Big changes are afoot in the markets. It’s time to pay attention! While Greece is very much all over the headlines these days – current events impact far more than Greece. We care about Greece because events there may mark a potential trend change in the world’s largest asset class - credit - and a possible rise of a new political environment, both of which may be traced back to Greece.

On May 21, 2014, I began a series of research pieces focusing on the Greek bond market. I was watching Greece carefully because it had always been my experience that, as the title noted, “Big Problems Start Small.” My goal was to look deeply into the quality of the credit markets because credit often reveals trend changes ahead of the equity market. Just as a chain will break at its weakest link, so will the markets. Greece barely survived a near-death experience in 2012 that required an enormous bailout and, frankly, its economy had shown little improvement since then. So when the Greek credit markets wobbled during the third week in May of 2014, I was watching closely.

The only news I could find on why the Greek bond market suffered such a reversal – more than a year ago - was political news. The first round of regional elections had been won by radical political parties who were opposed to the harsh terms of austerity imposed upon Greece under its 2012 bailout. With total unemployment at 27% and youth unemployment at twice that, I couldn’t say that I was surprised.

Bad economies breed radical policies when traditional political solutions fail to make voters’ lives any better. So legitimate voices with traditional - but ineffective - policies lose their ability to cope with an ever more desperate situation. Into this vacuum comes the more strident voices of the political extreme selling radical “solutions” to what may be in fact unsolvable problems. Desperate voters can often believe anything that seems to provide hope after years of disappointment. What was once fringe becomes mainstream thanks to a very bad economy – and Greece’s economy had already suffered through a down cycle worse than the Great Depression. In this week’s “Trends and Tail Risks,” I examine events in Greece and ask the question: do these latest developments indicate something more profound about the world’s credit markets and political status quo?

Contagion: Both Economic and Political

One is an anomaly but two is a trend! First Greece and now Puerto Rico. Is there a connection? Perhaps. With credit quality showing signs of worsening globally I see the potential outline of a broader trend change underway. New political winds are blowing with the shock announcement by Puerto Rico that its $72b of debt is “unpayable.” This trend started in Greece and is now expressing itself in Puerto Rico, illustrating how important it is to catch trend changes early. New trends are notoriously difficult to see and even harder to define even if you notice them early enough. It takes a lot of study to understand them and call them by their rightful names.

The first signs of weakness last summer in the Greek bond market have now broadened into a full blown crisis in Greece. The chart below of Greek bond prices shows the result of the carnage.

Greece yesterday defaulted on its debt to the IMF, which is the first time a country has done so in more than a decade – following the ignominious precedent of Zimbabwe. This is certainly not the behavior one might reasonably expect from a developed country in the heart of Europe – unless big changes are afoot. Greece’s duly elected but radical government is taking the country down a dark and uncertain path. Promises to repay that were once inviolate, such as debts Greece owed to the IMF, are now compromised. What other promises to repay may yet be broken? No one knows for sure where this will end. But I really do not like the direction in which this is heading because it has implications for many markets and potential new trends.

I see two possible trends that can trace their growth back to the small changes I first detected a year ago in the Greek bond market (May 21, 2014, “Big Problems Start Small”). One is economic while the other is political. The economic trend has been a gradual weakening of credit quality globally. For instance, in the U.S., I can find not a single sector of investment grade debt where credit spreads, the premium that low quality borrowers must pay over higher quality borrowers, have improved over the best levels of last year. In every single instance the market is demanding a higher premium now relative to the best levels of last year. Credit quality is getting worse globally. This is not good.

Contagion can be Political Too

Remember that the trend that first expressed itself last year in the Greek bond market was political uncertainty! The parties of the status quo lost their credibility due to their failed economic policies. Greek voters cried out for change – and change they got with the election of a coalition of radical leftist parties! What makes this combination of credit market weakness and political uncertainty so virulent in Europe is the flawed construct of the Euro. Countries who use the Euro are effectively borrowing in a foreign currency. Each country originally made what was a political decision to do so and through a political decision they can also decide not to do so. The Euro’s fragility supercharges political uncertainty and creates what George Soros has called a “reflexive” feedback loop where political uncertainty raises a country’s cost to borrow exacerbating an already dicey political situation. This dynamic makes even a seemingly small credit problem in Greece something to monitor very carefully.

Enter Puerto Rico and its $72 Billion in Debt

Puerto Rico, like Greece while it remains in the Euro, cannot conjure up its own money with which to meet its debt obligations. Puerto Rico, like Greece, is also a public market borrower – a government and not a company. First Greece and now Puerto Rico – does two make a trend?

