John D. MacDonald has been one of my favorite authors for many years. A writer who got his start banging out crime copy in the pulps of the 1940s and 1950s, MacDonald is best known among his dedicated fans for his long-running Travis McGee series. McGee is a colorful character - a boat-bum living aboard a houseboat in Fort Lauderdale’s Bahia Mar marina. But MacDonald’s legacy would extend beyond even this popular character.

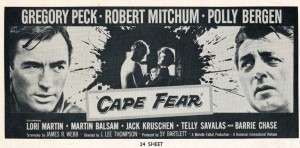

In the mid 1950s, MacDonald’s typewriter would bring to life one of the most impressive movie villains of all time, Max Cady. MacDonald’s book The Executioners, would make it to the silver screen as the renamed “Cape Fear,” and would do so not once but twice! Acting legends Robert Mitchum in 1962 and then again Robert De Niro in 1991 each lent his own particular brand of menace to MacDonald’s evil creation. I have seen both movie versions and highly recommend them! Time Magazine felt strongly enough about Cady to include him on its list of the greatest movie villains of all time.

The business of investing has its own villains as well. Of course, the villains of investing are not flesh and blood bad guys, but they present nonetheless a very real and dangerous threat to investors’ long term wealth. I have written in the past about the dangers to successful long-term returns in "The Power- and Illusiveness - of Long Term Compounding," 07/16/14. This piece must have struck a chord among investors because after a year it remains the most highly viewed of all our publications, read more than 16,000 times!

The business of investing has its own villains as well. Of course, the villains of investing are not flesh and blood bad guys, but they present nonetheless a very real and dangerous threat to investors’ long term wealth. I have written in the past about the dangers to successful long-term returns in "The Power- and Illusiveness - of Long Term Compounding," 07/16/14. This piece must have struck a chord among investors because after a year it remains the most highly viewed of all our publications, read more than 16,000 times!

In that piece I outlined how the humble $24 the Lenape Indians received from the Dutch in exchange for Manhattan Island in 1626 would have grown to become $223 trillion if it had only managed to compound at a seemingly modest 8% per year! This huge number is, of course, far more than the real estate value of Manhattan or New York or even that of the entire United States! Tragedy, disappointment, and outright treachery would keep the Lenapes from harvesting the enormous bounty that was once theoretically theirs as part of this long term exercise in mathematical compounding. What has happened to the world’s wealth over time? What are the biggest threats to wealth that have broken the magical math of long term compounding?

Frequent readers of this weekly know that an important part of our research involves thinking not just about what can go right, but more importantly about what can go wrong too. Thankfully, catastrophic risks are rare but their severity, when they do occur, demands that we always remain on the lookout for the next big risk, the next subprime crisis. In today’s “Trends and Tail Risks,” we explore the question of rare but systematic threats to long term wealth creation that we can identify and therefore hope to avoid.

Threats to Wealth

The sad tale of the Lenapes highlights just a few examples of this truth in action. For instance, the American Revolutionary War beginning in 1776 was followed by a hyperinflation which destroyed the value of the currency. A rare event yes but certainly a traumatic one! Small pox also was a new and unheard of disease – a stark example of Rumsfeld’s “unknown unknowns.” How could anyone have possibly foreseen it, a threat of which no one even knew, that had no precedent?

Other traumatic, but infrequent, events would crop up in the long sweep of U.S. history to threaten wealth, such as the massive dislocation of the U.S. Civil War, which required great skill and good fortune to profitably navigate. The Union’s “Greenback” dollar would survive while the Confederate State of America Dollar sank into total oblivion. A bit closer to home for today’s fixed income investors, the 1840s saw widespread defaults even by such worthy borrowers as U.S. state governments. The worst were Mississippi, Florida, Arkansas and Michigan which repudiated debts owed to their creditors. History is filled with negative surprises, of events gone horribly wrong in ways that investors did not expect.

What Does all This “Ancient” History have to do with the Thriving World of 2015? Plenty!

I can understand how, at first blush, the subject of threats to wealth seems like an odd question to ask when the U.S. markets are at an all-time high. Why worry about dangerous tail risks now? In fact now is precisely the time to ask this question. Tail risks never leap into existence fully formed. Rather, they appear subtly and small on the horizon, growing quietly in plain sight while few notice. In retrospect, of course, they are easy to spot. We are not interested in retrospection – we are interested in the future! The earlier we can identify a risk, the better we can understand it. For instance, our research highlighted the risks in Greece more than a full year ago. ("Big Problems Start Small," 5/21/14). Since then its stock market and bond market have crashed.

