Writing these weekly research pieces is often a revealing journey for me. I start by surveying the world for the most noteworthy events about which I am concerned. As I winnow and sift my thinking, I often find myself making the most startling connections. Half-forgotten quotations, history I once studied, a conversation I dimly recall are all sources that suggest a nebulous outline that may hint at a deeper and simpler truth. I often wonder: is there really a connection here or is my mind seeing patterns that aren’t there? In the world of investing, sadly, that answer can only be known in hindsight. Perhaps that is one of the mysteries of investing that keeps it so challenging – and potentially so rewarding.

Frequent readers of this weekly will know that I have been monitoring events in Europe, especially those in Greece, for more than a year now with rising alarm ("Big Problems Start Small," 5/21/14). In the last few days events there have taken a very disturbing turn. Events in Greece are escalating far beyond what almost anyone anticipated, at a minimum raising the risks to Europe’s credit markets. But could they also hint at something more – something deeper? This week’s edition of “Trends and Tail Risks” highlights the haunting precedent of the critical policy errors of August 1914 to ask the question: are global markets really prepared for what may happen in Greece?

Edward Grey was the longest continuously serving British Foreign Secretary, the rough equivalent of the U.S. Secretary of State. He held his role during the height of England’s power. He played a central role in defusing many thorny crises, such as the Agadir Crisis in Morocco in 1911. There a revolt against Morocco’s Sultan led to the French deployment of troops. Germany countered by sending a warship of its own to the scene. England in alarm responded by deploying its fleet. This event illustrated the crackling tensions that lay between France, Germany, and England under the surface. This was not the first sign of the jostling contention between European powers. Its most lasting takeaway was to push Grey and England closer to France.

Three years later in 1914, Grey, now an experienced and proven diplomat, was faced with a seemingly inconsequential incident that arose when Franz Ferdinand, the Archduke of the Austro-Hungarian Empire, was assassinated by a radicalized youth Gavrilo Princip. Europe’s tangled web of old alliances and prickly personalities quickly spiraled this tragic but isolated event into the threat of armed battle among the major European powers. Events somehow moved faster than policy-makers. Events took on a life of their own. Potential combatants blundered in reading the true intentions of their adversaries. Miscommunication was rife. Seemingly before anyone knew it, all of Europe was at war.

Grey’s speech to Parliament, from which I have borrowed liberally in this publication’s opening quote section, illustrates the extreme challenges he and all policy makers face in trying and rapidly changing times. I see many parallels to the events that preceded the “Guns of August,” in the fast changing events underway now in Greece.

Latest Developments: Greece’s Problems Escalate Dramatically

Last week, ongoing debt talks collapsed between Greece and its creditors. Greece’s newly elected leftist government called for a referendum, the results of which showed deeply entrenched voter frustration with Greece’s long-suffering austerity program. Policy makers now use the language of war, speaking of ultimatums and demands that must be met or Greece may be forced from the Eurozone.

During my years of following Europe’s credit markets, I have come to trust the reporting of Ambrose Evans-Pritchard, an experienced and savvy reporter on the staff of the UK’s Telegraph. So it was with amazement that I read a piece he wrote just yesterday outlining the enormous errors, creditor and debtor alike, that are piling up and rapidly escalating the situation in Greece to new and dangerous levels. The link below goes to his full article, which I will not repeat here. I encourage you to read it.

As I read his article I could not shake the comparison that leapt to mind of the sad and crippling errors that haunted Europe in the disastrous policy errors that led to World War I. Both then and now, events seem to take on a life of their own. Hopefully future events will prove that this is one of those instances when I made a connection where none actually existed. I will hope for that outcome in any case.

The Greeks do not have a monopoly on policy errors. Europe’s creditors, led by Germany, badly overplayed their hand - never dreaming that a sovereign people would come out so strongly against EU institutions and membership. All of a sudden an escalating crisis seems to be building upon itself in ways that no one can anticipate or control. A reasonable person could now observe this situation and feel as if only days remain to reach an important compromise before events spin even further out of control, with implications that even the most astute may be unable to forecast.

In the absence of the answers that I seek, I can, at least, offer some questions:

- What are the unintended consequences if Greece gets forced from the Eurozone? Will Russia’s Vladimir Putin miss the chance to forge an alliance with a country shunned by the Europeans who Greece once counted as allies? How will this change the ongoing struggle in the Ukraine?

- Will the contagion of the “power of the voter” spread? Will the disaffected youth throughout Europe’s debtor countries, with on average 50% youth unemployment, also press for a politically destabilizing referendum on EU membership or on controversial austerity measures? If so, would local creditors react as they did in Greece – with capital flight and crashing growth in the aftermath?

- Just how risky would an exit of Greece be from the Eurozone? The last big financial entity to be allowed to “fail” was Lehman Brothers – might confidence be misplaced about the durability of the credit system to suffer such a shock? I don’t think anyone knows the answer.

- Is it a mistake to let rhetoric and political stakes escalate so rapidly while imposing quickly approaching deadlines? At what point do events take on a life of their own?

Contagion: Edward Grey Learned About it the Hard Way – Will Europe’s Leaders Learn from Him?

Edward Grey learned to his dismay how events sprang out of control and grew beyond the ability of even the most ardent and attentive policy makers to control. When I look at events underway in Europe I fear that Europe’s leaders may come to learn Grey's lessons, the hard way.

