Chief Conclusion

Populism’s explosive growth is likely sowing the seeds for dramatic change in the markets. Every day we see evidence of this in the news and in the markets. My own belief and concern is that the market is not sufficiently discounting the rising tail risks from central banks whose power is structurally undermined by populism. Investors should be vigilant and watch for signs that our aging cycle may see an inflection in volatility and credit quality. History suggests that thoughtful investors can stay one step ahead by focusing their attention on the weakest links in the credit chain, the location from which small problems will begin to grow into much bigger ones. Thoughtful investors will begin to arm themselves now against the arrival of this darker day, by owning the highest quality and longest dated U.S. government treasury bonds and a carefully selected portfolio of stocks and bonds that our research suggests can best weather the storm.

It’s funny, the things that catch your eye. Sometimes the biggest insights can come from the smallest things. I came across this image of our President’s redecorated Oval Office and noticed the newly hung portrait of our 7th President, Andrew Jackson. This suggests that our new President respects and admires Jackson. How people choose to define themselves gives us important insight into their future actions. Accordingly, I spent last weekend reading Jon Meacham’s brilliantly written American Lion on President Jackson.

The new Administration has gone to great lengths to cite precedents for its own fresh approach to governing, drawing heavily upon historical examples especially from Jackson. Meacham’s book is a thoughtful and balanced treatment of this important but controversial figure. I read the book asking myself what I could learn from Jackson’s presidency that might foreshadow that of our new president. I was not disappointed.

To his supporters, Jackson was an innovator who deeply believed he was the voice of the common man, who felt forgotten. To his detractors, the self-made orphan was a savage and uncouth demagogue. Jackson’s presidency was vigorous. He repaid the national debt, banished Native Americans westward on the Trail of Tears, and guided the Union through a secessionist crisis that almost split the South from the North.

What is most relevant for today’s investors was his “bank war,” where Jackson fought the U.S. central bank of the day, the 2nd Bank of the United States, and killed it. If President Trump and his new administration can be defined in any way, it is certainly populist and anti-establishment. Is there any establishment institution more sacred to today’s financial markets than central banks, such as our Federal Reserve or the European Central Bank (ECB)?

What does the global rise of populism mean to the establishment? We believe that a sea change is underway where the political legitimacy of such prior pillars of the establishment is rotting out from beneath them. If so, the investing world is changing in important and profound ways that should lead to renewed volatility and credit stress. Allow me to explain.

The Cycle of Rising Populism Will Break the Power of Central Banks

No one active in European markets would question the dramatic turning point when the ECB’s Mario Draghi promised to “do whatever it takes” and single-handedly, with just a few words, stopped in its tracks the unfolding European sovereign debt crisis in 2012. That’s incredible power. The U.S. Federal Reserve, our own central bank, was finally able to get in front of the U.S. financial crisis, but only after a deluge of bail outs and guaranteeing assets that at the peak totaled as much as $11 trillion.

Even now, the unelected bureaucrats at the Fed sit on $4.5 trillion worth of bonds they purchased through their desperate gambit of “quantitative easing.” The European Central Bank has purchased and now owns 2.5 trillion Euros worth of bonds. “Desperate times called for desperate measures” is the argument that these central banks make. And in the heat of the meltdowns we were experiencing, it was an easy argument to make.

Surely these are incredible sums – even if they are “the experts.” Do today’s populist leaders respect experts, or the status quo that empowered these experts – or any others frankly? Clearly the answer is no. Today’s populists are in power because the “experts’” solutions failed, justifying in many ways populist contempt for the status quo - that central banks have just spent trillions of dollars trying to prop up. Certainly I am not the only one who can foresee a clash between the old guard forces of the establishment central bankers and the rise of populist politicians globally, who unlike the “experts” have the backing of the voters and therefore a mandate for change.

I will leave it to others to hope (fingers crossed!) that the changing political status quo will not impact the dominant role that central banks have taken in the markets. I don’t think fiduciaries can be so blithely optimistic. We have a deeper responsibility.

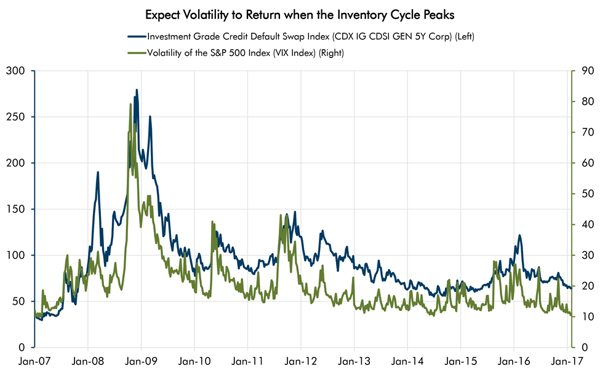

If the new politics is dis-empowering the world’s central bankers, doesn’t that mean that the “Greenspan/Bernanke/Yellen put” in which so many investors have placed their faith is less valuable? Shouldn’t that mean the range of possible outcomes is a lot wider going forward than it has been in the last few years? Isn’t that the very definition of rising financial volatility? Yet, as I display below, volatility and credit risk measures are near multi-year lows, at least in the U.S. I think these measures of risk are too cheap and will rise. When that time comes, riskier equities and lower quality bonds will surely suffer.