Today’s investing world is a big world indeed – and a highly interconnected one. What happens in foreign markets impacts our own markets back home. Their problems can become ours – or conversely we may even find ourselves benefiting, in the short run, from their challenging circumstances. For instance, emerging markets’ ill-timed debt binge on cheap U.S. dollar financing during the early days of Federal Reserve-driven “Quantitative Easing (QE)” backfired once the pace of QE slowed. Few realized how dependent emerging markets had become on cheap U.S. dollar financing. Once people discerned the truth, huge changes took place in global markets.

In mid-2013, fundamentals in emerging markets deteriorated rapidly and capital flew into the U.S. As capital flowed out of emerging markets into the relative safety of the U.S. dollar, the dollar strengthened and drove down the price of commodities while crushing many emerging markets. Because emerging markets were starved of capital, we now find ourselves presented with some very compelling valuations from which we can now benefit as investors. In fact, the dominant global themes of the last two to three years could be seen as a direct function of capital seeking safety from troubled emerging markets – or capital fleeing Europe’s seemingly interminable sovereign debt problems.

My own sneaking fear is that underneath rising asset prices the cumulative detritus of mistaken assumptions and flawed investments is quietly building. None of this means that we will wake up tomorrow and have to battle these dangers. Neither, however, can we relax our vigilance. These problems will invariably express themselves in the credit market, the most important market in all the world that keeps the machine of commerce humming ("Why Credit Matters," 4/22/15). Credit facilitates the expansion of business by financing growth that could not otherwise take place in the absence of the willingness of one entity to borrow and a corresponding other entity to lend. So confidence is key. Confidence is needed on both sides of the transaction.

Value Investing = Diversification + Patience and a Healthy Dose of Paranoia!

With a little work, thoughtful investors can construct a portfolio that maximizes the success of long-term compounding that also minimizes exposure to catastrophic risks. For us, that all starts with a deep foundation in a company’s fundamental business prospects and – most importantly – the price we pay for that business. We are value investors. As we have noted in prior publications, of all the future determinants of one’s future potential returns there is no more important variable than the price that we pay for that investment ("Price is What you Pay; Value is What you Get," 7/9/14).

Each investment must justify its position in our portfolio on its own merits. As a part of that analysis, we pay special attention to equities that pay healthy dividends. Investors, if they are not careful, can often underestimate the importance of dividends and future dividend growth to a stock’s long term total return. We understand the role of dividends in a portfolio and always delight in finding management teams that reward their shareholders with dividends.

Portfolio diversification also plays an important part of our strategy. It’s important to strike the right balance. On the one hand, concentrating our investments in our highest conviction ideas is the best path forward for the highest returns over time. However, our valuation discipline will invariably lead us to be early from time to time and thus can experience more volatility than we would like as we wait for the market to more appropriately value our investments. All this takes time – especially in our more activist investments, where we create the catalyst that unlocks shareholder value.

Ask the Question

Last but not least, please understand that we are quite serious when we highlight the importance of paranoia! Perhaps a more accurate phrase might be “radical open-mindedness.” All of the major financial disasters that have shocked investors over time sprang forth from events that “no one” could have anticipated. This was the narrative so prevalent after the 2008 financial crisis. However, this was a patently untrue statement I can assure you! My memory of the financial crisis was one of enduring wonder that it took so long to finally find full expression in the markets.

There were ample warnings that repeatedly flared up long before the subprime debacle of 2007 became the Global Financial Crisis. It is fair to say, however, that the vast majority of investors overlooked the clear warning signs, because these warning signs were unexpected and hence went un-noticed. For instance, the entire edifice of subprime securities that went bad was built upon one single and very flawed assumption: housing prices could not go down! Change that one assumption and the world became a very different place.

It’s true that it had been more than two full generations since housing prices had fallen. That’s a long time! So anyone “paranoid” enough to countenance such a “crazy” fall in prices would surely have had their sanity questioned. The willingness to ask the question – to be radically open minded – was the difference between success and failure in those challenging times. Now that I am well into my second decade of professional investing I understand that there is no view, opinion, or “fact” that is above questioning!

In Conclusion

We find these three tools (1) value investing, (2) diversification, and (3) radical open-mindedness are the most valuable in our toolbox for successful investing. While all of them are simple – none of them is easy! Our goal is to build portfolios that can thrive in the long run. We strive to invest with the cycle rather than to fight it. Our goal is to purchase cheap and underappreciated assets in times of want, when earnings are low, so that we may sell them in times of plenty, when earnings are high. Often this will lead us to own controversial investments. This often means leaning into the wind, selling into strength and buying into weakness. Invariably, we will be early. This is the nature of markets, value investing, and especially of activist investing! Through it all we focus on that which we do best. If appropriately done we can successfully navigate even the most challenging of times. No one said that it would be easy to beat the market villains! •