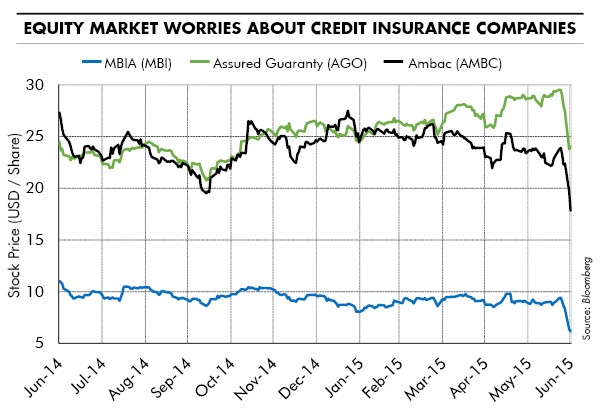

The chart below illustrates how deeply the market is concerned about the opening of a new front in credit market weakness. This chart illustrates the equity share prices of companies (Assured Guaranty, MBIA, and Ambac) who insure municipal bonds. These companies guarantee payment for many municipal bond issues in the event of default. Clearly the market is now much more worried about rising municipal bond defaults and is expressing this worry in the falling share prices of these companies.

The Problem with Tail Risks

The Problem with Tail Risks

Tail risks are very challenging to get right because, by definition, they arise from a low probability event with a potentially disastrous impact should it occur. This is why so often the language of financial tail risks borrows from the language of medical contagion, figuratively alluding to the swift growth of a virulent and dangerous disease.

Bonds are nothing more than a promise to repay money that has been borrowed. The durability of that promise is not impacted solely by the economic environment but also by political imperatives. Is the political willpower to honor promises changing? The answer in Greece and in Puerto Rico is clearly “Yes.” Might voters in other jurisdictions also want to have a say about the debt burden for which they are held accountable? You can rest assured that the angry voters in Spain, Italy, Portugal and other underperforming European countries are watching events in Greece. Might the long-suffering citizens of the worst, most highly indebted U.S. municipalities also be watching events in Puerto Rico? The quality of many promises to repay is dependent upon this answer.

I have been following this trend already for more than a year now. It may very well turn out to be the single most important trend in the markets over the coming years. Certainly, like a contagious virus, financial tail risks can quickly grow from an isolated outbreak into a full blown pandemic.

The Hegemony of the All-Powerful Central Banker: Will it Endure?

The prevailing narrative since the launch of Quantitative Easing (QE) in the U.S. has been the ability of the world’s central bankers to engineer higher growth outcomes by embracing “radical” policies, such as buying bonds. The improvement in the major economies engaged in these programs, including the U.S., is remarkable. I think it’s safe to say that these strategies have succeeded far beyond perhaps anyone’s expectations. How far the markets have come since then!

As these previously radical central bank policies demonstrate their worth, more countries are adopting them. Europe did so recently after a long and nearly fatal flirtation with highly contractionary monetary policies. Evidence is piling up that this medicine is now starting to work its magic in Europe. Perhaps even China is now joining the global trend of activist central banker policies. If so, expect to see global growth rates improve.

The track record of the last few years suggests that the world’s central bankers may yet have the power to seize the initiative with bold moves, just as Ben Bernanke did with QE when the night was darkest in the U.S. in late 2008. Seizing the initiative is one thing – maintaining the initiative may yet turn out to be quite another matter. Central banks are winning now. Will they continue to do so?

In Conclusion: Which Narrative Will Prevail? The “All-Powerful Central Banker” or the “Rise of the Voter?”

Joseph Bonaparte, Napoleon’s brother, understood that ultimately what is legitimate is determined by the government elected by and responsible to the people. Voters as always will get their say and will ultimately prevail. Are their voices growing louder? Might their concerns, now finding voice in Greece and Puerto Rico, swell into a cacophony that threatens the status quo of the all-powerful central banker? That would be an event that few anticipate, and is something I am monitoring very closely.

Eventually every economic issue is political. The rise of the all-powerful central banker took place under the aegis of the political status quo that still prevails. But never forget that by politicians was this status quo made and by politicians can it be unmade.

Puerto Rico has reached a point of decision. Its politicians have declared its debts to be unserviceable; so has Greece. Two political - not private - bodies have reached the limits of what is politically acceptable. Might we see a political contagion mirroring that of the bond market? Just how much should we fear the rise of dissatisfied voters throughout Europe? Many of these voters have endured slow growth and overzealous austerity under the rigors of the creditors’ thumb and are looking for “solutions.” They too want to give voice to their dissatisfaction with the weight of debt that slows Europe’s growth. Has Europe addressed these concerns quickly enough? Or has Europe’s dithering endured for too long? How will events now underway in Puerto Rico impact the rest of the U.S. municipal bond market? Only time will tell the answers to these questions which will be important for many markets. Now is the time to be especially attentive – and open-minded! •