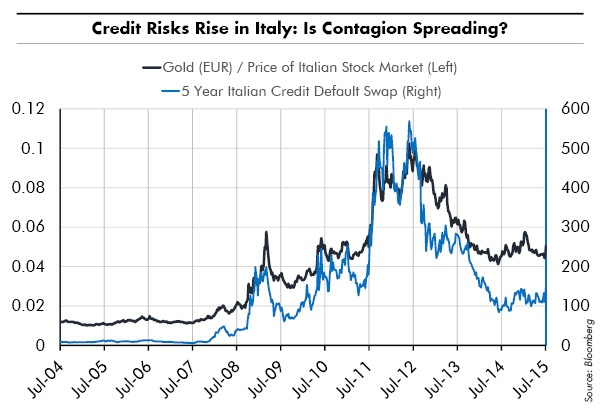

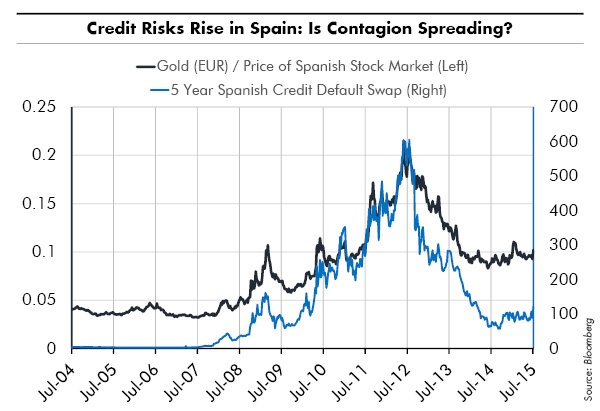

The evidence of stress is beginning to accumulate right where it should: in the credit markets. Below I show two items that demonstrate that credit stress is rising in the European debtor countries of Spain and Italy. These measures are 1.) the price of credit default swaps, which show a rising demand for default insurance as a hedge against the default of their sovereign debts, and 2.) the ratio of the gold price to the stock market price for these countries’ stock markets. Both measures tend to reflect rising credit risks and are now moving in lockstep. All are now above rising 200 day moving averages. Rightly or wrongly, these markets are showing concern. I think we should listen to them.

Finally, one of the most important tail risks for us to consider is the changing political dynamic in Europe’s debtor countries, again specifically in Spain and Greece. The Podemos Party, meaning “We can” is a Spanish anti-austerity party that shares many of the same views as Greece’s radical Syriza party. Podemos is the fastest growing party in Spain, led by its pony-tail-wearing spokesperson, former university professor, Pablo Iglesias Turrión.

It was the growth of Syriza’s political power that finally prompted the ongoing creditor panic in Greece. Could events go down a similar path in Spain? No one knows for sure but Spain must hold elections between now and December. This is one of the most important political milestones in Europe this year.

Italy has its own leftist, anti-austerity party that is also agitating to leave the Eurozone, the 5 Star Movement. Support for it is also surging while support for centrist candidates fell by half year over year. The 5 Star Movement’s candidates successfully gained seats in regional elections a month ago while support for centrist parties collapsed. Beppo Grillo, a comedian and blogger, is its colorful spokesperson.

NEW FACES OF LEFTIST, ANTI-AUSTERITY PARTIES

Left: Beppo Grillo, Five Star Movement - Italy. Right: Pablo Iglesias Turrion, Podemos - Spain.

Source: www.theguardian.com

Again it is still early days for developments that may stretch beyond the Greek credit markets but it is still noteworthy that these sensitive indicators of credit stress are showing signs that all is not well.

Investment Implications

If I have learned anything about investing it is that events move in cycles. Trends run to extremes, where – paradoxically – they are followed by extremes that move in the opposite direction! Greece is illustrative of the mighty power of Greece’s creditors in dealing with a recalcitrant debtor. But have the creditor powers overplayed their hand? Might we see some blowback as nascent leftist populist parties grow in protest?

The rebound of commodities off of severely depressed lows has been far more muted than I would have anticipated, particularly after a down cycle of such magnitude. Could it be that credit stress, now spreading out from Greece to infect larger and larger swathes of the world, is holding back global growth to a greater extent than people understand? Perhaps the simplest answers are the best answers? If so then it is likely that credit resides at the heart of the surprising underperformance in even these very undervalued equities.

In Conclusion

One of the hardest tasks that any investor faces is the appropriate understanding of the information of the day. The vast majority of days, the news - no matter how intimidating - can safely be ignored as noise. A good friend of mine, Pierre Lassonde the Chairman of Franco Nevada, once told me that the equity market was the junior tranche of civilization. What he meant was that markets tend to appreciate over time because mankind moves forward. Investors in equities, in civilization, progress as society moves ahead. This is one of the most consistent lessons of history. The best run companies, with the strongest management teams and business models – and most compelling valuations – can safely be trusted to outperform over time.

But, from time to time, it is the duty of any thoughtful investor and steward of capital to spend time thinking about what may go wrong. Bad things do indeed happen to good people – and good investors! Mistakes are always the least painful when they are caught early.

This is why I monitor tail risks such as events in Greece and ponder where they might lead – even when they seem small and inconsequential – or especially when they seem small and inconsequential! In this spirit I will continue to monitor events in Greece – not for their impact on Greece alone but for the now rapidly rising risk of contagion in credit markets and in political extremism. One of the most important questions facing investors now is this: does the future hold the economic rebound that so many people anticipate or could that rebound be threatened by spreading credit weakness emanating from Greece? To this question I wish I knew the answer. Somehow I think that by studying the credit markets of Europe we may all learn some valuable insight.•

Picture Sources:

Edward Grey. Source: Wikipedia