly working to uncover value in higher yielding bonds issued by strong companies where we believe the fundamentals are sustainable and the bonds are sound. Our research is also increasingly focused on strong companies in steady businesses that pay handsome dividends. Some of recent work has focused on pipeline companies, hydroelectric power generators, utilities, and niche REITs!

Fourth and finally we use our knowledge of cycles to understand the best time to be invested in our favored investments – and when the cycle is likely to change and present us with a better opportunity elsewhere. We use such methodologies, for instance, to decide when to favor duration risk over credit risk, as we have in the last year.

Negative interest rates are, like quantum physics, a strange phenomenon but they are also a small but growing part of our current financial reality. It’s imperative that we keep an open mind and monitor their progress. My fear is that we will be seeing more of them, and next time not just in Europe. We have developed ways to find better yields. We think that a prudent mix of the above strategies is the best. This is not the time for complacency but rather is the time to consider a more fully formed response to the threat of falling interest rates. Let us know if we can help.•

Picture Sources (in order of appearance):

1. The Double Slit Experiment, Source: http://abyss.uoregon.edu

2. 10 Year Government Bond Yields: Going, Going, Gone!, Source: Bloomberg