When might we expect an increase in volatility and concomitant weakening in credit quality? Our base case assumption should be to expect that inflection at the upcoming cyclical peaks in the inventory cycle and business cycle about which we have written (Navigating Confused Seas- December 2016). These are only probabilistic windows, but they represent our best guesses and are keeping us on our toes.

We can also watch carefully the weakest link in the credit chain; for it is always at the weakest link that the chain will break. For this reason, this publication analyzes the market’s major tail risks.

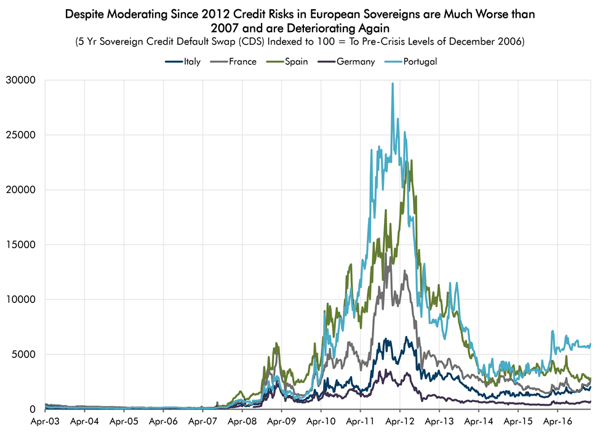

For instance, this publication has highlighted our concern, for a number of years now, over China’s extreme overindebtedness (The Dark Side of China?- September 2014) as well as the many and disturbing structural flaws within Europe. The rise of populism is deadly for Europe, given its many critical structural problems in the Euro currency and the Eurozone credit markets. As we outlined before the Brexit vote, the key risk in Europe is that countries who have adopted the Euro as their currency cannot follow the “Brexit” example and leave without untold economic carnage. In fact, we termed the Euro a “thermonuclear debt bomb” on June 15 in Brexit: All Eyes on European Banks.

As the chart below illustrates, it is time (once again) to pay close attention to events in Europe. Credit risks are rising again and remain vastly elevated relative to pre-crisis levels in late 2006. France and Germany will have national elections this year, with many more likely on the continent. Its incredible that the measures below of credit quality in the credit default swap (CDS) market are so wildly elevated (signifying much weaker credit quality) now versus pre-crisis levels. For instance, the CDS levels of Germany are 7 times their pre-crisis levels, 20 times higher in Italy, 27 times higher in France, and 59 times higher in Spain. Clearly, our world is already very different from that of 2006. And, after Europe’s upcoming elections this year, it could get a lot worse.

This publication began to outline our concerns about the deep fragility within Europe in May of 2014 (Big Problems Start Small) and has since added many other pieces chronicling the slow motion sovereign and banking crisis in Europe such as False Narrative: The Myth of All-Powerful Central Banks- December 2014, Twilight of the all-Powerful Central Bankers- January 2015 and Greece: War of Creditors vs. Debtors- July 2015.

This publication wrote about populism and the changes that would follow in its wake before Brexit, Trump and the now widely recognized global populist revolution, when we noted in 2015, “My belief is that our current system of central banking is an outgrowth of our political environment. If that environment is changing, perhaps the future of central banking might change as well.” In country after country, this insight is ringing true. Soon this may also ring true under darker skies, rather than the clear blue ones that the financial markets now seemingly enjoy.

In Conclusion

Populism’s explosive growth is sowing the seeds for dramatic change in the markets. Every day we see evidence of this in the news and in the markets. My own belief and concern is that the market is not sufficiently discounting the rising tail risks from central banks whose power is structurally undermined by populism. Investors should be vigilant and watch for signs that our aging cycle may see an inflection in volatility and credit quality.

It is always a challenge to forecast how long it may take for events to play out. Personally, I would rather be too early than too late. Patience is always a key raw material in manufacturing great investment returns. We can profit from our insights by avoiding investments that may suffer or through the careful selection of individual stock and bonds that may benefit. Our research is devoted to this goal.

History suggests that thoughtful investors can stay one step ahead by focusing their attention on the weakest links in the credit chain, the location from which small problems will begin and grow into much bigger ones. Thoughtful investors will begin to arm themselves now against the arrival of this darker day, by owning the highest quality and longest dated bonds and a carefully selected portfolio of stocks and bonds that our research suggests can best weather the storm.

One thing is very clear: at some point in this cycle, the “Forgotten Man” who has recently re-discovered his voice and empowered a new wave of populist leaders, will come to question how it was that un-elected central bank bureaucrats spent $4.5 trillion to prop up the status quo while he struggled. These will be uncomfortable questions with uncomfortable answers. I expect that, in their wake, central banking will be different and so will the markets and their volatility. Better to understand this change now and lead this insight to profit rather than, as Napoleon so astutely warned, hesitate and get dragged along behind it. •