Time and again in these pages I have found myself quoting the highly quotable Sir Winston Churchill. He was one of the most incredible people who lived in the 20th Century. I have been reading a brilliant biography about him, “The Last Lion” by William Manchester, that I wholeheartedly recommend to lovers of history and those who have dedicated themselves to the study of leadership under pressure. The book illuminates his formative years, meteoric rise, fall from political power in 1915, and the long “wilderness” years that stretched on into the 1930s.

Time and again in these pages I have found myself quoting the highly quotable Sir Winston Churchill. He was one of the most incredible people who lived in the 20th Century. I have been reading a brilliant biography about him, “The Last Lion” by William Manchester, that I wholeheartedly recommend to lovers of history and those who have dedicated themselves to the study of leadership under pressure. The book illuminates his formative years, meteoric rise, fall from political power in 1915, and the long “wilderness” years that stretched on into the 1930s.

Certainly few can claim to rival the raw impact of Churchill’s leadership when civilization itself seemed to hang in the balance in the early days of World War II. His first speech as wartime Prime Minister for England famously promised to the embattled and isolated citizens of the last beacon of hope in Europe: “I have nothing to offer but blood, toil, tears, and sweat.”

Of course, now we all know the end of the story. This pugnacious and cigar-chomping Briton who refused to quit would indeed triumph. But make no mistake: for a few weeks in May of 1940 after the fall of France, the world hung balanced on a knife's edge. Humanity held its collective breath to await the outcome of the Battle of Britain in the skies over England. We now know the outcome as an historical fact. Huge setbacks along the way seem now, in retrospect, only temporary bumps along the road to inevitable victory. Triumph only seems assured – because we know how the story ends. But for those living through those events in the present, in real time, there was nothing inevitable about which way they would break. Financial markets are eerily similar today.

The Financial Knife Edge of the World: The Ratio of the Gold Price to the Silver Price

To me, the investing world is finely balanced on the knife’s edge right now. For more than a year, we have outlined our increasing concern about a peak in credit quality (Is Credit Quality Peaking?, 8/6/14). For the longest time this deflationary pressure spreading from credit stress we identified last year seemed only to weigh upon emerging markets, junk bonds, and commodities. These markets withered while the U.S. Equity market prospered. Until a few weeks ago that is.

Of all the trends in the world over the past few years, perhaps none have been so persistent – and seemingly so one-sided – as the pervasive weakness in commodities. Make no mistake: the extreme weakness of the past few years in the commodity markets finds no precedent in the nearly 500 years of history that I have studied. I can find no precedent for the events underway today: a cumulative, consecutive, five year decline of more than 40% of a broad-based, equal-weighted commodity index. The data series I have studied stretches back to the world of Martin Luther when he nailed his protest to the church door in Medieval Europe, half a millennium ago. Will next year be another disappointing year for this sector of the market? For many years we have been cautious on commodities and emerging markets, but in the last few months, compelling values have started to appear. We find ourselves now in the tug of war between compelling valuations and the timing of when the market may start to recognize this undervaluation.

Timing versus Valuation: One of the Biggest Struggles in the Market

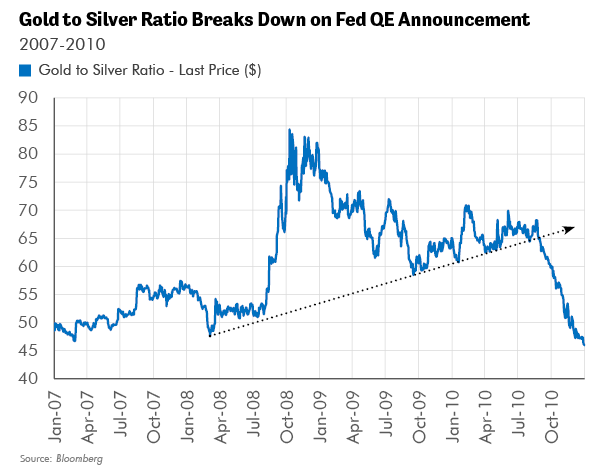

As value investors we strive to buy assets cheaply. The biggest risk to value investing is being early and watching cheap assets get cheaper. We try to manage that risk through the cyclical indicators that we monitor. Over time I have found that quite possibly the single best indicator is the gold to silver ratio, shown below. A rising ratio most often suggests that the forces of deflation have the upper hand. Surely since April of 2011 we have seen dramatic underperformance in commodities, emerging markets and most recently, high yield bonds. In the last few months this ratio has stabilized somewhat but remains at a very high and very deflationary level. This ratio is now testing the lower bound of the upward trend line of the last four years. Where this ratio goes from here may be very important for many different asset classes. Of course, I have a much higher degree of conviction when many of my indicators agree with each other. But oftentimes the first read on a cycle turn is the gold/silver ratio. This is why I watch it so closely.

A year ago we started to ponder the volatility we were then seeing in the market, as the inventory cycle turned down (Revisiting the Inventory Cycle, 10/1/14). We questioned whether or not the Fed’s monetary policy was too tight – despite short term interest rates at zero! A similar set of circumstances prevailed in 1937 with disastrous results for the markets.

Since October of last year, the broader markets have recovered and gone on to new highs but commodities, emerging markets, and high yield bonds have fallen. Recently other very experienced investors are voicing similar concerns, such as Ray Dalio (Equity Market Volatility (Finally) Catches Up to Credit Market Volatility, 9/9/15), who has stated that the next big move by the Fed may be to cut interest rates not to raise them (!).

It has been my experience that gold, and in particular the gold/silver ratio, is one of the best forward-looking measures for liquidity, and thus for the degree of monetary stimulus needed to sustain financial markets and credit quality. A rising gold/silver ratio may be considered one important sign that Fed monetary policy is too tight – at least too tight for commodities and emerging markets.

Last week, however, featured some market moves that we should ponder as we examine the ratio above. Investors’ expectations for a Fed rate hike were, once again, thwarted. The market also digested a much weaker than expected employment report. These two events drove down interest rates on U.S. government debt as the market started to wonder if its assessment of future growth was too high and if the Fed's future interest rate policy might be much less hawkish than previously believed. This potential reassessment also boosted the price of long-suffering gold, silver and their related equities.

Is this just a temporary blip, or are these, the most forward looking liquidity indicators in the market, starting to suggest that perhaps a turn may be at hand? This is a question I would dearly love to answer! An important part of answering that question will be to closely observe the indicator above. I do strongly believe that, at whatever time the Fed’s bias turns from tightening to loosening, this indicator will help us to identify that trend. The chart below of the gold/silver ratio in 2010 shows that certainly this ratio functioned beautifully back then. In 2010, the ratio began to fall when the Fed surprised the market by launching yet another round of quantitative easing (QE). The gold/silver ratio fell because both silver and gold rallied but silver outperformed gold. There had been many tests of that trend line along the way until it finally broke in favor of silver. Are we now at a similar moment in this process? Only time will tell for sure.

Interestingly, the price of gold today is just above its lows for 2014, so the price of gold has stabilized in the last year. Still I must admit that I have seen a number of false dawns, which makes me want to hold our current positions and cautiously await a clear signal of a turn before committing more capital to this sector.

We are, after all, more than a full year now into the virulent force of a strong destocking cycle. These cycles tend to go down faster than they go up, so our base case assumption should be that its power will soon wane. It’s also been my experience that off of a destocking trough the upward moves can be shockingly powerful as physical market and financial players rush to cover short positions. We should be on the lookout for such potential moves.

Is this the nascent message of the market in the past few days? I would like to hope for the best but as investors we also have to plan for the worst. Credit stress remains elevated in the U.S. and especially in China. If I had to guess, I would say that markets cannot stay where they are now, poised on the knife edge. Either the Fed overtightens and they slip into a new deflationary cycle or central banks realize their peril and let loose another round of stimulus. Much will be riding on the answer. The gold/silver ratio provides one of the earliest and clearest reads on this critical issue. •

Picture Source: Sir Winston Churchill, www.telegraph.co.uk